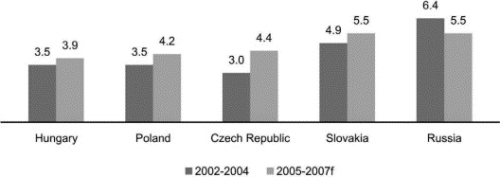

The economies of Central and Eastern Europe (CEE) will on average expand by 5% a year from 2005-2007, according to a study from research firm PMR (Emerging Europe: comparative macroeconomic analysis and forecasts for 2005-2007). (The study defines the CEE as encompassing the Czech Republic, Hungary, Poland, Russia and Slovakia.) This growth rate is slightly lower than in 2003-2004 but is still significantly higher than the average for the EU15 (the 15 countries in the European Union).

PMR estimates that in 2004, GDP growth in the CEE region accelerated to 6.1%, driven by the strong growth of the Russian economy and the good performance of the remaining four economies, boosted by their EU membership. In 2005 the region's economy was expected to slow down to slightly below 5%, mainly due to lower GDP growth of the region's largest members, Russia and Poland.

Russia is the largest economy of the region and grew the fastest in 2003-2004 (7.2%), but is starting to slow down, curtailed by its inability to increase output capacity, Russian companies' poor ability to compete, and a less favourable business outlook among Russian companies. Inadequate economic policy is the main reason why the GDP growth will dip below 5% in 2007, says PMR, but nevertheless, Russia will continue to be one of the fastest growing countries in the region.

The CEE's high economic growth was also underpinned by the healthy expansion of Slovakian economy. After slightly slower growth in 2005 (in comparison to 2004), PMR expects the Slovak economy to accelerate in next two years to reach 6% in 2007, fuelled by a surge in investments as big automotive investment projects enter their final stages. In 2007, net exports are expected to revive, to stimulate GDP growth more as Slovakia begins to export more car makers' products.

In 2004, the GDP growth in the Czech Republic, Hungary and Poland was higher than original forecasts. These economies were favourably boosted by the EU accession, and GDP growth was the highest since the end of previous century. According to forecasts, the economies of Poland and Hungary will accelerate from 2006, after slowing down in 2005.

“The EU accession was the main reason for the better-than-expected performance of the four CEE countries that became new EU members as of 1 May 2004,” the PMR report's author, Marcin Sadowski, says. “Yet, after slightly slowing down in 2005, the economies will get back onto the path of higher growth, powered by a large influx of investments and rising exports, resulting from the inflow of EU funds and their highly competitive products.”

The following statistics on the Central and Eastern European composites industry were provided by composites consultant Jan Orlt, who's based in the Czech Republic.

Czech Republic

Around 200 companies are involved in composites production in the Czech Republic (CR), ranging from 20 large manufacturers (with around 20-60 employees) to small, ‘family’ companies with several workers. The most important manufacturers account for around 85% of the country's total composites production.

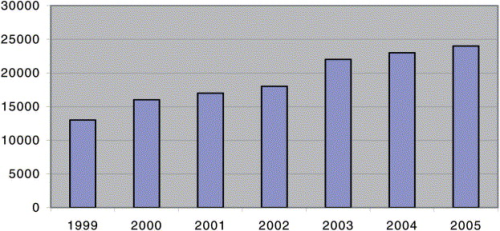

Figure 1 shows that the production of composites in the CR is characterised by steady growth, and an annual increase of 3-5% can be expected. There are several reasons for this positive trend:

- a long-term tradition both in resin and reinforcement production in CR (starting in the 1950s);

- extensive domestic research and development in the area of reinforced plastics (thanks, in the past, to limited possibilities of cooperation and gaining of new information from more developed countries);

- existence of all necessary processing methods by Czech manufacturers;

- quick implementation of new technical knowledge from foreign companies in recent years, and increasing quality as a result of strong competition;

- for the time being the comparative advantage of the low cost labour is still playing a role and a considerable part of production is exported.

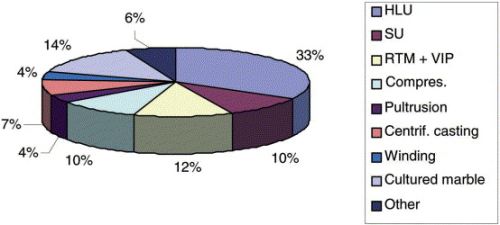

The whole range of technologies for fibre reinforced plastic (FRP) processing is used in the country: hand lay-up (HLU); spray-up (SU); pressing; pultrusion; filament winding; centrifugal casting; injection (RTM), vacuum injection (VARTM) and infusion (VIP) processes (see Figure 2). In the recent years the use of hand lay-up is falling and closed mould technologies such as RTM and VIP are becoming more popular. This trend is being driven by more stringent regulations regarding emissions in the workshop and the environment, and the advantages of these technologies from the point of view productivity, increased quality and the possibility of manufacturing large parts.

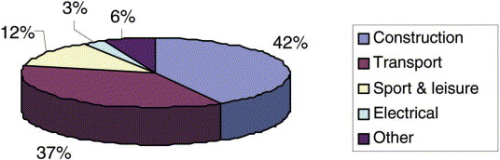

The applications for composites in the CR in recent years are illustrated in Figure 3. The transport sector includes cars, caravans, trucks, buses, rail vehicles, boats and aircraft applications. The sport and leisure sector includes products such as skis and snowboards, windsurfing boards, sports boats and sporting equipment. The production of wind turbine blades and generator covers is still fairly low.

Around 65% of the country's composites production is exported. Some manufacturers succeed in winning orders from abroad, while some work as joint ventures with a foreign partner or are partially-owned by a foreign company.

The outlook for the Czech reinforced plastics industry seems favourable, at least for next few years, with growth rates of around 3-5% annually. However there is a possibility, that some foreign partners will start to develop collaborations with and invest in countries with cheaper labour costs such as, for example, Poland, Romania and Ukraine.

Belorussia

The composites market in Belorussia is in the early stages of development and production is currently estimated to be approximately 3000 tons/year.

Bulgaria

There was a considerable amount of composites production in Bulgaria for military applications in the past using modern technologies; for example, tanks manufactured by filament winding, pultruded profiles for bridge and road structures, and military boats and ships.

Production volume today is estimated at approximately 5500 tons/year and cooperation with other countries is widespread, for example, boats and ships are being developed with US companies, and sanitary goods with firms in Greece. Some increases can be expected thanks to extensive Turkish investments in unsaturated polyester resin and reinforcements production, with some plants being built close to the Bulgarian border.

Hungary

There is a similar range of composites applications in Hungary as in the Czech Republic. Composites production in Hungary is estimated at around 10 000 tons/year. A lot of this production is exported, mainly to Germany and Austria.

Poland

There are three producers of unsaturated polyester resins and gel-coats in Poland, one producer of glass fibre and reinforcements, and several hundred composites manufact-urers with an overall production estimated at 80 000 tons/year. Production is mainly focused on marine applications, ranging from sporting boats and yachts, to parts for big ships. Another important business is parts for road and rail transport.

Romania

Hand lay-up is still widely used in Romania. A large amount of reinforced plastics production goes into sanitary goods such as bathtubs, sinks and bathroom equipment. Some years ago a HOBAS daughter company started production of tubes using centrifugal casting.

The total production of composites in the country is around 6000 tons/year, and most of this is exported because of Romania's low labour costs.

Slovakia

Composites production in Slovakia is estimated to be about 4000 tons/year. The main application sectors are transport (automotive, rail) and construction (including sanitary goods and swimming pools). A significant part of the country's production is exported, mainly to Austria and Germany, and some of bigger players in the market are daughter companies of foreign firms, such as REKU (Germany) and INDUPOL (Belgium).

Ukraine

Ukraine looks to be a promising territory for greater composites use, but production is estimated at 5000 tons/year for the time being. Rail transport (renewal of wagons), boats and other marine applications, car, truck, bus, trolleys and tramway parts are the main applications of composites. High-tech composites are used in the aircraft industry, which has a long-term tradition in the Ukraine.