In the next 20 years, commercial air traffic is expected to double, along with the global fleet of 100+ seat passenger aircraft, which will increase to more than 30 000 planes. This prediction is made in the latest global market forecast from Airbus, the OEM based in Toulouse, France, that builds two models of next-generation commercial passenger aircraft: the A380 (maximum passenger seating at 853) and the A350 XWB (440 passenger max). Both planes reflect the evolution of composites onboard Airbus aircraft, at 25% by weight on the A380, escalated to 53% in the A350. Also weighing in at 50% composites by weight is US-based Airbus competitor, Boeing, with its 300-passenger, next-generation 787 Dreamliner.

Clearly the past is prologue for the success of composites on these aircraft in terms of at least 40 years of proven weight savings and fuel efficiency benefits from traditional glass and aramid reinforced polymers, hybridisation of glass (GRP) and carbon fibre reinforced plastics (CFRP), composites combined with metal alloys, and now in a greater proliferation of CFRP. Toray’s TORAYCA® prepreg is single sourced for 787 primary structures, while Hexcel prepreg is single sourced for A350 primary structures. On the A380, Toray and Toho Tenax carbon fibres are used in prepreg from both Hexcel and Cytec, along with thermoplastic composites from Toho Tenax and TenCate.

Safety, performance and cost savings have also been delivered through composite components on previous aircraft, sufficient to convince OEMs that advanced composites in next-gen aircraft will provide significant maintenance savings.

“Composites play a big part in reducing overall maintenance cost through the elimination of metallic fatigue and corrosion,” states Dr. Roland Thevenin, Senior Expert in Composite Structure Conformance for Airbus. “Airbus is counting on these benefits from CFRP components on the A350 enough so that the traditional ‘intermediate’ check at year six is eliminated. Further, the first ‘heavy’ or former D-check tasks can be extended out to the 12th year.”

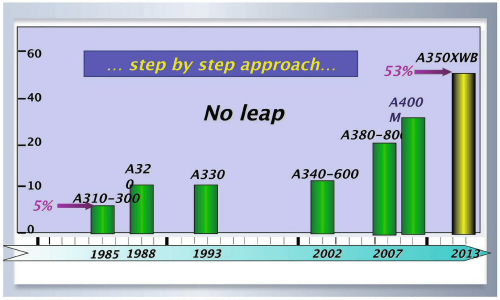

Thevenin cites the step-by-step approach taken by Airbus with composites, tracking from GRP fairings on the A300 in 1972 to 5% composites by weight on the A310-300, 10% on the A320 family, 11% on the A330/A340 family and on to the higher percentages already cited for the A380 and A350.

”Each step has resulted in the necessary knowledge to progress further,” he says. “With the A350, we have reached a good level of application, though we have not yet reached the maximum of what can be achieved with composites.”

For its 787, Boeing expects a 20-30% saving in maintenance costs. The OEM just delivered the first Dreamliner in September to launch customer All Nippon Airways (ANA). The 787 also features an extension of its first scheduled D-check at the 12-year mark. Further, Boeing believes maintenance costs after the 787’s design service objective (DSO), which typically increase as aircraft age, will remain fairly stable.

Finding and fixing damage

While next-gen aircraft may encounter less overall maintenance in composite components, effective repair methods must be in place when damage occurs. Certainly four decades of practical experience in composite repair by airline operators and maintenance, repair and overhaul (MRO) companies have established baseline methods to restore original safety and performance standards. However, the designs of new commercial aircraft will offer some unique changes that could affect the materials, tools, inspection equipment and training required to repair them.

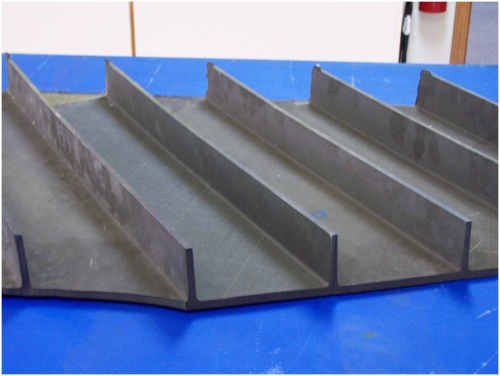

In particular, CFRP components in primary structure on the A380, A350 XWB and 787 are made with considerably thicker, monolithic laminate, estimated at up to 150 plies thick. Other design changes involve multiple parts integration into larger, single piece components with complex contours, and bonded spars/stiffeners that were previously mechanically fastened. Further, manufacturing methods for next-generation aircraft have changed, involving automated fibre placement and tape laying.

Thevenin verifies that laminate thicknesses in composite applications range from several mm up to 40 mm (1.57 inches) on the most highly loaded areas of the A380, though thicker laminate has been used in the A330/A340 vertical tailplane’s attachment fittings, at more than 70 mm (2.76 inches). He adds that “for monolithic structure, our step-by-step approach has been beneficial for airlines, since it has enabled them to introduce composites into their fleets in a gradual progression. Furthermore, the in-service experience of primary composite parts has validated the designs as well as the certification approach and maintenance concepts.”

This includes bolted repairs of metal or prepreg patches to thick, monolithic primary structure, as well as bonded repairs. Thevenin points out that “bolted repairs are in principle similar to what is required for metallic structures and are the only ones applicable for structural repairs to restore ultimate load capability.” Bonded repairs, he states, could be used for structural repairs only if they could fulfill the fail safe requirements of patch off/load limit capability. Currently, bonded repairs are only applicable to sandwich structure (skins over core).

“Whereas monolithic structures such as the horizontal and vertical tail planes have generally demonstrated good behaviour, sandwich structures have experienced issues such as water ingress, requiring remedial action,” he says. “Consequently, when Airbus came to design the A380 and subsequently the A350, we opted for the thicker monolithic laminate approach instead of sandwich construction, including the rudder and elevators.”

On the A380, new CFRP monolithic laminates are used in the entire rear fuselage, centre wing box, and select wing ribs, while the complete A350 fuselage encompasses large CFRP panels over a composite frame.

“The thicker laminate by design prevents water ingress and offers a tremendous advantage for robustness,” Thevenin states.

He adds that in-service experience by airlines over more than 150 million flight hours across all Airbus programmes has resulted in excellent feedback regarding the performance of composite monolithic structures.

“This experience has also allowed maintenance concepts to remain largely unchanged, with traditional ‘visual inspection’ and ultrasonic inspection techniques still fully applicable to assess damage.”

Certainly SR Technics is not new to handling and repairing composites or to Airbus and Boeing aircraft. The independent MRO based in Zurich, Switzerland, has 500 airline customers and currently services A310, A320 and A330/340 models, as well as Boeing 737s in its 350 000+ m2 of MRO facilities. The company is ready for composite repair to next-gen aircraft, according to Jurg Bislin, Vice President of Engineering and Planning.

“In principle, the repair techniques for laminate thicknesses of 100 or more plies remain anchored in methods already in use today,” he states. “Specific methods such as wet lay-up or hot bond prepreg patch repair must be chosen for each individual case.”

In terms of SR Technics’ composite shops, Bislin says: “We will be looking to develop specific jigs and tooling for future composite repair requirements. With our EASA 21J approval, we will also be developing new in-house on-wing and off-wing repairs, with engineering validation of all techniques. Another challenge will be identification of hidden damage, which is likely to be higher on composites than on metallic structures. So there is a need to ensure that necessary non-destructive testing (NDT) technologies are used in the most efficient way.”

In Greensboro, North Carolina, USA, TIMCO Aviation Services is in its 21st year of operation, with both FAA Part 145 and EASA 145 certification. The privately-owned MRO employs over 1000 mechanics working within its 1.5 million ft2 of facility space on 737, 757, 767, 777, A300, A310, A320, DC10, and KC10 aircraft. The company established TIMCO LineCare services in 2010 at 21 US locations to conduct overnight line checks, transit checks, cabin refurbishment and on-call services. Jim Dinwiddie, Business Planner, reflects on the company’s composites repair experience regarding expectations for next-gen aircraft.

“We anticipate larger and more involved repairs to be sanctioned on future aircraft fleet types because more surfaces will be composed of composite construction. Damage from ground handling could likely be a significant source for such problems down the road, making these repairs a critical necessity to maintain fleet availability.”

As a frame of reference for the time involved to repair composite sandwich structure compared to thicker monolithic components, Dinwiddie describes one of the large repair types currently conducted by TIMCO, involving damage to CFRP flight controls.

“Flight controls are made up of full length upper and lower panels, and the skin thickness ranges from three plies in the bay areas to as many as 10 or more at the panel’s edge (or about 0.030 to 0.100 inch in thickness). Extensive damage requires the skin panel to be completely removed to gain access to the inner surface. The cure method is dictated by the size of the damage. Smaller areas of damage are cured using heat blankets, while larger areas of damage require special tooling and cure in an autoclave. Care must be taken during the disassembly of these panels not to cause additional damage at the numerous fastener locations and at the trailing edge where the panels are joined or sealed together. Repairs of this nature average 250 man hours to complete.”

Inspection and training

At the airlines and MROs, adequate composite-specific training of technicians who will gets hands on in conducting repairs is crucial. Inspectors must also be trained to recognise the particular reactions of composites to impact, which is much different than for metallic aircraft. Even refuellers and baggage handlers can help keep extra and informed ‘eyes on’ composites-intensive aircraft by reporting any impact incident, whether visual damage is obvious or not.

Abaris Training, Reno, Nevada, USA, works with major OEMs and trains some 1000 mechanics, technicians, engineers and managers annually in the chemistry and material science of composites and to conduct and inspect repairs.

“Integrated structures present a greater challenge than conventional fastened structures,” Lou Dorworth, Division Manager of Direct Service for Abaris, explains. “The good news is that they are inherently more robust and less susceptible to damage. However, the fact that the pressure vessels on next-gen aircraft are made through automated fibre placement changes the approach to repair. Structures like these will require a certain level of advanced, composite-specific repair design and analysis to be done in concert with NDI and prior to damage removal performed by the mechanic.”

Different repair approaches are being examined. Dorworth identifies one as “use of multi-angle or parabolic scarfing to reduce the amount of good structure removed in preparation for repair of thick monolithic structures. For CFRP inner blade stiffeners, bonded or bolted metallic or composite doublers may be used in lieu of scarf repairs.” Abaris is working closely with aircraft and repair equipment OEMs to develop new materials, processes and process control systems for next-gen composite repairs. Dorworth says most are proprietary, but certain technologies, such as micro-wire thermal sensors used to read temperatures deep inside thick laminates, show promise.

Abaris leadership has long been involved in efforts to improve training for composites technicians, and Mike Hoke, company president, suggests additional training will be a plus to repair thick section CFRP components.

“Many of us believe some sort of certification of composite repair technicians is desirable because of the degree of detailed knowledge and technical hands on skills required to perform complete composite repairs to thick monolithic structures. While individual standards have been developed by various organisations, there are no widely accepted industry standards or technician certification programmes at this time.”

OEMs also view composite training as vitally important, as Airbus’ Thevenin verifies.

“For each aircraft, Airbus proposes the relevant training for composite repairs. This training is already in line with the FAA’s Advisory Circular 65-33, which provides guidelines for a formal training programme for composite maintenance technicians that includes theory and practice. The practice includes flush or protruding bolted repairs, and skin and core restoration within bonded repairs on sandwich structures.”

Great teams adapt

As with the lack of industry standards for composite training, so goes the dearth of repair materials standardisation, a fact known only too well by airline operators. Eric Chesmar is Principal Engineer of Composite Structures at the United Airlines Maintenance Base in San Francisco, California, USA.

“Composite repair has been and will continue to be an integral part of United’s aircraft maintenance programme. Adapting to technology on new aircraft models, whether in composites, avionics or engines, is a part of our business as we retire older fleets and replace them with newer models. As with the introduction of any new fleet type, training and education are instrumental for success.”

Chesmar expects only a small increase in composite repair with early introduction of new aircraft, and notes that Boeing has addressed issues of thicker laminate with extra steps in its hotbond prepreg repair techniques and training.

United has invested in some additional tooling for the 787, but Ron Torres, Managing Director of Component Maintenance and a 30-year veteran with United Airlines, identifies the best tool available as the airline’s experienced and resourceful shop technicians and engineers.

“They work together in a spirit of continuous improvement, having developed innovative solutions such as computer-based tracking of repair material shelf life, out time, and roll quantity. This helps us control on-hand material and more accurately forecast future orders for prepregs and film adhesives.”

The team also developed special tooling and procedures in a dedicated work cell for sandwich constructed fan cowls (CFRP skins over aluminium core), which improved repair effectiveness on over 50 units/annually, right down to salvaging latches.

“United’s composite repair professionals demonstrate every day as they face many challenges that there is no substitute for a great team,” Torres says.

Speaking of tooling, the largest European airline group, Air France-KLM, houses its share in maintenance hubs in Paris and Amsterdam. Michel Bruet, Vice President of Aerostructures AFI, makes this statement:

“At Air France Industries-KLM Engineering and Maintenance (AFI-KLM E&M), we have the advantage of being both a global airline and maintenance provider with proven past and present experience in the durability and reliability of composite structure in service. This helps us make choices between adapting and modernising our present industrial tools or investing in cutting-edge new tools.”

He suggests that adaptations for repair of next-generation aircraft composite components will involve not just tooling and equipment, but also managing the economics of material cost and the network to accommodate repair material availability – possibly through common sourcing among partners. AFI-KLM E&M already has operator customers for A380 aircraft and commercial contacts for future operators of the 787.

It would seem that adaptation is an essential ingredient in bringing positive progress from past experience. Leonard Kazmerski, TIMCO’s Vice President of Marketing and Business Development, sees this trend in the design and maintenance of next-generation composites aircraft.

“There will certainly be an adjustment process for MRO companies as they are increasingly called upon to make more complex composite repairs,” he says. “Some of the larger elements for composite repairs that are undertaken today should be usable in the new environment, such as large curing ovens and autoclaves. This is not unlike adjustments the industry has made in the past to advances like the all-glass cockpit and fly-by-wire technology. The aerospace industry is an adaptive one, and will likely once again adjust to accommodate this significant change in aircraft composition and its accompanying maintenance support requirements.” ♦

This article was published in the November/December 2011 issue of Reinforced Plastics magazine. To apply to receive your free copy of each issue of Reinforced Plastics please complete the subscription form.