The National Composites Centre (NCC) has come together in record time. It was launched as part of the UK government’s UK Composites Strategy. Published in November 2009, this outlined plans to advance the development of composites in the country. The strategy document stated that the NCC would provide industrial-scale manufacturing facilities capable of building prototypes to validate design concepts and rapid manufacturing processes. The University of Bristol was announced as the owner and host of the NCC.

The centre received £25 million in funding. £12 million came from the Department of Business, Innovation and Skills, £4 million from the South West Regional Development Agency (SWRDA), an organisation investing in the economy of South West England, and £9 million from the European Regional Development Fund (ERDF).

In March 2010, the Bristol and Bath Science Park was identified as the site for the new NCC building, and in June 2010, GKN Aerospace, Airbus, AgustaWestland, Rolls-Royce and Vestas signed long-term partnership agreements with the NCC. The building was finished in June this year and since then equipment and people have been moving in.

Peter Chivers was officially appointed the centre’s Chief Executive in June, after carrying out the role on an interim basis for the previous 15 months. He’s enthusiastic about the centre’s objectives.

“The NCC aims to bridge the gap between the university laboratory and the company factory – to de-risk the manufacturing process and reduce the ‘valley of death’ where new technologies die,” he says. “We offer a route from idea to prototype, with low risk, time and cost.”

The NCC is an industrial scale facility, set up for full-scale prototyping with a 10 m x 3 m capacity.

NCC membership (of which various levels are available) will give companies access to a range of versatile equipment, supported by product development experts. Personnel from a broad range of sectors are currently being recruited to work at the centre and by the end of this year 130-150 people are expected to be on site. Member companies are encouraged to locate some of their staff at the centre.

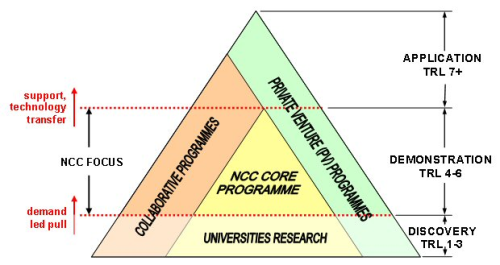

In addition to being the hub of the UK’s effort to develop and implement rapid composite manufacturing technologies, the NCC's role also comprises:

- leading the coordination of a network of regional centres of composites excellence;

- providing direction for fundamental research and collaborative links with UK universities; and

- helping to develop and coordinate training to support the skills base necessary for applying advanced composite technologies.

The NCC is also one of seven organisations comprising the first Technology and Innovation Centre in high value manufacturing (HVM), part of the UK government’s plan to grow the country’s economy. The HVM Technology and Innovation Centre (HVTIC) will aim to commercialise business-led research and innovation that will help UK manufacturing businesses become more competitive globally.

Facilities

During Reinforced Plastics’ tour of the facility most of the equipment was in place, ready for the centre’s official opening in November. A lot of equipment was acquired from Airbus, Chivers explains, and an Airbus team has already taken up residence at the NCC to take advantages of the equipment and facilities.

The heart of the centre, the production space, is designed like a factory and follows a process flow. The tour starts at the freezer room, which is larger than expected for this size of facility, since the NCC wants to store materials from a range of sources. There is a data and communications room, where customers can install their own servers and link to their own company networks, followed by an automated cutting machine, and two clean rooms. One clean room is designed for manual lay-up operations. Laser projection systems are in place to improve accuracy of ply positioning. A double diaphragm forming machine with 15 m x 3 m capability enables the production of large components.

The next room contains a unique twin-headed automated fibre placement (AFP) machine from Coriolis. This £2.6 million custom-designed machine has two robotic arms, each with an AFP head, and opens up new possibilities for creating composite parts.

Moving over to the other side of the facility, there are ovens, a hot press, and two autoclaves. The larger autoclave has a maximum temperature 425°C and max pressure 14 bar, and a tool size of 10 m x 3 m. It is equipped with comprehensive process monitoring equipment.

There is also a non-destructive testing (NDT) area, with a large ultrasonic unit, a large 5 axis CNC drill and route unit, and a waterjet cutter.

Finally, there is a materials laboratory with state of the art equipment including a Carl Zeiss scanning electron microscope (SEM), Nikon computed tomography (CT) X-ray scanner, and rheometer, DSC (differential scanning calorimetry), DMA (dynamic mechanical analysis) and TGA (thermogravimetric analysis) units from TA Instruments.

The production facilities are complemented by versatile office areas and meeting rooms.

Getting involved

Vestas, Airbus, GKN Aerospace, Rolls Royce, Agusta Westland and Umeco have signed up as Tier 1 members of the NNC. This top level membership, costing £0.3 million a year, includes a place on the NCC Board, participation in the NCC’s core research and technology programmes, company-specific programmes and full access to the NCC’s facilities and expertise.

Membership options are also available to suit small and medium sized companies wishing to develop new technologies, learn about existing technologies or see new materials, tooling or design services implemented at an industrial scale. As an open access facility the centre facilities will also be available to companies on a ‘pay as you go’ basis.

Although there is a strong focus to aerospace among the founder NCC members Chivers notes that 40-50% of the NCC’s work is non-aerospace.

NCC membership (or as Chivers prefers to call it ‘pre-paid research’) will give companies the opportunity to work alongside other manufacturers and material and equipment suppliers. This cross-disciplinary, cross-company interaction is at the heart of the NCC’s strategy. ♦

|

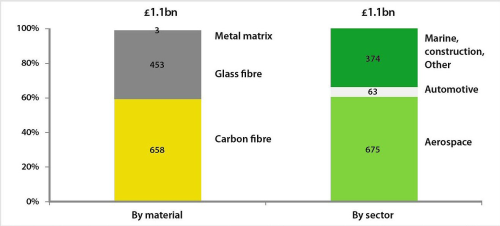

According to a 2010 report from Ernst & Young*, The size of the UK composites industry is between £1.1 billion and £1.6 billion. UK domestic demand for composite components is £0.9 billion, comprising UK production of £1.1 billion less exports of £0.4 billion (mostly aerospace) plus imports of £0.2 billion (mostly wind turbine blades). There are around 1500 companies involved in the UK composites industry, of which more than 85% of activity is undertaken by the 38 largest companies (including GKN Aerospace, Airbus UK, Hexcel, BAE Systems and Bombardier). Outside of the 38 largest companies, the UK composites supply chain is made up of smaller firms with revenues of less than £5 million. These companies could benefit significantly from regional or national support to identify export markets for their products and to diversify their production techniques and product range to exploit a wider range of application areas. In composite component manufacture, traditionally a strength of UK industry, the competitive position continues to weaken, as European competitors take a lead in manufacturing improvements, and lower labour cost countries invest, often with government support, to develop capability. The report notes that considering the growth potential of the sector, there is an opportunity to change the scale and global competitiveness of the UK composites industry. It identified the following areas of focus:

*UK Composites Industry Supply Chain Scoping Study – Key Findings, April 2010, prepared by Ernst & Young for UK Trade & Investment (UKTI) and the Department for Business, Innovation and Skills (BIS). |

This article was published in the November/December 2011 issue of Reinforced Plastics magazine. To apply to receive your free copy of each issue of Reinforced Plastics please complete the subscription form.