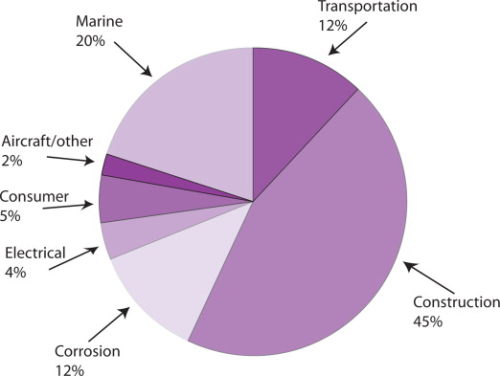

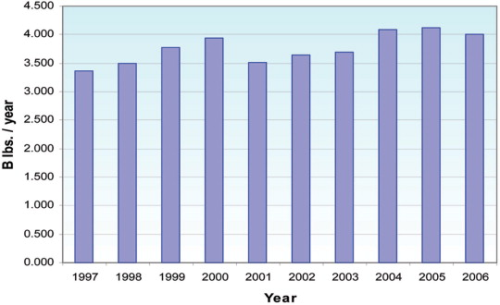

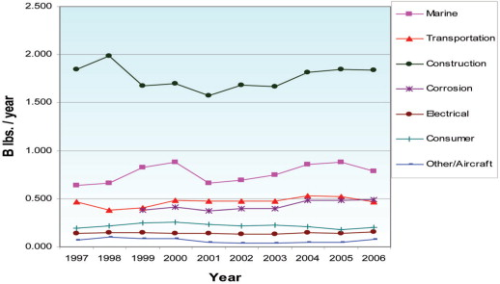

Statistics for the second quarter of 2007 show a 10% fall in total US shipments of glass reinforced thermoset composites compared to the same quarter of 2006. Shipments to the construction sector were over 11% down from the 2006 quarter, and shipments to the marine and transportation sectors were also substantially lower. These sectors account for large shares of the US composites industry (see pie chart).

Two factors are driving this slowdown in the composites market, according to Doug Frey, Executive Vice President, Global Composites, at resin supplier Reichhold, and a member of the ACMA's Board of Directors. The biggest of these is the slowdown in the US housing market (see box), which impacts many composite applications, including tub/shower, bath, kitchen, and residential infrastructure applications. The other significant downturn has been in the truck market. There was a major change in the standards for producing trucks which led to a build-up of truck purchases during the second half of last year but a subsequent drop this year.

“We saw the slowdown occur in the second half of 2006 and now, as we compare each month of this year with the second half of last year, it's getting a little better, but we're still below where we'd like to be,” says Frey.

Frey believes that a growth greater than gross domestic product (GDP) is the objective for the composites industry.

“If you review the recent decade in the composites industry, our industry grows a lot one year and not so much the next, but on average we're about GDP and we'd certainly like to be growing faster than GDP,” he states. “That's one of the major objectives of the ACMA – to build the market – and we're going to do that primarily by replacing other materials – wood, steel and aluminum.”

ACMA President John Tickle, who is also President of pultrusion company Strongwell, agrees. He explains that typically the composites industry has experienced large jumps in growth when it breaks into a new market; growth has never been steady. Tickle cites two examples where composites have taken over from other materials.

“There was a shortage of wood for tool handles several years ago and composites got into that market,” he reports. “The consumer saw it, and they liked it because it was better, so it stayed.”

Another, bigger, example cited by Tickle is wind energy, which is now a very strong market for composites worldwide.

Ups and downs

The diversity of the applications in which composites can be used is a benefit, because if one market is performing badly, another market will be growing. This is true of regional demand too; the European composites industry, for example, is currently doing well. Latin America is also strong.

“The good thing is that global composites demand is strong and growing,” says Frey. If you are well balanced globally you are more capable of weathering downturns.”

“Our company and other ACMA manufacturers are currently very competitive internationally due to the weakness of the dollar,” Tickle notes. “Unfortunately many of our ACMA companies sell their products strictly in the US.”

But while it will be a soft year for the US marine, automotive and construction sectors, it's not all bad news for composites. Some sectors, such as military applications, are showing growth, and there are other sectors which are strong.

“Anything to do with energy,” says Greg Benckart, General Manager, Reinforcements, Americas & EMEA Leader, Fiber Glass, PPG Industries (and an ACMA Director). “We see this segment as a great opportunity for composites – refurbishing and rebuilding power stations, oil field applications, there's a lot of investment going on in these areas.”

“The tank and pipe industry is also growing nicely,” adds Frey. “As living standards increase, the need for water supply and for waste treatment facilities is growing. That's true of the US, and even more so for the developing world.”

Pollution control is another emerging opportunity for composites as air quality becomes more important worldwide. The US has a lot of coal-fired generating stations which need gas recovery/gas purification systems, for example, jet bubble reactors (JBR), where corrosion-resistant composites can play a large role.

“Sometimes as an industry we think clean air regulations are a problem as we have some HAPs [hazardous air pollutants],” notes Tickle, “but we can deal with that. It's really created a nice business for us.”

“Another opportunity we've started to look at recently is bringing composite solutions to home building in hurricane areas – cooperating with builders to make the home stronger, to prevent loss of structure,” says Frey. “This could be a very nice opportunity in the long term. Unfortunately, hurricanes will continue to happen.”

The US aircraft market is small and mostly based on carbon composites (see box for more on the carbon fibre industry), but the new Boeing and Airbus aircraft are good publicity for composites.

“It's certainly leading a trend and awareness to the public of what composites can do,” confirms John Busel, Director of ACMA's Composites Growth Initiative. “It's very exciting for me to say that I was once a Boeing engineer and I was working on a lot that stuff. It took 25 years for the company to make that commitment; 25 years investigating the material for a very high visibility, consumer application.”

|

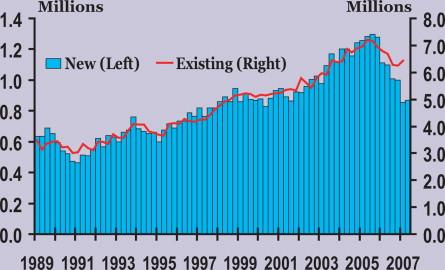

The US economy is growing at a 'below average' rate, explained Dr Stan Duobinis, a consultant specialising in analysis of the housing market. In his keynote speech at the ACMA's Composites & Polycon 2007 tradeshow in Tampa, Florida, in October, Duobinis reported that since the third quarter of 2005, US GDP has grown at an average annual rate of 2.3% and at just 1.9% during the past four quarters. The decline in housing activity reduced overall growth of the economy by 0.85% over the past four quarters and by 0.40% since the end of 2005. This takes into account 'building activity' and not suppliers and related industries. According to Duobinis, US housing starts in the third quarter of 2007 will be 35% below their peak of 2.1 million during the fourth quarter of 2005. We are near the bottom of the slump, he says, but warns that there will not be a big rebound. Instead, he expects that very slow growth in the levels of housing starts will be seen. |

Military aircraft producers of course have always made a much greater use of composites because they are focused on performance rather than cost. They want lightweight aircraft with longer range and more load-carrying capability, and additionally composites have stealth capability.

Trends

“What you're seeing is a trend of performance,” says Busel. “Whereas in the past the bottom line was cost, now people are appreciating performance. You can have a wind tower and a certain size blade, but you can do a lot more with that wind tower if it was a bigger blade capturing more wind.”

“Even in residential construction you'll start to hear a lot of words like sustainable,” he continues. “And a subset of that is going to be 'green' – green technology, LEED [the US Green Building Council's Leadership in Energy and Environmental Design Green Building Rating System] certified. Those are going to be potential marketplaces where the lexicon is changing.”

Busel is sure this will continue.

“You can ask ten engineers what sustainable is and you'll get ten different definitions, but they'll all agree that it's something that's going to be long-lasting.”

Are people also asking about recycling?

“Sure,” agrees Frey,” we see that a lot with thermoplastic resins and the automotive industry. That's one of the mega-trends that's out there, but that's tougher for thermosets than for thermoplastics.”

There is a company in Europe looking into the recycling of thermosets, he notes, but the technology has to develop. There is the issue of source of supply too.

“It's almost analogous to some of the recycling that was being done in this country in the very beginning with plastic bottles and aluminum cans,” says Benckart. “Not everyone was doing that so it was very expensive to recycle. Now that it's become mandatory in most communities you get greater volumes and a continual supply, and you can keep that recycling operation going. It's almost like turning on and off a glass furnace – you just don't do that – once you get it started you've got to keep it going if it's going to be economical.”

“One thing to keep in mind is that if we do put out finished products into landfill, those products do not pollute the landfill,” Tickle points out. “Other materials do.”

This makes recycling a tough question for the industry.

“It's tough because our materials are long lasting, so one of our strengths is also a weakness in terms of recyclability,” he adds.

Challenges

There are a number of other challenges facing the US composites industry. These include increasingly strict controls on the emission of styrene to the workplace and the atmosphere.

“That's one of the things our association is about,” says Frey, “to talk to legislators to make sure that the proper laws are in place to protect our workers and our neighbours, but that don't strangle our industry. There's a delicate balance there.”

“And we're very proactive with regulators,” adds Tickle. “We try to work hand in hand with them. Incineration is not the answer. That's just putting more pollutants into the air than we're taking out. Capture and control is a better solution.”

“We're also experimenting with resins to reduce the volatile organics content,” notes Frey. “But it's just beginning. I couldn't predict where we'll be in 20 years.”

Benckart notes that another issue facing the industry is building capacity to keep up with market demand.

“We have to keep diversifying our products and our customer base,” agrees Frey, “so that the industry can grow more consistently. The supplier that only makes cast polymers today is not having much fun. If he makes products that can go into other applications he can run his factory more sustainably.”

Another important issue is a shortage of workers wanting to go into the composites industry.

“We have good wages, good benefits, but the young generation that's coming out don't want factory jobs and shift work,” states Tickle. “There's a real shortage of workers. There are workers in the world that are willing to do this work. We need to change the immigration laws and let those people who want to work go where the work is.”

Cautious optimism

Although these issues will continue to challenge the US industry, the long term outlook looks good. Housing starts are expected to pick up slowly and the construction market will recover. Another positive sign is that this year's ACMA show attracted more visitors than ever before, even though the industry is not doing so well.

For 2008, Tickle, Frey and Benckart are 'cautiously optimistic' and say a little growth over this year would be pretty good.

|

Within the 'feast or famine' conundrum of the carbon fibre industry, demand has exceeded supply for the past five years. Forecasts suggest demand will double by 2012 to 60 000 tons, with US$57 billion worth of composite materials needed through 2026 in the aerospace segment alone. The total market for carbon fibre reinforced composite parts could grow to $9.9 billion by 2010. In October, a number of critical capacity expansions were announced by carbon fibre companies which are either North American-based or have facilities in the region. It remains to be seen how much the expansions assuage the supply 'famine' or simply meet already committed orders:

Contributed by Vicki P. McConnell. |