After the decline in the volume of glass fibre reinforced plastics (GRP) manufactured last year, AVK Industrievereinigung Verstärkte Kunststoffe e.V. (Federation of Reinforced Plastics) highlighted that a return to weak growth is expected for the European market this year. For some applications, countries and even manufacturing processes the trend is positive, but for others it is negative.

| The overall market in Europe is expected to grow by 1% to an estimated 1.02 million tonnes. |

AVK reports that as in previous years the trend line for the GRP market, a specialist segment of the plastics industry, more or less mirrors the current state of the economy and the general trend for the plastics processing market.

Market observations

AVK compiled the statistics by conducting a survey. The study includes those countries for which the production figures can be recorded and validated. Quantities manufactured in Turkey are considered but stated separately due to the lack of data for long-term comparison.

The survey includes all materials with a thermoset matrix as well as glass mat reinforced thermoplastics (GMT) and long fibre reinforced thermoplastics (LFT). Carbon fibre reinforced plastics (CRP) are not included (a separate report on this will be available on ReinforcedPlastics.com soon).

GRP production in 2013

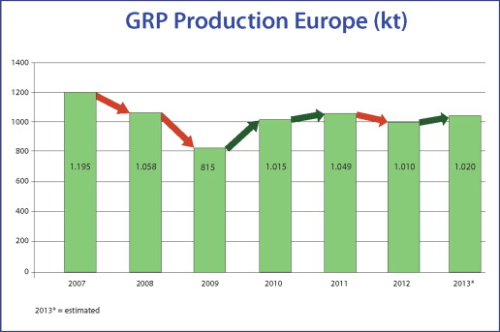

After a slight year-on-year decline in the volume of GRP produced in 2012, AVK says that the sector returned to weak growth in 2013. The overall market in Europe is expected to grow by 1% to an estimated 1.02 million tonnes (see Figure 1).

The GRP industry is dominated by small and medium-sized companies and is therefore extremely diverse not only in terms of the spectrum of manufacturing processes and level of automation but also in regional differences, country-specific conditions and the raw materials used.

Trends in procedures and components

SMC/BMC

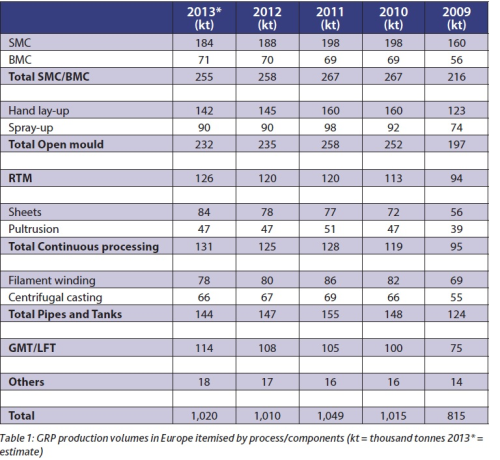

AVK reports that components made from SMC (sheet moulding compound) and BMC (bulk moulding compound), mostly series manufactured, still account for one quarter of the total quantity of GRP produced. The largest market is vehicle production, which is experiencing its most difficult year for some time in 2013. Consequently, SMC production has contracted by over 2%.

Production of BMC components grew slightly by 1.4%, which can be attributed primarily to applications in the electrical/electronics industry.

Open mould

The least automated ‘open processes’ (hand lay-up, spray-up) continue to decline. While the volume of components manufactured using the spray-up process is stagnating, the market for hand lay-up parts is shrinking by over 2%.

RTM

Growth in the production of components using RTM (resin transfer moulding), at around 5%, has been stronger than average in 2013.

Due to the wide range of production possibilities and the broad scope for changing its process parameters, AVK explains that RTM processes are currently among those receiving the greatest attention with regard to the development of large series production processes in the composites sector.

Continuous processing

With annual growth of nearly 8%, continuous processes for manufacturing GRP panels and webs have been among the fastest-growing in the sector. As well as applications in the transport sector, suppliers are also opening up an ever-growing number of new uses in the sports/leisure and construction sectors (for example, for facades).

After its contraction last year, the market for GRP pultrusion profiles has stabilised in 2013 and is no longer in decline in Europe.

Pipes and tanks

Western European countries, in particular, again recorded a slight fall of 2% in the production of pipes and tanks, which are manufactured using the centrifugal casting and filament winding processes. However, the production figures for Europe do not reflect country-specific differences or major drinking water projects in the countries of Central and South-Eastern Europe as well as North Africa.

GMT/LFT

As was the case last year, AVK reports that the market trend for glass mat reinforced thermoplastics (GMT) and long fibre reinforced thermoplastics (LFT) was significantly higher than the average. The main area of application for these products is the automotive industry. In this sector, manufacturers of thermoplastics have, above all, repeatedly found success in replacing other materials and opening up new areas outside this industry.

Short fibre reinforced thermoplastics

AVK adds that the quantities of short fibre reinforced thermoplastics produced are difficult to assess and record and as a result they are not included in the GRP figures presented. However, this area is growing fast compared to the GRP market as a whole.

It is estimated that the total quantity manufactured in Europe is more than 20% greater than the production figure for GRP stated. Approximately half the volume produced is used in applications in the transport sector, one quarter in the electrical/electronics sector and somewhat more than 15% in the area of sports and leisure. ♦

This article was published in the November/December 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing this registration form.