In the fast-paced North American market, homeowners, especially those with two breadwinners in the family, do not want to spend any time performing maintenance on their homes. Many homeowners are willing to spend extra money on products that assure them of little or no maintenance. In addition, the high cost of labour has made the contractor sensitive to service recalls within the warranty period on the home. Therefore, both groups have been seeking construction products that reduce their maintenance time and expense. This trend has created an opportunity for pultruded composites to showcase their inherent maintenance-free features in a number of high profile construction applications. Success in these high profile applications has spawned opportunities to replace wood, polyvinyl chloride (PVC) and aluminium in a variety of lower volume applications as well.

Pultruded profiles in window systems have earned a maintenance-free reputation over the last 20 years and are now recognised for superior performance in dimensional stability and thermal performance. Pultruded lineals are also finding a ‘home’ replacing wood in structural columns, railings and fencing. Recently, pultruded profiles have been incorporated by one of America's premier homebuilders in thousands of homes they build each year. Labour savings through parts consolidation and ease of installation ultimately reduce the cost of home construction when compared to construction of the home with wood.

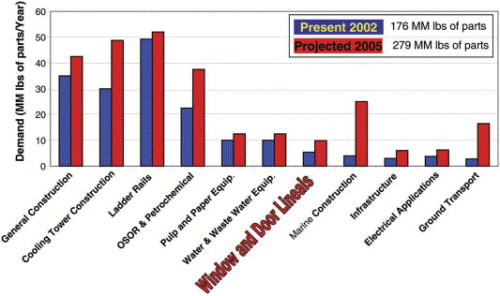

Market opportunities

Pultruded profiles have competed against traditional materials in virtually every market. If it were not for the ability of our materials and processes to provide corollary benefits, we would never prove our value in these marginal markets/applications and have the sales volumes we enjoy today.

These corollary benefits include:

- light-weight;

- high strength;

- dimensional stability;

- corrosion resistance/maintenance free;

- electrical insulation;

- parts consolidation; and

- thermal insulation.

In addition, we have to consider the inherent benefits of continuous long lengths and consistent strength/dimensional stability possible with the pultrusion process.

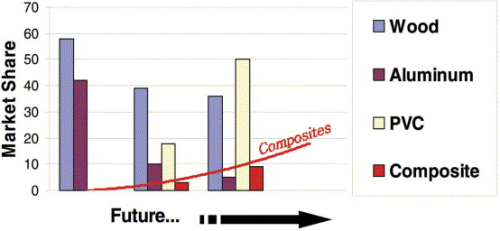

In the construction market we are typically competing with wood, aluminium, polyvinyl chloride (PVC), concrete and steel. While the focus is on competition with wood, we also see competition with PVC and aluminium, as these materials are typically extruded and therefore create a competitive target for pultrusions.

There are several markets where we now see active competition between pultruded fibreglass, wood, PVC and aluminium. These markets are:

- windows and doors;

- railings and fencing;

- pergolas and arbours;

- decorative structural columns;

- seawalls;

- heavy-duty planters;

- custom buildings; and

- residential construction.

The window and door market

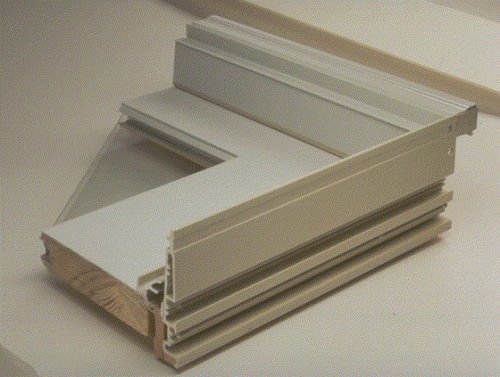

Window manufacturers use wood, aluminium, frost-broken aluminium, PVC, steel and composite materials to make framing, sashes, and door components. If wood is used it is typically as a solid lineal. Aluminium is used in thin walls because of its high cost versus wood. PVC entered the market in much the same way as aluminium since its cosmetics did not require painting as aluminium did. The strength of PVC, however, required reinforced walls and many wall stiffeners within its design. These complex shapes presented challenges for pultrusions. It was also a challenge to figure out how to assemble a fibreglass window.

The significant corollary benefit going for our industry is that the coefficient of thermal expansion for a fibreglass lineal matched that of the glass in the window. This made our windows perform better because neither air nor water ever penetrated an assembled fibre-glass window, giving it unsurpassed thermal performance versus wood, aluminium and PVC. Wood shrunk over time allowing air to penetrate. Aluminium expands linearly 2.5 times as much as fibreglass and PVC expands 8 times greater than does a fibreglass lineal. The dimensional stability of pultruded fibreglass qualified it as the performance material for premium windows.

One of the most significant composite successes has been in this window and door segment of the construction market. Fibre-glass lineals were introduced to this market in the early ‘80s. The total window and door market is over US$3 billion in sales volume annually. The penetration of fibreglass in windows was slow at best. Initially, manufacturers looked at pultrusions as a single component in a window rather than for the entire window. Andersen Windows was the first to use a profile in mass production with its Flexiframe® profile that formed the exterior of a fixed-frame window where wood was used for the interior structure and fibreglass for the exterior structure. This painted profile is still used today in very large quantities.

Window manufacturers gradually used more individual component profiles until one adopted an all-fibreglass window system. Interestingly, it was the wood window manu-facturers who initially adopted fibreglass pultrusions as the ‘next generation’ material.

Window producers are constantly seeking materials or designs that differentiate them from other window manufacturers. Today, most of the composite industry's opportunity is competing with wood as the material of choice for window producers, and most window producers consider fibreglass a quality material that must be considered when designing new systems.

The pultruder's challenges

It has not been easy for pultruders to penetrate the window market. There were serious manufacturing challenges to over-come first. The first was to manufacture thin-walled complex-shaped pultruded profiles at speeds that would allow fibreglass to compete with traditional materials in price and cosmetics. The specific challenges to overcome were to form fibreglass continuous strand mat at high speeds without mat wrinkles and with low scrap rates. The higher the processing speed, the lower the direct labour and manufacturing burden costs would be and the easier it would be for composite profiles to economically compete.

In earlier times it was not surprising for some pultruders to have scrap rates in excess of 10%. Many pultruders tried different technologies to permit high speed forming, yet many of these same pultruders gave up in the face of high processing and scrap costs in a market with generally low selling prices. Many found it easier to process conventional profiles that were not so complex than to compete in a market requiring very high production volumes at a generally low margin. You cannot lose money on every foot or metre and make it up on volume. The right forming technology also assured the pultruder of a uniform strength in his profile.

Another challenge required a fast cure cycle to permit an economical processing speed while giving the profile a cosmetic finish as close to PVC as possible. To do this, manufacturers had to balance the reactivity of the resin with an acceptable catalyst package and develop a temperature profile in each heating zone to get a fast cure and a quick release from the die. This quick release from the die contributes to a smooth cosmetic finish. In large male sections and in mandrels, many manufacturers found heat pipes in the die to be helpful in developing a fast processing speed with a uniform and complete cure that enhanced the chances of a good coating or paint job.

Painting or coating the profile is nearly always necessary for an acceptable composite weathering experience. Initially, pultruders outsourced the painting but the high cost of painting from an outside source, in a low margin product, impeded the pultruders' ability to competitively sell profiles. Some painted in urethane paints in spite of the environmental issues associated with them. Another manufacturer developed and patented a powder coating system although they never incorporated it into final production profiles. There are very few pultruders who have developed an in-house painting capability. Most use a water-based acrylic paint, which is environmentally friendly, with reasonable adhesion and weathering characteristics, while some of the window producers have elected to paint the lineals themselves. Over time, the window firms had to develop capabilities like painting and fabrication techniques to allow them to utilise this preferred lineal material having superior thermal performance.

Average annual growth rates

According to a 2004 Drucker market research study, aluminium window lineals are declining at a rate of 5% a year. Most industry professionals will acknowledge that the aluminium window will disappear in the next 5-10 years. Likewise, wood is declining by 3% per year. On the other hand, PVC continues to grow in usage, although now at a rate of only 2.5% per year where it had been growing in the past between 20-40% a year. Clearly, it has seen its heyday!

That same study says all composite materials are growing at a rate of 37% a year. They do not breakout fibreglass from the combined wood/thermoplastic composite materials, but it is clear that composites and fibreglass lineals have a place in the window market today. Unfortunately, most studies understate the use of fibreglass because fibreglass components are rarely counted. There are many manufacturers who use just a single fibreglass profile in a hybrid material window design. We may never have a clear idea of the volume but it is clear that the trend for fibreglass composites is up. Fibreglass will continue to compete with wood and frost-broken aluminium windows and this competition is in the top 15% of the window cost range.

There are many reasons why fibreglass profiles will continue to grow in market share in windows:

- the thermal performance of fibreglass windows allows more windows to be used in the average home while still meeting new federal and state government-mandated energy requirements;

- fibreglass is strong enough as a framing material to permit narrow frames allowing more viewing area in the window;

- the lower coefficient of thermal expansion limits air and water infiltration making the window more energy efficient;

- fibreglass windows have excellent condensation resistance;

- composite materials have excellent chemical resistance for harsh coastal environments and areas with acid rain;

- the maintenance-free painted surfaces on pultruded lineals extend the life of the cosmetic finish; and

- fibreglass windows have a lower projected life cycle cost compared to any other window material.

The shifting market forces behind pultruded composite material successes in windows are:

- fibreglass has earned a position of awareness and respect among architects, engineers and building owners;

- the window industry is increasingly recognising the superior performance of fibreglass components in window systems;

- fibreglass compliments the thermal performance of low-E glass;

- the entry of large wood window manu-facturers as pultruders lends credibility to fibreglass windows/components;

- window manufacturers have cut assembly time in half, making fibreglass windows more price competitive;

- more demanding federal and state energy codes dictate better performance in window systems favouring fibreglass as a material;

- window manufacturers and contractors seek to limit warranty claims; and

- fibreglass is seen as a new material and new materials are needed in the market to help differentiate various manufacturers' positions in the market.

The next growth opportunity

Pultruded fibreglass profiles are well on their way to achieving their deserved market share within the consumer window and door market. The area where we should see pultrusions focus in the future is in commercial construction. There have been some spotty efforts here but recently the US Department of Energy (DOE) has awarded funding to several manufacturers to develop a more energy-efficient commercial window system. The volumes involved here are large, but the challenge is to make a strong profile that is energy efficient and flame resistant. We can expect fibreglass profiles to enter this market on a mass scale in the very near future.

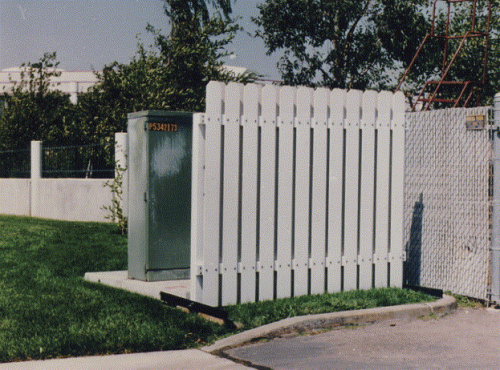

Railings and fencing

For years, wood and now PVC, have grabbed the majority of the market for railings and fencing. Wood because it was inexpensive and PVC because of its cosmetic appearance. However, PVC is not inexpensive and it does not answer all the needs of the end-user. To be really ‘structural’ in some environments PVC needs to be reinforced with steel, making it heavier and more expensive than PVC alone.

Fibreglass fencing enables the end-user to have longer spans versus PVC. This reduces the number of vertical posts and helps reduce the cost differential between fibreglass and PVC fencing. Fibreglass fencing has a more stable feeling versus PVC. PVC fencing and railings have what industry experts call a ‘slack rope syndrome.’ When you lean up against the PVC fence, especially in a hot environment, you do not get a stable resistance but a feeling like the railing is giving and will let go. This is why fibreglass fencing and railings are finding greater acceptance in today's market.

Builders claim to have fewer warranty issues with fibreglass and overall greater customer satisfaction with composite products.

Pergolas and arbours

The high strength, low weight and, when painted, the weatherability of composites, has enabled several landscaping product manufacturers to replace wood with composite pultrusions. One manufacturer of pergolas utilised a 5-inch square pultruded tubing to replace a wooden column, which had repeatedly deteriorated at the ground line. At the time, the manufacturer only used wood for the rafters to get the contemporary Far Eastern appearance his customers desired. Since painted wood weathers over time the wooden rafters will have to be repainted frequently.

Another manufacturer of arbours had a problem associated with large arbours. Many retailers of outdoor furniture wanted to showcase their furniture using an arbour. This required an arbour which had a clear span of 20 ft. Getting good wood that length was nearly impossible. When wood was available, it deflected under its own weight. This manufacturer elected to have the rafters, and the purlins above the rafters, made as thin walled pultrusions. The 1.75 inch by 7.5 inch rafters weigh just over 1 lb/ft (1.52 kg/m) while the purlins are 0.4 lb/ft (0.6 kg/m). The rafters deflect less than three sixteenths of an inch (about 4.5 mm) over the 20 ft span. Both profiles are only 2 mm thick and urethane castings then fit into each hollow end of the profile to give the ‘style’ look desired for the arbour.

The same gains that facilitated pultrusions to penetrate the window market – thin-walled profiles, high strength, a smooth cosmetic finish and good weathering paints – have helped pultrusions to enter this application area.

Decorative structural columns

Many architects and contractors have used wooden columns to support porticos, porches and other roof assemblies. Over time, the wood deteriorates and must be replaced. At least two US manufacturers have adopted pultruded fibreglass columns for this function. The inherent corrosion resistance of fibreglass makes it an ideal material for use in coastal areas. In addition, the fibreglass columns are more resilient than wood and can take more abuse without showing any damage.

These fibreglass columns are available in nominal 8, 10 and 12 inch square sizes. While some of these are simple squares with straight sides, newer versions incorporate a lineal design that makes the column look exactly like a handcrafted wooden column; the newest design even uses flutes. This has become a very large market for fibreglass. The recessed wood-look column weighs just under 5 lb/ft (7.41 kg/m). Even at 1 ft/min processing speed, this type of job is a pultruder's ‘dream.’

While the tooling cost for these large profiles is high and production requires a machine with a large envelope, this has become a large market opportunity for composites. Manufacturers of aluminium columns are also seeing pressure from fibreglass because they are not as susceptible to on-the-job damage and offer better corrosion resistance than aluminium. One US manufacturer has three different designs in two sizes. Production volumes on one of the sizes have already reached the point of requiring multiple cavity production.

Seawalls

Wood and steel materials have shared the market for seawalls over the years. Typically, the market using wood, used treated wood, but most of the chemicals previously used for treating have been found to be environmentally unfriendly. Steel rusts, creating replacement problems over the years. The problems with these two materials have opened the opportunity for PVC and fibreglass walls. Vinyl has entered this market but has strength issues.

These walls, sometimes in long lengths, need to be pounded into the lake or ocean floor. Pultruded composite walls have recently demonstrated their strength, corrosion resistance, and in long lengths, their ability to be installed under these conditions. The inherent corrosion resistance of composite materials makes them ideal for use, and dominance, in this application.

Commercial planters

A California company has begun selling a planter based on a pultrusion which is 9 inch by 9 inch (22.8 cm by 21.6 cm) in a ‘U’ shape and, like the decorative columns, it has detail that makes it appear to be made of wood. Fibreglass was selected for this application because of its strength in use. These planters have end caps, which allow the manufacturer to cap the ends of any length pultrusion.

Dimensions from 3 ft to 6 ft (90 cm to 1.8 m) are typical of sales in the residential markets, although the commercial market has taken lengths much longer. Many commercial planters are hung from the outside of buildings. Stainless steel hangers are anchored to the wall of a building. The planter has a lip at the top on each side, which the anchor fits neatly into. Using Tygon tubing to feed water to each planter takes the work out of watering each planter every day. While the planters weigh 3.3 lb/ft (around 4.95 kg/m), with dirt and plants in them, they can easily see 75 lb/ft (112 kg/m). For this reason, wood and PVC were not considered strong enough for the application. The strength of fibreglass was necessary to assure that the planters would not break at the hanger and fall on pedestrians. While landscape architects specify many of these planters, a number of consumer catalogues, including Smith & Hawken, have carried these planters for use in consumer gardens. New designs are emerging from this manufacturer that will enable even very large planters to be built on the same concept for more commercial uses.

North American pultruders of custom window lineals

OEM pultruders in North America

Trade names of fibreglass windows

|

Custom buildings

Pultrusions have been used for a number of custom buildings especially where electro-magnetic interference is critical. Both IBM and Apple Computer have test facility buildings made entirely from standard and custom shaped profiles.

When ‘Mother Nature’ delivers surprises like the Indonesian tsunami and the New Orleans Hurricane Katrina, temporary housing packages could be built from a series of profiles that would permit interim protection for families from the elements. Hospitals, kitchens and sleeping facilities could be fashioned from these profiles and broken down and stored for the next disaster after use. Governments need to look at the needs and the value of offering such facilities during these times of need. In the interim, custom buildings will continue to be built where the benefits of composite materials and the pultrusion process deliver benefits not available from traditional materials.

Residential construction

In a recent breakthrough, one of the largest manufacturers of residential homes, Pulte Home Sciences, has developed a series of profiles which allow a reduction in the time required to construct a single family house. The concept utilises the parts consolidation corollary benefit to allow one large profile to replace the function of three parts typically made from aluminium, PVC and wood, all traditionally installed separately. The gutter, soffit and fascia panel are pultruded and installed in one wide section replacing the three pieces/materials formerly used.

Pulte has patent pending on this concept and plans to use it in most of their US built homes. Pulte builds approximately 2% of all US homes. What makes this development most interesting is that the owner of the construction firm designed the profiles as pultrusions and found a pultruder to make the profiles. All this development was done without any help from the composites industry. While that may not sound like good news, it actually is most encouraging to know that we have become so well known as a material/processing system that someone took what they knew and charged ahead without us. When this happens it demon-strates that we are achieving a new degree of awareness within the markets. The size of this latest development will eventually become known, but it may not be too presumptuous to say that it may constitute the largest single opportunity in our industry, and it is happening in an industry that is extremely price sensitive.

Focus on value

Pultruded composite profiles have provided solutions in all these construction-oriented applications:

- window lineals, with their inherent thermal insulation, have superior dimensional stability in hot and cold environments allowing them to make the most energy efficient windows in the industry;

- composite railings and fencing offer strength (and stiffness) not possible with vinyl materials;

- pergolas and arbours take advantage of the strength of composite profiles to allow their rafters to span longer lengths than wood or vinyl, while offering corrosion resistance and now great cosmetics too;

- decorative/structural columns are strong, easily installed, maintenance free and very good looking;

- pultruded seawalls are strong and corrosion resistant;

- commercial planters are strong, light-weight, maintenance free and meet even the most demanding architect's idea of attractiveness;

- custom buildings of pultrusions take advantage of virtually all the composite and pultrusion process corollary benefits including electromagnetic transparency;

- the residential market, which many had written off as unobtainable, will soon find new pultruded applications opportunities which reduce labour costs, due to this application's parts consolidation benefit.

As an industry, we should forget about competing on price! Instead, we need to focus on value. Today we have many application successes based on value. The question shouldn't be how can we compete against traditional materials, but how can traditional materials compete with composite pultrusions? Our challenge, as pultruders, is to identify those markets/applications where our corollary benefits provide solutions not possible with traditional materials. Once we get our foot in the door, the benefits of our materials and processes will prove the value we all have to offer.

This feature is based on a presentation given at the Composites Europe 2005 conference in Barcelona, Spain, in October 2005, organised by NetComposites.