Read Part 1 of this article here.

Trends, outlook and risks

Analysts continue to see the CFRP market as solid and with high growth potential. The consensus is for annual growth of at least 13% while optimists expect growth of approximately 17%.

In 2012, approximately 65,000 tonnes of CFRP materials were sold in the various market segments. This corresponds to sales worth approximately $10.3 billion or $14.6 billion depending on the method of calculation.

By 2020, analysts forecast that the value of this market will grow to between $25.2 billion and $36 billion subject to the development of the market segments. The large ranges stated are due to the significant differences in the estimates relating to price and volume trends in the individual market segments.

The growth potential of the carbon fibre and also the CFRP market is currently based on three large volume segments – wind turbines, aerospace and defence and sport/leisure – as well as the automotive segment, which is viewed as the sector with the largest growth potential.

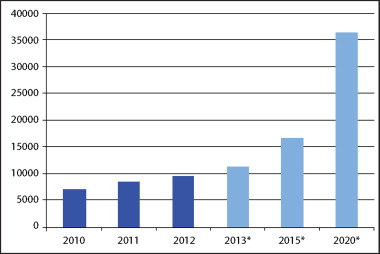

Wind turbines

According to the CCeV report, in the largest segment by volume, wind turbines, analysts forecast that the quantity of material consumed will quadruple by 2020 while revenues in the segment will ‘only’ triple during the same period. This is due to cost pressures and the expected gains in efficiency.

The total of approximately 9,500 tonnes of carbon fibre used in 2012 (total installed global wind energy generating capacity is around 280 GW of which 110 GW were in Europe in 2012) is predicted to rise to approximately 36,000 tonnes in 2020.

Growth in this segment will vary according to region. Annual growth of approximately 17% is forecast for Europe, currently the strongest growth region in this segment (74% or 7,000 tonnes of the total quantity of carbon fibre used in this sector in 2012). In this case, the USA and Asia have a combined share of 26% or 2,500 tonnes of carbon fibre in 2012. Growth forecasts for these regions (20% (USA) and 24% (Asia)) are also higher.

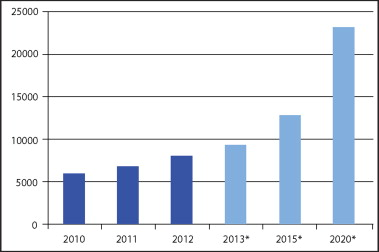

Aircraft

The aircraft industry is the most important factor in the aerospace and defence market segment. The survey reports that a significant increase in orders for new aircraft is expected over the coming 20 years. Airbus expects 27,800 new aircraft to be ordered between 2011 and 2030, while the forecast from Boeing is even higher at 33,500 aircraft.

Approximately 8,100 tonnes of carbon fibre were used in the aerospace and defence market segment in 2012. Based on the assumption of an annual growth rate of around 14%, demand is expected to total 23,000 tonnes by 2020.

Europe and the USA accounted for 6,400 tonnes or 79% of the carbon fibre used in this area in 2012. No significant change is expected in this distribution by 2020.

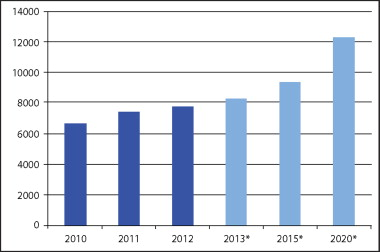

Sports

Sports/leisure is the third mainstay of the global CFRP industry, adds the CCeV report. This segment is an area, which has provided the carbon fibre and CFRP industry with an adequate market for many years. CCeV adds that this was also a significant factor in the industry being able to ride out the worst of the recession in recent years.

In 2012, the sector used a total of 7,800 tonnes, which is comparable with the two market segments already described. In contrast to the other major areas of application, growth forecasts for this area are considerably lower (6%). Demand in 2020 is forecast to be approximately 12,000 tonnes, by which time this sector will have declined to be the fourth largest segment by volume. However, revenues in this area will not grow at the same rate. As the sports/leisure area is subject to fierce price competition, annual growth in revenues until 2020 is only expected to be 3%.

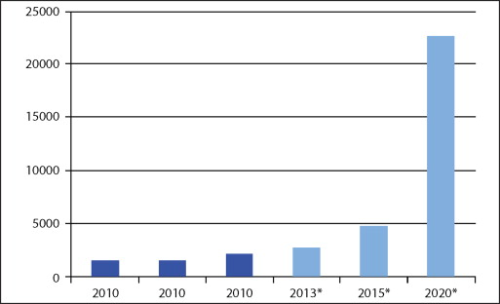

Automotive

| The automotive sector continues to be seen as the major driver and future market for carbon fibre ... |

CCeV adds that the actual quantities of carbon fibre used in the automotive sector in recent years were significantly lower than stated in previous market reports. One reason for this is probably the difficulty of obtaining reliable figures from the large OEMs. As this sector is still one of the smaller areas in terms of volume, revisions of just a few hundred tonnes immediately become more apparent as a percentage than is the case in the other three major segments. The automotive sector continues to be seen as the major driver and future market for carbon fibre and CFRP due to the relevance of the topics currently dominating the industry, such as general weight reduction of vehicles, fines for excessive CO2 fleet emissions, lightweight construction, e-mobility, pressurised containers for gas fuelled cars.

In 2012, this segment used around 2,150 tonnes of carbon fibre and analysts are forecasting annual growth of approximately 34%. This rate of growth is only possible due to the relatively low starting point of this pioneering market. By 2020, it is expected that around 23,000 tonnes of carbon fibre will be used in this sector. This implies its transformation from a small market segment into one of the top 3 sectors. (Carbon fibre used in CNG fuel tanks is not yet included in this view of the market.)

However, experts agree that this scenario will only transpire if the costs for CFRP components in the automotive sector can be reduced to a level in the region of approximately 20-30 €/kg of component weight. Cost reductions could be achieved by reducing the amount of material used (by up to 50% compared to 2010) and through innovative processes for manufacturing components (up to 90% compared to 2010). If the assumptions about the potential for cost reductions can be implemented, the prices imagined by the OEMs should certainly be achievable. The way should then be open to the high volume series production of CFRP materials.

The outlook for CFRP

CCeV concludes that in 2012 the global composites market was valued at approximately €76 billion assuming an annual growth rate of around 6%. In contrast, a growth rate of 13-17% is expected for the CFRP market, which represents only a small part of the composites market. There has long been a consensus in society, adds CCeV, that there must be a greater focus on conservation of resources and raw materials. Energy use is one of the key considerations in this instance. The potential of high performance fibre composites in lightweight construction will make an important contribution to increasing energy efficiency and certainly offers many opportunities whether in generating, consuming or storing energy. The durability and long life of CFRP and its ability to be combined with traditional lightweight materials will open the way to additional fields of application. In the area of lightweight construction, the search is on for intelligent methods of combining and integrating steel and CFRP. This could lead to ecologically and economically viable material combinations. Urban mobility that conserves resources will be one of the major trends in coming years. Lightweight construction will be paramount for most means of transport. Weight savings contribute to both an increase in efficiency and a reduction in costs. In this instance, CCeV highlights that the outstanding potential of CFRP becomes immediately apparent when it is weighed against all other materials. Optimally designed parts that efficiently exploit the properties of CFRP can be 70% lighter than steel and 30% lighter than aluminium. However, CCeV adds that tangible ecological and economic benefits can only be achieved if lightweight construction is used on a large scale. Mass production of CFRP parts and the associated automation of manufacturing processes are essential if this goal is to be achieved. This is the key to the large scale use of CFRP components in the automobile industry, explains the report. CFRP with thermoplastic matrix components will probably play an important role in this process. Partnerships/joint ventures between well-known automobile manufacturers (Audi, BMW, Daimler, Toyota and VW) and the carbon fibre industry show that there is now both a recognition of the necessity to investigate the opportunities of CFRP materials in detail and the will to do so.

| The automobile industry is seen as key area of growth followed by aviation and wind energy. |

The CCeV report concludes by saying that price-performance ratios will decide which materials and combinations of materials will be adopted in the various applications. In the future, the ecological rather than the economic aspects may well be the decisive factor. The positive market outlooks are also reflected in the results of the first market study conducted among members in early 2013 by the four major organisations representing the composites industry in Germany – AVK, CCeV, CFK Valley Stade and VDMA Forum Composite Technologie. These member companies see the development of their businesses as mostly positive or very positive. CFRP is seen as the most important area driving growth followed by GRP and combinations of materials. In terms of applications, the automobile industry is seen as key area of growth followed by aviation and wind energy. ♦

This article was published in the November/December 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing this short registration form.