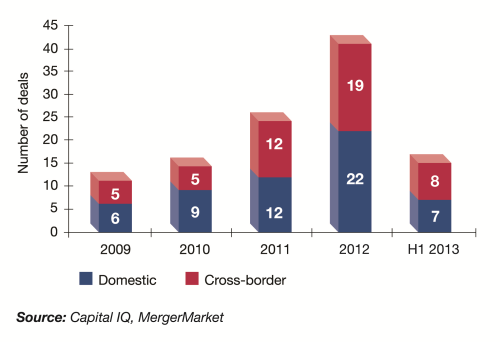

M&A in the composites industry reached a record high in 2012 with 41 deals worth over £2.3 billion. (See: Mergers, acquisitions & joint ventures review – 2012.)

Although deal volumes and values haven’t matched the first half (H1) of 2012 – there have been a total of 15 reported deals over the first half of this year compared to 21 transactions in H1 2012 – momentum in the sector over a longer period is strong. (See: Mergers, acquisitions & joint ventures review – 2013.)

Strengthening platforms

| A continuing M&A theme is the presence of large strategic buyers using acquisitions to expand into higher growth end-markets. |

A continuing M&A theme is the presence of large strategic buyers using acquisitions to expand into higher growth end-markets.

Netherlands-based specialist textiles manufacturer TenCate is one of the sector’s serial acquirers. Its M&A strategy is technology-driven and has used bolt-on acquisitions to create a broad capability base across thermosets and thermoplastics. TenCate’s acquisition of UK-based manufacturer Amber Composites at the beginning of the year increases its presence in the market for industrial and automotive composites, tooling materials and access to the aerospace market in Europe.

Strong order books for increasingly composite-intensive commercial aircraft and the ongoing pressure to develop more efficient aircraft means that deal activity involving aerospace specialists remains robust. OEMs are using M&A to access new technologies and capabilities and H1 saw acquisitions by US-based aerospace supplier Triumph Group of Primus Composites (UK and Thailand divisions) and by Japan-based Sumitomo Precision, which bought CFN Precision (Canada). Rolls-Royce was also active, acquiring US-based Hyper-Therm High Temperature Composites. Hyper-Therm produces ceramic matrix composites which Rolls-Royce believes can revolutionise the weight and performance of engines.

Joint ventures

Joint ventures and partnerships continue to be widely used across the sector to develop composites technology and secure supply. During H1, Germany’s SGL Group and South Korea-based Samsung established a strategic partnership to develop new industrial and electronic applications with carbon composite materials. The partnership also secures a stable, long-term supply of carbon fibre materials for Samsung.

SGL is forecasting 20% annual growth for the carbon fibre market in China and South Korea as demand from industries including automotive, electronics and wind energy increases.

In another cross-border agreement, US-based Kaman Aerospace Group and India’s Kineco Pvt Ltd have established a joint venture in India to manufacture composite structures for aerospace, medical and other industries using the latest carbon material and autoclave curing technology.

Confident outlook for the full year 2013

The second half of 2013 has got off to a strong start with six deals announced in July. Demand for capacity and new technology is supporting M&A. Manufacturers and OEMs will continue to be acquisitive, targeting those companies which help to secure capacity, technology and access to leading-edge materials as demand for composites increases across multiple end markets. ♦

Also see: