It took Boeing some time to match Airbus' composites challenge, but now that it has with the new B787 mid-size passenger jet, it has seized the initiative.

Airbus took a lead in the primary structural use of reinforced plastics in airliners back in the '80s, notably in rudders, empennages and wing control surfaces. Recently it has hit harder with the A380 ultra-jumbo where these stiff, low-weight materials account for a quarter of the A380's structure by weight.

Boeing, likewise, progressed from modest beginnings (control surfaces, wing tips etc) to a significant presence (around 12% by weight) in the B777 widebody jet in the 1990s. In particular, the B777's horizontal stabiliser is a large composite item. Boeing's most daring thrust, however, has been to adopt composites for the fuselage of the B787, which will be the first mainstream passenger airliner to have a plastic fuselage. (Raytheon's Premier 1 and Hawker 4000 [ex-Horizon] have advanced composite fuselages, but these are business jets.)

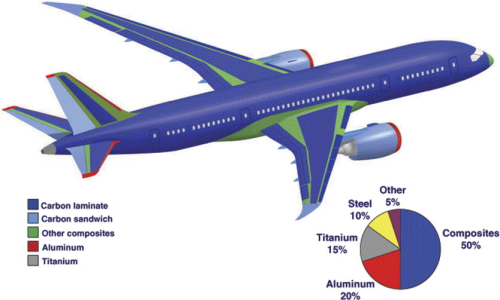

With largely carbon wings and empennage as well, the B787 has about half its airframe by weight made up of composites.

The carbon fuselage is controversial, however. Airbus has declined to follow suit in drawing up plans for its counter to the B787, the A350 (now in the early stages of development) and has specified a metal fuselage instead. Even so, it expects that some 35% by weight of its new airliner will be composite.

(NB: In response to market sentiment and the need to compete effectively with the B787, Airbus is considering whether to re-think its A350, a design partly derived from its earlier A330 series, and produce an all-new airliner having a wider fuselage and larger wing. The composite content of the proposed A370, for which service entry would be delayed by about two years, is not yet clear.)

Airlines at first reacted hesitantly to the B787 (Boeing calls it the Dreamliner), citing concerns over supposed difficulty of repair-ing and maintaining the fuselage. According to the Flight Safety Foundation, ‘ramp rash,’ or damage to lower fuselage sections caused by ground equipment (air stairs, baggage elevators etc) costs airlines US$10 billion per year, half of this being accounted for by damage repair and downtime. (Personal injury accounts for the rest). Repairing this damage, some of which is far from minor, is therefore a real issue. Airlines were concerned that composites might be more difficult to repair than metal, requiring greater down-time. Another worry was the fact that composites can be damaged without leaving evidence at the surface, whereas metals deform and show tell-tale dents.

Despite Airbus willingness to exploit this unease, Boeing largely succeeded, with a major customer relations and PR effort, in reassuring would-be operators. Subsequently, the B787 has become the fastest-selling airliner, at this programme juncture, in the company's history. Airbus, though achieving useful early sales for its A350, is trailing in Boeing's wake. Recent orders, including a large 45-aircraft (plus 20 options) commitment from Australian airline Quantas, have brought the tally of B787 orders to almost 400 units, while the A350, albeit a later starter, has under 200 orders to its credit.

Fuselage contention

There has been heavy thrusting and parrying over the wisdom or otherwise of making the critical fuselage/pressure vessel of a main-stream passenger-carrying airliner in plastic. The two protagonists have seized on this as a major differentiator between them, along with their divergent views on two versus four engines for long-range transports, subsidies, and forecasts of demand for ultra-large airliners.

Boeing's fuselage rationale is simple – that, in a world in which there is ever greater focus on fuel consumption and emissions, a lighter aeroplane will burn less fuel. Composite structures are lighter than metal equivalents. Ergo, composite fuselages can help aircraft become cheaper to operate and less polluting. Boeing cites other advantages: composites can, it says, provide a tougher pressure vessel, enabling B787 cabins to be pressurised to about 6000 ft equivalent rather than the more usual 7000–9000 ft, with consequent benefits to passenger comfort. Because composites are not subject to corrosion, a major enemy of metal fuselages, cabin humidity can be held to a constant 10-15%, compared with the 5-10% usual with metal fuselages, again improving passenger comfort.

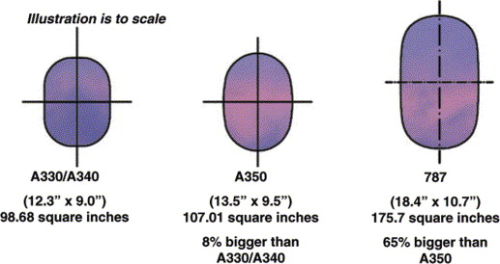

The ability with composites to tailor load paths mean that larger windows (about 65% bigger) can be fitted without compromising structural integrity or adding substantial weight. Boeing also believes that the virtual immunity of composites to corrosion and fatigue will make them more durable than metal in service. The US constructor courts controversy, however, when it claims that composite fuselages will prove cheaper to maintain in the long run, benefiting life cycle costs.

Airbus – for once made to look conservative over its stance on composites – holds that Boeing is taking a big risk. Although the US company has met enormous technology challenges in the past, it faces an absolute stunner now, the Europeans suggest. Even if it succeeds, they argue, the costs of doing so will exceed estimates, invalidating the models on which pricing and operator profitability predictions are based. Delivery and performance guarantees may also be in doubt. Independent analysts conclude that Boeing cannot afford too many hitches and that all the ‘pieces of the jig-saw must fall into place’ if its predictions are to be justified.

Airbus also strikes home with the argument that its A350, though less plastic than the B787, still leads in terms of advanced materials usage. This is justified on the grounds that the fuselage will have an aluminium-lithium skin. According to chief operating officer, commercial, John Leahy, the A350 will thus be 60% by weight advanced materials, beating the 787 on this front. Use of the low-weight alloy for skin panels reduces risk and cost, enabling Airbus to offer lower unit pricing for its airliner. It will also, Airbus points out, enable airlines to use standard repair procedures when the fuselage sustains damage.

The war of words around the fuselage/composites battle escalated recently. Boeing was irritated when Airbus apparently cast aspersions on the safety of the US product, despite both protagonists regarding as taboo attacks on each others' products on safety grounds. The supposed transgression happened at a safety conference and followed a Boeing decision that certification of its composite fuselage would be based on inspection for visible damage, with minimal need for non-destructive testing. A confer-ence speaker reportedly suggested that this policy might raise safety issues since damage, such as delamination or disbonds, can lurk inside the thickness of a laminate without leaving any surface evidence.

Boeing denies that safety would be affected, arguing that so much margin is being built into the 787's structure that undetected damage could not lead to catastrophic failure. As Justin Hale, deputy chief mechanic on the B787 programme contends, damage in a composite tends to remain localised, in contrast to metal where it can spread rapidly. Composite material can therefore maintain its structural integrity even with modest amounts of undetected damage.

Enlarging on his argument, Hale harks back to the days when Boeing was working on an intended transonic transport, the Sonic Cruiser, before abandoning this and switch-ing its attention to what has become the B787. Composites would have figured in the fast jet's design.

“Our Sonic Cruiser task group recommended that fuselage design allowables should be such that any damage in the composite that is not evident at the laminate surface on visual inspection will not prevent the structure from bearing its design loads,” Hale told us.

This philosophy has been applied to the B787. The fuselage has been engineered with carbon fibre laminate thicknesses ranging from almost an inch at access door surrounds and other vulnerable areas, including parts of the lower belly, to half an inch at joins between separately manufactured fuselage ‘barrel’ sections and just a tenth of an inch in parts of the crown (fuselage top). This tailoring of damage tolerance enables Boeing to advise, in effect, that if there is no damage to be seen, there is nothing to worry about and it is safe to operate.

Hale qualifies this by noting that the advice serves for the modest bumps and scrapes that typically constitute ramp rash. More substantial impacts should, he says, be reported by ground crews who, in the absence of a real-time health monitoring system, are the first line of defence. (Boeing has prototype health monitoring technology flying on other aircraft in its range currently, but this is unlikely to be ready in time to equip early 787s, scheduled for delivery from 2008).

Repair

Reporting of a substantial ‘bump’ should prompt a more detailed inspection, including from inside the fuselage, for evidence of damage. An inspector might look, for example, for signs of disbonding stringers – reinforcing members that are co-cured with the fuselage skins during production. Signs of separation could indicate high external impact forces. Any continued doubt about the nature and extent of damage incurred might signal a need for non-destructive inspection.

Pulse echo evaluation, for instance, has proven effective with empennages, control surfaces etc, and Boeing is working on a hand-held acoustic device intended to provide ‘go/no go’ indications of damage. This ramp damage checker (RDC) would provide readouts with which a repair team could consult the airframer's structural repair manual (SRM) for guidance on whether a repair is allowable for the revealed damage.

Airlines are also concerned about the repair of more serious and obvious damage outside the scope of the SRM. Justin Hale seeks to reassure them by quoting from a study of several actual cases in which metal aircraft were severely damaged. Major causative events included a tail strike, a nose gear collapse and a service vehicle collision. A Boeing support team ‘mapped’ the same damage onto a notional B787 structure and then estimated the labour and material costs needed to make a full repair. In every case, says Hale, the cost of the repair turned out to be within 10% of that required for an equiv-alent metal structure similarly damaged.

Another concern is that repairing composite structures might be such a step change from existing repair practices that engineering staff will find it hard to adapt. Not so, counters Hale, declaring that technicians will be able to continue repairing fuselage damage with bolted metal patches, just as they do at present.

“We did not want to handcuff operators with all-new repair techniques,” he explains. “We applied lessons learned six or so years ago with the Sonic Cruiser project. A service engineering team that included structures and composites experts decided that it would be best to allow airlines to continue with the repair methods they were used to.”

Consequently, bolt-on patches stay in the repair manual, though these may be of composite material or titanium, avoiding use of the more usual aluminium, which has poor compatibility with carbon. The SRM will, says Hale, authorise patch repairs for quite large areas, up to 1 m by 1 m. Operators wishing to restore the unblemished elegance of composites at a later stage can elect to remove bolted patches and replace them with bonded repairs, typically when an aircraft is grounded for a major engineering check.

Boeing has simplified procedures as much as possible ensuring, for example, that hot bonders can be used to cure the recommended prepreg repair material rather than having to rely on autoclave or oven cure. Specifying the same low cure temperature prepreg for most repairs avoids the need to store diverse materials with different refrigeration requirements and shelf lives. Boeing is taking care to ensure that materials and practices used to repair sections of the fuselage produced by different sub-contractors will be uniform.

For quick repairs in the field, the B787 engineering team has devised a technique that relies on a small pre-cured composite patch, ‘like a bicycle tyre patch, but bigger and for aircraft’ as one team member has described it. A lowly ‘hand warmer’ type heater is sufficient to heat the patch to the modest temperature required for cure, about 130°F. Boeing believes that this will, if necessary, provide something more than a temporary ‘get you home’ fix and will be sufficiently robust to carry an aircraft through to its next significant engineering check.

Comparable repair techniques will be available for wings, empennages and other composite structural parts.

|

In designing the B787, Boeing has moved well away from the ‘black aluminium’ school of aerostructural design that is still evident in some quarters. As Deb Limb, B787 fuselage/interior life cycle production team leader, told Reinforced Plastics: “The 787 gave us the opportunity to take a fresh look at manufacturing methods. Composites enable you to produce large integrated structures, with far fewer parts than would be possible with metal. We've really captured that benefit with this aircraft, especially in the fuselage where we're making some very large pieces. We are aiming for a 30-40% reduction in manufacturing time, and repeatable first-time results.” Each fuselage is made up of six large barrel sections produced by sub-contractors and transported by sea and special air freighter to Boeing's Everett facility, where they will be assembled into a complete unit. Because advanced composite manufacturing technology now allows sections to be produced repeatably to precise dimensions, the barrels can be joined without complex assembly fixtures. Joints are essentially mechanical, sections being fastened together with butt splices and stiffening. Production in six sections keeps the task manageable and has enabled Boeing to farm out manufacture to a global network of sub-contractors. The geometrically complex 13 m long nose section has been entrusted to Spirit-AeroSystems Inc at Wichita, Kansas. (A 21.3 m by 9.1 m autoclave is due to be completed there by the middle of this year.) Kawasaki Heavy Industries is producing the second, mainly cylindrical, section in Japan. The third section, essentially a part-barrel that fits over the centre wing, is the responsibility of Alenia Aeronautica, Italy, as is the fourth, a relatively straightforward fuselage ‘slice’. Alenia is carrying out the work at its new centre of excellence for carbon fibre structure at Grottaglien, near Naples. The fifth section, another ‘slice,’ and the sixth, tail, section will be delivered by US supplier Vought Aircraft Industries. Each section is of solid laminate, produced by laying carbon prepreg tape onto rotatable mandrels mechanically under software control. Stringers (longi-tudinal strengtheners) are inset as part of the lay-up and co-cured with the rest of the assembly so that they are integral. Completed lay-ups are vacuum bagged, subjected to repeated consolidation cycles, and autoclave cured in standard aerospace fashion. Carbon fibre fuselage frames, subsequently attached to the fuselage shell with rivets and composite shear ties, are to be produced by resin infusion. Efficient, high-rate automated production of all the barrel sections will be achieved with automatic fibre placement, plus machines for automated fastening, skin trimming, drilling and other operations. Boeing adopted this construction basis after investigating several alter-natives. A number of barrels were pro-duced by different methods and tested as part of the evaluation. It was necessary to address tough tooling challenges for sections having complex geometries – notably the nose, tail and over-wing section. Much of the groundwork for the 787 was laid as a result of Boeing's Sonic Cruiser activities. “All the major technologies developed during that project have transitioned to the 787,” says Limb. “That's why we have been able to advance so quickly.” To convince airlines that ‘ramp rash’ would not be a greater problem with composite fuselages than with metal equivalents, Boeing carried out comparative impact testing on composite and aluminium panels. This showed, according to the company, that typical ramp ‘bumps’ that might dent metal panels would leave their composite counterparts undamaged. To give their message impact, Boeing invited representatives of potential customers to make a direct assessment themselves. “We handed each of them a big mallet and invited them to attack some aluminium and composite panels,” explains Deb Limb. “They found it hard to make any impression on the composite panels.” To secure production uniformity between the different fuselage sections, manufacturing teams from the major sub-contractors producing them have been brought together at Everett as part of a single integrated group whose task has been to become familiar with the technologies and processes involved. To make doubly sure, Boeing has sent a team to the premises of each sub-contractor to oversee the fabrication of pre-production barrels. Manufacture of production-standard barrels is due to start towards the end of this year. The first set will be assembled at Everett next year, resulting in a complete fuselage during the second half of '07. Next year will also see early aircraft made available to the flight test programme, followed by others that will go into temporary storage pending certification. Boeing expects to start delivering B787s to customers in 2008. |

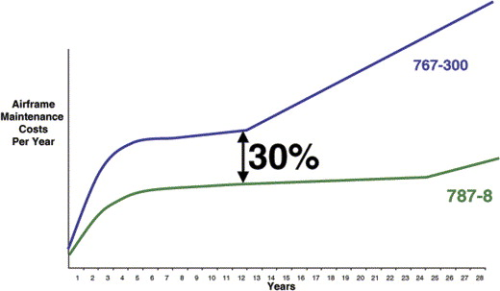

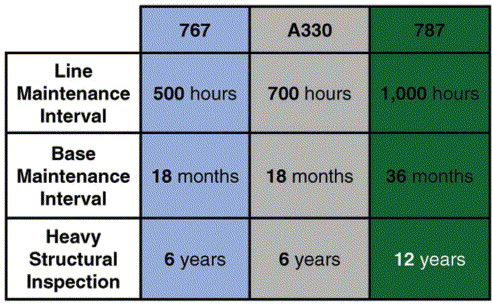

Boeing's diligence in addressing the critical repair issue has helped reassure would-be operators, who seem also persuaded by the airframer's assertions that the composite B787 will be less expensive to maintain than current types – cheaper even than the A350, it is claimed. The durable properties of composites are a factor enabling Boeing to extend intervals between groundings for major checks. The airframer says it can keep the B787 in the air and earning revenue for longer than current aircraft. Based on these extensions to maintenance intervals and a minimal requirement for attention to primary structure between times, Boeing claims a 30% lower maintenance requirement for its B787 than for any competing aircraft.

In a corner

Airbus, though remaining sceptical about using composites for the fuselages of mainstream airliners, at least in public, knows it must take care not to paint itself into a corner. It should not be overlooked that, while eschewing an all-composite fuselage, the company has adopted carbon fibre reinforced plastic (CFRP) for the rear fuselage and fuselage keel beams of the A350. Furthermore, while company officials are happy to suggest that composites may not be the best option at present, they may want to shift to a less unequivocal stance soon. Airbus has said it is ‘preparing to launch’ a successor to its present top seller, the popular A320 narrowbody. In considering this new model, it might wish to re-evaluate the merits of composite fuselages. An extensively composite A320 would compete head on with Boeing's successor to its own ubiquitous twinjet workhorse, the B737. For this aircraft, Boeing is likely to opt for composites for all the primary structure, including the fuselage.

A disturbing possibility remains, though, that external factors could yet dissuade both rivals from increasing their reliance on composites. Issues surrounding the supply of carbon and its escalating cost provide scope for competitors – advanced aluminiums, aluminium-lithium and hybrid metal/composite solutions like GLARE used in the A380 fuselage for example – to enhance their appeal as fuselage materials. Engineers might seek cost-effective material combinations, composites being just one element in the mix. Airbus has already shown signs of redefining its challenge in terms of advanced materials rather than just composites.

Clearly carbon, in the ascendancy at the moment, will need to constantly improve its price/benefit performance in order to stay competitive. In continuing their duel into the future, the planemaking rivals may find themselves battling not over ‘plastic fantastics,’ but on who can best utilise a whole range of advanced materials in order to provide the most efficient and marketable commercial aircraft.