A new report commissioned by Composites Germany shows the growth of glass fiber reinforced plastics in Europe.

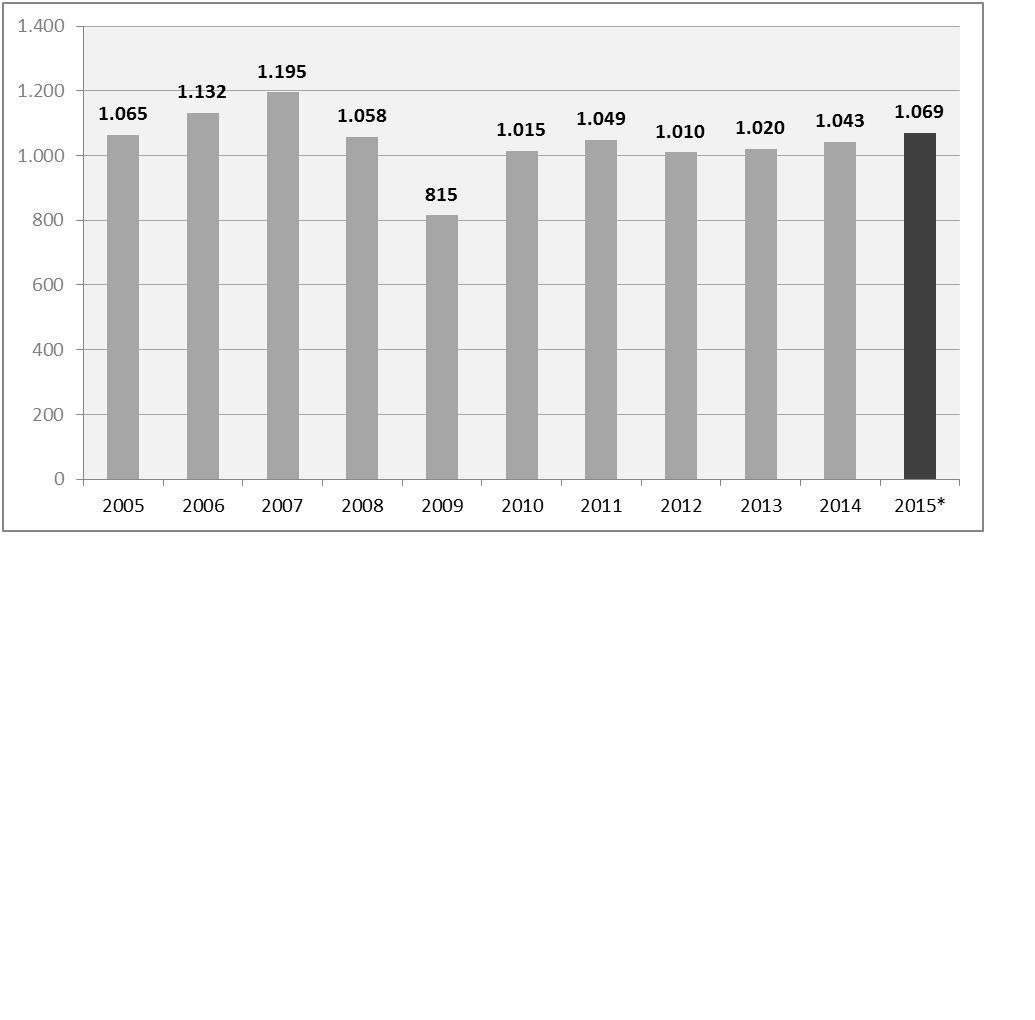

Europe’s production volume in glass fiber reinforced plastics (GRP) is growing at a rate of 2.5% in 2015. Having reached 1,069 megatonnes, the production volume is now at its highest level in eight years. This development generally follows that of the European economy in general. The heterogeneous developments in different countries have their parallels in the development of different processing methods which are used in the production of GRP components.

This 2015 GRP Market Report is based on a survey and covers all the European countries whose production volumes could be recorded with valid figures. The volume in Turkey has been included separately in the market survey. GRP refers to all glass fiber reinforced plastics with duroplastic matrices as well as glass mat reinforced thermoplastics (GMT) and long fiber reinforced thermoplastics (LFT). This also includes continuous fiber reinforced thermoplastics. The European production volume of short fiber reinforced thermoplastics is only available as a total volume and is therefore listed separately. Carbon fiber reinforced plastics (CRP) will be considered separately in part two of this market report.

Overall development

The first half of 2015 proceeded as expected, and forecasts for the second half appear to be equally positive, so that we can expect continuous growth for the entire European GRP production volume. It is estimated that the overall European market has increased by 2.5% to 1.069 megatonnes (see figure 1).

The main customer industries for GRP components are transport and construction, i.e. two sectors with relevance to the wider national economy. The development of GRP production therefore tends to follow the economy as a whole. Europe’s decreasing share in the global gross domestic product (GDP) is paralleled by its decreasing share in the global production volume of GRP. In particular, there has been a clear shift towards Asia and America in the production of commodities (i.e. standard products) over the last few years, especially in the BRIC countries (Brazil, Russia, India and China) with their above-average positive growth.

To obtain a genuinely meaningful picture of individual submarkets in the composites industry – an industry which is extremely heterogeneous – we need to break down market developments according to the processing methods used in GRP manufacturing and also according to requirements in each of the application industries and indeed separately for each European country.

SMC/BMC

The production of SMC (sheet moulding compound) and BMC (bulk moulding compound) parts makes for a quarter of the overall European volume, so that it is still the biggest segment in GRP production, although its growth has been the weakest (below 1%). At nearly 45%, the electrical and electronics industries are the biggest area of application for both SMC and BMC. The automotive industry is the second biggest area, with just over 40% for SMC and just under 40% for BMC. But SMC components are also used in construction.

Open mould/open processing

The volume manufactured under open processing – i.e. hand lay-up and fiber spray-up – is the second biggest on the GRP market. Growth in 2015 is expected to be slight, at just over 1%. In this segment both company sizes and manufactured parts can differ greatly. The high level of flexibility means that such processing – which has many of the qualities of craftsmanship – will always have its place in the composites industry.

RTM

The production of RTM (resin transfer moulding) components has been growing considerably, at an above-average rate of nearly 4%. This volume covers all the different (infusion and injection-moulding) processes. It follows that this segment covers a very wide range in terms of different processes. In the automotive industry, in particular, a substantial amount of work is currently taking place on further developments, covering both processes and materials.

Continuous processing

This year is seeing further growth in continuous processing. For many years now panels have been made for vehicles, in particular. Here, too, there is a major move to be innovative. The most important applications for GRP pultrusion profiles can be found in the construction sector, in railing and ladder systems and in plant construction. These market segments have relatively high levels of automation.

Pipes and tanks

GRP pipes and tanks made under centrifugal casting and filament winding processes are primarily used in the oil/gas and chemical industries as well as in plant engineering. The European market has been growing slightly this year, by 2%. It is dominated by a small number of large manufacturers, partly due to relatively large volumes per order and enormous administrative and licensing work.

GMT/LFT

Glass mat reinforced thermoplastics (GMT) and long fiber reinforced thermoplastics (LFT) have experienced above-average growth in 2015, reaching more than 9%. Of the total European volume (132 kt), nearly two thirds was LFT and one third GMT. Two-digit growth stimuli are coming from LFT products, particularly from the automotive industry. As well as developing new products, research is also focusing on so-called multimaterial systems and on investigating suitable applications of composite systems in structural components.

Short fiber reinforced thermoplastics

The European market for glass fiber reinforced thermoplastic compounds amounted to about 1,250 kilotonnes in 2014 and was therefore somewhat bigger than the GRP market under review (duroplastic materials plus GMT/LFT). With a volume increase of approx. 7% per year, this segment – which is marked by a high level of automation (injection-moulding processes) – delivers far stronger growth stimuli (source: AMAC).

Application industries at a glance

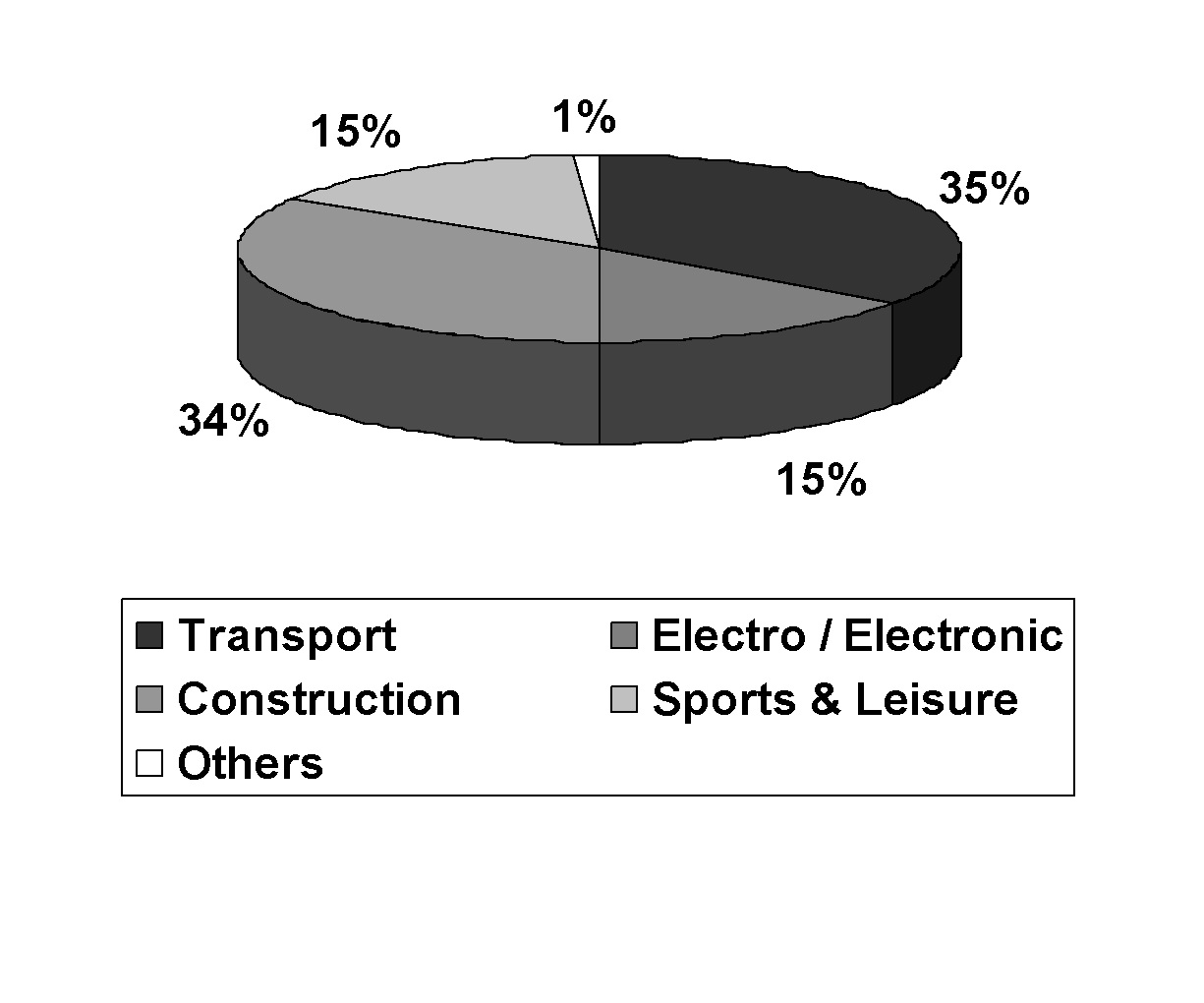

Despite the different developments on the various markets shown here for each manufacturing process, the share of the big GRP application industries has remained constant in Europe. A third of the entire production volume is manufactured for transport, and another third for the construction industry. Other areas of application are electrics, electronics, sports and leisure (see figure 2).

GRP production in 2015 by countries

The countries / groups of countries with the highest growth rates continue to be Germany, the UK / Ireland, and the Eastern European countries. Germany – the biggest European GRP/composites country – has had the highest growth rate (6%) in 2015 and a total volume of 212 kilotonnes. The Eastern European countries are developing at a rate of over 4%, and the UK / Ireland at nearly 3%. The only markets where decreasing volumes can be observed are those in the Scandinavian countries.

For the last few years surveys have also been available for the Turkish composites market. Compared with the European countries covered in this report, this is the biggest GRP market. For the first time, however, its growth has been slightly weaker in 2015 compared with previous years. According to the Turkish Composites Manufacturers’ Association (TCMA), this market has grown by about 2%. (Source: TCMA).

Other composite materials

Although a different impression may be gained from current media reporting and at trade shows, GRP continues to be by far the biggest material group in the composites industry. Glass fibers are used for reinforcement in over 95% of all composites. Of the 8.8 megatonnes of composites produced globally in 2014 (source: JEC Composites), 2.3 megatonnes of glass fiber reinforced plastics was produced in Europe.

The global requirement for carbon fiber reinforced plastics (CRP) has been estimated as 91.000 tonnes in 2015.

Outlook

Composites and GRP are construction materials of the future. There are, however, numerous challenges which need to be handled within the composites industry and also by working together outside the industry.

Hybrid and multimaterial systems versus. single material mindset

Quite often we can find rather an insular mindset within the composites industry. A major distinction is made between individual material groups, but also in relation to different manufacturing processes. In view of competing systems and/or certain specified material properties, this can become a problem. Instead, it would be good to work together on an expansion of the market, across material boundaries.

Enforced standardisation and market access

Companies are often rather reluctant to face the idea of standardisation. Such companies, however, tend to forget that standardisation does not just cost money and resources, but it can also determine access and/or barriers to a given market. European industry is currently losing a good deal of influence on international standardisation and is therefore becoming a ‘recipient’ of standards. Unfortunately, however, this link is hardly ever perceived by the industry as a challenge. A company can only specify and insist on its own standards if it makes an active contribution to the formulation of standards on a wider platform.

Practical suitability and feasibility

In recent years there has been quite an increase in research activities on composites. Like the media interest, this must be seen as highly positive, as the insights benefit both the parties who are involved and the entire industry. Yet it would be desirable if technical considerations could also concentrate more clearly on economic aspects.

Daily business versus future

Composites only unfold their ‘power’ when products are designed with a view to the loads they need to bear. Yet this factor is only one among many specific features of composites and is communicated within the industry quite naturally. What may not be quite so natural – though it happens frequently – is that the specific knowledge which is needed in order to use composites for design purposes is not yet ‘generally’ available. After all, composites are still being treated as marginal at universities, colleges and vocational schools,

Ambition versus reality

SMC/BMC materials have been used in large-scale automotive manufacturing for many years now. Yet we still come across articles and presentations encouraging us to work on solutions to ‘manufacture composites in large quantities/series’. Such work should actually be superfluous, as serial manufacturing is already well established. Although there are many endeavours with regard to the serial production of high-performance composites, in particular, it is worth pointing out that they concern specific subsectors of the composites industry.

Forecasts versus development

The composites market has been growing steadily over the past few years, even though its growth has not been the same in all segments and regions. It is impossible to predict any growth figures for the next few years. The fact is that composites offer a wide range of options and that their potential often has not been fully developed or is still waiting to be used more fully. Everyone along the value chain can look forward to a large number of options which, hopefully, will be used in the future. Ultimately, the prevailing material will be the one that offers the best long-term prospects for a given application. This may not necessarily be a composite, but it may well be.

This story is reprinted from material from Composites Germany, with editorial changes made by Materials Today. The views expressed in this article do not necessarily represent those of Elsevier.