Growth prospects in the aerospace market remain strong.

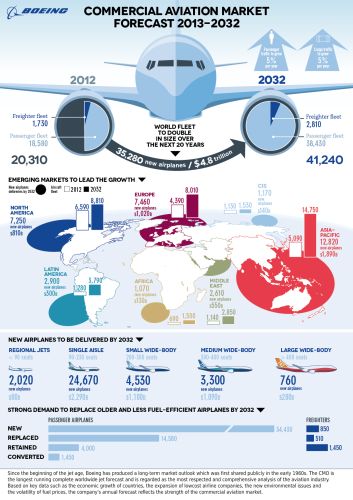

Both Airbus and Boeing won nearly $70 billion of orders at the show for circa 450 aircraft each, and Boeing is forecasting 35,000 new aircraft over the next 20 years. A proportion of new aircraft will be replacement of the older, less efficient fleet with brand spanking new designs.

This is where composites come in. The market drivers for composite materials in the aerospace sector continue to be strong i.e. demand for new aircraft the drive for lower running costs and the need to meet emissions regulations – all of which point to a rosy future for the composites sector.

The latest developments of new aircraft evidence the significant impact composite materials are having. The new Airbus A350 airframe comprises over 50% composite materials, with a similar percentage making up the primary structure of the Boeing 787.

| From an M&A perspective, corporate acquisitions continue to run at a pace. For some buyers, paying for technical know-how via acquisition in a rapidly developing market is more attractive than in-house development. |

| Tony Davis, Director, Catalyst Corporate Finance |

Not surprisingly, there were numerous composites-related investments and agreements also announced at the Air Show ... TenCate Advanced Composites signed an agreement with Fokker Aerostructures for the supply of thermoplastic composite materials used in aircraft components, and GE Aviation announced a $50 million plus investment in a composites facility at Hamble, UK, for wing components. (See: Paris Air Show 2013: Composites take off at Le Bourget.)

From an M&A perspective, corporate acquisitions continue to run at a pace. For some buyers, paying for technical know-how via acquisition in a rapidly developing market is more attractive than in-house development. As a result I expect there are some interesting strategic discussions being held between business development teams and R&D teams in the larger businesses around the world with an interest in this space.

In the meantime, privately owned businesses with a niche area of technical expertise and/or routes to market will continue to be highly attractive assets. ♦

Also see:

- Demand for composites leads to £2.3b record mergers and acquisitions Forecasts that demand for composite materials is set to double by 2015 are leading to record levels of mergers and acquisitions (M&A), according to a new report from Catalyst Corporate Finance and Ricardo Strategic Consulting.