We find ourselves in that familiar time of the year when most corporations are in the process of rolling out their strategic plans for the coming year. As a trusted advisor to large and small companies alike, I have had the pleasure and good fortune of working with management teams and corporate planning executives of all shapes and sizes across a number of industry verticals. Speaking from firsthand experience, the only constant that can be observed from boardroom to boardroom is that no two corporate strategies are the same. In a world where the average lifespan for a corporate CFO ranges between 21 and 24 months, strategic planning is taking on an increasingly near-term definition.

| In a world where the average lifespan for a corporate CFO ranges between 21 and 24 months, strategic planning is taking on an increasingly near-term definition. |

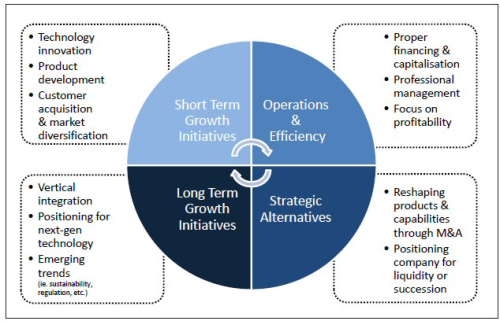

However, strategic planning is not a one, two, or even five-year project. Rather, true strategic planning involves a CEO and his executive team answering the fundamental questions of:

- Why do I exist?

- What market need do I fulfill?

- What solution does my company offer its customers?

- What type of company do we want to build?

- What is my end game and how am I going to get there? (we’ll come back to this one in a minute).

I recently moderated a panel of speakers addressing strategic planning for small and mid-sized companies in the aerospace and defence sector. The panel discussion was followed by a series of breakout sessions in which business owners, executives and consultants all discussed their views on strategic planning. I found that over-whelmingly technology insertion or programme procurement was mistaken for strategic planning. Given the multi-year nature of most contract and programme awards, companies in the aerospace sector are by nature forced to think long-term. However, long-term thinking should not be confused with strategic thinking.

| In the world of composites, we are seeing a fundamental and strategic shift in attention, focus and energy away from technology development and insertion toward scalable production. |

In the world of composites, we are seeing a fundamental and strategic shift in attention, focus and energy away from technology development and insertion toward scalable production. Given the nature of the industry, the advanced materials sector will always be inherently tech-rich. However, generally speaking there is less money and interest currently being allocated to new technology development and more emphasis placed on perfecting recently developed advancements and getting those into production.

We’ve seen this sort of ‘technology lull’ in the composites industry before as major new aerospace programmes transition from years of development to full production. Major commercial aircraft platforms like the 787 and A350 have shifted from development to production. Other key programmes in the business jet sector, as well as China’s COMAC and Bombardier’s single-aisle platform, are all moving in a similar direction. Even automotive composites activities are taking on a greater production emphasis (i.e. BMW), although there is still much work to be done on this front. On the less progressive front, key military programmes involving composites could be facing significant budgetary cuts due to un- resolved sequestration issues.

Given this evolution of the landscape, companies are being tasked perhaps now more than ever to adapt their strategic plans accordingly.

I’ve found that the most successful companies tend to take one of two strategic approaches in times like this. Some will look to launch a long-term investment in core or closely related products and technologies that will hopefully be mature and ready for insertion when the next big batch of opportunities comes along (typically five to ten years down the road).

| We see the next wave of investment being focused on technologies with lower system processing costs ... |

We see the next wave of investment being focused on technologies with lower system processing costs such as faster cycle times, non-autoclave curing techniques, lower cost tooling, and alternative forms of high-performance materials (i.e. long fibre thermoplastics and innovative woven forms like braids and uni-fabrics). These technologies are also the avenue that will open up non-aerospace markets to broader adoption of composite materials.

Sustainability and material recyclability will also be important strategic initiatives to consider.

Alternatively, we expect the most forward thinking companies to focus their strategic plans on acquiring new capabilities, new technologies, and avenues for new market success. Given the healthy amounts of cash still sitting on corporate balance sheets and the wave of acquisitions that have been announced over the last twelve months by industry heavyweights like Cytec (see Cytec completes $439m acquisition of Umeco) and TenCate (see TenCate acquires Amber Composites), we expect a strong level of acquisition activity in the coming year. The abundance of smaller technology-rich companies in an industry already ripe for consolidation should help fuel this fire. (See Mergers, acquisitions & joint ventures review – 2012.)

It is not to say that one of these strategies is more right (or wrong) than the other. In fact a balanced strategic plan should incorporate a healthy dose of all the above.

End game revisited

Defining a company’s end game is easily the least thoroughly considered element of most business plans I see. This is understandable as that end game may not ultimately be determined for many years to come and most companies are purely focused on serving the immediate needs of their customer or securing that next large order. And rightfully so – this is what keeps the lights on, payroll up to date, and hopefully keeps the company moving along a nice growth path.

However, the importance of defining a long term goal for the business simply cannot be understated. A small family owned or closely held business with intentions on staying just that will have a much different set of objectives than a company that is being built for strategic investment or acquisition.

Understanding the ultimate goal of your company will allow you the best chance to play an integral role in achieving that goal, whether you work in the corner office or on the factory floor. Whatever the future of your company may hold, it’s never too early to start planning for it and being an important part of it. ♦

Further information

Michael Del Pero is an investment banker with FocalPoint Partners LLC, Los Angeles, California, who works primarily with advanced materials companies advising them on mergers, acquisitions, divestitures, capital raising, and strategic planning; e-mail: mdelpero@focalpointllc.com; www.focalpointllc.com

A special thanks to industry consultant Steve Speak for his contribution to this article; e-mail: steve@stevespeak.com

This article was published in the March/April 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.