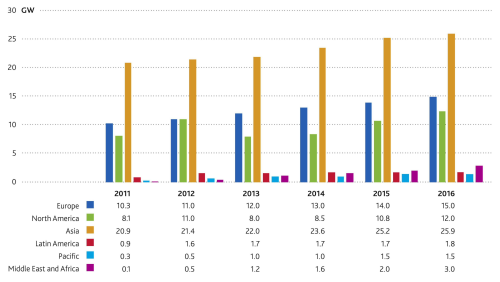

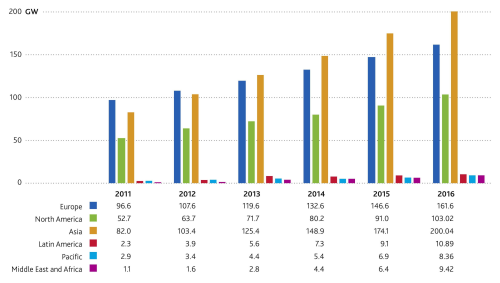

GWEC’s Global Wind Report – Annual Market Update 2011 predicts that the global wind industry will install more than 46 GW of new wind energy capacity in 2012, and by the end of 2016, total global wind power capacity will be just under 500 GW, with an annual market in that year of about 60 GW.

Total installations for the 2012-2016 period are expected to reach 255 GW, with cumulative market growth averaging just under 16%.

“For the next five years, annual market growth will be driven primarily by India and Brazil, with significant contributions from new markets in Latin America, Africa and Asia,” reports Steve Sawyer, GWEC Secretary General. “While the market continues to diversify across all continents, it is at the same time plagued by continued slow economic growth and budget crises in the OECD [Organisation for Economic Co-operation and Development], as well as the continuing credit crunch.”

Asia in the lead

For the second year running, the majority of new installations in 2011 were outside the OECD, reports GWEC, and this trend is expected to continue. Asia is set to continue to be the world’s largest market with far more new installations than any other region. It is forecast to install 118 GW between now and 2016, surpassing Europe as the world leader in cumulative installed capacity sometime during 2013.

After nearly a decade of double and triple digit growth, the Chinese market has finally stabilised, notes GWEC, and will remain roughly at current levels for the next few years.

Having achieved a 3 GW market for the first time in 2011, the annual market in India is expected to reach 5 GW by 2015.

The European market remains stable. Given the EU’s clear policy framework and targets out to 2020, GWEC believes there are unlikely to be many major surprises from this region. Germany had a strong year in 2011 and the government’s decision to phase out all nuclear power by 2020 gives the wind industry a boost. Spain had a disappointing 2011 and 2012 is likely to be even more so, GWEC predicts, but Romania, Poland, Turkey and Sweden have made progress.

GWEC expects the North American market to have a strong 2012, as both Canada and Mexico will install well over 1000 MW to complement what is expected to be a strong year in the US, which began the year with more than 8 GW under construction. It now seems unlikely that the reauthorisation of the US federal Production Tax Credit will happen in time to have a major impact on the 2013 market, so a substantial drop is expected in 2013 in the US market, while Canada and Mexico remain strong. Overall, just over 50 GW is expected to be installed in North America from 2012-2016, bringing total installed capacity to just over 100 GW at the end of the period.

The Latin American market is dominated by Brazil, GWEC reports, which is now becoming established as a major international market with a strong manufacturing base, and will constitute the vast majority of the regional growth in the period to 2016.

Offshore buzz

| Although offshore wind is often the most talked about part of the wind sector, it currently represents less than 2% of global installed wind power capacity. |

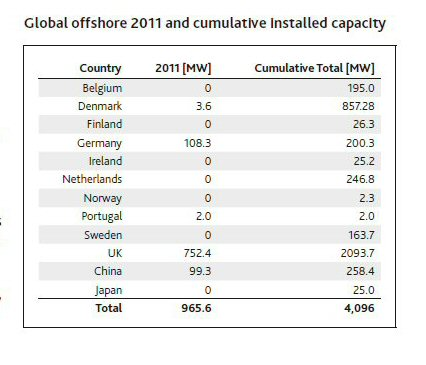

Although offshore wind is often the most talked about part of the wind sector, it currently represents less than 2% of global installed wind power capacity, GWEC points out. 2011 installations of about 1000 MW represented approximately 2.5% of the annual market. By 2020, offshore wind is likely to account for no more than 10% of global installed capacity.

GWEC points out several reasons for the huge interest in offshore wind energy:

- it is a relatively new technology with significant opportunities for cost reduction and technical innovations;

- wind resources offshore are generally greater;

- it is particularly suitable for large-scale development near the major demand centres represented by the major port cities of the world, avoiding the need for long transmission lines to get the power to very large concentrations of demand, as is so often the case onshore; and

- offshore makes sense in very densely populated coastal regions with high property values, where there are big constraints for onshore development.

More than 90% of the world’s offshore wind power is currently installed off northern Europe, in the North, Baltic and Irish Seas, and the English Channel. Most of the rest is accounted for by two ‘demonstration’ projects off China’s east coast. Offshore wind is an essential component of Europe’s binding target to source 20% of final energy consumption from renewables, and China has set itself a target of 30 GW of installations off its coast by 2020.

GWEC notes that it’s an exciting new technology and a new business, and governments and companies in Japan, Korea, the United States, Canada and even India have shown great enthusiasm. By 2020 GWEC believes it will have a much better picture of offshore wind’s long term prospects outside of northern Europe and China.

Currently, almost 6 GW1 of offshore wind capacity is under construction in Europe, 17 GW has been consented, and there are plans for a further 114 GW. It is expected that during this decade, offshore wind power capacity in Europe will grow ten-fold. The European Wind Energy Association (EWEA) estimates that by 2020, 40 GW of offshore wind power will produce 148 TWh annually, meeting over 4% of the EU’s total electricity demand.

In terms of cumulative installed offshore capacity Siemens (53%) and Vestas (36%) have the largest shares in the European market, followed by Repower (5%). The vast majority (around 80%) of installed offshore capacity was developed and is owned by utilities. DONG, Vattenfall and E.On together have around 53% of the market. The Belgian Belwind consortium remains the largest independent offshore developer in Europe. The first phase of their Bligh Bank project was successfully completed in 2010, and the second phase is under construction.

| The UK maintains its position as world leader in offshore wind. |

The UK maintains its position as world leader in offshore wind. At the end of 2011, the country’s offshore wind power totalled more than 2000 MW. The UK is expected to install a total of 8 GW by 2016, and a further 10 GW by 2020. In fact, the UK already gets close to 2% of its net electricity consumption from offshore wind, and this is set to grow to 17-20% in ten years’ time. ♦

This article was published in the July/August 2012 issue of Reinforced Plastics magazine.