In responding to Boeing’s radical B787 Dreamliner, Airbus first hoped it could get away with an upgraded development of its established A330 twin, but this concept cut little ice with potential customers so the European company had to think again. Ultimately, it put forward an altogether new aircraft, gaining competitive edge by giving it a wider fuselage than that of the B787 (hence ‘XWB’).

Airbus leaders had to backtrack on their previous assertions that Boeing was foolish to adopt a reinforced plastic fuselage for its Dreamliner. Plastic fuselages are an undoubted challenge because previous commercial passenger jet fuselages have been metal and no-one knew how best to fabricate a large composite pressure vessel that has to accommodate hundreds of passengers. Nor was it clear how such a plastic fuselage would behave in service. Unknowns range from the likely effects of fatigue on a structure subject to repeated thermal and pressure cycles, to detection of damage in composites and subsequent repairability.

Yet, stung by Boeing’s bold adoption of a predominantly composite airframe, including the fuselage, Airbus has followed suit, notably specifying reinforced plastics for its wide ovoid fuselage as well as wings, empennage and other primary aerostructure. In fact, the billed 53% composite content of the A350 slightly trumps the 50% of the B787. The European contender is 53% composite, 19% aluminium-lithium, 14% titanium, 6% steel and 8% other materials.

Of course, operators are not interested in competition around plastic content for its own sake, but are keen to have the weight and performance benefits that composites can bring. Reassured that Airbus has recovered from its wrong-footing by Boeing, 35 customers have (at time of writing) ordered 573 A350 XWBs. (Airbus claims this number of firm orders and another 80 commitments.) Something around 600 copies is a creditable tally given that the aircraft was officially launched in 2006, more than three years after the B787.

Composites advantage

Airbus believes it has advantages in the composites arena. For a start, while Boeing has had to make a large jump from barely 10% composites content in its B777 airliner to the B787’s 50% figure, Airbus was an early composites adopter and has gained expertise while progressively adding fairings, nacelles, empennages, control surfaces and wings to its composite structures portfolio. It now has extensive experience of reinforced plastics fabrication and service behaviour, while composites engineers on the A350 programme benefit also from the 15% plastic content in the Airbus A380 ‘superjumbo’. Admittedly, Airbus might still have preferred to maintain its more incremental approach to composites adoption but, goaded by its competitor, it is now fully committed to the plastic fuselage revolution. Although low-weight metal solutions, primarily aluminium/lithium alloy and metal/composite hybrids such as GLARE, were considered, composites won out because of the prospects for greater integration, fewer parts and fasteners, lower maintenance and, it seems, the favourable attitude of airlines to the precedent set by Boeing.

Paradoxically, the European planemaker gains from not being the leader in this particular airframe race since it can learn much from the problems experienced by Boeing that have led to a likely three-year delay in first deliveries of B787s. Although the A350 programme is facing delays of its own, so far these are of the order of months rather than years. With first deliveries and service entry likely in 2014, the new Airbus should not be nearly as far behind its competitor in terms of its availability as was once anticipated.

Broadly, the A350 family will comprise three aircraft sizes; the A350-800, A350-900 and A350-1000 designed variously to carry 270 to 350 passengers (up to 400+ in the highest-density configuration). The aircraft was conceived as an A330/340 replacement and will compete with larger variants of Boeing’s new B787 and its existing B777 long-range widebody twin. All A350s will have a range in excess of 8,000 nautical miles. The variants will share a largely common wing design and wing span though the -1000 model will have a 4% larger wing area, achieved by extending the trailing section aft.

Intensive development

An intensive development effort has achieved significant milestones. One, reached in December 2008, was Maturity Gate 5 (MG 5), the point at which the aircraft configuration is considered fully defined. MG5 cleared the way for detailed design of components and enabled production of jigs and tooling to commence for long-lead items. This is crucial in the case of composites, for which production requires early commitments to tool manufacturers. Airbus regularly updates its data to these suppliers and many of the required tools are now available. The Maturity A milestone, which encompasses MG5 and earlier gates, was followed last year by Maturity B, by which point all design teams had finalised their designs.

Today the A350 XWB is progressing steadily from the design and development phase towards production. Airbus has assembled a detailed digital model of the aircraft for use as a common reference for component manufacture by its own sites and its suppliers. Rather than rely too much on this, however, the airframer has also implemented a demonstrator programme under which a physical mock-ups of the fuselage, wing and other major structures are being produced. A350 programme head Didier Evrard describes this activity as an essential ‘bridge between the digital model and the real world,’ important for validating composite production processes as manufacture ramps up towards the 10 aircraft per month rate targeted.

A modified production strategy for the A350 sees Airbus relying on a select group of Tier 1 supplier/partners chosen for their ability to shoulder full responsibility for delivering large pre-assemblies that are complete and ready for assembly into the final aircraft. It has not gone quite as far down the dispersed outsourcing track as Boeing first aimed to do and, by maintaining closer supervision within its partnership arrangements, hopes to avoid the supply chain pitfalls that have afflicted the Dreamliner programme.

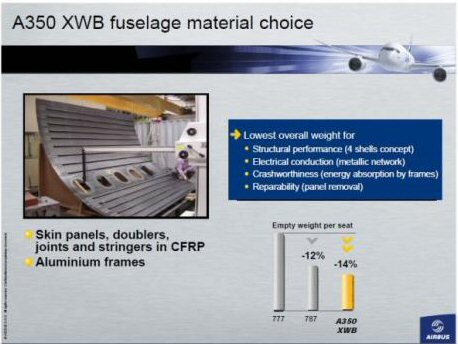

The biggest difference in approach between the airframers, however, is that related to fuselage manufacture. Whereas Boeing is producing the B787 fuselage in large monolithic tape-wound barrel sections that are subsequently joined, Airbus has opted to clothe a pre-fabricated fuselage skeleton with large carbon fibre composite panels. This less radical solution reduces risk, says Airbus, while also having the advantage that panel properties can be optimised to their locations in the fuselage (whether crown, belly or sides) with resultant weight saving. Other benefits include easier handling, less expensive autoclaves and the fact that having a panel fail at post-manufacture inspection for any reason is less of a setback than losing a complete barrel. Stringers and most frames are of carbon, though certain frames in high load areas are titanium so that crashworthiness criteria can be met. Airbus reversed an earlier decision to use metal stringers in favour of co-curing carbon stringers within the skin panels. This reduces the number of separately fabricated parts and fasteners. Crossbeams, however, are of aluminium-lithium.

The nose section is only partly composite, metal having been retained because the one-piece carbon fibre structure that had earlier been considered would have required titanium reinforcement to meet bird strike requirements, making it uncompetitive on cost.

Airbus Hamburg is responsible for fuselage development and final assembly, with an associate plant at nearby Stade producing some carbon fibre panels. Centre fuselage build-up takes place at the Aerolia (formerly Airbus) site in Saint-Nazaire, France, using upper and lower shells provided by Spirit AeroSystems Inc in North Carolina, USA.

Wings are produced mainly in the UK (Filton and Broughton), while the centre wing box is manufactured at Nantes in France. However, Spirit AeroSystems is responsible for the wing fixed leading edge including the front wing spar, a 105 ft long composite structure weighing some 2000 lb. Tailplane (empennage) components are being produced by Airbus Spain and Germany, and in China. Final assembly of the aircraft will take place in Toulouse, France.

Many of the production facilities, including those for composites, are new. A €150 million fuselage assembly hangar at Hamburg, with a production area of some 15 000 m2, was completed this summer. At a ceremony in July a topping out wreath decorated with carbon fibre was a symbolically appropriate part of the occasion. A new composite production facility at Stade currently has a workforce of about 100, but this is expected to grow to nearer 500 as production builds up to full rate. In July, Spirit AeroSystems formally opened a new 46 500 m2 composite manufacturing facility in Kinston, North Carolina, after a two-year construction phase. By now, some 200 people there are engaged on Airbus work, a tally that is expected to rise to about 700 over the next few years.

The A350 has a wing and centre wing box that are more extensively composite (about 80%) than on previous Airbus aircraft and the production arrangements reflect this. With majority production of the wings taking place in the UK, Airbus has expanded its capability at Broughton, North Wales, with a new 46 000 m2 factory dedicated to A350 XWB wing production. Wing design and engineering take place at the Airbus UK site at Filton, Bristol.

Broughton is due to commence assembly of the first wing about now. According to Brian Fleet, head of the wing programme, the British operations had to fight hard to keep wing production in the UK and have committed to efficiency improvements aimed at cutting cost by around 30%.

Parts of the wing are manufactured elsewhere. The role of Spirit AeroSystems in producing the fixed portion of the forward part of the wing, including the forward spar, has already been mentioned. GKN Aerospace has invested substantially in the site at Filton that it acquired from Airbus in 2008. Here, co-located with the Airbus wing design activity, it is setting up to produce the entire portion of the wing aft of and including the rear spar, except the wing skins which are being manufactured in mainland Europe and certain trailing edge components being made by GE Aviation at Hamble near Southampton in the UK.

Dozens of organisations around the world are involved in the supply chain. Aerolia, the French aerostructures specialist that emerged out of Airbus in 2009, is responsible for A350 nose and fuselage structures in both metal and composite, and has invested €160 million in a new composites facility. Its own supply chain tail includes Corse Composites (landing gear doors), Latecoere (nose fairing), plus a number of design associates. In Germany, Premium Aerotec, a similarly semi-autonomous EADS subsidiary, is producing much of the forward fuselage plus parts of the aft fuselage including the side shells, floor grid and aft pressure bulkhead. Its investment of some €360 million in the programme has included €6.5 million on a new 25 m long by 8 m high South Korea-built autoclave weighing 260 tonnes. This is installed at a new production hall at Augsberg.

Figeac Aero, also in France, is to manufacture floor sections under sub-contract to Aerolia while FACC AG, the Austrian company now majority owned by the Xian Aircraft Industry Group, has a contract to produce blended winglets along with a number of other A350 components. The Duqueine Group, France, is to fabricate fuselage frames for Premium Aerotec and Aerolia, plus window frames for Spirit AeroSystems. Frame production work has also gone to Alliant Techsystems (ATK) in the United States, along with manufacture of fuselage stringers. ATK recently spent €175 million on expanding its composite production facilities.

China’s Avicopter, one of the country’s composite leaders, has a joint venture (JV) with Airbus parent EADS to produce A350 rudders in a new factory at the Harbin Hafei Airbus Composite Manufacturing Centre. This JV is also to produce A350 elevators, under contract to Aernnova Aerospace in Spain. Airbus and China have an understanding that 5% of the A350’s airframe should be built in China, a commitment that was fully fulfilled with the recent allocation of wing spoiler and droop panel manufacture to Chinese companies. Another EADS joint venture is that with German company SGL to produce fuselage frames. Goodrich Corporation is to supply composite engine nacelles and thrust reversers. Korean Air Aerospace Division is to fabricate three of the aircraft’s safety-critical composite doors.

Automating composite production has engaged a number of suppliers including:

- MAG Industrial Automation Systems, provider of Viper automated fibre placement machines used at several production sites;

- M Torres, supplier of gantry-style automated tape laying, fibre placement and inspection machines;

- Flow International, manufacturer of machine tools for composites, including abrasive waterjet units; plus

- Aim Engineering and several other jig and tool specialists.

Hexcel Composites expects to make billions of dollars over the life of the programme by providing composite materials, principally its HexPly toughened epoxy product incorporating intermediate modulus carbon fibre. Two years ago Hexcel opened a carbon fibre production plant at Illescas near Toledo, Spain, fibre from which goes to a partner plant in nearby Paria for conversion into prepreg.

Final aircraft assembly will take place in Toulouse where a new A350 XWB assembly unit is being built close to an existing A330/340 production line at a cost of €140 million. The 7.4 hectare assembly area, nearing completion after almost two years of construction, has impressive ‘green’ credentials. There is a high proportion of natural lighting, and with 27 000 m2 of photovoltaic roofing and an advanced energy management system, the site is expected to generate over half of its energy. Use of parallel workflow lines is expected to enable up to ten A350s to be produced per month eventually.

Logistics

As with the Dreamliner, A350 production involves considerable movement of large aerostructures. Fuselage items manufactured in North Carolina will be shipped across the Atlantic to be received at a new Spirit facility in Saint-Nazaire and assembled there into the full 65 ft by 20 ft centre fuselage frame section, which next goes to Hamburg for full fuselage integration. These and other fuselage sections completed at Saint-Nazaire are transported by Beluga – an Airbus A300 modified to carry outsized cargoes in its large whale-like cargo belly - to either Hamburg or Toulouse. Since Saint-Nazaire, Hamburg and Toulouse all have waterside access, items may optionally be shipped by sea.

Spirit AeroSystems will despatch its wing contribution to its operation in Prestwick, Scotland, for integration into the wing leading section before the latter is transported to the final assembly site. The main body of the wing, complete with the trailing edge portion, is flown from the wing assembly site at Broughton, UK, to Toulouse as a final assembly item.

Centre wing boxes are transferred from Nantes to Saint-Nazaire for integration. Other items are transported to European plants from as far afield as the United States, Korea, Malaysia and China.

‘Becoming real’

A key production milestone achieved at Nantes in December 2009 prompted Didier Evrard to declare, “the A350XWB is becoming real!” This happened when work on the centre wing box (CWB) began with the fabrication of a large carbon composite panel. The panel, with its 36 m2 surface area, was formed using a new state-of-the-art tape laying machine and is the largest ‘monobloc’ composite panel ever manufactured at Nantes. Subsequently, tooling for the keel beam was commissioned in Nantes in June. This is a large item that enables the lower shell of the keel beam and the lower panel of the centre fuselage to be laid up in one go. Assembly of the first keep beam is due to start about now.

| In August, work began on one of the largest carbon fibre reinforced plastic (CFRP) items on the aircraft – a 31.6 m by 5.6 m upper wing shell. |

At Stade, in August, work began on one of the largest carbon fibre reinforced plastic (CFRP) items on the aircraft – a 31.6 m by 5.6 m upper wing shell. A massive autoclave facility installed at the plant can accommodate and cure two of these shells simultaneously. Airbus’ use for the first time of automated tape laying to produce this shell is aimed at ensuring speedy production, and consistent high product quality. In September, Airbus in Spain unveiled an even larger piece of wing skin at its Advanced Composites Centre in Illescas. The 32 m by 7 m lower wing cover, a double-curvature item fabricated to precise tolerances, is one of the biggest CFRP components ever built by the aeronautical industry.

Meanwhile in the UK, GKN Aerospace engineers early this year fabricated and evaluated their first composite wing spar, intended for the A350 wing box demonstrator. Preparations are now being finalised at Filton for series production of spars using automated fibre placement and other automated techniques.

At the same time, 11 Airbus and associated sites in Germany, France and Spain have been working together to produce a demonstrator fuselage. Recently the programme completed a second large test fuselage section (the parallel part of the fuselage is produced in three sections). The 18 m long section, with a diameter of more than 6 m, served to develop and validate the compete process chain, from the manufacture of individual panels, frames and clips to shell assembly, section assembly and production of long circumferential joints. Airbus has also had to develop and refine methods for producing fuselage frames, window frames, fasteners and doors, including a hybrid CFRP/titanium door structure being used for the first time.

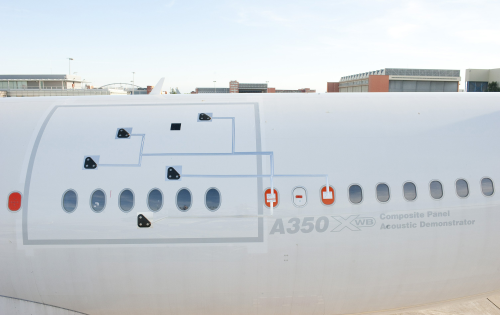

As well as establishing production processes, demonstrators are used to validate the Electrical Structure Network (ESN), a critical matter with composites since electrical paths for lightning strikes have to be engineered into the structure rather than being freely available as in metals. This is achieved on A350 fuselages by connecting metal frames, aluminium strips attached to composite frames, the metal floor grid etc together in a conductive network. (Boeing is incorporating an electrically conducting metal mesh within its B787 fuselage lay-up.)

Another vital aspect of fuselage evolution is panel development. In September/October, Airbus flight tested an A350 CFRP fuselage panel on an A340 test aircraft, where it was installed in place of a standard metal panel. The 14 m2 panel, produced at Nantes, incorporates microphones so that technicians can assess the panel’s acoustic behaviour when combined with various insulation materials. This is to determine to what extent acoustic energy will be transmitted into the aircraft through a stiff carbon structure, a matter that is still in question. Fuselage sections equipped with fully furnished cabins will be used for assessing the acoustic characteristics of a full composite fuselage. Production of panels is commencing at Premium Aerotec, Aerolia and other aerostructure partners.

Frames, too, are a particular composites focus. Duqueine produced its first frame for Airbus’ demonstrator fuselage in January, using a multiaxial prepreg bending process that it developed in partnership with Airbus over the previous two years. ATK Aerospace Structures recently delivered its first composite stringers, produced using its proprietary automated stiffener forming system, and frames will follow.

Longer wait

Given what is, even for Airbus, a quantum leap further into composites, it is perhaps not surprising that the development programme is slipping behind schedule. So far the airframer has admitted to a delay of about three months, forcing it to compress the originally intended 15-month flight test programme into 12 months in order to meet early delivery commitments. Industry analysts and sources within Airbus suggest that the final delay will be greater than this.

Although manufacture of initial parts is now under way, these are for the demonstrator mock-up and parts for the first production aircraft, MSN001, come next. Start of final assembly of MSN001, the first A350-900, has been pushed back from the second quarter of 2011 to the third quarter, with first flight projected for mid 2012. The ensuing compressed flight test programme will require five aircraft to amass 2600 flight hours before certification can be achieved. The sixth aircraft manufactured will be the first for customer delivery.

Airbus cites four main issues stretching the development timescale: airframe sizing, the electrical structure network, the wing root join, and fuselage damage tolerance. Of these, the first two are considered resolved and progress on the other two is said to be good. Didier Evrard admits that the decision to push back fabrication is due to working in so many areas with carbon fibre. He says that, unlike with metal, it is not possible to commit from a global finite element model and that with composites ‘you only get one chance.‘ He adds that the delays should affect only the -900 variant. The smaller -800 should follow a year after the baseline -900, and the largest -1000 a year after that.

In addition to evidence of slippage in detailed engineering, sources within the supply chain say that shipments of some parts are up to six months late. Analysts may well be justified in suggesting that the first -900 delivery will not take place before 2014. Moreover, early aircraft are likely to be overweight.

Even so, customers do not seem unduly perturbed at present. Given the prospect of an exceptionally light, largely plastic low-maintenance long-range widebody aircraft offering operating costs some 20% lower than current-generation jets, they are prepared to wait a little longer.

This article was published in the November/December issue of Reinforced Plastics magazine.