Established in 1987, ZCL Composites Inc, headquartered in Edmonton, Canada, ZCL is North America’s largest manufacturer and supplier of fibreglass reinforced plastic (FRP) underground storage tanks. It also provides aboveground FRP and dual-laminate composite storage tanks, piping and lining systems and related products and accessories where high corrosion resistance is required.

Its subsidiary companies are Xerxes Corp, ZCL Dualam Inc and Parabeam BV.

ZCL has six plants in Canada, six in the US and one in the Netherlands. The company has three business units:

- Petroleum Products;

- Water Products; and

- Industrial Corrosion Products.

Its brands are ZCL, Xerxes, Parabeam, Dualam and Troy.

ZCL's Petroleum Products business is a leading provider of underground fuel storage tanks for the retail service station market in Canada and the US. It manufactures both single wall and double wall FRP tanks. It also operates internationally through technology licensing agreements.

ZCL developed the Phoenix System™ tank lining system as an alternative to the replacement of underground storage tanks. This Underwriters Laboratories (UL) and Underwriters Laboratories of Canada (ULC) listed system allows in-situ upgrades of a single wall steel or fibreglass tanks to a secondary containment system. A key component of both ZCL’s double wall tank and the Phoenix System is Parabeam®, a patented, three dimensional glass fabric manufactured and distributed from the company’s facility in The Netherlands.

ZCL's Water Products business provides underground FRP storage tanks as an alternative to the concrete products that have traditionally dominated this market. Applications include onsite wastewater treatment systems, fire protection systems, potable water storage, rainwater retention, and storm water retention.

ZCL's Industrial Corrosion Products business manufactures fibreglass tanks, piping and related products and accessories for industrial projects. ZCL’s capabilities include the manufacture and installation of custom engineered FRP and dual-laminate composite products for use in the power generation, chemical, chloralkali, pulp and paper, mining and oil sands industries.

The Petroleum and Water Products business units make up the company's Underground Fluid Containment operating segment. Industrial Corrosion Products are included in the Aboveground Fluid Containment operating segment.

Analysis

In early 2011, the ZCL management team established a 'simplify to grow' strategy. One part of this was a move to 'profitable growth' from its previous objective of strong annual revenue growth. During 2011, the company's strategic plan included a focus on core competencies and the identication of non-core assets for sale.

| Our balance sheet is in excellent fiscal condition, our profitability is improving and our people are re-focused on activities that create shareholder value. |

| Ron Graham, President & CEO, 2011 ZCL Composites annual report |

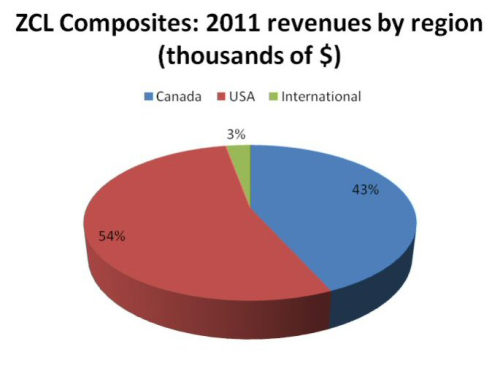

These actions resulted in a return to profitability and significantly reduced debt. Net income from continuing operations improved to $3.5 million in 2011 from a loss of $16.7 million in 2010. 2011 revenue of $127 million was the highest in ZCL’s history.

In the Underground Fluid Containment segment revenue in 2011 was $4 million (4%) higher than in 2010. This was the result of gain in the Petroleum Products lines in Canada and the US. However, Water Products revenue was $2.8 million (15%) lower in 2011 and 2010, due to the weak US economy.

Revenue in the Aboveground Fluid Containment (Industrial Corrosion) segment in 2011 was 6% higher than 2010, with the increase coming from the ZCl Dualam division.

2012 will see the company continue the quest for profitable growth, with a continued focus on cost control and core assets.

Selected financial information

| 2011 | 2010 | 2009 | |

| Revenue | 127,046 | 121,574 | 103,153 |

| Gross profit (% of revenue) | 19,454 (15%) | 11,658 (10%) | 17,085 (17%) |

| Net income (loss) from continuing operations | 3,454 | (16,700) | 3,635 |

| Net loss from discontinued operations | (164) | (149) | (1463) |

| Net income (loss) | 3,290 | (16,849) | 2,172 |

| EBITA (% of revenue) | 10,349 (8%) | 2,539 (2%) | 9,816 (10%) |

| Net debt | 4,567 | 17,591 | 3,955 |

| Backlog | 42,200 | 24,900 |

| Revenue | Gross profit | ||||||

| 2011 | 2010 | % change | 2011 | 2010 | % change | % of rev 2011 | |

| Underground Fluid Containment: | 17,356 | 13,200 | 31% | 17% | |||

| Petroleum Products | 86,468 | 79,764 | 8% | ||||

| Water Products | 15,122 | 17,852 | (15%) | ||||

| 101,590 | 97,616 | 4% | |||||

| Aboveground Fluid Containment: | 2,098 | (1,542) | n/a | 8% | |||

| Industrial Corrosion Products | 25,456 | 23,958 | 6% | ||||

| Total | 127,046 | 121,574 | 5% | 19,454 | 11,658 | 67% | 15% |

Company headquarters

ZCL Composites Inc, 1420 Parsons Road SW, Edmonton, AB, Canada, T6X 1M5; tel: +1-780-466-6648.

President & CEO: Ron Bachmeier (succeeded Rod Graham on 8 August 2012).

Recent events

- ZCL reported revenue of $42.9 million for the second quarter of 2012, an increase of 44% on the same quarter of 2011. (ZCL Composites reports second quarter 2012 financial results.)

This profile was last updated on 13 August 2012.