China is undoubtedly the powerhouse of the Asian region, but with a population of 1.1 billion (second only to China) and a booming economy, India is also attracting a lot of attention. India's gross domestic product (GDP) growth rate is around 8.5% (2006), labour costs are low, the country has a strong base of skilled IT professionals, and English is widely spoken in the business world. Not surprisingly many foreign investors and companies are planning to, or have already, set up production units in India.

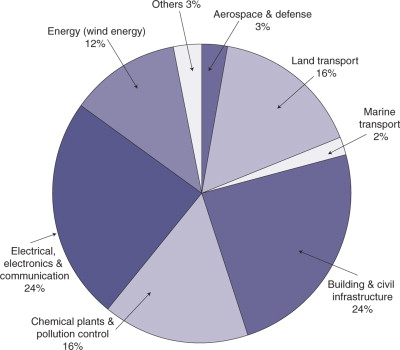

In this environment the Indian composites industry has been faring well, registering a 25-30% annual growth rate over the last three consecutive years, more than twice that of general industrial growth and three times that of GDP. This is according to consultant Dr N.G. Nair, of NGN Composites, Chennai. Nair is also founder of the FRP Institute, a society which aims to bring together all those who are concerned with fibre reinforced plastic (FRP) composites in India.

Indian manufacturers of composite products are generally small- to medium-sized companies, Nair told Reinforced Plastics. There are about 300 medium-sized companies and over 1200 small companies (turnover less than 1 million rupees). There are over 60 larger companies. Around 25 companies are exporting their products, led by the manufacturers of chemical process equipment.

When Reinforced Plastics asked Indian composites manufacturers about the challenges facing their industry, they highlighted four main issues:

- availability of quality raw materials;

- high price sensitivity of the market, combined with rising raw materials costs;

- lack of skilled labour; and

- lack of awareness of composites in the Indian industrial world.

Quality assurance and standardisation are further issues which concern manufacturers.

India needs more raw materials manufacturers to set up in the country, including producers of glass fibre, speciality resins and chemicals, and styrene monomer, says Nair.

“Raw materials prices are generally higher in India than in the international market,” Nair reports. “This affects the cost competitiveness of composite products compared to products made of conventional materials. But this gap is narrowing. Import is possible but many cannot afford to import in bulk. Suppliers should open offices in India to stock materials at affordable cost. This will help to expand the market.”

The awareness of engineers and the general public about composites is very poor, explains Nair, and very few academic institutions teach composites. Services such as manpower training, design, mould design and mould making are inadequate and this may slowdown technological growth, he adds.

The Technology Information, Forecasting and Assessment Council (TIFAC), part of the Indian government's Department of Science and Technology, is running an Advanced Composites Programme (ACP), aims to address some of these problems. The programme provides financial assistance on a repayable basis for projects on composites technology – the only requirement is that the product is ‘a first’ for India. The ACP has supported the development of several composite products, including composite interiors for train drivers' cabins, and modular toilet units for Indian Railways. However, despite these successful projects, Mr Soumitra Biswas, Advisor, ACP, admits that large-scale orders have not followed. The higher price of composite products is an issue for institutional buyers such as Indian Railways; they also have little knowledge of, or experience of using, composite materials.

Growth areas

As well as the rail industry, other potential growth markets for composites in India include infrastructure, chemicals, transport, and wind energy. Indian companies also believe there are huge opportunities for offshoring manufacturing of labour-intensive, value-added composite products for the USA and Europe.

Wind energy

India is the fourth largest market in the world in terms of installed wind power capacity. In terms of new capacity added in 2006 it was third in the world. A good local production base for wind turbines now exists in the country, with 15 manufacturing companies active in this sector. Suzlon Energy Ltd, based in Mumbai, is the world's fifth largest wind turbine generator company, and the largest in India (it is estimated to have over 50% of market share) and Asia, and the company reported record growth for the financial year ended 31 March 2007. Overseas sales accounted for around 48% of total sales during this year.

Leading wind turbine blade manufacturer LM Glasfiber has two factories for manufacturing blades in India and it opened a new R&D Centre in Bangalore in May, joining its existing R&D Centres in Denmark and the Netherlands. The Indian Centre, which will employ more than 40 engineers by the end of the year, will specialise in finite element method (FEM), computational fluid dynamics (CFD) and computer-aided design (CAD) for product development.

Aviation

The aerospace sector is growing fast and many industries are getting into composites not only to meet Indian requirements but also for the global market. Many companies are getting production outsourced from Europe and America.

India is one of the fastest growing aviation markets in the world. According to the Centre for Asia Pacific Aviation, passenger numbers are growing faster in India than anywhere else. The booming economy, people having money to spend on travel, cheap fares and numerous new, budget airlines are driving this growth. Hundreds of new aircraft are being ordered (Boeing estimates that India will need over 850 aircraft worth $US72.6 billion over the next 20 years), airports expanded, and new infrastructure built. Growth is also anticipated in the military aviation sector.

Rail

Indian Railways runs around 11 000 trains every day, of which 7000 are passenger trains. It transports 13 million passengers each day. Indian Railways is investing in the renewal of old tracks, bridges, track circuiting and rolling stock as well as new lines and signalling, upgrading of current trains and manufacture of new models.

Automotive

The Indian automotive sector is booming. The number of vehicles on the roads has been growing at an average rate of around 10% a year over the last five years. Exports are increasing and the component industry is becoming an attractive Tier 1/original equipment manufacturer (OEM) supplier.

Renault and Nissan are joining forces with India's Mahindra & Mahindra to build a new car plant in Chennai. Production is expected to start in 2009 and the plant will be able to turn out 400 000 cars a year. Mahindra and Renault already have a joint venture producing Renault's low cost Logan car for India. Both Ford and Hyundai have opened plants in Chennai, and BMW looks set to follow.

The Ministry of Heavy Industries & Public Enterprises Automotive Mission Plan 2006-2016 wants to make India a global automotive hub. It believes that a US$145 billion business in the design and manufacture of cars and automotive components can be created in the country by 2016.

Construction and infrastructure

Building work can be seen all over India. The Indian road network is the second largest in the world, carrying about 65% of freight and 80% of the country's passenger traffic. More roads and associated infrastructure are needed to cope with the growing number of cars on the roads. Rural development programmes are underway to provide basic infrastructure facilities, such as schools, health facilities, roads, drinking water, and electricity. The country is also gearing up to host the Commonwealth Games in 2010.

The piping industry is benefiting from all this activity. Demand for filament wound composite pipe is strong, and many Indian companies are setting up production plants.

Economic growth is leading to greater power consumption. To counter power shortages the government has launched a programme to increase the country's generation capacity by 100 000 MW by 2012 and is working to develop five ‘ultra mega power projects’, each with an initial capacity of 4000 MW.

Indian companies

A selection of Indian composite suppliers and manufacturers, and members of the FRP Institute.

Devi Polymers Pvt LtdHeadquarters: Chennai Date established: 1975Annual turnover: US$16 million Number of employees: 400Main composites products/expertise: Glass reinforced plastic (GRP)/sheet moulding compound (SMC) panel-type water tanks; GRP/SMC enclosures; GRP/SMC canopies; OEM products.Certifications: ISO 9001.Percentage of production exported: 50%Main countries for export: Middle East, USA, UK, South Africa etc.Strategy for future growth: To grow all existing business to meet increasing in demand, by building adequate manufacturing capabilities and increasing export to new markets.

Composite Designs & Technology (CDT)/Epsilon Composite Solutions (ECS) Headquarters: Pune Date established: 1999Number of staff: 16Main composites products/expertise: Product design and process engineering of composites, for infrastructure, architectural, transportation, marine, and corrosion applications.Certifications: Not a manufacturing unit. Designs to EUROCOMP Code norms.Percentage of production exported: 50% of designs.Main countries for export: Singapore, Bahrain, Japan, UK.Strategy for future growth: Focus on characterising new materials and designs through in-house test programmes. Implementing modern materials and processes for optimisation of designs in the ‘design for manufacture’ process. Aim for ultimate product optimisation and deliver efficient, reliable structures. Constant staff training to international standards. Close interaction with R&D activities of industry and academia.

Gandhi and AssociatesHeadquarters: Vadodara Date established: 1972Annual turnover: Rs40 000 000 Number of employees: 70Main composite products/expertise: Anti-corrosion applications, process equipment.Certifications: ISO 9001.Percentage of production exported: 5%Main countries for export: Middle East, Europe.Strategy for future growth: Expansion in product range.

Industrial & Commercial EnterprisesHeadquarters: Pune Date established: 1988Annual turnover: Rs1 crore Number of employees: 10Main composite products/expertise: Skylights & structural fibre reinforced plastic (FRP).Certifications: nonePercentage of production exported: 0Strategy for further growth: To start a joint venture with a leading company in Europe which specialises in automotive components in SMC & DMC. The company has procured a 40 000 ft2 plot of land near Pune for this purpose and is currently working out a detailed plan regarding the machinery and process for this venture.

Kamak Plastics Pvt LtdHeadquarters: ChennaiDate established: 1964Annual turnover/production: over Rs2 crores/100 tonnesNumber of employees: 25Main composite products/expertise: Wind turbine covers, textile machinery covers, cabins, motor covers, tanks, etc.Certifications: ISO 9001 2000.Strategy for future growth: Setting up a state-of-the-art autoclave and prepreg moulding plant in Chennai to service the requirements of the helicopter and aerospace industry.

Kineco Pvt LtdHeadquarters: GoaMain composite products/expertise: design and manufacture of composite products for rail, automotive and petrochemical industries, including pipes, boats, underground storage tanks.Certifications: ISO 9001-2000Main countries for export: USA, Europe.

Mechemco IndustriesHeadquarters: MumbaiMain composite products/expertise: Manufacture of polyester resins, vinyl ester resins, speciality resins and gel-coats, and also resins for solid surface and casting.

Naptha Resins and Chemicals Pvt LtdHeadquarters: BangaloreDate established: 1974Annual turnover: Rs40 crores/8000 tonsNumber of employees: 100Main composites products/expertise: Unsaturated polyester resin, vinyl esters, phenolic resins, polyester pigments, gel-coats, filled resins, putty resins.Certifications: ISO 9001: 2000.Percentage of production exported: 0Strategy for future growth: Continue to focus on customers. Continual R&D to bring out new and innovative products. To provide composite solutions – ‘one stop shop’ strategy. Upgrading technology to international standards.

NTF (India) Pvt LtdHeadquarters: ManesarDate established: 1996Annual turnover: US$7 millionNumber of employees: 270Main composites products/expertise: Interior & exterior panels for automotive, railway coaches, locomotives, wind turbines, commercial vehicles, farm equipment, and construction equipment. Expertise in resin transfer moulding (RTM), Light RTM, vacuum assisted RTM, MIT, SMC, hand lay-up, thermoplastic composites. Polyurethane composites by RRIM. Painting of thermoset & thermoplastic parts with polyurethane paints solvent & water based. In-house engineering capability from product concept to production.Certifications: TS 16949: 2000.Percentage of production exported: 20%Main countries for export: USA, Italy, Japan, Spain.Strategy for future growth: Through entry in phenolic prepreg & carbon fibre with or without honeycomb/other core material by using vacuum bagging/resin infusion. In autoclave parts for metro railways, airport furniture, aerospace industry etc.

Permali Wallace Pvt Ltd Headquarters: BhopalDate established: 1961Annual turnover: Rs21 croresNumber of employees: 250Main composites products: Densified wood-based sheets & machined parts; sheets & machined components based on glass fibre & other reinforcements like polyester fabric, cotton fabric, carbon fibre, Kelvar etc. Prepregs based on glass fibre cloth, Nomex paper, ceramic paper, carbon fibre & other fabrics. Glass fibre based pipes & tubes made by filament winding or vacuum moulding. Epoxy castings for electrical insulation. Compression moulding, wet lay-up, RTM.Certifications: ISO 9001-9002 since 1997. (Going for ISO 14001 & OHSAS 18001.)Percentage of production exported: 5%Main countries for export: USA, UAE, Malaysia, Japan, Australia, Italy, Switzerland, Indonesia, Israel, Egypt, France, UK.Strategy for future growth: Rs18 crore (US$4 million) plan to increase capacity three times its existing 1500 tonnes within the next two years. Also developing new applications for Indian Railways, defence and other industries.

Resadh Group: Satyen Polymers; Marketing International Headquarters: MumbaiDate established: 1976Annual turnover: Rs450 million (Resadh Group)Number of employees: 30-40Main composites products/expertise: Satyen Polymers – manufacturer of unsaturated polyester resins, all grades; Marketing International – distributor for Magnum Venus Plastech, exporter of designed/fabricated equipment & turnkey projects.Certifications: ISO 9001 2000.Main countries for export: UAE, Saudi Arabia.

Sintex Industries Ltd Headquarters: KalolDate established: 1931Annual turnover: Rs874 croresNumber of employees: 2000Main composites products/expertise: Rotomoulding, blow moulding, thermoforming, SMC, pultrusion, prefabs, BT shelters, hand lay-up, FRP underground tanks etc.Certifications: ISO 9001: 2000; UL certification for underground tanks; in process of getting UK moulders programme certification for various products; in process of CE marking for electrical meter boxes.Percentage of production exported: 10% of overall, 30% of composite production.Main countries for export: USA, Australia, Africa, Middle East, Europe.Strategy for future growth: 1) Further consolidating position as the largest electrical meter box supplier in Asia by approaching various State Electricity Boards as well as quoting for major exports to the USA and Europe. 2) Already exporting large quantities of custom moulded products to the USA and expecting to finalise a few more this year. 3) Focus on automotive sector for SMC and pultruded components.