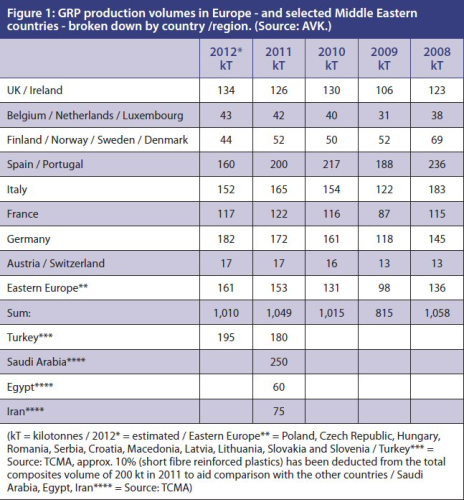

Compared to 2011, the AVK predicts that the production of glass reinforced plastics (GRP) in Europe will fall by approximately 4% to 1.01 million tonnes this year (see Figure 1). Following two years of growth in 2010 and 2011, this figure seems to indicate a slowdown in the market, but a more detailed look at the statistics reveal this is not the case in all countries and for all composites applications.

GRP production by country

The GRP industry in individual European countries is dependent on a number of factors, including the general economic conditions in those countries and the major application industries for composites in the countries, the AVK notes.

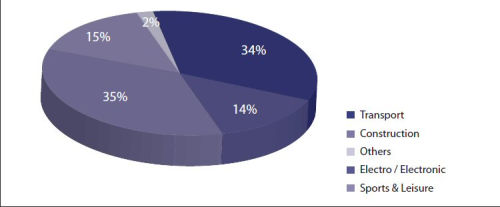

For example, recession and falling domestic demand in countries such as Spain impact on every sector of the economy, including the construction sector, which is the biggest user of GRP in Europe (see Figure 2). The continued fall in car sales expected in Spain, Italy and France will exacerbate the weaknesses in these countries and have a direct impact on GRP companies which supply automotive components.

According to AVK’s statistics the strongest growth in GRP production in Europe this year is in Germany, the UK and Eastern European countries. Factors such as outsourcing of production to India or purchasing components manufactured in China is affecting all European countries, AVK notes. At the same time, the development of the world economy, including Europe’s falling share of global output in the medium- and long-term, will also leave its mark on GRP production. Currently, Europe as a region (including the countries not considered in the AVK report) accounts for around one quarter of total global production of all composites. The remainder is essentially distributed between North America and Asia, with Asia having the larger share.

For the first time, the AVK survey also includes Turkey, Saudi Arabia, Egypt and Iran. According to figures provided by the Turkish Composites Association (TCMA), this market has now reached a size of nearly 200,000 tonnes. It is therefore larger than any other European market considered here and is enjoying above average growth – Turkish GRP production expected to increase by approximately 15,000 tonnes in 2012. (See Composites market in Turkey set for growth.)

(For a more detailed breakdown of the country statistics see The European GRP market – by country.)

Thermoplastics growth

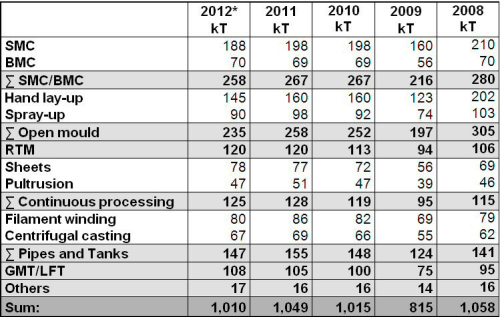

A look at the production of GRP by process adds more to the picture (see Figure 3). Falling demand in vehicle production throughout Europe is reflected in a decrease in the production of SMC components in 2012, while the production of components using bulk moulding compound (BMC), which is primarily used in the electrical/electronics sector, is growing slightly. SMC and BMC production accounts for nearly one quarter of the total European GRP market.

As was the case last year, demand for parts produced using open mould processes (hand lay-up and spray-up) has continued to fall. The market for resin transfer moulding (RTM) and parts manufactured using this process has shown no growth, while continuous processes for manufacturing GRP panels are one of the few areas to have grown a little over the past year. The market for pultruded profiles, in contrast, has fallen by 8%, with production volumes continuing to be relatively low. There is also a clear decline in the manufacture of pipe and tank components using the centrifugal casting and filament winding processes.

Glass mat reinforced thermoplastics (GMT) and long fibre reinforced thermoplastics (LFT), with growth of 6% this year, are the only materials with a non-thermoset matrix considered in the AVK report and are clearly ahead of the general trend in 2012.

Transport and construction lead

The proportions of GRP parts used by individual application industries in Europe has remained relatively constant over time, AVK reports. The transport and construction sectors each consume about one third of total production volume (Figure 2). In this survey, as well as automotive parts, the transport sector also includes components for railway vehicles, boats and aircraft. In the construction sector, important applications include pipelines and infrastructure projects as well as industrial plant construction and the production of rotor blades for wind turbines.

Other sales markets include the electrical/electronics sector (including boxes for circuit breakers etc.) and the sports and leisure segment, which is the only market in which products are primarily manufactured for the consumer market.

Outlook

According to Dr Elmar Witten, Managing Director of the AVK, integrated production technology is becoming essential for high wage European countries and material and energy efficiency are ever more important. The interaction between business and research, as well as investment in research, is a key factor in the success and innovative power of Europe’s GRP industry.

Overall, the composites market is highly dynamic, he reports, especially in the area of manufacturing, which is dominated by small and medium-sized companies. These companies are seeking new areas of application for their products, diversifying their ranges and even the smallest companies are increasingly internationalising both the purchasing and sales sides of their businesses.

If the potential of automation can be tapped (not just for commodities), the volume of composite production as a whole will enjoy even higher rates of growth than in recent years, Witten notes.

On the marketing side, an analysis of the sustainability of various materials could reveal many advantages for composites compared to ‘traditional’ materials. A consideration of the ecological, economic and social effects of production over the complete life cycle of the product suggests that the ecological advantages of GRP may be the driving force that leads to the substitution of other materials.

Finally, advantages in training and expertise will be critical factors in the success of innovative and competitive composite materials and these must be improved.

Carbon fibre

For the first time, this year’s AVK reports includes details of the carbon fibre composites market, compiled by Carbon Composites eV (CCeV), an association of companies and research institutes in Germany, Switzerland and Austria. The complete report is available to download from the AVK website. ♦

This article was also published in the November/December 2012 issue of Reinforced Plastics magazine.