Jushi Group Co Ltd is China's largest producer of fibreglass with a current annual capacity of approximately 360 000 tonnes; by 2010 it plans to have increased this figure to 700 000 tonnes. The company produces direct and assembled E-glass rovings as well as some C-glass products. With around 50-60% of its current production destined for export, Jushi is also becoming a well-known name outside of China.

Jushi (which means ‘huge stone’ in Chinese) traces its roots back to a fibreglass fabrics plant established in Shimen in 1970. The company was established as Tongxiang Jushi Fiberglass Co Ltd in 1993 and in this year it moved to the Tongxiang Economic Development Zone. In 1996 the Jushi Group was established. Today, the company is owned by three shareholders.

Most of Jushi's production takes place at its headquarters in Tongxiang, in Zhejiang Province, around 120 km from Shanghai. There is plenty of room for expansion. At present there are two fibreglass lines at the site; another line (of 120 000 tonnes annual capacity) is currently under construction, and a new office building, 25 storeys high and capable of housing 1000 people, has just been completed. Construction work is fast in China – Jushi can build a new fibreglass line in around 10 months.

Production

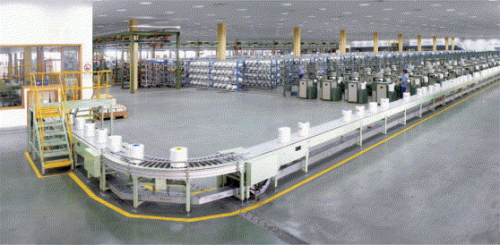

A tour of the Jushi site in Tongxiang starts with the modern and spacious fibreglass factory. The plant is located next to the Yangtze River and so raw materials come in by ship. Most materials for making the glass (sand etc) come from surrounding provinces; only boron is imported. An Air Products plant situated adjacent to the site supplies oxygen for the furnaces.

The direct-melt furnaces feature 1600, 2000 and 4000 hole bushings and automatic winders. The lines operate 24 hours a day on three shifts, producing assembled and direct rovings of various tex. There are around 700-1000 staff associated with each line.

The plant is run from a central control room, where around 6000 measurement points are monitored, including temperature and fibre breakage (which equates to efficiency).

Waste emissions and water from the plant are treated and the water is recycled.

An R&D and testing laboratory includes capabilities for testing materials and products.

The products leave the plant by truck to Shanghai. Gibson is exclusive distributor for Jushi products in the USA.

Just across the road from the Jushi fibreglass plant is the joint venture company set up with German firm P-D Interglas Technologies. This factory will be capable of producing 50 million metres of fabrics upon completion of its first phase of construction at the end of 2006.

Five-year plan

Jushi is currently in the process of implementing a five-year plan (2005-2010) which aims to increase the company's total annual capacity to 700 000 tonnes by 2010. The Tongxiang plant is scheduled to have five fibreglass lines by 2010, accounting for 500 000 tonnes of the group's total production.

According to Jushi's sales and marketing director Daniel He, the company's biggest challenges at present include the cost of energy, logistics, and increasing demands from customers (including technical and after-sales service). Jushi can supply product and technical service – its aim is to be a long-term partner to customers instead of just a supplier.

Daniel He expects the volume of Jushi product exported to remain at around its current level (50-60% of production) in the future; it may even reduce as the Chinese market grows.

“Many global companies are coming to China and need a local supplier,” he notes. “For example, in the wind energy industry, companies need to buy glass and resin in China.”

“Most of the commodity FRP parts produced in the future will be made in China,” he predicts.

He believes the biggest markets in China today are pipes; engineering plastics (thermoplastics); pultrusion; weaving; and C-glass. Wind blades will become a big market in the near future. The boat building is developing, although it is in the initial stages at present.

The chairman's view

Reinforced Plastics spoke to Yuqiang Zhang, who has been president and chief executive officer of Jushi for nearly 25 years. He started with the company as a worker in the factory.

“Previously Chinese producers did not care about their own products or their customers,” he says. “Some smaller producers did not care about the long term – their focus was on short-term profit not long-term partnerships. This is now improving, but it will still take time for Chinese companies to reach international standards and become global suppliers.”

Mr Zhang sees good prospects for the composites industry in China.

“The government has adopted a plan to grow the country's economy without affecting the environment,” he says. “We must preserve natural resources, and this offers growth potential for the composites industry. Energy cost increases are a challenge to all industries, especially transport, and composites offer advantages of high strength and light weight.”

“If we take a realistic view, the composites industry is still not big enough – there is still room for further expansion. Ten years ago we had some excuse as fibreglass for FRP was not good enough and this hindered the growth of the downstream industry. Ten years ago Jushi and other Chinese manufacturers made great efforts to find glass technology of higher quality to meet the demand of the downstream industry, but now fibreglass technology is at a higher level than the FRP industry. The composites industry is a little behind the fibreglass industry which will hinder the FRP industry.

The reason for slower growth of the composites industry in China is that there are no leading companies in the country,” Mr Zhang explains. “This is the big difference between the fibreglass industry and the composites industry. The second main issue is that FRP products are mainly produced for the domestic market, and seldom exported, so producers do not follow the standards of international suppliers. Current manufacturers of FRP products have no vision for the future and this will hinder the growth of the composites industry. We admit there was fast growth of the composites industry in China, but compared to the fibreglass industry it is slow.”

Jushi is working to try to encourage Chinese composites manufacturers to improve.

“Jushi has a lot of contact with international companies so from time to time we introduce technology to local manufacturers. We also hold an annual international conference and hope that having such meetings and exchanges of information will help, but companies also know there is a challenge to catch up to the right level.”

Every year Jushi holds a three-day meeting for its customers. This year is the 12th of these events and approximately 500-550 people are expected to be present, including customers from abroad and from China, as well as a number of Chinese officials.

“We notice fast growth in the Chinese market for composites, and some problems, but we are sure that the fibreglass and composites industries will grow,” continues Mr Zhang. “China is a country which lacks natural resources so great potential is predicted for the composites industry. We are very happy that we can be a part of this exciting industry and we will do our best to supply not only the local market but also the global composites industry. I am sure we will follow this route to become a national industry.”

“We have already set up our targets for the next five years,” he concludes. “We are very confident we will realise these goals but we need more and more customers and friends to help with the expansion of our glass.”