India is an emerging entrepreneurial, skilled, competitive economy, position-ed to be one on the world's greatest economic centres in the near future. This is according to a recent business report from Ernst & Young. India has recently been elevated to one of the region's strategic hubs and is undoubtedly one of the best picks for private equity investments, it says. The factors said to make India more investor friendly than other growth markets in the region are a well-established corporate legal system, professional business culture, liquid capital markets, stable political system, use of English as the language of commerce, and the availability of quality managers.

India will sustain 6-7% real GDP growth, led by information technology services, pharmaceuticals, business outsourcing and financial services industries. The composites market has been steadily gaining growth over the last few years, reflecting this strong economic growth. The end-use markets with the best growth potential for composites are wind energy, transportation vehicles, municipal pipes and telecommunications.

Growth sectors

India's total consumption of glass reinforcements in 2005 was around 35 000 tons, estimates glass fibre manufacturer Owens Corning. The company notes that although the composites market in India is relatively small, compared to per capita consumption in other parts of world, it is expected to grow around 20% in the next few years.

Owens Corning produces glass fibre at a plant in Taloja, Mumbai; Owens Corning (India) Ltd OCIL is a joint venture between Owens Corning and Indian company Mahindra & Mahindra.

Owens Corning currently has around 400 employees in India. It views the country as the fourth largest Asian market after Japan, China and Korea, and one of the world's largest markets in the future. At the International Conference and Exhibition on Reinforced Plastics (ICERP) 2006 tradeshow in Chennai this February, organised by the Indian FRP Institute, Satish Kulkarni, managing director of Owens Corning (India) Ltd told Reinforced Plastics that the growing domestic market now takes around 40% of the Taloja plant's production and next year he expects this to reach 50%. In two to three years he believes the domestic market could be taking up to 70% of the plant's products.

Indian companies are raising their level and global customers are moving into the country, he notes.

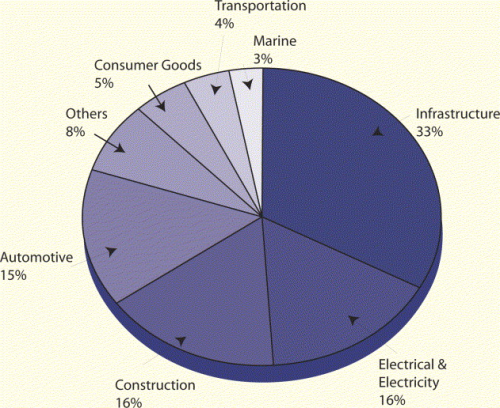

According to Owens Corning the biggest markets for composites in the country are infrastructure and construction, in which it includes the wind energy and pipe sectors (see chart). Some examples of applications in these markets are wind turbine blades, pipes used in water and sewage transportation, water treatment, and oil and gas exploration.

Pipes

Indian composites manufacturer Kineco Pvt Ltd, of Goa, has set up a joint venture with US FRP pipe manufacturer Conley Corporation, of Tulsa, Oklahoma, for the manufacture of glass reinforced epoxy (GRE) piping systems. The joint venture is called Conley Kineco Pipe System Pvt Ltd and it is investing US$1 million in a state-of-the-art plant in Goa. The plant is all set to go on-stream by August 2006. Kineco says that it will be the first GRE pipe manufacturing plant in India.

The plant will manufacture filament wound pipes, fittings and accessories using Conley's proprietary technology. It will have an annual production capacity in the range of 75-150 km depending on the pipe diameter.

The joint venture's target markets include the petroleum (onshore and offshore) sectors, shipping, chemical and pharma-ceutical plants, and water and waste water installations. As well as catering to the growing Indian market, it will cover the rest of Asia, Eastern Europe and parts of Western Europe. It will also serve as an outsourcing facility to Conley USA.

Conley chose India for this joint venture for two reasons – a growing domestic market, and a cost effective manufacturing base. Kineco says that it was chosen as a partner because of its experience in filament winding technology.

Saudi Arabian pipe manufacturer Amiantit also has a joint venture in India. Its partnership with the Salgaocar Group of Goa is called Amiantit Fiberglass Industries India Ltd (AFIIL). The joint venture anticipates a record 90% growth in sales for 2006 as the facility steps up production to meet increasing demand from India's booming industrial sector.

In March this year AFIIL completed a US$6.5 million contract from Essar Oil for engineering, supply and installation super-vision of glass reinforced plastic (GRP) pipes for the sea water intake and outfall system at its upcoming refinery in Vadinar, Gujarat. This was followed by a bigger order from India's largest petrochemicals and refining company which specified Amiantit GRP pipes for its seawater intake and outfall system. This order is worth $10 million and is to be completed in 2006. In addition, an order valued at around $2.5 million for GRP intake pipes for a power plant has been received.

AFIIL has also been awarded orders worth $3.5 million for the supply of double-wall GRP underground fuel storage tanks to Dutch oil company Shell India, which has a license to open 2000 retail outlets.

Amiantit says its Goa plant is the world's biggest manufacturer of GRP single- and double-wall storage tanks and previously received the world's largest ever order for 5000 single-wall GRP underground fuel storage tanks from Indian oil, gas and chemicals group Reliance Industries.

In addition to these industrial projects, AFIIL says it has supplied GRP pipe systems for various drinking water projects in rural India.

Wind power

India overtook Denmark to become the fourth largest wind energy market in the world in 2005 and it is the largest in Asia. As a result of strong economic growth, India has a large unmet demand for power. In recent years, initiatives have been made to meet this demand through national and local legislation to promote private investments in renewable energy. The Indian government has defined a target that renewable energy must represent 10% of the country's power consumption by 2012.

During the ICERP 2006 show, Owens Corning announced that it has added a second glass fibre knitting line at the OCIL plant in Taloja. The company says it intends to increase production of multiaxial glass fibre fabrics, targeting the growing wind energy industry in the country. The Taloja plant also produces glass rovings.

Owens Corning declined to reveal the current capacity of the plant.

Satish Kulkarni told Reinforced Plastics that the multiaxial fabrics produced at the plant are destined for the domestic market as well as for export. Most will be customer-specific products.

At the end of last year Danish wind turbine blade maker LM Glasfiber announced an increase in blade production in India in response to the strong growth in the region's wind power market. The new facility in Dobespet (District Bangalore-Rural) in Karnataka represents an investment of approximately Danish kroner (DKK) 100 million will create around 300 local jobs when the factory becomes operational in the second half of 2006 bringing the number of LM employees in the region to approximately 720. Designed for the manufacture of blades with lengths of 34 m or more for multi-MW wind turbines, the factory will have an annual production capacity of about 400 MW. Production of smaller blades will continue at the company's existing facility in Hosakote near Bangalore.

“We are witnessing a sharp increase in demand for large 1.5-2 MW wind turbines in India, and the new factory will provide our customers with great, local production capacity for the latest generation of multi-MW blades,” said LM's sales and marketing director Sren F. Knudsen. “Three factors are decisive for our customers: that they can source locally manufactured blades of a consistently high quality in the principal markets, that they can buy the blades in local currencies, and that they can minimise their transportation costs and working capital requirements.”

LM says the Indian wind energy market has grown by 20% on average per year since 1994, when it opened its first factory in India. In India, LM supplies blades to Vestas Wind Systems, GE Energy, Suzlon and NEPC, and it claims to have supplied almost 40% of the blades for the installed wind power in the country by the end of 2004.

Indian company Suzlon claims to be the fifth largest wind turbine manufacturer in the world, the largest in Asia, and the market leader in India with over 53% market share. Suzlon plans to expand its presence both in India and around the world.

Rail

Australian company Quickstep Holdings Ltd has announced plans to establish a manufacturing centre in India. It says it has reached an in-principle agreement to form a joint venture with New Delhi-based NTF (India) Pvt Ltd and Japanese company Avanti Corp. The joint venture will use Quickstep's closed moulding technology (see pages 21-25 of this issue for a feature about this process) and will focus on the manufacture of railcar interiors and exteriors. Quickstep will have at least a 44% ownership stake in the joint venture, which will be managed by NTF on a day to day basis.

Quickstep says that the joint venture partners are now bidding on specific manufacturing opportunities in India and Australia. The company says that opportunities have also been identified in Japan and Australia.

Under the terms of the joint venture, Quickstep will supply an initial Quickstep QS20 production machine by 31 October. It will also complete further test work in Perth on sample parts and provide technicians to manage commissioning of the Indian facility by 30 November. NTF has already built tooling required to manufacture sample parts and will provide staff for the facility.

“The New Delhi facility offers the opportunity to establish an international standard global manufacturing centre with a low cost base, leveraging off the country's highly competitive labour costs,” says Quickstep's CEO Nick Noble. “India has some of the lowest comparative skilled labour rates of anywhere in the world – some US$0.95-2.00 per hour in 2005, compared with US$23.00 per hour in Australia, US$23.10 per hour in the USA and US$34.00 per hour in Western Europe.”

“The joint venture partners have already had very encouraging discussions with a number of key potential customers in the mass transit sector, and we expect that the first project undertaken by the joint venture group will be a multi-million dollar contract to manufacture and supply interior panels for rail coaches for contracts in the mass transit sector,” he claims.

Noble said the new manufacturing venture would also immediately target value-added opportunities, such as the manufacture of flat panels using a relatively new thermoplastic range of reinforced high-performance composites suitable for use with the Quickstep process.