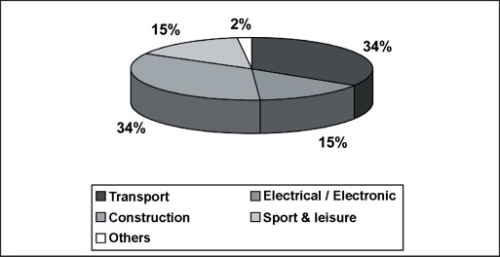

Applications

AVK says that once again this survey has detected virtually no shift in the proportions of GRP components used in the individual application industries in 2013. The transport and construction sectors each consume one third of total production volume. Other sales markets include the electrical/electronics sector (E & E) and the sports and leisure segment.

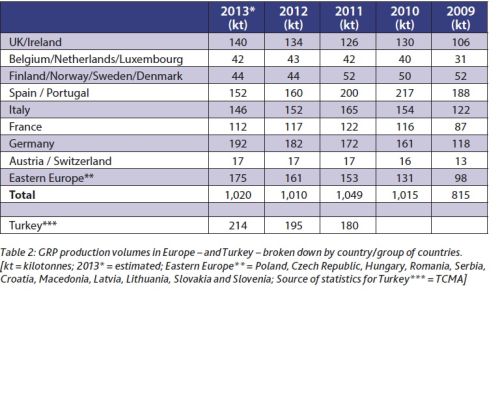

GRP production in 2013 by country

Table 2 shows clear differences in the development of the market in the various European nations. These correspond very closely to the growth or contraction in the respective economies and the major applications for GRP components in these countries. Only a few countries are experiencing any growth at all.

As was the case last year, these include Germany, the UK/Ireland and Eastern European countries. In the case of Germany, AVK points out that this is due to the generally good growth in its economy. In Eastern Europe, growth is primarily being driven by major infrastructure projects. GRP production is still declining most significantly in the countries of Southern Europe, whose economies continue to be in recession – although this negative trend is less pronounced than in 2012.

Volumes in the Benelux countries are also shrinking while the markets in Austria and Switzerland are stagnating. According to figures provided by the Turkish Composites Association (TCMA), the country is again expecting above average growth – compared to the rest of Europe – of nearly 10% in 2013.

The slow growth of the European GRP market in 2013 closely mirrors the general development of the European economy. Nor is any other region of the global economy growing as strongly as last year. Although continued growth is expected in the BRIC countries (Brazil, Russia, India, China) in 2013, this is significantly weaker than in recent years.

Outlook

AVK adds that it is extremely difficult to make any forecasts regarding the future development of the composites market considering the current backdrop of general economic uncertainty and fragility in many countries. This task is made even more difficult by the extremely diverse nature of the composites industry, which serves a wide range of different industrial applications.

AVK reports that it is clear that the German composites industry has emerged stronger from the crisis years of 2008 and 2009. For example, it has expanded its share of total production volume in the area of Europe covered by this survey to nearly 19%. Thus, within four years, Germany has become the most important manufacturing country in this sector in Europe. The reasons for this are often stated as the high quality of its manufactured products and excellent standard of service offered.

According to AVK, opportunities generally arise for composites companies when tailor-made solutions are required or they are able to serve the needs of special segments and applications. The ability to respond to individual requirements and develop specific solutions allows companies to build a competitive advantage and generate added value for their customers.

History has shown in other sectors of industry that German and European companies cannot compete with the rest of the world purely on the basis of price in the long term.

Secure and sustainable long-term growth can only be achieved if effective and efficient processing techniques that conserve resources are combined with an innovative engineering and pioneering spirit and the courage to work together with partners along the entire length of the value added chain – and when necessary, even those operating outside their own material segment. ♦

Read Part 1: A return to weak growth for European GRP market (Part 1)

This article was published in the November/December 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.