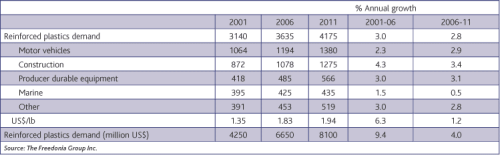

Reinforced plastics demand in the USA is projected to increase 2.8% annually to 4.2 billion lbs in 2011, to give a market valued at US$8.1 billion. This will create a market for 2.8 billion lbs of resin and 1.4 billion lbs of reinforcements. Material substitution will remain the driving force behind advances. Higher performance requirements, combined with resin, reinforcement and processing improvements, will broaden applications and enhance competitiveness with steel and aluminium. Price increases for reinforced plastics are expected to moderate following the significant price spikes experienced between 2004 and 2006, which resulted from escalating petroleum and natural gas prices.

Resins

Thermoset resins, primarily unsaturated polyester, will account for over 60% of all US reinforced plastics in 2011. Thermoset resins exhibit low cost and excellent performance in a broad range of construction, motor vehicle and marine uses. Inroads into non-traditional markets such as wind turbine blades, bridge decking and utility poles will be driven by needs for greater durability and reduced maintenance. Polypropylene, thermoplastic polyester and nylon (polyamide) are the leading reinforced thermoplastic resins. Reinforced thermoplastics will exhibit better growth due to their greater design capabilities and easier processing.

Reinforcements

Reinforcements are used in plastics to increase stiffness and impact strength and enhance other properties. The degree of strength is determined by the type of reinforcing fibre used, its alignment within the matrix, and the percentage of fibre used. Glass fibres will remain the dominant reinforcement material based on their low cost, high strength-to-weight ratio, good processability and chemical resistance. However, carbon, aramid and nanomaterial reinforcements will exhibit faster growth based on needs for higher performing, more cost effective materials, particularly in motor vehicle, aerospace and industrial markets. Nanomaterials will expand at the most rapid pace, albeit from a small 2006 base, as capacity increases, prices fall and processing techniques improve.

Markets

Motor vehicles and construction will together account for 64% of total US reinforced plastics demand in 2011 (Table 1). Motor vehicle applications will be driven by reinforced plastics' ability to reduce weight, consolidate parts, resist corrosive chemicals and high temperatures, and produce shapes not achievable with metal. Construction will present the best growth prospects, stimulated by the low cost, durability and corrosion resistance of reinforced thermoset polyester in products such as tanks, pipe and bathroom components. The producer durable equipment market will be stimulated by heightened demand for business equipment and other electrical and electronic products due to rapid technology changes and needs for productivity enhancements.

Motor vehicles

Motor vehicles accounted for one-third of all US composites demand in 2006. Reinforced plastics are chosen by motor vehicle manufacturers for a variety of reasons. Composites typically weigh 30–40% less than steel, are corrosion resistant and durable, resist high temperatures and corrosive liquids, and allow reduced labour costs via parts consolidation. Composites also greatly broaden design flexibility for both aesthetic and structural purposes. However, reinforced plastic components must still deliver a cost saving or unique performance advantage, or it will not be specified.

While composites have made significant inroads in under-the-hood applications, smaller gains have been realised in large parts such as body panels due to the cost efficiency of stamped steel in high volume production runs.

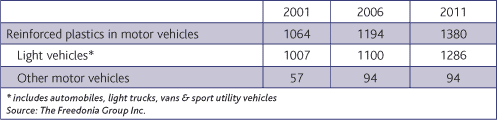

The motor vehicle market for reinforced plastics in the USA is forecast to increase nearly 3% per year to 1.4 billion lbs in 2011 (see Table 2). Opportunities will be fuelled by improved resin and processing developments, as well as needs for lighter weight and cost competitive materials. Continued growth is anticipated for average composite poundage per vehicle as a result of growing applications such as valve covers, panels and grille opening reinforcement. Improvements in surface finishes will also enhance applications in automotive panels due to their better paintability.

Light vehicles (including automobiles, light trucks, sport utility vehicles and vans) will account for 93% of all reinforced plastic use in motor vehicles in the USA in 2011. Advances will exceed anticipated growth in light vehicle production based on improved resins and processing techniques, which will broaden uses. Recent applications include pickup truck beds, front fenders and convertible hard tops.

Heavy duty truck components made from reinforced plastics include diesel engine covers, sleepers, airfoils, hoods and splash panels. Bus shells made from a glass fibre-reinforced vinyl ester laminate have also been fabricated from composite materials.

Construction

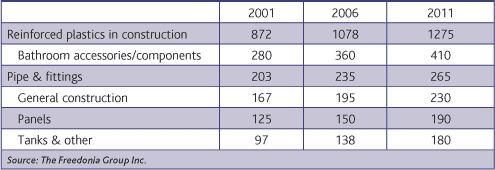

Construction markets, which accounted for 30% of all US reinforced plastics demand in 2006, will provide a variety of opportunities for composites. Significant inroads have already been made in areas such as plumbing fixtures, panels, bathroom components, and tanks and pipes. These advances reflect cost, performance and aesthetic advantages over wood, metal and glass materials. Future inroads will be dependent upon expanding plastic performance parameters via processing and resin advances while maintaining cost competitiveness.

Demand for reinforced plastics in construction applications in the USA is forecast to grow 3.4% yearly to 1.3 billion lbs in 2011 (see Table 3). Advances will reflect numerous advantages over wood, metal and glass construction materials in terms of weight, impact resistance, maintenance requirements and design considerations. Growth in traditional uses will be driven by replacement needs and expansion requirements. Improved processing and resin technologies will broaden applications into areas such as rebar, bridges, seawalls and marine pilings.

Producer durable equipment

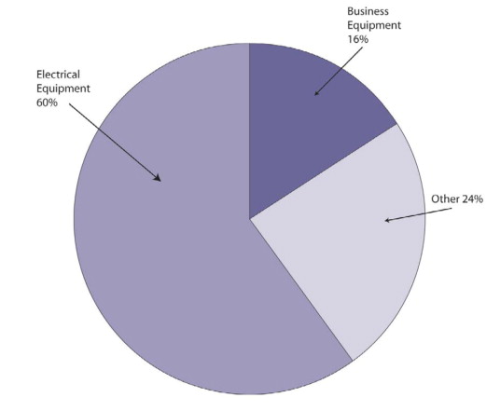

Producer durable equipment accounted for 13% of reinforced plastic applications in the US in 2006. This market includes industrial machinery and equipment, computers and office equipment, electronic components, and other electrical and electronic machinery. Producer durable equipment demand for reinforced plastics in the USA is expected to rise 3.1% annually to nearly 570 million lbs in 2011 (Figure 1). Stimulants include needs to enhance productivity and subsequent demand for electrical and electronic products such as telecommunications equipment, information processing products, factory automation equipment and updated industrial machinery.

Opportunities for reinforced plastics will result from heightened needs for durable, lightweight materials with good strength, high temperature resistance and good dielectric properties. Fastest gains are expected in the business equipment segment as a result of growing use in housings and other components for products such as printers, copiers and personal digital assistants. Electrical equipment requirements will reflect growing service and maintenance demands for the distribution and transmission of electricity, where composites' light weight and insulative capabilities surpass other materials.

Marine

Marine applications accounted for about 12% of US reinforced plastics demand in 2006. The marine market for composites consists primarily of recreational boats – power boats, personal watercraft and sail boats. Recreational boating products are generally considered luxury items, and hence, demand is tightly linked to disposable personal income levels. Reinforced plastics and aluminium are the primary materials used in the construction of recreational boats.

Commercial and military boats are small markets for reinforced plastics as they rely mainly on metals due to more stringent durability and strength requirements. Minesweepers are commonly built with reinforced plastic hulls, which flex to absorb some of the shocks of an exploding mine and do not detonate magnetic mines. However, minesweepers are built in limited numbers and offshore producers dominate the market.

Marine demand for reinforced plastics in the USA is projected to rise less than 1% annually to 435 million lbs in 2011. Gains will parallel anticipated increases in recreational boat shipments, with average plastics weight per boat expected to flatten out through 2011. Gains in average boat weight will be limited as manufacturers increasingly employ such hull core materials as balsa, plywood and closed-cell foams to make lighter vessels.

Other markets

Composites also have widespread applications in other markets such as consumer durables, and aircraft and aerospace. Consumer durables such as appliances, sports goods, exercise equipment, power tools and toys accounted for 9% of US demand in 2006. Advances for composites in this sector have been slower than in others because of the high price sensitivity of this segment. Benefits such as corrosion resistance and low maintenance will remain key stimulants to greater use of composites in these applications. Continued inroads are expected in products such as appliance components, power tool housings, and sports goods such as fishing rods, skis, basketball backboards and archery components. Factors impacting consumer durables demand include general economic conditions, demographic trends, household formations and disposable personal income levels.

Other markets for reinforced plastics include aircraft and aerospace equipment, trains, subways, farm equipment, medical devices, firearms, ordnance and other products. Aircraft and aerospace will be the primary growth driver, although diverse opportunities are also anticipated in other areas. Resin and processing improvements will broaden applications by enhancing performance and cost parameters. Aircraft and aerospace markets will be stimulated by growing demand for composites in military aircraft, and other military products such as helmets and body armour. Significant increases are also expected for commercial aviation markets where composites may comprise up to half the weight of new generations of passenger planes. Higher performing aircraft make significantly greater use of advanced reinforcements such as S-2 glass, carbon and aramid.

Reinforced Plastics to 2011, study no. 2195, is available from The Freedonia Group Inc.