At this moment in time – when it is economically more difficult to purchase a new car or truck and critical to produce them with optimum fuel efficiency – the pedal’s literally to the metal (and every other material selected) to deliver a whole bogie of complex vehicle performance benefits. Not the least of which is the latest US corporate average fuel efficiency (or CAFÉ) target of 54.5 mph in cars and light duty trucks by model year 2025. Getting there will likely involve drastic changes to vehicle design and manufacturing. Based on what fibre reinforced plastic (FRP) suppliers tell us here, composites appear to be more in the automotive materials mix than ever before, helping original equipment manufacturers (OEMs) meet this moment.

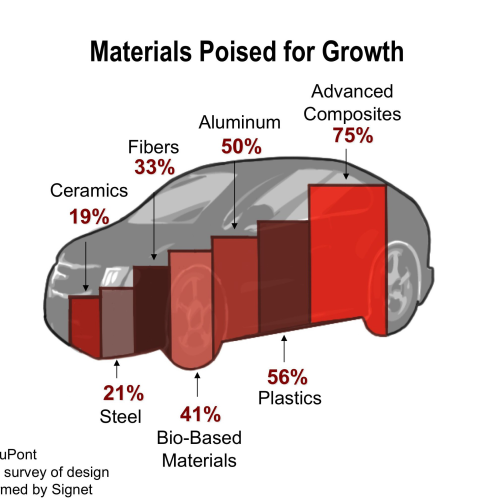

“The latest CAFÉ horizon will require quick and cost effective development of advanced materials, alternative propulsion systems and new technologies,” states Dr David Glasscock, Global Automotive Technology Director for DuPont, Wilmington, Delaware, USA.

“We believe lightweight composites can contribute to automotive solutions in many areas. The two most obvious involve helping downsize power-boosted engines, in the short term. And further, bringing double-digit weight reduction from chassis, structural applications and body exterior.”

DuPont launched more than 1700 new products last year and invested 22% of its US$1.7 billion R&D budget on reducing fossil fuels dependence, new chemistry and materials.

“In the current environment, the reduction of dependence on fossil fuels is challenging us all to rethink the function of every component and system,” Glasscock continues. “This is a defining moment, not just for materials, but for the automotive industry as a whole. It’s bigger than one material, one technology, or one part of the value chain. I believe we’re on a course toward considerable innovation and invention that further engages multiple materials and unique business teams who will collaborate globally.”

Certainly there’s been intense collaboration news in the past 36 months. Official joint ventures and other partnership arrangements announced between OEMs and FRP suppliers have included BMW with SGL Group, Daimler and Toray, Toyota with Toho Tenax, Audi with Voith GmbH, Evonik and CAMIMSA partners, and the formation of HIVOCOMP as part of the European Union’s Seventh Framework Programme.

Patrick Ferronato, DuPont Automotive’s Global Marketing Director, observes that “each component in today’s engines faces a different ‘chemical cocktail’ or load at temperature, and one material can’t do it all.”

DuPont’s newest family of resins designed specifically in composites as an alternative to metal includes five grades of Zytel PLUS polyamide (PA) and two of Zytel HTN 92 series polyphthalamide (PPA). All utilise DuPont’s SHIELD technology, involving an enhanced polymer backbone and special additives package to withstand hot oil, calcium chloride, and engine temperatures to 230°C.

Last October, General Motors adopted Zytel PLUS in a 35% glass-reinforced Cadillac engine cover within just 90 days of the resin’s commercialisation. The resin is also now being used in a reinforced exhaust gas recirculation system. DuPont’s testing of Zytel PLUS has demonstrated that the resins can double the lifetime of certain engine components as compared to standard, heat-stabilised polyamide.

The HTN 92 series PPAs deliver performance a step above non-aromatic polyamides, with 1000 hours of oven age testing at 230°C showing 200% higher strength properties compared to standard PPA resin and 20-25% greater than polyphenylene sulphide (PPS) resins. Component candidates include exhaust mufflers, oil and transmission pans, oil filter modules, rocker covers and other transmission parts.

Another family of Zytel HTN PPA resins is “electrically friendly” polymers that can withstand high voltage at temperatures, making them attractive for hybrid and electric vehicles. In China, DuPont is increasing its production capacity for Zytel HTN to 20 000 tonnes by 2013.

Pop the bonnet, shine up the SMC

For sheer volume in established FRP automotive parts, body panels and under bonnet components share this tally. Sheet moulding compound (SMC) and bulk moulding compound (BMC) materials with glass, mineral, nanocomposite and other fillers own the non-metallic body panels category, which includes Class A door and side panels, window surrounds, roofs, bonnet and boot covers, fenders and bumpers, spoilers, hard trim and other closeout panels. “SMC answers many needs: light weighting combined with green and sustainable products and ease of styling at total cost parity with metals,” states Jim Plaunt, sales representative for resin and compounds supplier AOC, Collierville, Tennessee, USA. “The SMC moulding process [compression, injection and injection-compression moulding] allows production rates that suit the automotive manufacturing arena.”

Mike Dettre, AOC Business Manager, notes that “in addition to the new CAFÉ standard, President Obama has subsequently announced the first-ever national policy to increase the fuel efficiency and decrease greenhouse gas (GHG) emissions associated with medium and heavy duty trucks, covering the 2014 to 2018 models. This involves a 20% reduction in heavy truck fuel consumption by 2018, a 15% reduction for heavy-duty pickups and vans, and a 10% reduction for vocational vehicles such as delivery trucks, buses, and garbage trucks.”

He also believes that “meeting these new regulations will undoubtedly require mass reduction in future vehicles. The superior strength-to-weight ratios of SMC/BMC, coupled with excellent surface quality, dimensional stability, corrosion resistance, and formulation flexibility to meet the most demanding vehicle performance requirements make these materials a logical choice.”

He points out that “there are many formulations already ‘on the shelf’ and available for implementation in a wide variety of components, including closure panels, structural members, underhood parts, fuel cells and battery trays, just to name a few.”

Bringing carbon fibre reinforcement to the SMC materials option will require collaboration with carbon fibre producers, according to both Dettre and Plaunt.

“Beyond the higher cost of carbon fibre,” Dettre points out, “the strand geometries currently available generally form a flat, dense mat of chopped fibre that is challenging to wet out with existing compaction units. Additionally, epoxy and some vinyl ester resins bond satisfactorily with carbon fibre but so far, more development is needed to couple carbon fibre with unsaturated polyester resins as successfully.”

AOC will continue to work with customers, OEMs and national laboratories to address carbon fibre cost and processability in SMC, while further developing SMC formulations with other reinforcements that provide lower density, low flame and smoke properties, toughness, and greener and more sustainable grades.

“If we’re truly at a moment of change in automotive design and manufacturing,” Plaunt posits, “this may also be an opportunity for a renaissance era with SMC.”

BMC growth

With more than 30 years’ experience in formulating BMC compounds, Bulk Molding Compounds Inc (BMCI) of West Chicago, Illinois, USA, expects “growth in 2012 automotive material sales of about 7.5% across the regions we serve.”

This estimate is from Len Nunnery, Vice President of Global Marketing.

“I based this estimate on newly-developed thermoset BMC formulations that can be used in parts to replace either metal or engineering thermoplastics. Even if auto builds remain flat next year, BMCI can still look to sector growth derived from continued expansion of our materials in throttle bodies used by European OEMs, as well as in forward lighting components by Asian auto builders, NAFTA-specified heat and impact shields, and South American thermoset fascia and grille components.”

In the two LED forward light assemblies on the 2012 model Audi A6, 4 lbs of glass-filled of BMC TD 156 make up the entire mounting or foundation for the headlamps and the cluster surrounding the bulbs. Nunnery estimates about 500 000 lbs of BMC will be used in total for these components in this model. He's enthusiastic in stating “The growth metric for our company is kilos of BMC per vehicle. If we experience increased global demands and higher auto builds in 2012, this will affect our sales growth exponentially.”

Jim Cederstrom, BMCI’s Market Development Manager, reports that “we’re seeing a tremendous increase in the level of application development for metal replacement in both traditional and new powertrain applications. We developed zero-shrink Dimension X BMC several years ago as a metal replacement in electronic throttle body housings. This led to BMC 584, which is formulated with similar backbone chemistry to Dimension X but with enhanced lubricity, specifically to replace die cast metal in powertrain pump housings. Our new BMC 665 is a polyester-based grade for glass filled cylinder head covers, front timing-chain covers and oil pans, developed as a lower cost alternative to our BMC 695 vinyl ester product. We’ve also found that it offers cost advantages over engineering thermoplastics in the high heat environments of new powertrain architecture.”

Powertrain options also include electric and hybrid propulsion and BMCI has developed several new high flow BMC grades for the low pressure over-moulding of a variety of electrical components and sensitive electronics.

“BMC offers inherent dielectric properties as well as weight and cost reduction advantages, which fit well with EV battery components, electrical and charge connectors, and encapsulated electric motor components,” Cederstrom explains. “The increasing number of controllers, sensors and motors associated with vehicle electrification offer further BMC part opportunities.”

BMCI also offers grades 940 and 955 for conductive bipolar plates used in commercial hydrogen fuel cells. “Carbon fibre is in the matrix of our formulation investigations for future compounds,” Cederstrom says. “However, carbon fibre has a cost challenge, without question. Since BMC has been positioned as a low cost, high performance alternative to metals and engineering thermoplastics, maintaining some of our key application enablers (such as part cost reduction versus machined metal components) means cost will continue to be a key consideration. This being said, weight is rapidly emerging as an equivalent driver for metal replacement.”

Tougher body panels

It’s been eight years since the automotive industry handled the problem of paint pops on Class A body panels by developing toughened SMC formulations that could survive E-coat powder priming on the assembly line. Continental Structural Plastics (CSP) in Troy, Michigan, USA, trademarked and patented the Toughened SMC for Class A Applications (TCA™) tag in 2002 within its Budd Plastics assets, when participating in a consortium led by General Motors researcher Dr Hamid Kia. The company has worked extensively with AOC’s Atryl resins to produce a range of TCA formulations, as well as moulding TCA parts for GM such as hoods and decklids.

“TCA definitely took us to a higher level of painting effectiveness,” states Probir Guha, general manager of CSP’s R&D and Materials.

He started at Budd right out of graduate school and participated in prototype projects with carbon fibre SMC as early as 1977-78.

“TCA composites have been quite successful for OEMs in Class A components, and we are also now testing a mid-density TCA formula (MDTCA™) with a bogie of net 1.4 g/cm3, compared to 1.3 for stamped metal and aluminium and 1.8 for standard SMC. Use of 16-micron glass microspheres helps us achieve the density target. We will continue to push that envelope, as well as SMC formulations that are transparent to all weather conditions and that further help OEMs economically achieve component weight reduction.”

CSP holds a number of valuable patents related to bonding, which Guha says affects the level of read through on a Class A surface as well as helping remove mass. The supplier also formulates and moulds composite material systems with thermoplastics and long glass, direct long glass, glass mat and BMC reinforcement for Class A, under bonnet, underbody, and structural components such as truck bed boxes.

“Are we anywhere close to talking about more widespread use of carbon fibre SMC? Not at this point. Primary challenges with the material involve wet out and flow properties. CSP has considerable collaborative activity in place with OEMs, suppliers and major universities driving toward lower density structural and body panel composite materials."

Within its full palette of thermoset resins for SMC, Ashland Performance Materials, Dublin, Ohio, USA, offers toughened SMC formulations for Class A panels. Based in its AROTRAN polyester, low-density and low mass SMC can feature nanoclay fillers and microsphere additives. The company’s Aropol PET-based resins are applicable for structural, non Class A SMC components – such as reinforced panels, cross car beams and grille opening retainers – that require high mechanical and impact properties and fast cure. The supplier’s Envirez soy-based bioresin can be formulated with filler for both Class A and non Class A auto parts.

According to Rob Seats, Ashland’s Technical Service Manager: “Automotive industry trends appear to be favouring composites more than ever, in both niche vehicles and new models where low mass composites such as SMC offer materials advantages. Sales for 2012 are expected to climb, especially if a boost in hybrid and electric vehicles occurs. Response by OEMs to the recent CAFÉ standards will have a longer term impact, but we expect an increase in parts that utilise composites on 2013 and 2014 models, and beyond.”

In terms of adding carbon fibre to the SMC material mix, Seats agrees with other sources here: “The cost of carbon fibre and processing cycle time for epoxies still present significant challenges. However, an opportunity exists if one or both of these hurdles can be addressed.”

Engineered thermoplastics

Composite underbonnet parts, as well as trim and non-visible components benefit from long and short glass reinforcement in engineered thermoplastics and Reinforced Plastics asked glass fibre supplier PPG, Cheswick, Pennsylvania, USA, what its 2012 growth potential looked like in this market.

“We’re expecting 5-6% average annual build growth globally over the coming five year period,” reports Gerry Marino, Global Director for Transportation and Consumer Segments. “Further, we expect the trends in light weighting and cost savings that are served by composites to essentially double the rate of composites growth in automotive applications: on the order of 10-11% over the same time period.”

Marino also says that “automakers are finding it more and more difficult and costly to implement fuel savings measures that are in any way more effective than taking weight out. This positions composite material solutions favourably in OEM design consideration.”

PPG’s TUFROV long fibre thermoplastics (LFT) and CHOPVANTAGE chopped glass strands have been in the automotive market for several years. Most recent TUFROV LFT developments encompass high performance, resin-specific grades, such as TUFROV 4510 fibre glass for PA-specific applications and 4575 for polypropylene (PP)-specific applications.

“In the coming months, we will introduce TUFROV 4589 fibre glass for PE and 4585 for PET/PBT thermoplastic polyesters,” Marino says.

PPG’s CHOPVANTAGE HP 3610 short fibre glass for PA and HP 3786 for PBT are used extensively in automotive components, and improved performance CHOPVANTAGE products in high temperature PPS and hydrolysis-resistant PBT are expected to launch by early 2012.

Long and short glass engineered thermoplastic formulations from Borealis AG, Vienna, Austria, address the primary auto industry demands among its European OEM customers: light weight, fuel efficiency and emissions reduction, sustainability and recyclability. In NEPOL GD302HP, 30% long glass/PP replaces a hybridised polyurethane (PUR)/steel seat carrier for BMW, achieving 35% part weight saving and 15-20% system cost saving. NEPOL GB215HP with 20% long glass delivers 23% part weight savings and 20% system cost savings in a BMW instrument carrier.

For Fiat/Lancia, Borealis’s XMOD GD301HP (32% short glass/PP) beat out glass/PA for total part weight in a pedal carrier, and demonstrated 16% part weight reduction compared to 30% glass/PA 66 in an air filter system.

In a variety of Volkswagen models, the OEM switched from glass/PA to XMOD GB306SAF 35% short glass/PP in air intake modules to achieve a reduction in carbon dioxide emissions (CO2) of 60% as measured by external lifecycle analyses. Borealis won the Frost & Sullivan 2010 New Product Innovation Award in the category of Under the Hood Plastics for achieving system and production cost reduction and up to 15% weight reduction in the air intake manifold units made with this step-change PP compound.

DAPLEN EF341AE 30% talc/PP reduces part weight over steel by 50% in the fenders for BMW X5 and X6 models, and enables 60% CO2 emission reduction based on external lifecycle analysis of these vehicles. Borealis is currently working on natural fibre fillers from sustainable, renewable wood in PP resin for visible and non-visible interior trim and underbonnet components.

To meet projected growth in the global auto industry of 10% next year, LANXESS AG, Leverkusen, Germany, makes its own glass and high-modulus thermoplastics. Udo Erbstober, Communications Manager, reveals that the chemical company is expanding production capacity in China and India of its Durethan PA 6/66 and Pocan PBT+PET/PBT+PC resins. He says sales to automotive customers represent a 15% segment within total LANXESS group sales.

To meet the lightweighting and higher engine temperature resistance needs of OEMs, Erbstober reports products from the company that include a hybrid composite/metal injection moulding process using glass/PA in sheet form. This has been commercialised in an Audi front end with 20% weight reduction over aluminium. Further innovations are expected with glass/PA 6 in components such as ‘hot side’ charge air tubes, fuel filters, and in larger, support components that can be highly glass filled and injection moulded.

Within its glass/Pocan engineered thermoplastics, LANXESS is having success with utility vehicle tractor bumpers from PBT+PET as an alternative to SMC, as well as in truck panelling, fenders, wind deflectors, A pillars, and access steps. The Pocan PBT+PC blend has proven highly effective in the manufacture of an uncoated radiator grille for a Volvo construction truck model. These thermoplastics, as well as the hybrid composite/metal materials, are also finding positive demonstration in structural battery trays for electric vehicles, complemented by injection moulded glass/Durethan in battery covers and electronic housings. The Innovative Plastics strategic business unit within SABIC has been pursuing its own ‘automotive weight out’ with customers for some years. The company suggests that use of its resins could result in weight reduction of 24 kg from a typical car, and lower CO2 emissions per km traveled of 2.4 g. Over a fleet of 210 million vehicles, this translates to 9.6 million tonnes of polluting emissions eliminated annually.

Achievements this year in particular components are expected to lead into further, similar applications on new vehicle platforms. SABIC IP’s STAMAX long glass fibre/PP replaced steel in the semi-structural front end module assembly (FEM) of Chang’an Automobile’s CX30 model, and in interior components for the Range Rover Evoque.

The 40% weight cut in the CX30 FEM contributed to a 4 kg reduction in total vehicle weight, and to reduction of overall system cost as well because modular assembly was possible that boosted production efficiency. The FEM fully integrates the radiator, headlamps, lock bridges, and bumper beams, reducing 22 different metal parts into a single injection-molded composite part.

For the Evoque, the STAMAX composite provides higher stiffness and lower density than alternative materials in instrument panels and inner door modules. The excellent flow properties of this long glass thermoplastic mean less material is needed to achieve strength/stiffness properties. At 1600 kg, the Evoque is the lightest Range Rover ever built.

High-volume CFRP

The volume, supply, form, processability and price point of carbon fibre for high-volume vehicle platforms will be very different from the concept cars, low-volume supercars and alternative fuel vehicles, and Formula 1 race cars that have readily drawn upon carbon fibre reinforced plastic (CFRP) for weight, crash resistance, and aerodynamic styling advantages. However, such special projects have made it possible to demonstrate wholesale replacement of the traditional metallic body-in-white (essentially the structural frame on which all primary vehicle systems are mounted) with a prototype carbon fibre/epoxy body-in-black.

“Technologies are well along the way to reduce carbon fibre cost,” states C. David Warren, Program Manager for Transportation Materials at the US Department of Energy’s Oak Ridge National Laboratory (ORNL) at Oak Ridge, Tennessee, USA. “Textile-based precursors could be ready to enter the market within months, and lower cost precursor conversion technologies within a couple of years. Non-PAN precursors such as lignin are likely within three to five years.”

In 14 of his 20 years at ORNL, Warren has been part of the CFRP research team and helped establish the Oak Ridge Carbon Fibre Composites Consortium, which will hold its inaugural meeting this September. The goal of the consortium is to develop a carbon fibre grade that meets the cost target of $5-7/lb.

“Lower cost carbon fibre will require entry into the market by new producers with a high volume commodity vision, and that is beginning to occur,” he says.

Ventures in recent news bear this out: the formation of Zoltek Automotive (St. Louis, Missouri, USA) to produce intermediates from large-tow carbon fibre with the processability desired by automotive customers; the memorandum of understanding between Dow Europe GmbH and carbon fibre and acrylic fibre producer AKSA (Istanbul, Turkey); and the formation of SGL Automotive Carbon Fibres (Moses Lake, Washington, USA and Wackersdorf, Germany). Teijin Ltd (Tokyo, Japan) blew the lid off carbon fibre cycle time with its one minute press forming of parts equal in size to metallic body-in-white elements, and thermoplastic/carbon fibre intermediates to accommodate this process time.

Plasan Carbon Composites (Bennington, Vermont, USA), an ORNL consortium member working on the lignin-based precursor, has developed an out-of-autoclave process that allows carbon fibre/epoxy component cure in 10 minutes.

Another ORNL consortium member, Advanced Composites Group Ltd (Heanor, UK) is making inroads with its DForm (Deformable Composite System) slit prepreg that is cross plied into rapid laminating format so as to retain long fibre properties with the deformability of a short fibre moulding compound. The material can be press formed like SMC.

Steve Cope, Automotive Market Sector Manager, says ACG has also demonstrated an automated production system emphasising robotic handling of highly conformable prepregs like DForm to achieve cost reduction, improve rate and repeatability in high-volume moulding of composite structural parts.

A CHF30 million follow-on supply contract for Class A body panels awarded in May to prepreg and parts producer Gurit (headquartered in Wattwil, Switzerland with automotive composites facilities on the Isle of Wight, UK) utilises the company’s patented carbon fibre SPRINT CBS (car body sheet). First used in 2007, SPRINT CBS body panels feature carbon reinforcement around syntactic core and an in-mould primer layer. Low bake, light weight and high bake (200°C) variants are available. The unnamed OEM offering the most recent contract – through 2016 and with potential to net another 40% beyond the initial order – is likely Aston Martin.

“Lightweight, Class A exterior body panels made with our patented Resin Spray Transmission (RST) technology use dry carbon fibre rather than prepregs and cure in minutes without an autoclave,” states Dale Brosius, Chief Operating Officer, Americas and Europe with Quickstep Technologies Pty Ltd, North Coogee, Western Australia. “We believe this will reduce manufacturing costs and be easier to implement into assembly of composites for primary body structure.”

He adds that “the biggest issue with the manufacture of carbon fibre components today is not the cost of the fibre but the cost to convert it into parts. The RST process only requires the resin to flow in the through-the-thickness direction, making it ideal for thin-skinned panels in the 1.2-1.5 mm range. We’re also working on reducing cure cycle for carbon fibre/epoxy to several minutes.”

Short cycle RTM

Toray Industries produces precursor, carbon fibre, fabric, preforms, matrix resins, CFRP intermediate materials and manufactures composite parts. In all these endeavours, the company emphasises life cycle management “in order to help realise a sustainable, low-carbon society by reducing the environmental impact over the entire life cycle of a product,” says Nobuyuki Odagiri, General Manager of Toray’s Advanced Composite Materials Technology Dept. in Tokyo.

Over the life of carbon fibre and composite products, he explains, especially as used in lightweighting of cars and trucks, the environmental tradeoff of greenhouse gases created by carbon fibre manufacturing will be significantly less than the greenhouse gases (GHGs) saved in the operation of more fuel efficient vehicles.

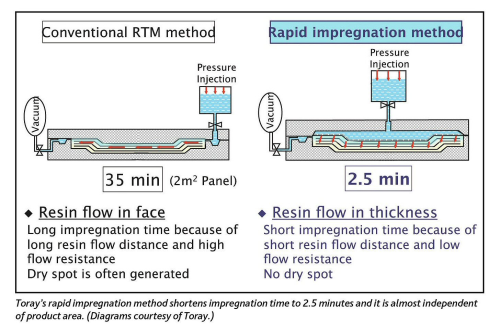

Maximising GHG reduction simultaneous to manufacturing productivity while reducing total parts cost led Toray to develop the Short Cycle Resin Transfer Moulding (RTM) process in 2006. As a participant within the five-year, government-funded Automobile Lightweight Structural Elements of CFRP Composites project, Toray scientists combined automated layup of 3D carbon fibre preforms with rapid-cure epoxy impregnation. Proof of concept parts included a door inner panel and front floor pan.

“Achieving a cycle time of about 10 minutes, which is significantly shorter than for prepreg and about one-fifth the time required for conventional RTM, makes this a realistic technology for automotive parts manufacturing,” Odagiri concludes.

He adds that further enhancement of the short cycle RTM technology in Toray’s joint venture with Daimler will be integral to the production of the OEM’s CFRP automotive parts.

Thinking inside the box

Collaborative engineering leads to competitive advantage, as new composite products that answer the needs of automotive OEMs are demonstrating. The software developers at VISTAGY Inc, Waltham, Massachusetts, USA, believe a predictive design tool that helps evaluate part producibility, performance and cost early on in the design cycle can only boost the effectiveness of collaboration.

“Our FiberSIM software helps engineers and designers cultivate innovative ideas in a ‘work like you think’ mode but also within the familiar CAD/CAE environment,” relays Ed Bernardon, VISTAGY's VP of Business Development. "By simply pointing and clicking, relevant data from a complete master model definition of a specific composite part can be automatically accessed and reused as needed in up or downstream documents and processes.”

Bernardon and Steve Luby, VISTAGY founding partners, are familiar with the needs of high volume automotive composite processing since they created FiberSIM® after years as researchers developing manufacturing equipment for the fast forming and manufacture of composite parts and preforms in programmes such as the Dodge Viper.

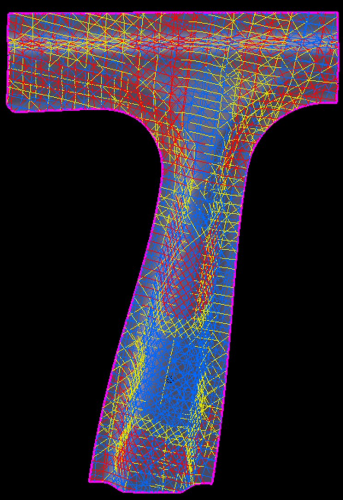

“FiberSIM predicts the manner in which fabric and fibre in a laminate layup will wrinkle or reorient, based on part and ply geometry and the selected manufacturing and operating conditions,” Bernardon explains. “Since it’s likely that a variety of composite materials will be used for automotive applications, including non-crimp fabrics (NCF), FiberSIM can give vehicle engineers the flexibility to rapidly evaluate tradeoffs in laminate design with the these different material architectures. Formability, shear, in-plane buckling, fibre orientation and flat patterns for a selected part shape, laminate, material and manufacturing process can be created or analysed with FiberSIM to meet the performance and packaging requirements of a part.”

Automotive designers may find the comfort level afforded by such software a top priority, considering the sensitivity of design parameter changes on composite laminate performance.

“A change in fibre orientation of only 15° can cause a reduction in performance of 75%, since these are anisotropic materials, unlike metals,” Bernardon states. “What FiberSIM ends up giving engineers is a way to evaluate the key design characteristics – from part shape to materials to manufacturing process interaction – so they can quickly design the composite components needed for cost effective, high-volume light weight vehicles.” ♦

This article was published in the September/October 2011 issue of Reinforced Plastics magazine.To apply to receive your free copy of each issue of Reinforced Plastics magazine please complete the subscription form. (The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria.)