The study, US Wind Power Markets and Strategies: 2010-2025, also predicts a near-term US wind market landscape wrought with increased competition.

With the proliferation of favorable state and federal policies, however, the US wind industry is on track to add more than 165 GW of new capacity through 2025, resulting in a total installed base of 200 GW, according to the study.

The study forecasts anywhere from 6.3-7.1 GW of wind could be installed in 2010, 40-60% lower than 2009 installations.

“2010 marks the first time since 2004 that the US wind industry will not surpass the previous year’s growth level. Despite unprecedented federal wind incentives, reverberations from the financial crisis continue to create a difficult near-term market landscape especially in light of continued energy policy uncertainty,” says IHS Senior Analyst Matthew Kaplan, one of the study’s authors.

“However, the US wind market is poised to emerge from this near-term uncertainty with a clearer path toward strong future growth.”

The US wind industry will represent US$330 billion in investments between 2010 and 2025, with more than 90% stemming from onshore wind, according to the study’s projections.

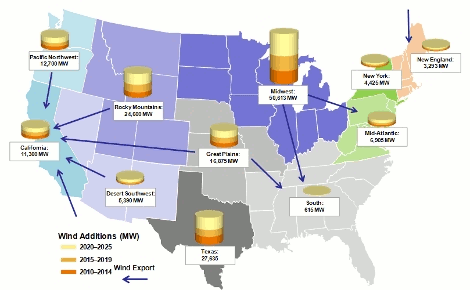

The Midwest, Great Plains and Rocky Mountain states will act as major wind export hubs to areas with large appetites for renewables, including California, the Mid-Atlantic and the South.

Offshore is expected to account for only 5% of total US wind build in 2025, despite the beginning of offshore wind in the USA with the Cape Wind project.

Slashing expectations

Despite large build years in 2009, leading independent power producers EDP Horizon and NextEra Energy Resources have slashed wind build expectations exemplifying near-term challenges.

“Transmission remains one of the greatest barriers to the development of US wind projects. Coordinated national policies will be necessary to more efficiently link the US’ vast wind resources to high-demand regions, however, even with enabling policies, there will be a lag of several years for projects to become operational,” says Kaplan.

“A national renewable energy standard or federal energy policy legislation along with a streamlined transmission siting and cost allocation process are the essential ingredients to building a robust future US wind market.”