The volume of glass fibre reinforced plastics (GRP) manufactured in Europe will grow by over 2% in 2014, concludes the 2014 GRP market report from AVK Industrieeinigung Verstärkte Kunststoffe e.V. (Federation of Reinforced Plastics). Growth has therefore stabilised in this segment, which is by far the largest area of the fibre reinforced plastics and composites industry. The report adds that the composites market is extremely heterogeneous not only in terms of company size and the processing techniques used in GRP production but also in the types of components and products manufactured. The dynamics of the market vary widely depending on the industry for which the components are destined. In addition, there are significant regional differences.

Market observations

As in previous years, the European GRP market report 2014 is based on data for those European countries, for which production figures can be recorded and validated. Turkish production is considered but (still) stated separately due to the lack of data for long-term comparison. In the following report, the term GRP refers to all glass fibre reinforced plastics with a thermoset matrix as well as glass mat reinforced thermoplastics (GMT) and long fibre reinforced thermoplastics (LFT). Data on the European production of short fibre reinforced thermoplastics is only available as an overall quantity and are stated separately. The report also states the sizes of the markets for other reinforcing fibres (natural and basalt fibres). Carbon fibre reinforced plastics (CRP) are dealt with separately in a second market report on pages 38-45.

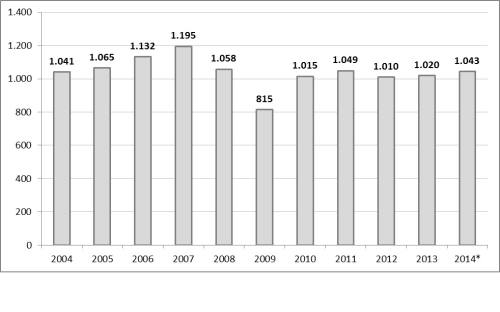

GRP production in 2014

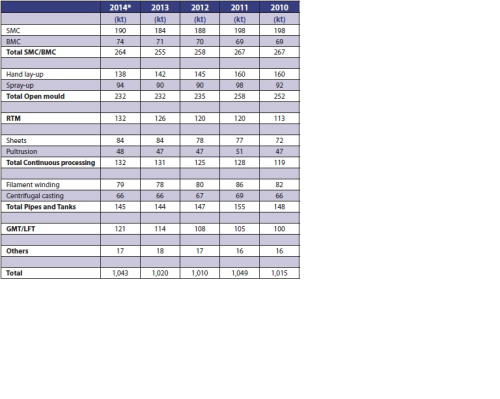

The AVK report states that European GRP production enjoyed an excellent start to the year in 2014. The first six months exceeded the expectations of most market participants. Although growth is expected to weaken slightly in the second half of the year, the overall trend is one of continuous growth. The European market as a whole is expected to grow by over 2% to an estimated 1.04 million t (see Figure 1). AVK adds that observers of the long-term trend for GRP will see that it tends to follow the pattern of the general economy. This is hardly surprising as the largest buyers of GRP components are in the transport and construction sectors, which play a major role in national economies. As Europe’s gross domestic product (GDP) contracts as a share of global GDP, the volume of GRP it manufactures as a percentage of worldwide GRP production also continues to decline. Production and consumption are shifting perceptibly towards the BRIC countries (Brazil, Russia, India and China) whose share of global GDP is growing steadily. GRP production in Europe is expanding but failing to keep pace with the worldwide trend. However, the market trends vary widely depending on the type of manufacturing process, the requirements of the corresponding application industries and even the specific European country in question. Trends in the development of processes/components are given in Figure 2.

Thermosetting materials

SMC/BMC

After enduring a difficult 2013, the AVK report says that the automobile industry has provided considerable stimulus in 2014, which has benefited its suppliers and GRP manufacturers. Although China is the largest growth market, there are positive developments in the car and commercial vehicle sectors in Europe and especially in Germany, which is the leading market. Manufacturers of SMC (sheet moulding compound) and BMC (bulk moulding compound) components have been among those to profit. The volume of SMC/BMC produced grew by over 3% in 2014.

Open mould

Production of GRP using ‘open processes’ has stagnated in 2014. The number of components manufactured using hand lay-up techniques continues to fall. In contrast, good growth has been observed in the spray-up sector. The many small companies operating in these markets not only have to compete with ‘closed processes’ (for example, RTM) but also, and importantly, with non-European competitors.

RTM

Growth in the production of RTM (resin transfer moulding) components has continued the trend of stronger than average growth (nearly 5%) observed last year. This category includes all components manufactured using a closed mould although the processes sometimes differ significantly (infusion and injection). The automobile industry, in particular, is working very hard to develop and refine these processes.

Continuous processing

After enjoying relatively strong growth last year, European production of GRP using ‘continuous processes’ has stagnated in 2014. Panels are primarily produced for use in vehicles. The most significant applications for GRP pultrusion profiles are in the construction sector. The continuous processing segment is characterised by its relatively high level of automation.

Pipes and tanks

GRP pipes and tanks manufactured using the centrifugal casting and filament winding processes are primarily used in the oil/gas and chemical industries. The European market, which accounts for around one quarter of worldwide production, is stagnating. The market is dominated by a few large manufacturers not least because of the relatively high quantities of material involved per order. The industry sees significant growth opportunities especially in pipes for water and wastewater projects, although the most dynamic markets in this sector are currently to be found outside Europe.

Thermoplastic materials

GMT/LFT

Glass mat reinforced thermoplastics (GMT) and long fibre reinforced thermoplastics (LFT) are still growing at an above average rate of over 6% in 2014. Like other processes that primarily serve the automobile industry, companies in this sector have been participating in and benefiting from the development of new applications as well as the general market dynamic in Europe. Moreover, the substitution of components previously made from thermosetting materials (for example, SMC) offers the possibility of further growth.

Short fibre reinforced thermoplastics

AVK adds that the large market segment of short fibre reinforced thermoplastics must be mentioned in addition to the quantities of GMT/LFT stated in the GRP figures in this section of the market report. At approximately 1,160 kt, the European market for thermoplastic, glass fibre reinforced compounds was somewhat larger than the market for the GRP products that are the major focus of this report (thermosetting materials plus GMT/LFT). Production volumes in this segment are growing significantly faster at around 5% per year.

Applications

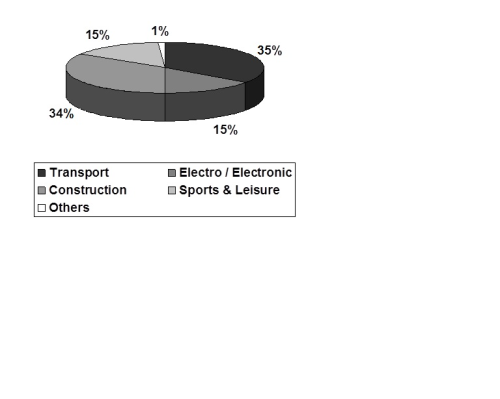

Despite the slightly different trends observed in the markets for the various manufacturing processes, the proportions of GRP used by the major application industries in Europe remain constant. The transport and construction sectors each consume one third of total production. Other application industries include the electro/electronics sector and the sport and leisure segment (see Figure 3).

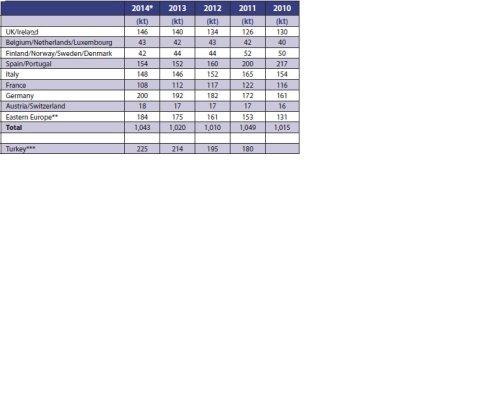

GRP production in 2014 by country

Figure 4 clearly shows that there is no uniform market trend throughout Europe. The key growth factors are the state of the national economy of the country in question and the trends for the major GRP applications used in that country. The continuous, above average growth in Germany, UK/Ireland as well as in Eastern European countries has stabilised. This trend is principally supported by the automotive industry in Germany and by the construction sector in the UK. According to the Turkish composites Association TCMA, the sector in Turkey once again experienced above average growth of nearly 5%. The Turkish market has been included (separately) in this market report since 2011 (source: TCMA).

Other composite materials

GRP are by far the largest group of materials in the composites industry. Glass fibres are used for reinforcement in over 95% of the total volume of composites (short and long fibres, rovings and mats). Europe is expected to manufacture 2.2 million tonnes of glass fibre reinforced plastics in 2014 with global composites production forecast to exceed 8.5 million tonnes during this period. Of these, the GRP products studied in detail in this report will account for 1.04 million tonnes and short fibre reinforced thermoplastics the remaining 1.16 million tonnes. Worldwide demand for carbon fibre reinforced plastics (CRP) is estimated at 79,000 tonnes in 2014 (see pages 38-45). 92,000 tonnes of components made from natural fibre reinforced plastics, mostly used in the automotive sector, were manufactured in the EU in 2012. 260,000 tonnes of wood-plastic composites were produced in the EU.

Outlook

Industrial companies see great potential in thermoplastic materials and are investing accordingly in their future. Consequently, thermoplastics are currently attracting greater attention in the market than thermosetting materials. Machinery manufacturers, in particular, have also identified and committed themselves to composites as a key trend of the future. This is due, not least, to well-publicised flagship projects in the transport and aviation sectors. Finding ways to combine different materials remains a major challenge for the future. Developers and industry are increasingly working on solutions that are based not on single materials but on efficient and elegant combinations. Over recent years, composites have succeeded repeatedly in finding new applications. For example, the specific requirements of the construction sector offer many opportunities.