Remko Goudappel has been with DSM for almost 16 years and he's been running the Sizings & Binders business for the last two and a half years. Prior to this he held various managerial positions within DSM, including roles in the melamine and polypropylene businesses, as well as a management development role with corporate DSM. He studied chemical engineering at Delft University in the Netherlands and has a business degree from Rotterdam University. He likes the culture at DSM.

“It's a good company, offering excellent career opportunities. I like the whole philosophy of developing people – to me that's a key asset of DSM.”

DSM is also very ambitious in terms of its growth and business targets, seeking to establish a leadership position in the markets in which it operates. DSM Resins consists of a group of four business units:

- DSM Composite Resins;

- DSM Coating Resins;

- DSM Neoresins (waterborne resins); and

- DSM Desotech (UV-curable coatings and resins).

DSM Composite Resins' main activities are Structural Resins (unsaturated polyester resins, gel-coats, polymeric plastisicers), Sizings & Binders, and Distribution.

“Our position as European market leader in structural resins is strengthened by our pan-European distribution business operating under the Euroresins service brand. We are currently in the process of integrating this business within Structural Resins to maximise the synergies. As well as our five European sites, we also produce structural resins in China. Our focus in China is very much on the higher end of the market, developing and marketing speciality products, where we can fully leverage our technical know-how.”

“In terms of our sizings and binders business”, continued Goudappel, “we're the global number one and our new production plant in Shanghai, which will serve the whole Asian market, is progressing as planned. So, as you can see, we have leadership positions in our Composite Resins businesses but that's not to say we're prepared to rest on our laurels.”

Global growth

So where does Goudappel see the DSM Composite Resins business in five to ten years' time?

“That's a good question. We have ambitious goals and want to grow globally. We also want to become the most innovative company and the partner of choice in the sectors where we operate. We already have a reputation for technical competence and innovation but we want to step that up a gear.”

“As I've mentioned, the Asian market is clearly a focus of our attention. Our strength here is that we can use the technologies that we've developed in Europe and transfer them into China. After China we want to expand our position in North America. We have a presence there in sizings and binders and we believe that we need to further strengthen this position. Recently we began the manufacturing of Neoxil products through the US production location of DSM Neoresins. Glassfibre production is a global business but the unsaturated polyester market is still quite regional. Having said that, we are beginning to see a globalising trend amongst key customers, for example in the automotive industry. This also affects China. We see a trend towards adopting global standards in China as the Chinese start playing a key role in the global economy.”

Innovation

“The key driver in the composites industry is weight reduction – especially in replacing metal parts with composites,” Goudappel says. “This means developing materials that are stronger and lighter and which offer lower system costs. For example, aviation and wind energy are currently two sectors in which polyester systems can be used. We are developing some interesting products that, we believe, offer good performance with improved handling properties and lower system costs. So we're really focusing our innovation efforts on those kinds of new industries.”

Aviation is a very new market for DSM.

“Yes, that's true, and we realise that we're at the start of this process. We still need to prove, technology-wise, that we can meet all the challenges, but it's the kind of sector where we can utilise innovation to become a leading player.”

“In our Sizings & Binders business we also serve the thermoplastics industry. There are important markets like automotive where we can play a key role in the high-end thermoplastics industry like high temperature resistant applications or applications requiring high resistance to hydrolysis. The sizings can make a crucial difference in the performance of the composite, since they are the binding force between the resin matrix and the glassfibre. There's a lot of chemistry involved which is, after all, one of our core competencies.”

Challenges

We ask Goudappel to list the top three challenges to DSM Composite Resins' business at the moment.

“Only three! These are challenging times for the composites industry but in a positive sense. With our strong technology position, we're well equipped to play a leading role in the environmental arena – for example REACH [the Registration, Evaluation and Authorisation of Chemicals regulations expected to come into force in 2007 will affect manufacturers, importers and downstream users of chemicals]. As market leader we have a responsibility to represent the value chain as far as these standards are concerned.”

Growth in China

DSM Composite Resins' joint venture with Jinling in China [Jinling DSM Resins Co Ltd (JDR)], is located in Nanjing and produces unsaturated polyester resins and gel-coats. JDR's new general manager is Stephan Dusault and during the China Composites Expo in Shanghai in September he outlined the future strategy for JDR.

DSM publishes a new strategy every five years and the latest plan is based around three areas:

- growth in emerging countries (China is one of the most important of these);

- growth through innovation and existing products;

- further improvement of efficiency of business processes ('operational excellence').

One of Dusault's objectives is to grow JDR's position in China.

“One of the ways we will do this will be by intensifying cooperation between the various DSM business units present in China. The DSM group has around 3000 employees in the country and the plan is to optimise talent (employees) and information exchange between the different units, as well as improving business capabilities between these units. Growth through innovation will focus on increasing the value of DSM's products to its customers, through production, logistics and customer service.”

Dusault is expecting a 30% growth in sales and production for the coming year.

“Operational excellence will focus on issues such as safety and risk control and improving the efficiency of business processes. This will guarantee a sustainable long-term supply to customers.”

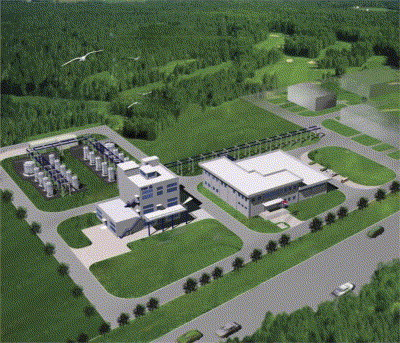

Remko Goudappel was also at the China Composites Expo to give an update on the Sizings & Binders business. He confirmed that a new plant is being built in the Pudong area of Shanghai. It is expected to start up in the first half of 2007. A new binder specifically for the Chinese market is also being launched. Called NEOXIL 990 PMX, it is a powder binder used to produce glass mats. New products for the thermoplastics market are also being developed. The Shanghai plant will supply key existing products, carry out custom manufacturing of sizings, and has room for future expansion. It will also provide technical support for the Asian market. Dusault finished with some thoughts on the Chinese market.

“The future is bright, but there are a lot of players. The companies that will survive are the companies which will attract the best people, and those which take environmental considerations seriously.”

“Innovation is the second key challenge. We recognise the opportunities but we need to be able to develop the right products and services to exploit these opportunities. As mentioned, aviation is one of them, but it's going to be a challenge because of the lengthy approval times and the need to convince the industry that UP composites are a dependable alternative, especially with the high levels of performance and reliability required in those industries.”

“Our third challenge is the pressure on our costs. If you look at what's happening in the glassfibre industry with the announced merger of Saint-Gobain and Owens Corning, it's all about reaching a critical mass and reducing the pressure on costs. Consolidating their activities brings world market leadership and a more cost efficient structure. Resin producers also need to consolidate if they are to survive – especially the smaller operations.”

“We are continuously faced with enormous increase in raw material prices,” says Goudappel. “Last year we witnessed an unprecedented increase in oil prices, naphtha prices and all downstream derivatives, including styrene, which is the main raw material in resin production. We hoped things had levelled out but it's now starting all over again, forcing us to once more increase prices. This is not a problem specific to our industry since raw materials across all sectors are going up as a result of oil price developments, which has a supply/demand side but also a political side. There's enormous, increased demand in Asia – China in particular – that is creating an imbalance in supply and demand.”

How does DSM tackle these issues?

“Well, you can start by controlling the things you can control. That means being sustainable in terms of cost controls, technology, safety, and environmental issues; but also in terms of raw material contracts. For most raw materials there is supply-demand imbalance so if you are a small player and you don't have the contracts in place then you don't get the raw materials. We have been able to leverage our strength as part of a large global speciality chemical business to ensure a consistent and stable supply of essential raw materials. This way we can ensure that our customers are supplied even when the market becomes very tight.”

Another challenge that faces the composites value chain is recycling.

“We are very active in looking for solutions,” continues Goudappel. “We have the Green Label ECRC initiative [European Composites Recycling Company], which we helped to found together with other structural resins producers, glassfibre producers, compounders and moulders. We are dedicating a lot of time and money to studying how to manage composite waste in an efficient, viable and sustainable way. It is a tough challenge but one that is vital to the future growth of the European composites industry.”

The future

Presumably, like other resin producers, DSM has found it tough this year?

“In terms of volume growth it's satisfactory and in line with our expectations,” Goudappel says. “In terms of pressure on costs it's tough as we are constantly faced with increased raw material and energy prices. So commercially it's tough, but from a volume/growth point of view it's healthy. We see economic developments picking up in Europe, Asia is growing strongly and the US is also seeing a positive upturn. Overall we're confident about the rest of 2006 into 2007. The potential for growth is there as long as we see some levelling out in raw material costs. We are in a strong position to lead the UP resins industry and exploit growth opportunities wherever they occur.”

So how does the Composites Resins business fit within the DSM group as a whole?

“DSM has sales of around €8 billion worldwide. The nutritional products cluster (DSM Nutritional Products), which also includes DSM Food Specialties, contributes a lot to these sales. Then there is the Performance Materials cluster, which consists of DSM Resins, DSM Engineering Plastics, and DSM Elastomers. A third, smaller cluster, is industrial chemicals, which includes the commodity chemicals such as agrochemicals, caprolactam, melamine and acrylonitrile. Finally there is the pharmaceutical products cluster.”

“DSM has identified Performance Materials as one of the strategic growth areas, so we have aggressive growth plans. DSM is focusing on three key strategies to realise growth within the business: innovation; mergers and acquisitions; and growth in emerging countries – especially China. We're actively looking for interested partners that we can work with to innovate and to strengthen our international position. One of the strengths of DSM is the strategic process that we have in place, on a corporate level and on a business unit level, which we have to re-evaluate every three years. The new corporate strategic plan requires us to double our total business in three to four years. This underlines the commitment of DSM to the composites industry.”