Polymer composites are not used much in the Indian automotive industry at present, but Mahindra Composites Ltd's new CEO Ajit Lele is planning to change this. Lele joined Mahindra Composites a few months ago and he is tasked with growing the company's business, particularly in the automotive sector. Before joining Mahindra he worked for a company making metal automotive parts and so he is very familiar with the challenges facing suppliers to the Indian automotive market.

The first challenge is to convince the designers to use composites, he says. It requires education since designers in India are not using the full potential of fibre reinforced plastic (FRP) to re-engineer parts when looking at substitution of sheet metal or plastic.

The Mahindra Group

Mahindra is one of India's largest and oldest industrial groups. It started out in 1945, collaborating with US company Chrysler to produce left-hand drive jeeps for India and making its name as a jeep company. At that time there were only three or four automotive companies in India. The company subsequently branched out into manufacturing passenger vehicles and agricultural tractors.

Today, Mahindra is a US$4 billion group with nearly 40 000 employees and several business lines. Its biggest businesses are still the automotive and tractor sectors, which account for more than US$1 billion in sales each. The Automotive business is the number one manufacturer of sports utility vehicles (SUVs) in India, producing around 20 models. It also produces light commercial vehicles and three-wheelers and exports into countries such as the USA, Asia, Europe, Middle East and Africa. The Indian automotive industry is one of the fastest growing in the world and it is the largest market in the world for three-wheelers.

Mahindra is also the number one manufacturer of tractors in India with a market share of more than 50% following a recent acquisition, and one of the largest tractor companies in the world. India is the second largest market for tractors after the USA.

The group has plants in India, the USA and China and a combined capacity to produce over 200 000 tractors a year. Mahindra (China) Tractor Company Ltd manufactures tractors for the growing Chinese market and is a hub for tractor exports to the USA and other western nations. A US subsidiary, Mahindra USA, assembles products for the American market.

As well as the automotive and tractor businesses, Mahindra is active in many other sectors, including financial services, information technology, infrastructure development, and systems and technologies (the Systech business, which includes Mahindra Composites).

The Group has eight manufacturing facilities in India. It has acquired plants in China and the UK and has three assembly plants in the USA. Mahindra has a joint venture with French car maker Renault (Mahindra Renault) which will manufacture and market the Logan, a C-segment (compact), low cost car, in India. It also has a collaboration with Nissan. In February, Mahindra, Renault and Nissan announced the location of what could be one of the largest automotive production sites in India, with an installed capacity of 400 000 units per year after seven years. Production is expected to begin at the site in Chennai in 2009.

Mahindra also has a joint venture with US company International Truck and Engine Corp (the principal operating company of Navistar International Corp) which will manufacture trucks and buses for India and for export. Mahindra will also provide component sourcing and engineering services to ITEC.

The next issue is of course cost. The purchasing departments of the car manufacturers have a ‘$ per lb mindset’ and composites are more expensive than metals though almost one quarter of the weight per volume. Even if the designer can be convinced to choose composites, benefits such as a longer service life and part integration make only a very small impact on a purchase department if the product is more expensive initially. In addition, the Indian automotive industry is not yet seriously interested in weight reduction and so this argument has less benefit.

“No company will buy a product that is costlier,” Lele confirms.

But it's not all bad news. Lele says that until two years ago the comparative prices of steel and composites were not making composites an attractive choice.

“Steel costs have now gone up and composites now make more sense economically, as they offer the ability to combine parts and reduce tooling costs in a significant way,” he says.

In addition, buyers have started to understand the importance of total life cycle cost instead of just price per piece.

Lele also believes that international companies ITEC, Renault and Nissan, which are collaborating with Mahindra to set up manufacturing in India, will use more composites. In addition, the Indian composites industry in general has been showing a 25-30% growth over the last few years, according to figures from the country's FRP Institute. As a manufacturer of moulding compounds and moulder of components, with design, prototyping and mould development capabilities, Mahindra Composites is in a good position to take advantage of this growth.

Full service provider

The composites unit is part of Mahindra's Systech business, an automotive parts supplier offering a full ‘design to delivery.’ Established in 2004, Systech comprises around 14 companies. These operate as independent entities in areas such as forgings, steel stamping, axel/gear manufacture, and casting. Systech company Mahindra Engineering Services (MES) provides a full range of product design and engineering services and acts as a central resource for the group.

Systech already has a portfolio of domestic and international clients, including all India's automotive companies as well as major international players.

Mahindra Composites was set up in 1982 to produce high quality, engineered polymer composite materials and products. The company has a technology agreement with Menzolit GmbH, the German manufacturer of sheet and bulk moulding compounds (SMC/BMC), whose products are used by major automotive companies around the world.

Mahindra Composites employs nearly 100 people and has two manufacturing units. The plant in Mangaon (around 150 km south of Mumbai) was set-up in 1987-1989 and started manufacture of SMC (using a Menzolit SMC machine) and parts made from the material in 1989. In 1999 resin transfer moulding (RTM) and hand lay-up facilities were added. In 2000, the company received Underwriters' Laboratories (UL) approval for its compounds. Today, the Mangaon also houses a paint shop and prototyping shop.

2001 to 2005 saw the beginning of exports of moulded products to the USA, and in 2004-2005 the Pune plant was set up. This is now the company's head office and also the site of a compression moulding shop and the engineering services department.

Today the company has the capacity to manufacture 10 000 tons/year of SMC (not fully utilised at present) and around 4000 tons/year of dough moulding compound (DMC). There are 10 hydraulic hot compression moulding presses from 100 tons to 500 tons in size on which it moulds parts for the electrical and auto sectors. It also has three RTM machines from UK company Plastech (now Magnum Venus Plastech) and 15 000 f2 of shopfloor dedicated to hand lay-up products. Customers include General Electric (Healthcare & Industrial Systems), L&T, Schneider, Legrand, Siemens, Mahindra (Automotive/Farm Equipment Sector), Tata Motors, Bajaj Auto, Ashok Leyland, and Swaraj Mazda. Today exports account for around 20% of sales and this figure is expected to rise. The majority of the exports are medical equipment to GE in the USA.

Mahindra Composites does not make its own tooling but there are a large number of tooling companies it can use in the Pune area. The team also in-house expertise in compound formation. It recently developed a compound for headlamps. This is not as big a market in India yet as it is in Europe, but a couple of companies have started using it and Mahindra expects this application will grow rapidly in future.

Automotive plans

Moulding of automotive components is not a recent activity for Mahindra Composites, starting around ten years ago. Today, the company's sales are divided roughly 80% to the electrical industry, and 20% to the automotive sector. Lele's objective is to boost the automotive side of the business, while maintaining growth in the electrical sector. This is a big challenge since the electrical sector in India is currently experiencing growth rates of around 40%.

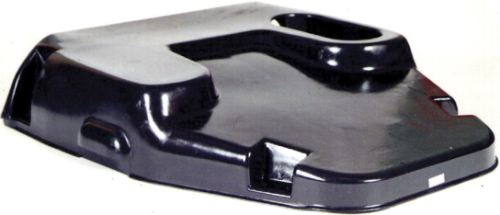

Although use of composites in Indian trucks and cars is low at present, Mahindra Composites is currently working on about six new products. Its five design engineers can redesign existing metal parts in composite to demonstrate to the car and truck manufacturers. Electric vehicles offer good prospects as weight reduction is essential for these vehicles. Tractor companies have started to look at composites as a way of making more attractively styled models. (Tractors are not just used for agriculture in India, but also for transporting people, materials and animals!)

At the moment Mahindra Composites does not have any technology agreements with car or truck manufacturers but Lele is looking at this as one way to speed up the company's development of automotive expertise. The Mahindra group already has collaborations with Renault, Nissan and ITEC which can be leveraged to achieve this.

Mahindra Composites' goal is to become a leading compound and component manufacturer and to develop its component manufacturing in a variety of sectors. Lele believes that in three years time it may be possible to build the automotive component business to 50% of Mahindra Composites' sales. There is plenty of room for expansion at both the Mangaon and Pune sites.