Holding 2010's Wind and Tidal Technology Symposium (WATTS) alongside the annual Seawork exhibition in Southampton, UK, was a calculated move intended to increase awareness among marine suppliers of the needs of this potentially large sector of renewables activity.

Though the conference facility itself was somewhat makeshift, the content of the presentations was informative, leaving delegates with an encouraging sense of several technologies now moving from conceptual to demonstration scale.

Speakers were clear, though, that significant marine resources, from specialist installation vessels to fast crew boats, are needed to enable this renewable sector to take off in the way offshore wind is now doing.

This fact was well illustrated by Martin Wright, managing director of Marine Current Turbines, in the graphic account he gave of the difficulties experienced in installing MCT's SeaGen tidal stream turbine in Strangford Narrows, Northern Ireland. He presented a catalogue of snags and hold-ups that might have stymied a less determined management team.

SeaGen's tide race

Wright stressed that working in an 8 knot tide race was not for the faint-hearted and likened it to wind turbine installation teams working in a 300kph wind. He said that specifically designed installation vessels would be needed for similar work in the future, though existing marine assets were being utilised in the meantime.

Originally, he said, it was intended to install the 1.2 MW SeaGen on a monopile, since anchoring techniques would not be reliable enough under the strenuous tidal conditions, and monopile technology is now familiar through its use in offshore wind.

Arrangements had been under way to charter a jack-up vessel with a crane to undertake the drilling out and grouting of the rock sea bed to take the necessary large single-piece steel monopile. However, due to a crane breakage, the time slot that had been available expired and the first plan had to be reconsidered.

Rather than piling into the seabed, it was decided to produce a quadripod foundation that could be installed by crane barge instead of a jack-up. This barge would have to be highly capable, with a powerful crane and precise positioning and station-keeping capability. Positioning to within a tolerance of 5cm was needed because the feet of the quadripod are held in position by steel pins driven into the sea bed. In the event, the well-known Dutch crane barge Rambitz was chartered.

The Dutch crew proved adept in carrying out the operations, according to MCT, which involved timing the work carefully so that much of it could be carried out at slack tide, a period of just three quarters of an hour in each tidal cycle.

Snags they faced included a vortex problem that made grouting difficult, and a 65mph wind that sprang up at one point. Once the foundation was in place, wires used to lower SeaGen onto it had to be led clear of the turbine's vulnerable rotor blades. Then, Rambitz had to leave before installation had been completed and a smaller construction barge was brought in as substitute. Later, access to and from the turbine had to be arranged, with rigid inflatable boats (RIBs) being used to convey personnel to the site and disembarking them onto the SeaGen crossbeam.

The programme was also delayed when a rotor blade was broken and needed replacing. A small landing craft was used for this. Another tricky operation was carrying out the directional drilling required to bury the sub-sea connecting cable.

| [MCT's] Wright stressed that working in an 8 knot tide race was not for the faint-hearted and likened it to wind turbine installation team working in a 300 kph wind. |

After the trials and tribulations of installation, SeaGen was successfully commissioned and is now delivering ‘loads of power’, according to Martin Wright. He reports that some 5MWh per tide is produced and the machine is often at full output. It operates 24/7 and some 1.66 GWh had been sold to the grid at the time of the conference earlier this year.

Wright reported that, to date, there had been no perceptible environmental effect from SeaGen's operation. He did concede, however, that costs had to be reduced, and hopes this will be achieved with second-generation machines when deployed in arrays, such as a 5MW array planned for the Pentland Firth off Orkney.

In addition, MCT is also planning to top its tidal turbines with wind power.

“We starting looking at this some years ago,” said Peter Fraenkel, technical director, “and we obtained a patent. Now we are looking at sites.”

The patent, obtained in the UK in 2003, is for a “combined air and water flow turbine”.

The new device, to be called SeaGen W, will use a wind turbine in the 3 MW range. It will add power and is expected to provide savings in terms of maintenance and connections. It will also have the advantage of high visibility for shipping, though SeaGen S, the standard version, can also be seen by mariners.

Visualising an array of tidal turbines, Fraenkel said that, due to the close spacing of tidal turbines, it would be impossible to put a wind turbine on top of every tidal turbine. “We plan to put a wind turbine at each end of the array,” he said.

Wave power moving forward

Slated for the fast tides of the Pentland Firth, in this case under the auspices of E.ON, is a second-generation Pelamis wave energy converter, developed by Pelamis Wave Power. Business development director Max Carcas told delegates that, in the aggressive marine environment, simplicity is a virtue.

“The machine has to be cheap and easy to fix,” he declared, “and you are aiming for automated self-optimising running.”

Accordingly, structural simplifications in the second-generation Pelamis have reduced costs. At the same time, power take-off arrangements have been improved, with more articulation taking place between adjacent Pelamis cylinders, such that more energy is extracted from the waves. There is greater ability in the revised design to tune the device to the predominant wave conditions by altering the ram restraints.

Pelamis has been designed to operate in extreme conditions, including 100-year wave events, “hydrostatic clipping” ensuring that the system never becomes overloaded.

Sea trials of Pelamis P2, now taking place in the North Sea, will be followed by shipping the system to Orkney. Again, deployment in numbers is seen as the means to achieve future reductions in costs per kW. Carcas says that economies of scale will come with large projects and envisages 20-30 MW wave power farms.

Pelamis Wave Power works with engineering design consultancy Atkins on aspects of offshore deployment.

Martin McAdam, CEO of Aquamarine Power, admitted that there has been no technology convergence yet in the wave space, a situation that contrasts with that in the wind energy sector where the three-blade, horizontal axis ‘Danish’ model has become the de facto wind turbine standard. He is a strong proponent of wave power, contending that there are about 42 terawatts of power out there to be tapped, compared with 3.7 TW of tidal power. Wave power is not subject to periodic flow reversals and it is also, he argued, an ideal complement to wind since the waves keep rolling for some time after the causative wind has subsided. As such, it can help counter wind's intermittency.

McAdam spoke highly of the European Marine Energy Centre (EMEC) at Orkney, north of Scotland, where a number of contending technologies can be operated on a trial basis in the tough marine environment. One of these will be Aquamarine Power's Oyster near-shore device, essentially a giant seabed-mounted hinged flap that extracts energy from surge, the horizontal component of a wave's elliptical motion.

Power from the device is piped ashore hydraulically rather than via an electrical connection, and conversion to electricity takes place on shore. Oyster requires no control system and is self-regulating, McAdam pointed out. The existing machine has completed some 4000 operating hours.

A second-generation Oyster, half as big again as the present 315 kW Oyster 1 and generating two and a half times more power, is due to be installed at EMEC next year, as a three-flap array. However, delegates were told, there is more work to be done, particularly in terms of cost reduction.

“We need to get down to about £3m per installed megawatt to be competitive,” says McAdam, who hopes that a pending third-generation machine, now in development, will go a long way towards meeting this objective. This 10 MW Oyster 3 will be the last pre-production machine before a definitive production version is launched.

The eventual production standard machine, he asserts, should be able to provide investors with a 10%-15% return. Aquamarine Power has plans for a 200 MW Oyster farm and claims to hold a lease for an appropriate site.

| “The machine has to be cheap and easy to fix and you are aiming for automated self-optimising running.” |

| - Max Carcas, Pelamis Wave Power |

Radical

In a conceptual sense, MCT took the prevailing wind turbine model, with its large open rotor on a horizontal axis, and adapted it for under-water tidal power extraction. The rotor blades have become shorter and fatter, and there are two of them not three, but the principle is the same.

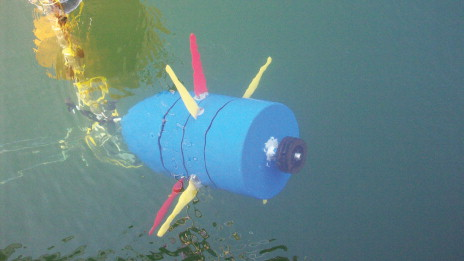

Dublin-based OpenHydro, however, has adopted a radically different approach, having engineered a bi-directional ring generator that operates between two concentric ducts.

Open Hydro hopes to circumvent the sort of difficulties that arose in the installation of SeaGen by mounting its machine on a tripod that rests on the sea bed. Operations manager Sue Barr told WATTS' delegates that installation requires no piling, the foundation simply being lowered into position at the required location. A 6 m (diameter) turbine was installed at EMEC in 2006 and this started generating two years later. Jack-up barges were used for early installation work, though subsequently a purpose-designed vessel, OpenHydro Installer has been commissioned.

Barr agreed with previous speakers that robust simplicity is key to success in underwater machinery and commended OpenHydro's open-centre turbine for this quality.

Latterly, the company has been working on a 10 m version of its design for Nova Scotia Power. Last November this was installed in the Bay of Fundy, another of the world's tidal ‘hot spots', but this had not yet (at the time of presentation) been connected.

Unfortunately, two of the tidal turbine's blades were lost and have to be replaced. This requires the unit to be recovered to shore, an operation that is scheduled for later this year. Meanwhile, the Irish company is also working on other prospects, including a four-turbine array for deployment at Paimpol in France.

Sue Barr expressed the view that the shortage of vessels and other equipment needed for wave and tidal converter installation and maintenance could become a delaying factor for this nascent sector. These is a strong need, she argued, for offshore wave and tidal practitioners to engage with marine interests – a major justification, as it happens, for the combining of WATTS with Seawork.

Shortages within the marine supply chain could also hinder the vital aspect of electrically connecting installations to shore. According to energy consultancy Senergy, a shortage of cable laying vessels is looming: Giles Thomson said, “it takes two to three years to build a cable laying ship. We should be starting to construct several of them now.”

Andrew Hunt, a principal engineer with Soil Machine Dynamics Ltd, outlined the use of subsea cable ploughs for digging sea bed trenches in which to bury interconnecting cables. He also mentioned a ‘rock ripping’ trencher, towed by a seabed tractor.

In offshore wind farms, cable connections are currently one of the most significant risk areas, accounting for some of the largest insurance claims. There was concern to learn the lessons and improve matters in the marine renewables sector. Gabriel Greve, CEO of Global Marine Systems, spoke of how his company's expertise installing sub-sea cables, having done this for a number of wind farms including Horns Rev and, currently, London Array.

New life for ports

Neil Kermode, managing director of EMEC emphasised the need for suitable ports to act as bases for fleets of survey, installation and crew transport vessels, as well as waterside manufacturing and assembly facilities in some cases.

“What do we need to make it [wind and tidal power] all happen?” he asked rhetorically. “We have the devices, and many of the industrial ‘first movers' are here [at the conference] today. We also have development sites [including EMEC]. There is some good policy in place, and acceptance for water-based renewables is growing. Overall, it's a good start, but in order to seize the ‘golden goose’, more money is needed. We need it to provide tools for deploying this technology; for example, the ports and waterside facilities that are necessary for implementing converters on an industrial scale.”

This could be an opportunity for ports where traditional activities have been in decline. Martin Boyers from the Port of Grimsby trumpeted his port's advantages for offshore renewable energy providers. These include deep water access, ability to handle craft up to 20 metres long, waterside space for device assembly, and proximity to a large arc of existing wind farms – such as Dowsing and Dogger Bank.

Significant infrastructure development had already taken place, he explained, adding, “five years ago, our port was all about fish. By the end of this year it will be 50:50 fishing and renewables. Wind farms seem to be the 21 century gold rush. All sorts of interests are trying to get in, but [in-port] water space will be a big issue.”

And he argued that a rational ports development policy is needed: “we don't want all the business to go to [ports like] Cherbourg, Hamburg, and Bremen, where large investments have already been made. We can't make that level of investment ourselves.”

| After the trials and tribulations of installation, SeaGen [has been] successfully commissioned and is now delivering ‘loads of power’, according to Martin Wright. He reports that some 5 MWh per tide is produced and the machine is often at full output. |

And the fact that Siemens, Centrica and EON all have operation and maintenance bases at the port of Grimsby indicates a degree of success for the city to date.

Challenge

John Armstrong of the TidalStream Partnership highlighted the maintenance challenge. He speculated that offshore devices would, like wind turbines, need an average of two tower visits per year for maintenance – possibly more in the case of tidal turbines. Many of these installations would be in waters more than 40 m deep, where large waves can form readily in strong winds, reducing the times when access would be possible.

A way to address this difficulty is, Armstrong proposed, to mount multiple devices on a submersible platform that would rest on the sea bed. This would permit not only rapid float-out and installation of devices, but also equally rapid recovery, enabling units to be taken ashore for maintenance and overhaul.

His company has tested a one twenty third-scale model of a 1200 t submersible structure dubbed the Triton platform. This would have mounted to it between two and six tidal turbines. There are hopes, he reported, of placing a full-scale version at EMEC.

Doug Huntington, systems sales manager for MacArtney UK, dealt with the wide variety of electrical and instrumentation components his company can provide, ranging from telemetry to multiplexers, and from terminations to Wet Mate connectors.

Transferable skills

Skills developed in the North Sea oil and gas sector are now available to renewables exploiters, too as Senergy's Giles Thomson pointed out.

This company specialises in securing large structures to the sea bed and has expertise in foundation solutions, tethers etc. Meanwhile, Mojo Maritime of Falmouth has its sights set on turnkey installations, and plans to supplement its own landing craft type vessel with assets chartered on a job-by-job basis. Its principal staff have discovered over the last decade that their expertise, originally honed in the oil and gas sector, is readily transferable to offshore renewables, having engaged in installation planning, mooring design, and other activities.

Expertise is also transferable from the aviation industry, believes Angus Fleming of Aviation Enterprises. He pointed out that with machines being developed for service lives of 20-25 years, material and structural fatigue would become a major issue and a cause of future unscheduled maintenance. Given that, as was suggested, ‘wind and tidal devices are inherently fatigued machines’, fatigue would become a powerful enemy. Aviation is well versed in fatigue mitigation and Aviation Enterprises believes it can usefully apply some of that expertise to marine renewables. For instance, Fleming asserted, more testing should be done than at present, embracing everything from material coupon testing to static and dynamic evaluation of complete structures.

Composite materials will also have a part to play in addressing this issue, as they have in aircraft. An interesting snippet from Fleming was that, anecdotally, properties of carbon fibre composite actually improve with age when immersed in water.

Prospects

Alan Banks, CEOof EnviroBusiness, was expansive about wave and tidal prospects in the UK, saying that the country has 45% of Europe's total wind and tidal resource. He spoke of the ‘fantastic opportunity’ the UK has to build a US$1 trillion industry based on exploiting these resources, at the same time displacing the use of some 1bn barrels of oil per year.

This would, he asserted, require Government seed funding since investing in non-proven technologies offering 20-year pay-backs was not something private capitalists were interested in. Partnering with large companies would, he said, be one way to address the shortage of venture capital.

| “We need to get down to about £3m per installed megawatt to be competitive,” |

| - McAdam, Aquamarine. |

It was also pointed out that the emerging wave and tidal sector would have to compete with offshore wind for resources. He cautioned all concerned to avoid the danger, when seeking funding, of over-promising and subsequently under delivering, a sequence that deters future investment.

Duncan MacKay, project manager, wave and tidal for Crown Estate, owner of much of the sea bed around the UK, told delegates that Crown Estate wants to foster the wave and tidal industry and has targeted 10 demonstration projects, totalling 1.2 GW capacity, to be in place by 2020. Anyone, he stressed, can apply for demonstration leases. He agreed with other speakers that grid expansion would be essential, and cited the need for an extension to the Pentland Firth, based on 132 kV lines.

| While it is true that sources of public sector funding to the industry are flowing […] the same is not true of venture capital, [which is] tighter than a couple of years ago. |

Dr Alan Owen, a reader in renewable energy and clean technology at Robert Gordon University (RGU), and director of the Centre for Understanding Sustainable Practice, sounded a cautionary note warning of the danger of going too big too early.

“We have to gain experience with smaller devices first,” he opined. Intriguingly, he also suggested that moving from horizontal axis tidal turbines to vertical axis might offer significant advantages, particularly in terms of installation.

A conclusion from a final Q&A session was that, at this stage of marine renewables evolution, there is still plenty of scope for innovation. Use of concrete towers as support structures and floating assets out to their intended locations rather than carrying them on expensive ships were two innovations worth following up, it was suggested.

Summing up the day's proceedings, MCT's Martin Wright declared that the UK is a world leader in water renewables at present, but that it was vulnerable to competitors with higher funding and superior integrated policies. There is a need, he thought, to make more use of world-class facilities like NaREC and EMEC, and not to allow the work to be bled away to overseas competitors.

Vulnerability may also stem from crippling shortages of marine assets, a matter that other panelists concluded should be addressed with more strategic planning. For example, they thought, policy makers should be estimating how many foundation heavy-lift vessels, survey and installation vessels will be needed, and provisioning for them in advance. Otherwise, competition with other sectors – traditional ones like telecoms, plus oil and gas as well as offshore wind – will push up charter rates to prohibitive levels and make it difficult to achieve competitive energy costs.

Renewable Energy Focus, Volume 11, Issue 6, November-December 2010, Pages 48-53