The commercial production of carbon fibre can be traced back to 1969, when Courtaulds in the UK opened a 5 tonnes a year plant to make a staple carbon fibre that had an ultimate tensile strength (UTS) of 1900 MPa and a tensile modulus of 180 GPa.

The technology and scale of operations have changed considerably since those early days: the present new production lines being built by Toray Industries and Mitsubishi Rayon have capacities of over 2000 tonnes, based on 12/24k tow. Another major producer, Toho Tenax, announced in early 2006 that its next new line in Japan, due in production 2008, will have a capacity of 2800 tonnes. Moreover, the mechanical properties of the carbon fibre from these new lines are over 4800 MPa UTS and 235-250 GPa tensile modulus.

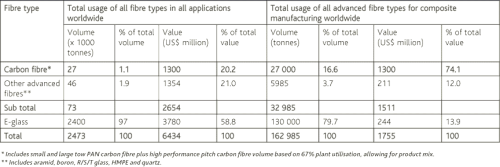

In 2006, the global production of carbon fibre totalled some 27 000 tonnes, with a value of about US$1300 million. In terms of consumption, the market was divided geographically as follows:

- Europe 30%;

- North America 35%;

- Japan 15%; and

- the rest of the world 20%.

In recent years, the key application sector driving the growth of carbon fibre reinforced plastics (CFRPs) – and consequently of the carbon fibre industry itself – has been the civil aerospace industry, which derives particular benefit from CFRP's unique combination of light weight and high strength compared with comparable metal components. Additional proven benefits include corrosion resistance and the ability to design single piece parts where previously multiple components were necessary. Other end-user sectors – such as wind energy, offshore and compressed gas storage – are also taking advantage of the properties and design possibilities of CFRPs.

All of these key application areas are themselves experiencing strong growth, and as a consequence the CFRP market is forecast to expand rapidly over the next few years: by 2010, the global market for CFRP is predicted to be worth $13.6 billion, representing a huge increase of 37% over 2006. This will necessitate a considerable increase in carbon fibre plant capacity worldwide: with 2005 as the base year, the world's carbon fibre manufacturers will invest over $800 million in capacity expansion projects up to 2008, with further heavy expansion forecast beyond that date.

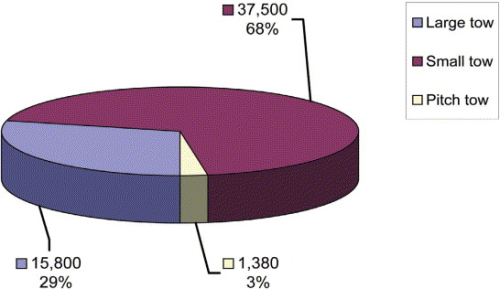

Specifically, small tow carbon fibre capacity worldwide is forecast to increase from 29 750 tonnes in 2006 to 40 600 tonnes by 2008, an increase of 36%. (The two major aircraft manufacturers – Airbus and Boeing – are forecast to account for 15-20% of the worldwide small tow carbon fibre usage by 2010). By 2008, Japan will produce 46% of the world's small tow carbon fibre, USA will produce 28%, Europe 19% and the rest of the world 7%. Meanwhile, the global capacity for large tow carbon fibre will increase from 10 300 tonnes in 2006 to 18 800 tonnes by 2010. Pitch-based carbon fibre capacity will increase from 1380 tonnes in 2006 to 2480 tonnes by 2010.

These capacity expansion projects should relieve the current tight supply situation and so allow for price reductions in real terms, allowing carbon fibre to make further in-roads into less advanced applications, such as general automotive, civil engineering and infrastructure. This could create a second growth spurt for the industry, leading to even greater usage.

Key companies

Many of the major international companies who entered the carbon fibre and prepreg business in the early days of its commercialisation have since left the sector, with Courtaulds, Asahi, BP, ICI, BASF, Ciba-Geigy, Hercules and Rolls-Royce being former producers who exited the market some years ago. Others, such as Conoco, have exited more recently.

The carbon fibre industry currently consists of 13 major suppliers of fibre. Nine of these are producers of polyacrylonitrile (PAN)-based fibre: Toray Industries, Toho-Tenax, Mitsubishi Rayon, Hexcel, Cytec, Formosa Plastics, Zoltek, SGL and Aldila; and four are manufacturers of pitch based fibre: Cytec, Mitsubishi Chemical, Petoca Materials and Kureha; with only one company (Cytec) producing both. The PAN-based manufacturers can be further categorised by small tow (1k-24k) and large tow (40k and above). The small tow producers are dominated by three major Japanese companies – Toray Industries, Toho-Tenax and Mitsubishi Rayon – who between them account for 72% of the world's small tow capacity today. This figure is set to increase to 78% by the middle of 2008 as all three major Japanese producers have announced large expansion programmes. Of all the producers worldwide in 2008, Toray – at 34% – will have the largest worldwide capacity for small tow. Hexcel is also adding an additional production line in the USA and is constructing a new carbon fibre plant in Spain. These facilities are due to commence production in 2007 and 2008, respectively. In 2006, Cytec started up one additional line at its USA facility, which has been idle for several years.

There are four large tow producers: Zoltek, Toho-Tenax (ex-Fortafil plant), SGL and Carbon Fibre Technology (CFT), a joint venture between Aldila and SGL in the USA. At present, all have similar production capacities, though Zoltek is currently under-going large expansion programmes both in the USA and Europe; the company plans to double its capacity as a result.

Supply and demand

A perennial problem in the carbon fibre industry has been tight supply and demand, with many producers only increasing capacity when demand has caused the price of carbon fibres to rise to a level deemed sufficient to warrant the investment needed. The small tow manufacturers have been generally reluctant to increase capacity to meet the demand from end-users for a lower priced product that could find a wider range of applications. This dichotomy of needs between producer and end-user has, at times, caused a degree of animosity and frustration, as well as an unstable price. Several times since 1990, prices for standard 12k/24k fibre have fluctuated between $12-40/kg ($5.50-18/lb) in a 12-15 month period.

In order for the industry to expand and move forward into a wider range of applications, such large price fluctuations must be reduced and prices need to stabilise. In fact, there are positive signs that the carbon fibre manufacturing industry is entering a period of stability, with most carbon fibre producers, both small and large tow, now under-going expansion programmes and the major aircraft (Boeing and Airbus) manufacturers now more confident of the future, with positive order books for the next five to ten years. Having said that, if Airbus build programmes continue to experience severe delays, then the knock-on effect could see small tow producers with spare capacity on their hands.

Aerospace

The use of composites in the aerospace sector is growing rapidly. Composites (all types) make up some 50% of Boeing's new 787 passenger aircraft, with the remainder being aluminium (20%) and titanium (30%). By comparison, the 777 aircraft, currently Boeing's most advanced passenger jet, only has 12% composites whereas it contains 70% aluminium.

Boeing hopes to get its new 787 in service by mid-2008, and then to develop the bigger 787-9 by 2010. The even bigger 787-10 would follow, probably in 2012. In addition to the 787, Boeing's product development team is already studying a composite replacement for the single-aisle 737 family of jets.

Boeing expects that the high use of composites will reduce maintenance time and expense, and cut fuel burn per passenger by 20%.

Airbus' demand for composites is also expected to rise steeply. Currently, approximately 6 tonnes of composites are used in Airbus' A340/500 and A340/600 aeroplanes. The newly launched Airbus A380 contains about 25-30 tonnes (55 000-66 000 lb) of composites, 85% of which is CFRP. The mid-size Airbus A350, due in full production by 2010-2011, will require 16-20 tonnes (35 000-44 000 lb) of composites, making up around 41% of the aircraft's construction.

Unfortunately – and as has been well publicised – the Airbus A380 has been hit by severe delays. In June 2006, Airbus announced that it faced a year delay in production of the A380 but subsequently increased this estimate again to two years. Its prediction that it will only be able to deliver four of the aircraft in 2007 is less than half the number that it had predicted in June 2006. The delays have already led to severe financial repercussions for the company, and these are set to increase dramatically. Not only might Airbus have to face late-delivery penalties, but it must also reduce its production costs by approximately 2 billion Euros. Moreover, the delays to the A380 are likely to have a knock-on effect with the A350 build programme.

Military aircraft also offer major opportunities for the composites sector. It is thought that some 40% of the structural weight of the Airbus A400M aircraft will be accounted for by composites. The main partner companies involved in its manufacture are virtually the same as the A380, and most, if not all, of the composites technology it will embody is derived from the Airbus programme.

The funding of US military projects is less clear today then in the past. Several potential cuts to the financial year 2006 budget could reduce US military expenditure, which could ultimately affect several key research programmes with composites projects, covering aircraft, ship building and weapon systems.

Other applications

Outside of aerospace, other industrial sectors are also growing in importance, though some are by comparison still considered niche markets. The industrial sector overall (excluding aerospace and sports/leisure) is forecast to grow to represent 50-55% of the total usage of carbon fibre by 2010. There will be opportunities for the industrial sector to grow even further as new applications are developed, though growth could be dramatically reduced if the carbon fibre manufacturers are unable to meet the availability and price targets that the sector needs in order to make the material attractive enough to replace more conventional – and by and large cheaper – materials.

A particularly strong growth market for carbon fibres and CFRPs over the next few years will be the production of wind turbine blades. The leading wind turbine blade manufacturers are European, and the top ten turbine makers/suppliers have more than 95% of market share. Vestas Wind Systems AS (Denmark) and Gamesa Eolica (Spain) lead the field with over 50% of the turbine market worldwide and an even higher proportion (70-75%) of the blade market.

Vestas produces more than 10 000 wind turbine blades annually, and an increasing proportion of the blades it makes contain carbon fibre reinforcement – on average 300-350 kg/blade. The company depends heavily on the use of pultruded profiles for blade tip reinforcement. Other significant turbine manufacturers are Siemens (Denmark), Enercon (Germany), Nordex (Germany) and REpower Systems (Germany).

The wind power market for carbon fibre and CFRP – like other new industrial applications – will be strongly influenced by the availability and pricing of carbon fibre. Some blade manufacturers are concerned at the present tight supply situation and spiralling prices, and are looking at alternative designs using glass fibre reinforced plastic (GRP), which despite its lower performance still dominates in this market.

The market for carbon fibre for automobiles is forecast to grow by about 8% per year until 2010. The growth will be mainly in the high performance and racing cars that already use a high percentage of carbon fibre. Europe leads the way, with all the major Formula One (F1) racing car producers being heavily reliant on carbon fibre for their structural applications.

The majority of commercial high performance car manufacturers also have carbon fibre composite programmes in order to develop parts that can reduce the weight of the vehicles, as low weight leads to better performance and improved efficiency. The latest high performance car to be introduced is the SLR Mercedes McLaren, which has a large percentage of CFRP in its body shell, including a new carbon fibre sheet moulding compound (SMC) with a very short cure cycle that can be moulded practically waste free.

Originally the largest end user of carbon fibres, the sports goods sector now only accounts for about 23% of the overall market, and future growth is predicted to be low or even flat. Carbon fibre in the sports goods market is dominated by four major applications: golf clubs, hockey sticks, tennis rackets and archery. Golf shaft production accounts for over 45% of the total usage, hockey sticks 10%, tennis rackets 12% and archery 8%.

The latest large growing sports application for carbon fibre is bicycles, mainly in the USA and driven by Lance Armstrong's success in the Tour de France.

Trends in processing routes

As a result of the large increases in demand for CFRP, the availability of efficient composite fabrication processes will be of increasing importance. Such techniques include processes for intermediate products such as woven, prepreg and moulding compounds and direct conversion routes such as filament winding, pultrusion, mandrel wrapping, compression moulding, autoclave moulding, wet lay-up and resin transfer moulding (RTM)/vacuum-assisted RTM (VARTM) processes.

New materials technologies will also play an increasingly important role; these include new fibre types and a wider variety of tow counts to enable a more cost effective product. Improved surface finishes that increase the fibre/resin translation properties in processes such as filament winding and pultrusion are also being developed, along with new size-type coatings for some of the resin matrix systems (such as vinyl esters and polyesters).

Both Boeing and Airbus are qualifying some of the higher performance intermediate modulus type fibres, such as T800 manufactured by Toray, IM7 produced by Hexcel, MR50 from Mitsubishi Rayon and IM400/600 from Toho-Tenax, along with new toughened epoxy resin systems in a prepreg tape form. To convert these tapes into composites, processors are using automated processes such as automated tape laying (ATL) and automated fibre placement (AFP). Such techniques as these have replaced the hand lay-up techniques previously used in the aerospace industry.

Woven fabrics and epoxy prepreg fabrics have historically been the material of choice used in the aerospace sector. In 1990, prepreg fabrics accounted for 85% of usage, compared with 15% for unidirectional prepreg tape. However, the pattern of usage is changing, and by 2007/2008 it is predicted that the ratio will be approximately 55% unidirectional prepreg tape (unitape) and 45% prepreg fabrics.

The unitape product gives better fibre translation into composites than woven fabrics as a result of the uniform tow alignment during production. It is possible that up to 70% of the structural components of the Boeing 787 aircraft will be manufactured from the unidirectional tape product.

The increase in filament winding, pultrusion and RTM/VARTM/Seeman Composites Resin Infusion Moulding Process (SCRIMP) usage has been as a result of growing demand from the industrial sector.

Filament winding has shown the largest growth in direct conversion over the last 10 years. The forecast demand for 2006 is 2600 tonnes (5.7 million lb). The three major applications are self contained breathing bottles (SCBA), compressed natural gas (CNG) tanks and industrial rollers in areas like paper mills for the replacement of granite rollers, and on a smaller scale, photo print rollers.

The largest new potential end use for filament wound CFRPs could be the manufacture of riser pipes, drill risers and choke and kill lines for the offshore oil industry. A single 3000 m carbon reinforced plastic riser string with 100 joints consumes about 60 tonnes (125 000 lb) of carbon fibre, and on some rigs there are up to 20 riser strings.

CFRPs have distinct performance advantages compared with traditional materials in this application, especially in terms of weight: this is a determining factor for the offshore oil industry as it attempts to drill deeper offshore.

Recycling issues

One of the important issues affecting the future of the CFRP industry is what to do with the waste during CFRP production, and also how to reuse the material at the end of its service life, especially in the light of new environmental regulations. It is estimated that more than 1800 tonnes (4 million lb) of CFRP are produced in the USA every year; Europe is lower at about 900 tonnes (2 million lb), but even so this is still significant. One new technology being developed to overcome this problem converts thermoset-based carbon fibre composites into recycled chopped fibres, maintaining almost 100% of their modulus and 93% of their strength.

This article is based on information contained within a recently published market report entitled The Carbon Fibre Industry: Global Strategic Market Evaluation 2006-2010 by Tony Roberts. For further information on the 295-page report, contact the publisher, Materials Technology Publications, UK; www.mat-tech.co.uk