The company reports net earnings of $43.8 million for the 2013 quarter compared to $58.4 million in Q3 2012.

New portfolio

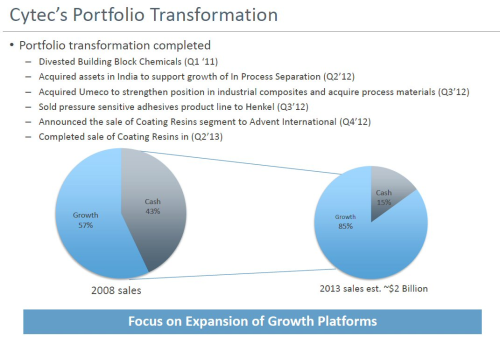

Cytec (NYSE: CYT), headquartered in Woodland Park, New Jersey, USA, has restructured its business over recent years to focus on growth areas (see first chart).

In 2012 it acquired Umeco plc, a UK headquartered provider of advanced composites and process materials, for US$439 million in 2012 (see Cytec completes $439m acquisition of Umeco).

As we look ahead, our new portfolio has us well positioned to capture future growth in several of our major markets. While we continue to pursue many exciting opportunities, we must navigate through some of the shorter-term market challenges. |

| Shane Fleming, CEO, Cytec |

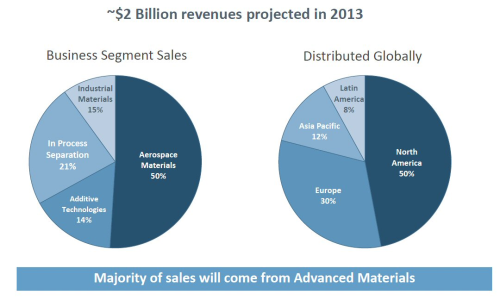

Cytec expects the majority of its sales will now come from its Aerospace Materials business, which supplies composite materials for the commercial and military aerospace markets (second chart).

Aerospace Materials

For Q3 2013 Cytec's Aerospace Materials sales were up 7% on Q3 2012 to $236 million, and operating earnings increased slightly to $40.7 million.

Total selling volumes were up 4% from Q3 2012. Approximately half of this was due to the acquisition of Umeco, with the remainder mostly driven by higher large commercial transport build rates.

"In Aerospace Materials, Cytec's growth this year is primarily in the large commercial transport sector as a result of Boeing's ramp up of the 787 with some additional support from single-aisle programmes," reports Shane Fleming, Cytec's Chairman, President and CEO.

"As I mentioned last quarter, we saw some inventory destocking by our customers in the military sector which has inhibited growth in the shorter term. We expect this to continue over several more quarters. In addition, we see demand for the rotorcraft market, mostly blades for military rotorcraft, to remain weak."

Industrial Materials

Cytec's Industrial Materials sales increased 1% over Q3 2012 to $71 million, and operating earnings were $5.1 million.

Sales in Q3 2013 include approximately $15.5 million of higher sales related to timing of the acquired Umeco business which closed in July 2012. Included in the third quarter 2012 results is $9.0 million of sales related to the distribution product line which was divested in July 2013. Excluding these two items sales were down approximately $6 million.

This decrease is the result of lower demand in the high performance automotive and tooling sectors and also reduced sales of process materials to the wind energy market.

"The Industrial Materials business has experienced some modest improvements in structural composites in a very weak European market," Fleming says.

"Process Material sales volumes are still negatively impacted by the drop in wind energy demand that started in the second quarter. We anticipate steady incremental improvement in volumes for the remainder of the year."

Also see: