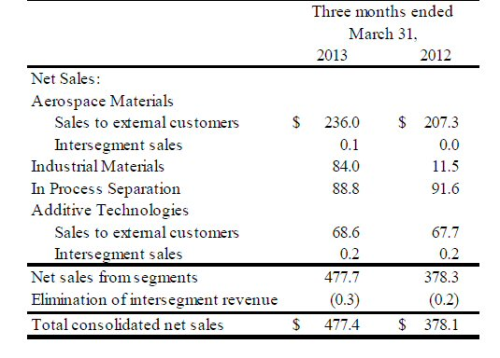

Net sales from continuing operations for the first quarter (Q1) of 2013 were $477.4 million, compared with $378.1 million for Q1 2012.

Earnings from continuing operations for Q1 2013 were $8.0 million ($30.2 million for Q1 2012) and earnings from discontinued operations were $25.9 million ($23.4 million for Q1 2012).

The new Cytec

| With the Coating Resins divestiture now behind us, I am extremely excited about the opportunities ahead of us as we begin operating as a new Cytec. First quarter 2013 revenue growth met our overall expectations as we anticipated a modest start to the year with stronger growth in the remaining quarters of 2013. |

| Shane Fleming, Chairman, President and CEO, Cytec |

On 3 April Cytec, headquartered in Woodland Park, New Jersey, USA, announced that it had completed the sale of its Coating Resins business to private equity firm Advent International for a total value of $1,133 million. Following this sale, the company plans to focus on the areas of advanced materials and separation technologies, and on 18 April it announced a change in its business segment reporting structure.

From the first quarter of 2013, Cytec's reportable operating segments will be:

- Aerospace Materials, which includes the advanced composites, carbon fibre, structural film adhesives, and the aerospace product lines;

- Industrial Materials, which includes the high performance industrial products, process materials, structural industrial and distribution industrial product lines;

- Process Separation, which includes the mining chemicals and phosphine's product lines; and

- Additive Technologies, which includes the polymer additives, specialty additives and the formulated resins product lines.

Aerospace and Industrial

For Q1 2013 Cytec Aerospace Materials sales were up 14% on Q1 2012 to $236 million. Selling volumes increased by 4% versus the 2012 first quarter, primarily driven by higher build rates in large commercial transport and larger business jets as well as new business jet programmes. Higher selling prices and acquisition-related volumes increased sales by 3% and 7% respectively.

Q1 2013 operating earnings of $41.5 million were down from $43.3 million in the prior year quarter, primarily due to higher period costs related to increased manufacturing headcount versus the prior year quarter. In addition, Cytec says it experienced an atypical surge in orders in the first quarter 2012 as customers were preparing to meet build rate increases and this resulted in higher production levels and lower unit production costs versus the first quarter 2013.

Cytec Industrial Materials sales were $84 million for Q1 2013. Sales of the Structural Materials product line were $51 million reflecting the challenging European environment which impacted the high performance automotive and motorsports markets. Included in Structural Materials is $12 million of sales related to the distribution product line which is in the process of being divested.

Sales in the Process Materials (vacuum bagging) product line were $33 million which reflected improving sales into the wind energy market.

Operating earnings were $2.6 million for the quarter. These were below Cytec's expectation primarily due to unfavorable product mix within process materials and lower selling volumes in structural composites. The company also incurred $0.8 million of one-time costs associated with exiting a distributor agreement and other head-count reductions.

2013 outlook

| We have revised our earnings per share forecast for the remainder of 2013 taking into account the current demand environment. Our new estimate for 2013 adjusted diluted earnings per share is in a range of $4.50 to $4.75, down from our prior guidance of $4.70 to $4.95. This forecast represents a substantial increase over 2012 results of $3.02 adjusted diluted earnings per share. |

| Shane Fleming, Chairman, President and CEO, Cytec |

"We continue to be optimistic about both our short and long term growth opportunities yet there remain a number of risks in the global economy mostly impacting our Industrial Materials segment," notes Fleming.

Cytec expects the Aerospace Materials segment to grow at a low double-digit rate with estimated annual sales in a range of $980-$990 million, driven by increasing build rates in large commercial transport and as Boeing ramps up to its expected 787 year-end rate. Sales are also expected to be supported by growth in business jet programmes.

The company also says it is making great progress in integrating the aerospace portion of its Umeco acquisition into its existing aerospace business. Full year operating earnings are projected to be in a range of $170-175 million, up significantly over 2012 figure's of $156 million.

The estimate for annual sales for the Industrial Materials business is in the $300-315 million range full year operating earnings of $18-$22 million are expected.

- In 2012 Cytec acquired Umeco plc, a UK headquartered provider of advanced composite and process materials, for US$439 million, strengthening its presence in the industrial sector and its technology in advanced composites (see Cytec completes $439m acquisition of Umeco.)