Rising demand leading to investment in capacity

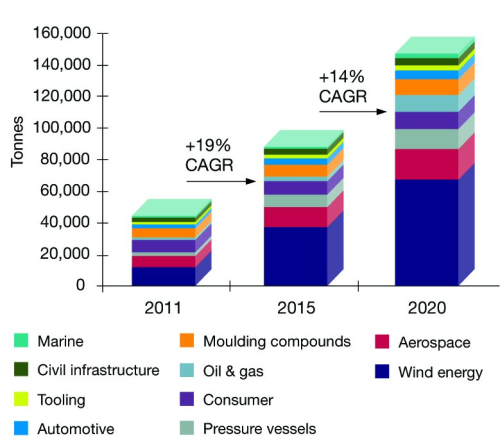

Improved fuel efficiency and demand for high-strength lightweight materials is increasing the penetration of composites with demand for carbon fibre reinforced plastic (CFRP) forecast to double by 2015 (Figure 1). This is particularly true of the automotive and aerospace sectors. In addition, wind energy suppliers and industrial suppliers are also increasing their use of composites.

The top producers are reacting to these changes by investing heavily in their production capability. Cytec is spending US$250 million annually in the medium term to meet the demand from its aerospace customers, whilst Toray is targeting annual capacity of 27,100 tonnes to cope with increased demand from its partner Daimler (see Daimler and Toray establish joint venture for manufacture of carbon fibre parts.)

Acquisitions used to access higher growth markets

Manufacturers and suppliers are positioning themselves to be at the forefront of opportunities driven by the growth of composites as they are increasingly substituted for conventional materials. This is being done in a number of ways. Strategic buyers are using acquisitions to help them expand into higher growth end markets and to gain access to new processes and technologies. A number of large acquisitions have made the headlines in the last 12 months, evidence that major producers are confident that the use of composites is set to grow significantly, particularly in the higher volume industrial and automotive industries.

Aerospace specialist Cytec’s 2012 acquisition of Umeco for £348 million has enabled the company to move up the supply chain and capitalise on Umeco’s composite components manufacturing and process technologies. This includes energy efficient and more cost effective out-of-autoclave technology that it is developing to shorten thermoset production cycles. (See Cytec completes $439m acquisition of Umeco.)

TenCate has also been active. Their acquisition of US thermoplastic producer PMC Baycomp in 2012 will extend the company’s customer base beyond aerospace to industrial applications including oil and gas and automotive. More recently, the acquisition of UK-based Amber Composites will provide TenCate with greater access to the European markets. (See TenCate acquires Amber Composites.)

Controlling more of the supply chain

| Suppliers are under pressure from OEMs to safeguard against supply disruption. The aerospace sector supply chain in particular is becoming increasingly consolidated with OEMs preferring to outsource larger packages of work to fewer trusted suppliers. |

Suppliers are under pressure from OEMs to safeguard against supply disruption. The aerospace sector supply chain in particular is becoming increasingly consolidated with OEMs preferring to outsource larger packages of work to fewer trusted suppliers. Companies are therefore using a vertical integration strategy to protect their position in the supply chain, another feature of recent M&A activity. UK-based OEM supplier Avingtrans acquired Composites Engineering Group, which has certifications in the aerospace market and its own tooling capability, to gain access to the aerospace composite market and provide an integrated composite and metal components service to its global OEM customer base.

Another example of this is Germany-based SGL’s acquisition of Portuguese Fisipe which is part of its strategy to secure raw materials from multiple sources. SGL also has a secure supply of industrial carbon fibres via joint ventures with Lenzing and Mitsubishi.

OEMs using joint ventures to overcome auto production challenges

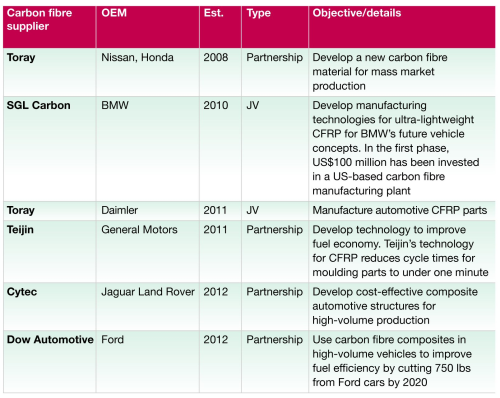

As the use of carbon fibre becomes increasingly important in achieving fuel economy and carbon dioxide (CO2)emissions targets in the automotive sector, advances in cycle times and capacity are being driven by the establishment of joint ventures between composite producers and major automakers (Figure 2).

BMW has adopted a vertically integrated approach in the production of the BMW i3 and i8 sports car. The i3, which will be launched later this year, will be a volume-production all-electric car with a CFRP passenger cell. BMW has redesigned the full production chain including establishing a joint venture with SGL to supply semi-finished carbon fibre products exclusively to BMW. (See BMW/SGL joint venture opens US carbon fibre plant.)

Other joint ventures and partnerships have been established between Dow Automotive and Ford, and Teijin and General Motors.

Elsewhere, automotive equipment supplier Faurecia has acquired the automotive business of Sora Composites, which has expertise in glass and carbon fibre for automotive applications (see Faurecia acquires Sora Composites automotive business). Sora’s customers include Renault, PSA Peugeot Citroën and Aston Martin, and in the UK, Jaguar Land Rover and Cytec have a partnership to develop cost-effective composite structures for higher-volume production.

“Composite materials have an increasingly important role to play in achieving the targets for fuel efficiency and reduced carbon dioxide emissions that leading automakers are aiming for in the years ahead,” comments Ian Kershaw, Managing Director Ricardo Strategic Consulting.

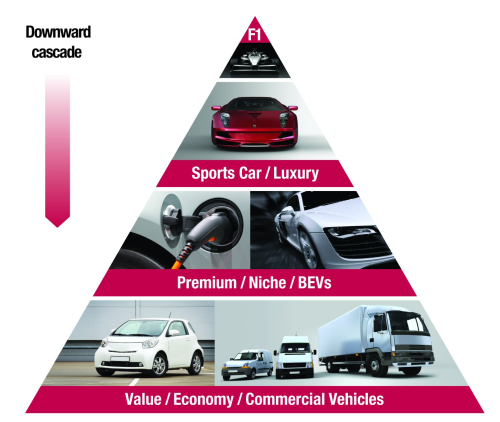

“While many composite materials are already familiar to the motorsports and supercar sectors, work is underway to develop the out-of-autoclave production processes necessary for mainstream automotive products.” (See Figure 3.)

Smaller companies need to develop their offering

The composites sector is highly fragmented and characterised by numerous small players with specialised knowledge. OEMs are driven toward those suppliers who can provide a complete solution to help navigate through the adoption cycle. Small companies wishing to prosper should look to provide an increasing proportion of the composites value chain. Reducing manufacturing costs and cycle times, and gaining scale will offer the greatest potential to grow a business in the medium term.

M&A levels reaching new highs

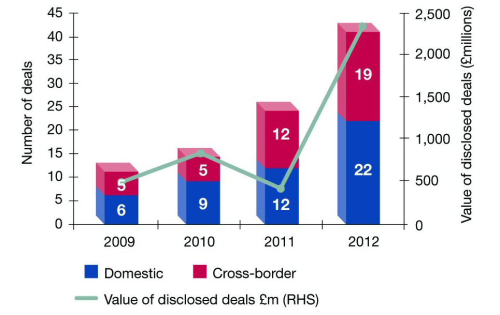

With the drive towards greater use of composites across a range of sectors, mergers and acquisitions will continue to reach record levels over the next few years, predicts the report. M&A activity hit a record high in 2012 with a 71% annual increase in the number of transactions (see Figure 4) and it is off to a strong start in 2013. Trade buyers will be at the forefront of this trend and the high level of cross border transactions will continue. “The driving force behind this trend will be raw materials manufacturers looking to secure component production capacity alongside OEMs who will be leveraging partnerships to access key technologies”, explains Mark Humphries, partner at Catalyst.

“We also expect to see not only trade buyers active in the market, but increasing interest from private equity who will see the sector as an opportunity to develop buy and build platforms or acquire businesses to build their portfolio in the sector.” ♦

Further information

The report was produced by Catalyst Corporate Finance and Ricardo Strategic Consulting. Copies of the report are available for download from the Catalyst website or the news & media section of the Ricardo website.

This article will be published in the May/June 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics magazine is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.