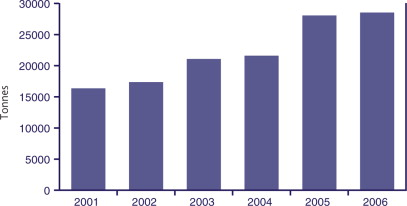

Apart from 2001-2002 (when production was affected by severe flooding in the country and the recession in Europe), manufacture of composite products in the Czech Republic has been growing steadily (Figure 1). During 2001-2006 the Czech composites industry experienced an average annual growth rate of 14.1%, according to Dr Miroslav Cerný , president of the country's Association of Composites Manufacturers (SVK). Growth in European composites production as a whole was much lower, at 2.6%, in 2006. (The SVK figures are based on total consumption of unsaturated polyester resins in the Czech Republic and do not include epoxy resins.)

The main reasons behind this growth, says Cerný, are the strong base of raw materials production in the Czech Republic, a long tradition of materials research and development, and low labour costs compared to the EU15 countries. (The EU15 refers to the member countries in the European Union prior to the accession of ten candidate countries on 1 May 2004. The EU15 comprised Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden, and the UK.)

The Czech Republic joined the EU in 2004 and this has been a positive factor for the composites industry, Cerný told delegates at the Karlovy Vary conference, which is held every two years. Around 50% of the country's composites production is now exported, mostly to the EU, but also to eastern European countries.

Unsaturated polyester resins, gel-coats and epoxy resins are manufactured in the country by Spolchemie AS, based in Ústí nad Labem; the unsaturated polyester resins are sold by Reichhold CZ, and the epoxies by Spolchemie. A significant amount of resin is now imported into the country (mainly from the EU15 countries). Glass reinforcements are manufactured by Saint-Gobain Vertex a.s., in Litomysl, but a large proportion of the reinforcements used by the Czech industry is also imported.

Cerný estimates that there are about ten large manufacturers of composite products in the Czech Republic, but the majority of companies are very small, with less than 20 employees. The SVK was founded in 1998 and has around 40 member companies, the majority of which are manufacturers of composite products. SVK has been a member of the European Composites Industry Association EuCIA (formerly GRPMC) since 2000.

Processes and applications

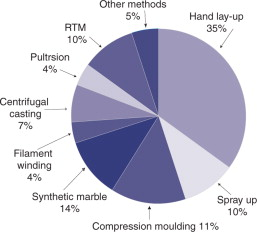

Low cost hand lay-up is still the most widely used process in the Czech Republic, accounting for approximately 35% of all composites production. This is more than the EU15 average of 20%, but less than other Central European countries. All the various composite processing technologies are employed in the country (Figure 2) but production facilities need to be enlarged and upgraded. Recently closed mould technologies such as resin transfer moulding (RTM) and vacuum assisted RTM (VARTM) are beginning to be used more as regulations regarding emissions of volatile organic compounds (VOCs) tighten up. The use of natural fibre reinforcements, glass mat thermoplastics (GMT)/long fibre reinforced thermoplastics (LFT) is still low.

| The XXIV Conference on Reinforced Plastics was organised by Dum techniky Plzen spol. sro. (House of Technology Plzen Ltd). The next event is scheduled for 2009. |

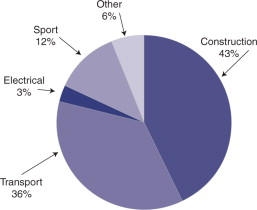

The sports equipment sector is also strong and includes skis, snow and winds and boards, sports boats and other sporting equipment. Production of composite wind turbine blades, a large market in many European countries, is still low in the Czech Republic.

Outlook

The outlook for the Czech composites industry appears favourable, notes Cerný. Reduced labour and manufacturing costs and the country's growing market mean that European companies are still expected to invest in the Czech Republic, but Cerný warns there is a possibility that some foreign investments will be moved to countries with cheaper labour costs in Eastern Europe.

Another threat facing the country's composites industry is the yet to be determined impact of incoming EU environmental legislation, including the End of Life Vehicle (ELV) Directive, REACH (Registration, Evaluation, and Authorisation of Chemicals) legislation, WEEE (Waste Electrical and Electronic Equipment) Directive, and the Waste Framework Directive (WFD).

HOBAS CZ a.s.; manufacturer of centrifugally cast GRP pipes. Peter-GFK spol. s.r.o.; RTM, VARTM and hand lay-up of parts for trucks, buses and other vehicles. AAR plast s.r.o.; manufacturer of pipes and other structures for the waste water industry. 5M s.r.o.; producer composite materials and products, including adhesives, epoxy systems, prepregs. Reflex spol. s.r.o., manufacture of containers for collecting waste etc. PREFA Kompozity a.s.; pultruded products. GDP Koral s.r.o.; pultruded parts. Epuz spol. s.r.o.; boats, automotive and other parts. Plzenské dílo v.d.; compression moulding, injection moulding. LA Composite s.r.o.; composite structures for the aircraft and rail industries. |