As we find ourselves kicking off the New Year, we are faced with numerous questions regarding the future.

Who will be the next President of the United States?

Hhow will the challenges of the Eurozone financial system be solved?

Will 2012 be the year that the global economy convincingly declares itself officially on the mend?

For companies in the composites industry, questions pertaining to the future are of similar macro relevance, albeit a bit more technical in nature. As an advisor to companies in the advanced materials industry we have had the fortune of working with some very exciting companies to develop their targeted strategic growth plans. As such, we see a lot of opportunity on the horizon as well as several fundamental challenges that the advanced composites industry will face in the coming years.

The pull for technology

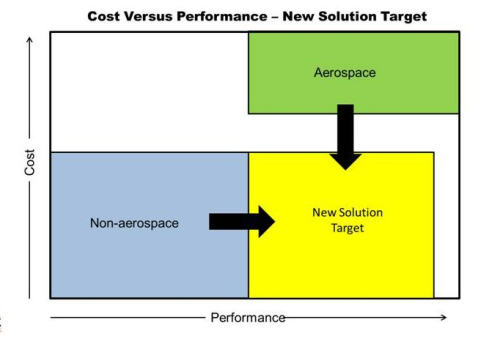

While composites offer an undeniably advantageous value proposition for numerous applications facing increasingly demanding performance requirements, there is a significant hurdle to adoption of any new technology. This has been less of a problem historically as the pull for material technology has come from the aerospace industry, which has very high performance requirements and typically carries a high material cost. However, it has created a bias towards application specific technology at almost any cost with very little focus on building a thriving broad-based business utilising composites technology.

Moving forward, we anticipate that the pull for technology will shift to more non-aerospace applications which also require high performance, but at a much more affordable cost. This will require greater focus on building a business case where cost is equally if not more important than technical performance alone.

In addition to being an extremely technology-rich industry, the composites space is also highly fragmented with literally hundreds of small companies all providing individual pieces of the overall value chain. In fact, there are only a select few industry players with the capability to provide comprehensive solutions which are applicable across broad market and technology sectors. Furthermore, even fewer of these companies currently have the financing to actually grow to a scale that will be meaningful for the industry.

The ability to achieve meaningful scale will be a key success factor to the industry as a whole as the applications and demands for composites expand and customers look to fewer suppliers to deliver more of a complete solution.

Opportunity

As is often the case, in every challenge lies opportunity – especially for those willing to seize it.

To facilitate technology and materials adoption, small companies will need to expand their ability to provide a complete solution to the customer and to help them quickly and easily navigate through the adoption cycle. Those companies that are able to provide an increasing portion of the overall value chain directly to their customer will be the best positioned moving forward and are subsequently likely to see the most amount of growth in their business.

Smaller companies need to be thinking about growing to a scale where they can be impactful and more importantly, survive. This may require external financing or investment, which can be an unnecessarily intimidating concept for smaller entrepreneur-backed companies.

Larger companies on the other hand need to be proactively seeking out acquisition or joint venture opportunities that offer scalable technology possibilities. This can be accomplished through partnerships, alliances or merger and aquisition (M&A) efforts aimed at securing a full tool kit of competencies and capabilities that enable the transition to a new material technology.

A great example of this strategy can be found in the recently announced joint venture between GM and Teijin that will allow for much wider adoption of carbon fibre material in automotive applications. The dramatically reduced manufacturing cycle time offered through Teijin’s newly established mass-production technology will translate into price affordability for GM – not to mention open up a huge market opportunity for carbon fibre reinforced plastic (CFRP) usage.

Companies with purely an aerospace focus will need to find avenues to access non-aerospace opportunities.

Conversely, companies primarily focused on more industrial applications will need access to higher performing material science and technology such as what is found in the aerospace sector. This can be accomplished through organic development over a long period of time for those who have the patience and appetite for execution risk. Alternatively, this strategy can be executed much more quickly through strategic M&A efforts focused on building the necessary competencies, skills, scale and market access required to proactively enable the adoption of composites outside of aerospace.

Otherwise, the industry will remain reactively waiting for the customer to tackle this technology adoption challenge. If this is going to be the case, we would expect the rate of composite adoption in non-aerospace to follow a slow and very conservative path as it has in aerospace over the last several decades. ♦

About the authors

Michael Del Pero is a seasoned investment banker with FocalPoint Partners LLC, Los Angeles, California, who works exclusively with advanced materials companies advising them on mergers, acquisitions, divestitures, capital raising, and strategic planning.

Steve Speak is the former president of Cytec’s global aerospace composites division. He currently acts as an industry consultant and also offers executive coaching services.

This article was published in the January/February 2012 issue of Reinforced Plastics magazine.To apply to receive your free copy of each issue of Reinforced Plastics magazine please complete the subscription form. (The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria.)