According to a 2010 report from Ernst & Young (UK Composites Industry Supply Chain Scoping Study – Key Findings), prepared for UK Trade & Investment (UKTI) and the Department for Business, Innovation and Skills (BIS), the UK composites industry was estimated to be worth between £1.1 billion and £1.6 billion. UK domestic demand for composite components was £0.9 billion, comprising UK production of £1.1 billion less exports of £0.4 billion (mostly aerospace) plus imports of £0.2 billion (mostly wind turbine blades).

There are around 1500 companies involved in the UK composites industry, of which more than 85% of activity is undertaken by the 38 largest companies (including GKN Aerospace, Airbus UK, Hexcel, BAE Systems and Bombardier). Outside of the 38 largest companies, the UK composites supply chain is made up of smaller firms with revenues of less than £5 million.

According to Ernst & Young, British composites companies could benefit significantly from regional or national support to identify export markets for their products and to diversify their production techniques and product range to exploit a wider range of application areas. In order to do that the National Composites Centre (NCC) was created at the University of Bristol as part of the UK government’s UK Composites Strategy.

UK Composites Strategy

Published in November 2009, the UK Composites Strategy outlined plans to advance the development of composites in the UK. The strategy document stated that the NCC would provide industrial-scale manufacturing facilities capable of building prototypes to validate design concepts and rapid manufacturing processes.

The Composites Leadership Forum, which has been formed to deliver the next stage of the UK Composites Strategy, held its inaugural meeting on 10 October 2012. Supported by the UK government, the Forum has begun to work with key stakeholders to map and define UK composites capability and future growth potential – all of which will help to ensure that the UK remains globally competitive in the sector. Representatives from the automotive, aerospace, construction, motorsport, education and skills sectors were all at the inaugural meeting. The rail, renewables and marine sectors will all be represented in the near future.

Stakeholders in the Forum include the UK government’s Department of Business, Innovation and Skills (BIS), funding bodies – the Technology Strategy Board (TSB) and the Engineering & Physical Sciences Research Council (EPSRC), industry trade association Composites UK, the Composite Skills Alliance (CSA), the NCC, the EPSRC Centre for Innovative Manufacturing in Composites, and the Knowledge Transfer Network.

Composites hub

Composites UK is the trade body for the UK composites industry. It was founded as the Composites Processing Association in 1989 to represent all levels of the industry in the UK from the smallest one- or two-man moulder to the largest multinational companies.

Composites UK describes the Composites Hub as “the joined up response by three of the central organisations responsible for meeting the strategic and day to day challenges of delivering both the original intent of the UK Composites Strategy and emerging BIS manufacturing and skills policy.”

The founding members were the NCC, the Composites Skills Alliance, and Composites UK.

The Hub aims to:

- ensure the delivery of complementary products and support to meet industry needs;

- be a virtual and physical organisation connected to and meeting the composites needs of UK industry;

- provide a connected and collaborative vehicle for wider partnership and collaboration; and

- inform and service the composites sector leadership.

Industry is expected to benefit from increased access to advice, linking of offers and sorting out effective delivery at the right scale, and price and mix for all customers. The Hub also facilitates industry partnering in areas such as collaborative technology, development and shared training, and skills development programmes including apprenticeships.

Composite networks

| The new network maximises the impact of support for rapid manufacturing technologies and cross-sectorial coverage, as well as strengthening the UK’s composites supply chain. |

The NCC leads the coordination of the network of Centres of Excellence through coordination of technology transfer across regions. This work is undertaken in conjunction with the NCN which is part of the Materials Knowledge Transfer Network. The new network maximises the impact of support for rapid manufacturing technologies and cross-sectorial coverage, as well as strengthening the UK’s composites supply chain.

These centres work together to support, develop and lead all composite capabilities in the UK. The NCC provides direction and focus for fundamental research and collaborative links with UK universities, which members are able to influence and direct. It also helps to develop and co-ordinate training to support the skills base necessary for applying advanced and specialist composite technologies. The centre influences research funding bodies and acts as a focal point for composite funding, as well as a proven collaborative vehicle, in which all sectors and companies will benefit from the cross fertilisation of capabilities.

Design and training

|

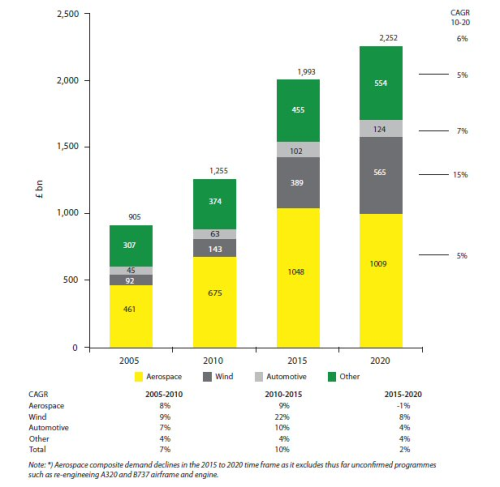

According to Umeco’s 2102 Annual Report: “Industry estimates show a compound growth in demand for carbon fibre – a key indicator in relation to the wider market for composite materials – of 19% per annum between 2011 and 2015 followed by 11% per annum between 2015 and 2019. The global industry for composite materials is forecast to grow significantly in the coming years. The three sectors that will drive this growth are anticipated to be aerospace and defence, renewable energy and automotive, where the combined market size for prepregs and process materials is estimated to grow by a factor of almost two between 2010 and 2016.” AerospaceAccording to the Umeco report: “The growing demand for lower fuel consumption, aligned with advances in composite construction techniques, has led to a significant increase in the use of composites in civil aircraft in the last few years. New aircraft such as the Airbus A380 XWB and the Boeing 787 have approximately 50% composites compared to approximately 20% for current models.” The Inter-agency Composites Group (IACG), which is made up of representatives from different government departments and government-funded agencies working on composites published a report called Technology Needs To Support Advanced Composites in the UK . The IACG says that “the UK has the second largest aerospace industry in the world in terms of employment and turnover, and is one of only six countries involved in the design, manufacture and marketing of the full range of aircraft products.” AutomotiveThe automotive industry is an important part of the UK economy. There are more than forty companies manufacturing vehicles in the UK – ranging from global volume car, van, truck and bus builders, to specialist niche makers with 1.6 million cars and commercial vehicles produced each year, and 3.0 million engines. The industry as a whole has a £51 billion turnover, contributes £10.3 billion value added to the UK economy and creates more than 800,000 jobs. ConstructionThe IACG says: “The construction industry in the UK accounts for around 8% of GDP with an annual turnover of £100 billion. It is five times the size of the aerospace industry and three times the size of the automotive industry. Within the industry 26,400 tonnes of composite materials are used and is forecast to grow by 3.6% per annum. This is lower than growth in the EU (6%), US (5%) and Asia almost 9%.” Marine“The UK marine sector has many SMEs that occupy niche market positions,” says the IACG. “It also has world-leading UK manufacturers with a significant international presence. The UK leisure marine industry achieved revenues of £2.95 billion in 2007, which amounted to a growth of approximately 6% over the previous year. Of this amount, exports comprised £1.05 billion (= 35.1% of turnover) [BIS Marine website]. Exports from the UK marine sector contribute greatly to the UK's overall exports. There is already significant usage of composites in the marine industry. Composites are extensively used in recreational and utility craft (military and civil) and lifeboats. This includes the low end of composites technology, and higher end technology such as that used in the Sunseeker luxury motor yacht and the Mirabella luxury sailing yachts.” Wind“With the potential deployment of up to 29GW of additional offshore wind capacity by 2020,” says Umeco’s 2012 Annual Report, “the UK is the single largest territory for offshore wind globally for the foreseeable future. This presents a major opportunity for the UK given the potential demand for bigger, stronger and more durable composite turbine blades." According to the IACG: “Offshore wind is a rapidly growing sector across Northern Europe and will play an important part in meeting Britain’s renewable energy and carbon emission reduction targets as well as improving energy security by 2020 and beyond. It has the potential to employ a further 40,000-70,000 workers by 2020, bringing annual economic benefits and investment to the UK of £6-8 billion. Turbine blades are expensive and can amount to as much as 20-25% of the total cost of manufacture and installation of a wind turbine. It is estimated that the value of the UK wind turbine blade market alone will be worth above £5 billion by 2020. The UK is the largest single market for offshore wind globally.” According to RenewableUK, which claims to be the UK's leading not for profit renewable energy trade association, there are currently 4,510 operational turbines in the UK with 1,183 turbines under construction. Vestas, a major producer of wind turbines, said it had delivered 1,324 wind turbines in the UK by the end of 2012. |

The UK government’s enormous investment is highly laudable but it could be wasted if there are insufficient people to implement the Composites Strategy.

Dr Rod Martin is Chief Executive, Element Hitchin (previously the Materials Engineering Research Laboratory/MERL), which is based in Hitchin, Hertfordshire. He is acutely aware of the personnel challenge as he has many years experience in the development of test methods for materials. Polymer composites are relatively new materials and they could replace traditional ones in thousands of products in the UK.

Martin and his staff have a heavy standards workload. He explains: “It is a 10 year cycle to produce some of these standards.”

In order to produce those standards the UK will need many more polymer composites specialists who understand the materials and how to design and implement test methods.

Martin says that people who are used to designing in steel can be retrained to design with polymer composites. He adds that just getting good people is very hard and laments that “few people want to leave school and become plastics engineers.”

With an enormous pool of talent it will be interesting to see how the UK composites market will grow. ♦

Also see:

- The UK composites industry: bridging the gap between technology and skills Tom Preece, Business Manager, Composites Skills Alliance, explains how the composites skills shortage in the UK is being addressed.

This article will be published in the May/June 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics magazine is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.