Russia's economy is currently booming. The country has experienced several years of strong growth (8% in 2007) and it is now the tenth largest economy in the world. Its vast oil and gas resources are key to its economic strength; the country is the second largest oil-producing country in the world and state-controlled Gazprom is the world's largest gas company.

A strong economy, a population of over 140 million and the potential for significant long-term growth have made the country a priority market for many international companies. Some of the areas identified as opportunities for international companies include the oil and gas, power, aerospace, automotive, and construction sectors.

On the downside, Russia is not an easy place to do business. International companies complain of high levels of bureaucracy and corruption. The 2008 World Bank's Ease of Doing Business survey (covering the period April 2006 to June 2007) ranks Russia 106 out of 178 countries. This puts it behind Paraguay and Ethiopia and just ahead of Nigeria and Bangladesh.

In the longer term, Russia could face significant labour shortages. The country's population is falling by over 700 000 per year and male life expectancy is now 58 years (which is comparable to Bangladesh). There is already a shortfall of skilled workers, which is exacerbated by low labour mobility.

Composites

As would be expected, the strong Russian economy is spurring growth in the country's composites industry.

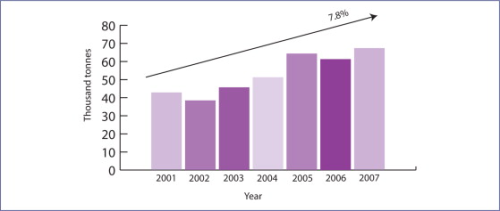

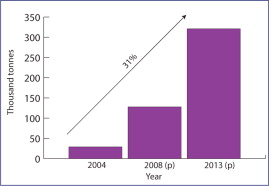

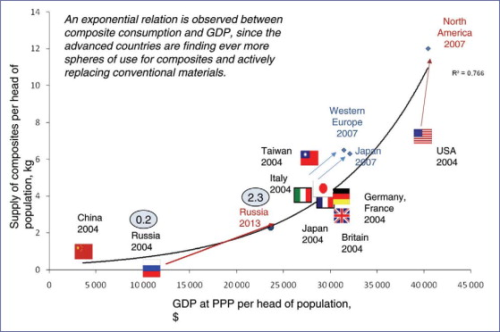

According to the Moscow-based Union of Glass Fibre Manufacturers (UGFM), during the past six years the use of glass fibre in Russia has grown by 150%, at a compound average growth rate (CAGR) of 7.8% (Figure 1). Imports have varied between 23% and 41% during this time. In his conference presentation, UGFM's Executive Director Kirill Vasiliev explained that the use of glass fibre composites in Russia is expected to treble in the next five years, to reach an estimated figure of 321 000 tonnes in 2013 (Figure 2.) And there is potential for much more growth. Vasiliev explained that composites consumption per capita in Russia was just 0.2 kg in 2004 and it is expected to increase to 2.3 kg by 2013, which is still very low compared to many other regions (Figure 3).

Although these predictions look rosy, Vasiliev also highlighted some of the challenges facing the Russian composites industry. These include:

- domestic production being supplanted by imports;

- lagging behind developed countries in terms of production methods, product quality, scale of production and product range;

- the conservative attitude of manufacturers and consumers towards new materials;

- poor government support (and the strong position of the metals industry); and

- a shortage of skilled manpower.

| The 1st International Conference on the Russia/CIS Composite Market was held on 22-23 May 2008 in Alushta, Crimea, Ukraine. It was organised by Business Forum. The event was sponsored by ETC, AOC, and Fiber China. A second conference is planned for May 2009. |

UGFM was established in 2004 with the aim of safeguarding the interests of Russian manufacturers of glass fibre and products based on glass fibre. Today, its 20 members include manufacturers of glass fibre from Russian and other Commonwealth of Independent States (CIS) countries, as well as international equipment suppliers. Its objectives include promoting the applications of glass fibre products, encouraging the formation of standards for the industry, strengthening cooperation between glass fibre producers, users of glass fibre products and suppliers of specialist equipment, and fostering international cooperation.

In terms of import issues the UGFM is calling for abolition of duties on imported advanced technology not manufactured in the country, and the introduction of measures to protect against growth in product imports. It is also campaigning against ‘grey imports.’

Markets

According to Dimitry Bulychev, Account Manager, Russia and CIS, for Owens Corning Vetrotex (OCV) Reinforcements, the composites market is growing at a rate of up to 16% a year, 1.5-2 times more than the growth of gross domestic product (GDP) in Russia. In his conference presentation, he highlighted a number of markets with high growth opportunities for composites:

- construction: new housing commissioned in the country was up 19.4% in 2007 and 9-12% growth is forecast for 2008-2010;

- vehicle manufacture: 12 vehicle production plants will be built by 2010; by 2015 they are all set to have localised component production;

- highway construction: there are plans to construct more than 10 000 km of road in Russia by 2015;

- infrastructure: 150 000 km of water supply and sewer pipes are to be modernised by 2012; and

- the oil industry: replacement of metal pipes by corrosion-resistant composite pipes with a service life of up to 50 years.

In July, Owens Corning announced that it is doubling the production capacity of its glass fibre composites facility in Gous-Khrustalny, which is around 200 km east of Moscow. Owens Corning acquired the facility as part of its 2007 acquisition of Saint-Gobain's composites businesses. Construction at the plant is expected to start this year, with start-up anticipated by the end of 2009.

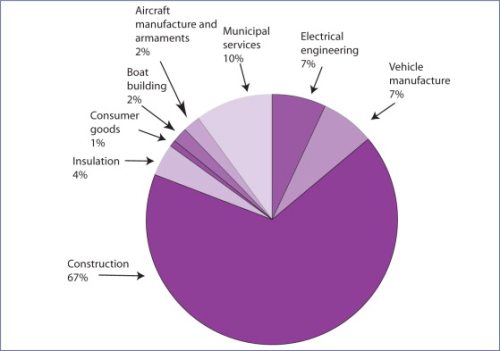

According to Bulychev, the glass fibre market in the CIS in 2007 was 130 000 tonnes, with composites taking 30 000 tonnes of this. The glass fibre market in Russia in 2007 was around 80 000 tonnes, with construction representing over 60% of this (Figure 4).

Oil & gasRussia possesses up to 14% of world proved oil reserves and 36% of world gas reserves. Continued growth in production will require the development of deposits in inaccessible regions and this cannot take place without the use of the world's best technologies, equipment and engineering. Total investment needed for the full development of the Russian oil and gas onshore industry is estimated at £500 billion. There is also the cost of potential offshore oil and gas projects estimated at £30-40 billion. ConstructionThe construction industry is one of the fastest growing sectors in the Russian economy and it's attracting large amounts of foreign investment. Demand for high quality building products is estimated to be growing at a rate of 10-15% a year. The market for building products in Russia is estimated to be worth over £3 billion. Urban regeneration projects in Moscow, St Petersburg and other Russian cities are underway, large infrastructure projects are set for execution, and industrial companies are planning new investments. AerospaceMilitary and civil aircraft are currently produced at 13 specialised plants. They are operating below capacity using out-dated equipment and technology. The industry has survived thanks mostly to export orders for Sukhoi and MiG fighter jets, but the government now has ambitious plans to revive the aerospace industry. Russia's strengths lie in military jet design and the use of titanium, but there gaps in areas such as fuel efficiency, high volume manufacturing, and service and support networks, where outside expertise is needed. AutomotiveFuelled by a booming economy, the Russian automotive sector has emerged as one of the most dynamic in the world. In 2006 Russia became the fifth largest passenger car selling country in Europe. Analysts forecast that in 2014 as many as 2.3 million new cars will be sold in Russia. Growing purchasing power, government programmes to stimulate production, and expanding dealership networks are creating favourable conditions for domestic and foreign producers of cars and components. TransportRussia is experiencing growth in air traffic. The country's 360 airports and their infrastructure need considerable investment. Ten airports have a priority status for investment from the State development programme. Russia operates the world's second largest rail network. The railway network is state-owned although around 80 private freight operators run trains. The national main line railways systems are being restructured and upgraded. There are considerable opportunities in the areas of railway repair and maintenance and other related services. EngineeringEconomic growth has created relatively favourable conditions for the development of the manufacturing sector. Most Russian manufacturers need to replace or upgrade their production equipment and technologies, and they are looking for foreign suppliers of state-of-the-art production facilities and equipment. Sports & leisureThe Russian sports and leisure market has been growing steadily. There are good growth opportunities for the majority of sporting goods. The city of Sochi, located on the Black Sea, will host the 2014 Winter Olympics and the government has implemented a £6 billion investment programme to develop the region's infrastructure and accommodation. |