GKN Aerospace (GKNA) says that composites feature strongly in its plans for further business growth. According to Frank Bamford, senior vice president, business development and strategy, present workload breaks down by value as approximately 40% composite and 60% metallics but this ratio is expected to reverse, as part of a significantly expanded total workload, within five years. By 2012, says Bamford, several major aerospace platforms in which GKNA has invested will have ramped up to full production.

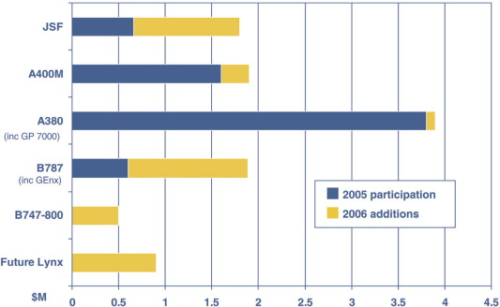

By then the 50% composite Boeing 787 should be pulling in as many as a dozen ship sets of GKNA items worth some US$1.8 million per set, each month. Of this, a substantial composites portion will include the pioneering fan containment case for the aircraft's ultra-efficient GEnx engine, plus an electro-thermal ice protection system which, embedded in composite mat, will keep the wing free of ice. The Airbus A380, likely to be in its full production stride by then, could well account for 20-30 sets per year of flap track beams and resin-infused trailing edge panels for the wings.

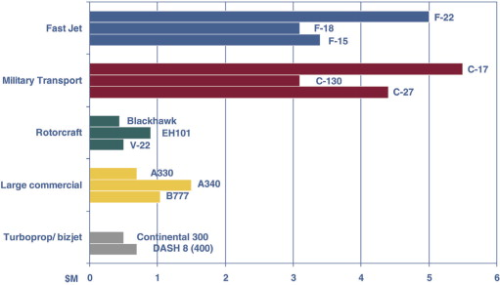

The A400M from Airbus Military should also be in full-rate production. Each of these military airlifters is to have within its largely composite wing an advanced carbon main spar and composite trailing edge panels from GKNA. Production of Lockheed Martin's radical F35 Joint Strike Fighter should by that time be drawing in high-performance carbon composite vanes and the air inlet for the aircraft's Pratt and Whitney F135 engine, from the GKN company's US production facilities. Annual revenues from this programme alone should be worth tens of millions of dollars. Another revenue stream, worth $5 million per ship set, should accrue from anticipated continued sales, including export, of the Lockheed Martin F22 Raptor advanced fighter. GKNA produces inlets and complex resin-infused wing spars for this aircraft.

More business will be generated by the trend to add efficiency-enhancing winglets to passenger jets, both at new build and as retrofits. Winglet specialist Aviation Partners and Boeing recently selected the UK-headquartered company as part of an international team to produce these items for Boeing 737 Classic, B757 and B767 airliners. GKNA will produce large winglet structures, up to 3.35 m tall, using automated resin film infusion and tape placement techniques. At the same time, the GKN facility in Alabama, USA, is likely to be turning out monolithic carbon fuselage barrels for the HondaJet, the Japanese entrant to the very light jet (VLJ) arena. VLJs are a recent development that is expected to add a large fleet of tiny jets to the global air transport mix within five years. HondaJet fuselage sections will be produced using tape winding or laying.

Meanwhile GKNA expects to continue producing engine nacelles, thrust reverser parts, cowls and control surfaces as demand dictates. These were the items that launched the company into the large-scale primary aerostructures business originally. Currently, composite-metal hybrid nacelle structures are produced for the Bombardier Dash 8 Q300 turboprop regional airliner as well as the Bombardier Challenger 300, Gulfstream G100/150 and Dassault Falcon 50X business jets. The Challenger nacelle, an integrally-stiffened carbon epoxy structure with a monolithic carbon composite inlet, is particularly admired. Other platforms benefiting from the company's weight-saving nacelle technology include the Lockheed Martin C-130J Hercules and Alenia C-27J military transports. Flap vanes for the Boeing C-17 Globemaster III and over-wing panels for Airbus A330/340 series are, likewise, mainly composite.

Product lines will change as new aircraft come on stream but, as established types amass more flying hours, repair and overhaul of in-service parts will assume greater importance. Already aftermarket activities account for some 15% of total revenue and this proportion is expected to grow.

Some demand is expected also from manufacturers of unmanned air vehicles (UAVs), a type of platform that is assuming greater importance in the military field and in certain civilian applications. The company has designed and is producing much of the airframe, in composite, for the American X-47B, a prototype for an intended unmanned combat air vehicle (UCAV).

Rotary

Helicopter heritage (GKN Aerospace was formed originally when engineering group GKN acquired Westland Aerospace, a sister company of the then Westland Helicopters) shows through in parts produced for the Westland-Agusta EH101 Merlin, Sikorsky Black Hawk, Sikorsky CH53 and the Westland-Agusta Future Lynx. Composite items range from the complex forward upper cockpit structure and rotor blade skins for the EH101 and its variants – including the US presidential US101 helicopter fronted by Lockheed Martin – to a potential integrated tail cone assembly for Future Lynx. Most exciting, enthuses Frank Bamford, is the prospect that within a few years the St Louis, Missouri facility of GKNA will have embarked on a production run of major fuselage sections for 156 Sikorsky CH-53K Sea Stallion helicopters. Before then, the company will have supplied seven development ship sets under a system design and development (SDD) contract recently awarded. A new ‘emerging high-performance material’ (details undisclosed) will be used for the section, part of the fuselage which transitions from the rear of the cabin to the aft fuselage and includes the loading ramp. Advanced manufacturing methods including automated fibre placement, automated trim and drill, and digital inspection will be applied to meet quality, weight, production rate and affordability objectives.

The company expects also to have maintained its penetration into aircraft propulsion by progressing from exterior items – nacelles, cowls, ducts, thrust reversers, fan containment cases etc – to the rotating heart of the engine. Recent strategic acquisitions of US companies Teleflex Aerospace and Stellex Aerostructures accelerate this penetration on the metallics side, but Frank Bamford foresees the company supplying integrated modules that combine the strengths of metallics and composites.

“One can envisage a largely composite front end – fan and containment case typically – with a mixed-material compressor and then metal matrix composites for the hot section,” he told Reinforced Plastics. “We are now well positioned for this sort of approach.”

This snapshot of the activity GKNA foresees for itself in five years time is based on firm foundations already laid. In deliberately targeting and investing in aerospace platforms that will be leaders in their fields, the company expects to reap the dividends later. This process – already well established with existing platforms – is accelerating as new aircraft move into their production cycles. The company recently shipped its fourth spar set for the A400M, is up to ship set 45 for the A380 now that this programme is picking up speed again, and has recently seen its ice protection system for the B787 achieve FAA and JAA certification. Nacelles for the Challenger 300 and other biz jets are on schedule, while development trials are taking place now on structures for the HondaJet. Results from six months of testing on the front frame of the JSF engine are as predicted and an ice protection system, trialed in December, is now being included in production items. Following its pioneering work on the GEnx engine, the company is in discussion with other leading propulsion suppliers on the possibilities for composite fan containment cases and other items.

Strategically, the company is positioning itself for ‘the big one’, an intended presence on the next generation of single-aisle narrowbody passenger jets. The A350XWB from Airbus and the yet-to be-launched successor to Boeing's ubiquitous B737 are likely to up the ante for advanced low-weight materials even further than the B787 does.

“We see those new-generation aircraft as a strong focus for our growth and are looking hard at the technologies that could be involved,” declares Bamford.

He cautions that composites may not be the only weight saving option since titanium and aluminium, along with various alloys such as aluminium-lithium, are strong competitors. Rising demand could create difficulties in the composite supply chain, he argues, and the consequent pressure on prices could enhance the competitive position of metals.

“On the other hand,” he counters, “we have been able to push the cost of manufactured composite items down substantially, thanks to work we have done in automating the production cycle and developing out-of-autoclave processes. The resin film infusion process we have developed, for example, avoids prepregging, is more flexible in terms of handling and storing materials and frees up the supply chain.”

The company has shown that RFI, along with related processes including double diaphragm forming, can usefully reduce autoclave time while still producing items to aerospace quality standards. Such measures, its technologists believe, can avoid the daunting prospect that meeting future aerospace demand will require multiple ‘large factories full of autoclaves’. Substantial continuing investment is focused on a range of potential cost-reducing techniques and processes including, for instance, infrared and microwave curing. Costs can be further lowered, Bamford asserts, by exploiting the part reduction potential that composites offer.

“A big issue for aerospace composites,” he argues, “is to get out of the ‘black aluminium’ syndrome whereby designers minimally adapt familiar aluminium structural designs and simply substitute composite parts for existing metal ones.”

This, he holds, still happens and, of course, negates one of the major benefits of composites – that of achieving major part reduction by co-moulding and curing entire structures, complete with details, into single integrated assemblies.

Whatever the future holds in terms of the composites versus metals balance, Bamford expects that GKNA will be there, providing a materials solution that meets requirements and is affordable. Often, he predicts, a mixed materials solution will be appropriate.

Making its mark

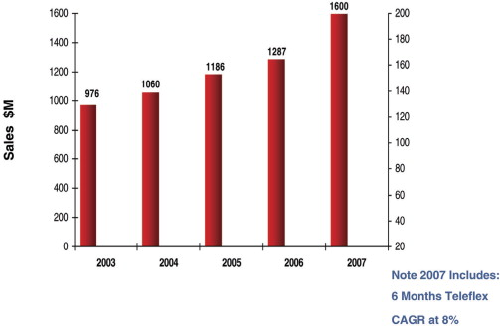

GKNA, a First Tier supplier which already boasts an annual turnover of $1.6 billion, expects to grow that to $4.2 billion by 2016, while achieving double digit margins. Frank Bamford believes that this aim is entirely realistic based on the company's strong technology and funding, its presence on aerospace platforms offering prospects of large production runs, and its status as a global player with major facilities in North America, Europe and Asia-Pacific. In addition, its forward strategy allows for further acquisitions. Particularly intriguing have been recent suggestions that, as part of a major cost-reduction drive by the troubled EADS (of which Airbus is part), the European aerospace prime contractor might regard GKN as a natural choice for business partner in its Filton, Bristol, wing structures operation. Any such partner would have to buy its way onto the mainstream Airbus wing programme, but the on-going revenues it could expect in return would be long-term and substantial. If GKNA were to become a stakeholder in the Filton site, it would take the company further up the Airbus supply chain and would clearly make waves in the industry.

Meantime, Frank Bamford believes that GKNA is still undervalued by leading opinion formers.

“Some commentators still tend to overlook us,” he concedes. “They know GKN as a long-established British engineering company but are not as familiar with the Aerospace arm.”

He predicts that this situation will change with a vengeance as the company continues to make its mark and as it meets its own ambitious strategic goals.