The world economy, which was at high tide until early 2007 and experiencing synchronised global expansion, suffered a financial shock in August of that year as the US economy derailed. This has spread rapidly and unpredictably to inflict extensive damage on markets and institutions at the core of the financial system. In its latest economic forecast, the International Monetary Fund (IMF) predicts that world economic growth will slow to 3.7% in 2008 and 2009, down from 4.9% in 2007.

The Middle East (or West Asia) is located where Africa, Asia and Europe meet. The Gulf Co-operation Council (GCC) bloc, comprising Saudi Arabia, United Arab Emirates (UAE), Kuwait, Oman, Qatar and Bahrain, occupies a relatively small geographic area of 3.5 million km2 but boasts of the world's richest energy reserves. UAE is a federation of seven states that include Dubai, Sharjah and Abu Dhabi. The countries of the bloc possess 48% of the world's oil reserves and 20% of worldwide natural gas reserves. Their combined oil production and exports are equivalent to around 25% of the global output.

Despite the political turmoil in the region, the Middle East was one of the fastest growing regions in the world in 2007, after China and India. This was achieved through a combination of high oil prices, low interest rates, ample liquidity in the banking system and expansionary government budgets, which were the key driving forces for the region's stellar average economic growth of around 5.8% in 2007, compared to a world average of 4.9%. High oil prices are supporting increased government spending on infrastructure and social projects, and strong expansion of credit to the private sector. Growth is projected to rise over 6% and remain robust in both 2008 and 2009.

On a high

The GCC reportedly earned close to US$400 billion from oil exports in 2007. Cumulative earnings are expected to exceed several trillion if oil prices continue to hover round the $100 mark.

Construction and the Middle East have become synonymous in recent years, with the region claiming the top spot for the world's tallest structure (the Burj Dubai tower is reported to be over 700 m high). With over US$1 trillion worth of projects currently underway in the GCC and another $150 billion in the pipeline, the region's construction sector is at an all-time high. Saudi Arabia, UAE, Kuwait, Qatar and Bahrain are presently in the midst of a construction frenzy and there are also several major infrastructure projects on the cards. The construction industry plays a substantial role in the UAE's economy, accounting for almost 20% of its GDP.

As a result of the major infrastructure and property developments currently being undertaken in the region, there is a high demand for construction products and technologies. While traditional construction materials such as carbon steel, aluminium, concrete and timber still hold sway, glass fibre reinforced plastic (GRP) has been slowly, but surely, making greater inroads as an alternate, technically and commercially viable, material of construction.

Steel and aluminium

Steel is the mainstay of the modern construction industry because of its strength, durability and versatility. Steel production in the region equates to over 20 million tons a year, translating to about 1.4% of the total global output. The GCC steel industry's demand for iron ore pellets is expected to increase from the current 5 million tons to 24 million tons by 2012.

The GCC region is set to emerge as a major centre of aluminium production as a result of the availability of low cost power that constitutes more than 30% of the cost in aluminium production. According to a global report on aluminium industry status, the energy reserves in the region are so high that the GCC will remain competitive over the next decade, and this is why many smelters are being set up in Saudi Arabia, Oman and Qatar. The GCC global market share for aluminium is expected to rise from the current 5% to over 10% by 2010, and up to 18% by 2015.

Composites

Extensive investment in developing modern infrastructure in the Middle East in general, and the GCC region in particular, has meant that GRP is bound to play a bigger role in projects such as sewage networks, building structures and water storage and distribution systems. The corrosive climatic conditions prevailing in the region (high temperature and humidity levels coupled with high soil salinity) are one of the reasons making GRP more attractive than rival materials for pipes, tanks (buried and above-ground) and numerous building and industrial applications. GRP has been accepted as a versatile, viable alternate material of construction in view of its advantages such as high strength, light weight, resistance to corrosion and reduced maintenance.

Geographically, the Middle East (and especially the GCC) is strategically positioned to be a hub for import of glass fibres from Europe, the Far East and South Asia. It is a virtual supermarket as far as imported glass fibre availability in the region is concerned. The suspension of glass melting and fibre forming operations by the sole glass fibre producer Fibertech (in Saudi Arabia) in the region in late 2006 caused a vacuum, albeit temporarily, which was quickly filled by a host of alternate suppliers, especially from China, India and Europe. The availability of natural gas and electricity at competitive prices in the GCC and the growing usage of GRP have encouraged some enterprising investors to venture into the manufacture of glass fibre in Bahrain and Saudi Arabia. The Bahrain plant (which is a joint venture between Chinese company CPIC and local partners) is slated to go on stream later this year with the commissioning of the first phase of 30 000 tons. Another company, Glass Fiber Technology Co Ltd, announced commissioning of a conversion plant for glass fibres at Rabigh Industrial City (close to King Abdullah Economic City) in Saudi Arabia earlier this year to meet the growing demand in the Kingdom. The company's website lists a basket of products – chopped strand mat, direct (single end) roving, spray-up roving, woven roving and woven tape. It reportedly sources the glass fibres for the above products from the Far East.

Unsaturated polyester resin continues to be the workhorse matrix for the GRP industry in the region. Several global manufacturers, including Scott Bader and Reichhold, have established unsaturated polyester resin and gel-coat production facilities in the UAE (in excess of 35 000 tons), and the region's requirement is supplemented by imports from South Asia, Singapore, Malaysia and the Far East.

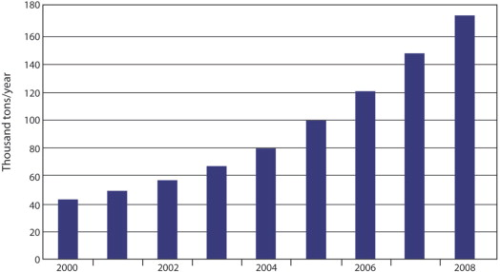

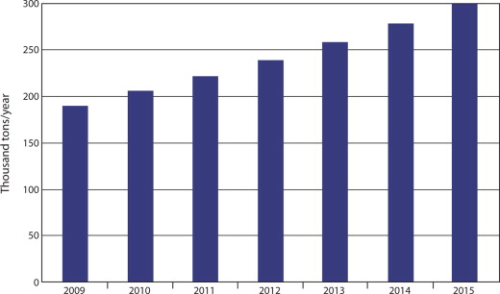

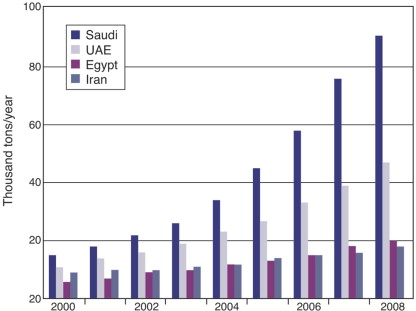

The current annual demand for glass fibre reinforcements in the Middle East (including the GCC, Egypt, Iran, Jordan, Syria and Lebanon, but excluding Turkey, which is generally considered as part of Europe) is around 176 000 tons. The demand in Jordan, Syria and Lebanon is insignificant compared to the other countries in the region.

Historical growth of glass fibre demand in the Middle East and future projections clearly show that demand is growing at a rate almost double the current global industry growth of 4-5%, which is in tune with the growth trend of composites in the principal emerging economies.

Wide range of applications

Pipes for sewage and potable water transportation and offshore applications in the oil and gas sector continue to be the single largest growth driver for GRP and account for close to 70% of all GRP usage in the region.

The next principal market segment for GRP is the building/construction sector. A myriad of applications include sanitaryware products, indoor swimming pools, canopies, awnings, domelights, minarets, skylights for buildings, patio covers, lighting poles and doors, as well as handrails, walkways, gratings, ladders, storage tanks and scrubbers for refineries, desalination plants and chemical industries. The automotive and marine sectors are a close third, although the majority of GRP yacht production is earmarked for the export market. GRP bodies for coaches and trucks constitute a small segment of the market.

Prepregs

Prepregs are now produced in the GCC and they are based on vinyl ester resin. Gulf Composite Materials produces vinyl ester prepregs under an exclusive arrangement with Simex, Canada, the original pioneer. The vinyl ester prepregs use glass, carbon or aramid as reinforcements and are claimed to combine the excellent thermal and mechanical properties of epoxy prepregs with the ease of processing and fast cure properties of unsaturated polyesters. Typical resin content of the prepregs is 36-40% by weight. The reinforcement fabrics come in a variety of styles – plain, crowfoot, satin and 4×4 basket weave. The prepregs are used in a variety of applications, including sporting goods, chemical process equipment, medical and protection equipment.

SMC water tanks

A common sight in the Middle East (chiefly the GCC) is the extensive use of GRP water storage tanks for residential and industrial use. While the practice is to make such tanks (cylindrical or spherical) by the traditional contact moulding technique, innovations over the years have resulted in the tanks being made by cold press moulding (giving a smooth finish on both sides). Gulf Polymers LLC in the UAE manufactures water tanks constructed using panels made from sheet moulding compound (SMC) which have been approved by municipalities in the UAE for storing potable water and meeting health and hygiene requirements. The panel thickness ranges from 6-8 mm with a 12 mm flange. Stainless steel hinges and bolts are used for joining the modular panels with the option of hot dip galvanised steel structures for mounting the panels. There are other companies also that make the sectional GRP water tanks by cold press moulding.

Pipes

GRP pipes and tanks (buried and above-ground) continue to be the single largest application of polymer composites in the Middle East. In view of GRP's inherent resistance to corrosion in the region's saline soil conditions, GRP has become the material of choice. GRP pipes systems are used in a variety of applications, including water distribution and transmission lines, in sewer systems, drainage, irrigation and firefighting, power generation plants, desalination and petrochemical plants, oil and gas exploration, and the chemical industries. Underground gasoline storage tanks are another major application in the region.

While GRP pipes based on unsaturated polyester resin are most commonly used, glass reinforced epoxy pipes are preferred in the oil and gas industries in the region and have great potential in the near future. The pipes offer the perfect solution to problems of internal and external corrosion (associated with metallic pipes), as well as being virtually maintenance-free, lightweight and easy to install.

Amiantit Group (the global leader in GRP pipes) has facilities for producing GRP and reinforced epoxy pipes at multiple locations in the region. Designed for a service life of 20 years, the reinforced epoxy pipes are suitable for above-ground, underground and submerged applications. Pre-fabricated spools are specially assembled for combinations of pipes and fittings that allow for in-plant hydro-testing prior to delivery at site. The reduction in the number of field joints results in faster assembly time and lower installation costs – unlike similar steel/metallic spool configurations that require jointing to be done at site – thereby increasing installation costs. Another advantage over metal is that smaller diameter pipes can be used, thereby reducing energy costs for pumping. This is because the pipes have a smooth interior surface that offers less resistance to flow and consequently, higher flow capacity. Furthermore, reinforced epoxy pipes do not collect stray ground currents that can corrode pumps, valves and other equipment connected to the system. Steel pipes require a protective coating and lining (in view of lower corrosion resistance) and cathodic protection of the pipeline is required to monitor and retard corrosion. This adds to cost with little guarantee that corrosion will not occur in the pipeline.

The other leading producer of GRP and reinforced epoxy pipes in the region is Future Pipe Industries Ltd (FPIL) with manufacturing plants in UAE, Saudi Arabia, Qatar, Lebanon, Egypt and Oman. There are a host of other (smaller) GRP pipe manufacturers spread across the region.

Elsewhere in the region …

Iran has gone about promoting GRP in a systematic manner. The GRP industry has been growing at an average rate of 8% a year since 1999-2000. The installed capacity for unsaturated polyester resin is around 45 000 tonnes/annum. There is no local production of glass fibre in the country. The chemical sector accounts for about 45% of GRP usage, followed by marine (30%) and building/recreation (25%). Contact moulding, SMC/BMC and filament winding are the popular processing techniques. The manner in which the country is promoting GRP, through the formation of the Iran Composites Association, is worthy of mention. The Third International Composites Exhibition was successfully held in Tehran in February 2008. The focus continues to be on the building/construction, chemical, and oil and gas sectors.

Egypt is another country in the Middle East whose economy has been doing well in recent years. The country's GDP grew at 7% in 2007. Strong local economic growth has boosted liquidity in the Egyptian economy which benefited from Western institutions shifting their focus to emerging markets with strong economies and good earnings visibility. The government is encouraging setting up of manufacturing industries. The GRP market has always had a strong base since 1990 with a proliferation of pipe manufacturers and this trend continues. Pipe manufacture accounts for 70% of the Egyptian GRP market. The non-pipe GRP market comprises of marine, infrastructure and automotive applications.

The real jewel in the crown is Abu Dhabi, capital of the UAE. It is pouring hundreds of billions of dollars into infrastructure, industry and real estate and now rivals Dubai in projects of scale and vision. The recently established Abu Dhabi Polymers Park (ADPP) is aimed at developing a world class plastics conversion cluster for businesses spanning the plastics (including GRP) value chain. This has been set up with the view that between 2009 and 2012, more than 15 million tons of plastics raw materials will come on stream in the GCC region, representing half of the global planned capacity increase.

Building & construction

While GRP pipes will continue to be the staple application into the next decade, it is the building and construction sector which holds enormous prospects enumerated below.

Folded plate structures

GRP readily lends itself to the folded plate structure design that is so common in building applications. All recent developments in GRP structures are curvilinear and are typical examples of stressed skin construction, in which the skin not only forms the enclosure but also substantially contributes towards carrying the external loads. GRP domelights are a classic example of successful use of translucent sheets, fabricated in flat or corrugated form, for use in industrial, commercial or public utility buildings. GRP is particularly suited for this application because the structure can be self-supporting and can be designed so that it can be supported on the roof without the aid of supporting framework. Arabian Profile Company Ltd (APCL), Sharjah, has moulded a number of exquisite designs of GRP domelights installed in different parts of GCC. Some of the GCC's landmark buildings, such as Burj Al Arab, Jumeirah Beach Hotel, Dubai Autodrome, Sharjah Cultural Square and Dubai Mall, bear APCL's unmistakable stamp of workmanship.

The folded plate system in which the stress acts in the plane of the structure is the most popular form used with GRP and can be sub-divided into prismatic, pyramidal, prismoidal and shell structures. Capacity to carry out design of such geometrical structures in GRP, using sophisticated software that simulates load conditions, is already in place in the region, thus enabling designers to translate their ideas into a commercial reality that blends artistically with the region's culture.

The current trend to use GRP for cladding other structural materials, or as an integral part of either a structural or non-loading wall panel, will continue in the foreseeable future as well, as this is an ideal way to meet aesthetic and structural requirements especially in high rise buildings. Flat GRP sheets with motifs can be used for cladding concrete structures. The advantages of GRP are the ease of fabricating large panels to minimise joints, and the infinite range of coloured and textured surfaces. Fixing devices and joints accommodate the movement caused by the differential thermal expansion between GRP and other materials such as concrete and metal.

Structural profiles

While the region was a regular importer of pultruded profiles until 2005, the advent of Saudi Pultrusion Industry (SPI) with a manufacturing facility in Al Khobar, Saudi Arabia, in 2006 set the trend for extensive use of GRP profiles in a wide array of industrial applications in the oil and gas sector (including refineries, desalination and chemical plants) hitherto considered the domain of steel and aluminium. SPI manufactures the GRP profiles under technical license from Exel (formerly Pacific Composites), Australia. SPI has a strategic alliance with Zamil Ladders in Saudi Arabia for GRP ladders.

GRP profiles, besides being much lighter than those of steel and aluminium, and virtually maintenance-free, also have significantly better properties in flexure and tension, and are inherent thermal and electrical insulators. Steel profiles require periodic painting/welding/replacement due to oxidation and corrosion; aluminium profiles are prone to galvanic corrosion by chemicals, and conduct heat and electricity, resulting in handling problems and requiring grounding. GRP walkways, handrails, gratings, ladders etc can all be produced on site from an assembly of the appropriate base profiles. Installation costs in GRP are significantly reduced in view of ease of handling, low weight and lower transportation costs. GRP bolts and nuts are far less expensive than their stainless steel counterparts.

The coming years will witness extensive usage of GRP structurals by Saudi ARAMCO (Arabian American Oil Company), SABIC (Saudi Basic Industries Corporation), SWCC (Saline Water Conversion Corporation), SAFCO (Saudi Arabian Fertilizer Company), and other chemical industries in the Kingdom dealing with manufacture and/or handling of corrosive materials. All these companies have successfully used GRP structural profiles, which has prompted SPI to consider expanding its capacity from the existing level of 1000 tons a year.

Pultron, a leading manufacturer of pultruded profiles in New Zealand, has a presence in Jebel Ali Trade Free Zone in Dubai. Pultron's speciality has been GRP re-bars for concrete reinforcement, apart from traditional products such as ladders, handrails, walkways etc.

The exponential increase in use of GRP structural profiles in the region is a certainty, due to local availability and distinct advantages compared to traditional rivals such as carbon steel and aluminium.

Concrete re-bar

With the advanced nations in the West having successfully commercialised the use of GRP concrete re-bars (in lieu of steel) after extensive testing spanning more than a decade, this is one application that should prove very successful in the Middle East in the coming years. Pultruded GRP re-bars (in shapes matching traditional steel) provide excellent corrosion resistance (and hence longer life) in conjunction with special grades of epoxy and vinyl ester resins exclusively developed for this application. They also display excellent mechanical properties when subjected to axial, torsional and bending loads. The American Concrete Institute (ACI) and other groups such as Japan Society for Civil Engineers have been instrumental in developing specifications and test procedures for GRP re-bars, many of which are well accepted globally today in concrete construction. Test methods are outlined in ACI 440.3R-04. ACI 440.1R-03 is the accepted industry guide for Design and Construction of Concrete Reinforced with GRP Re-bars.

There is bound to be an increase in the collaborative effort between the Middle East region and the US/Europe in furthering the knowledge and experience of the West and repeating its success in the use of GRP for this application, thereby putting it in the ‘fast forward' mode. This is another exciting GRP application that is poised to take off in the region, albeit with a touch of cautious optimism in the initial years.

Material of construction

As a result of the major infrastructure and property developments currently being undertaken in the Middle East region, demand for all materials of construction (including GRP) is bound to register unprecedented growth in the coming years. There have been several steep increases in prices of steel and aluminium since early 2008, and steel is currently in short supply. GRP pipes and tanks will continue to maintain strong growth as in the past.

GRP is fast emerging as the ‘material of choice' in the region due to availability of key raw materials, significant narrowing of the price gap between steel and GRP, emergence of local processors offering structural profiles, and flair amongst designers/engineers in exploiting GRP's unique geometrical shapes through advanced Finite Element Analysis (FEA) and architectural innovations. The resultant synergy portends an extremely bright future for GRP as a commercially viable alternate material of construction in the region in the foreseeable future.