Fibres are used to strengthen thermoplastic compounds, improving physical properties such as modulus, tensile strength, heat deflection temperature and dimensional stability. The market for fibre reinforced thermoplastics continues to grow as they replace traditional materials such as metal and as users look for even better performance from plastics. Well-known advantages of thermoplastics over traditional materials include design freedom, reduced weight and corrosion resistance.

Improvements in surface finish are expanding reinforced thermoplastics use into more applications, notes Nitin Apte, general manager of GE Plastics’ LNP Specialty Compounds business.

Growth of fibre reinforced polypropylene (PP), particularly in automotive and appliance applications, is the main driver for growth of fibre use, notes Carl Eckert, principal at Principia Partners Consulting, a marketing and business consulting firm for the plastics and related industries. Reinforced PP continues to replace engineering resins because it is relatively inexpensive, light-weight, and can meet many thermal and physical property requirements.

Globally, glass fibres are the most widely used fibre type in thermoplastic compounds. In North America, glass fibres have more than 90% of the reinforced thermoplastic market share, estimates Principia. Of this, most is short, chopped glass fibres, while about 6% is long glass fibres (LFT) and another 6% is glass mat (GMT), says Principia. Other fibres for thermoplastic reinforcement include wollastonite, a short, fibrous mineral; long, natural fibres, such as flax, hemp, and kenaf; aramid fibres; and carbon fibres. Carbon and stainless steel fibres are used for their electromagnetic interference (EMI) shielding and conductive properties.

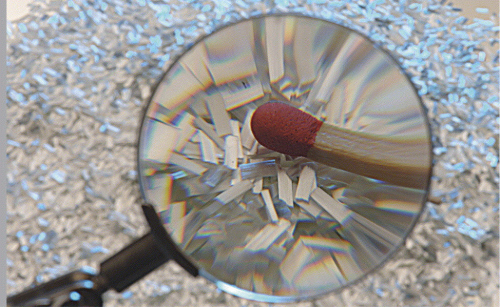

Fibre feeding and dispersion are critical in compounding reinforced thermoplastics. Fibre bundles must have integrity for handling and feeding, but must be able to break down and wet out easily in the extruder. Completely wetting out fibres eliminates loose fibres and helps a compound run smoothly in the moulding process, notes Karl Hoppe, R&D specialist for long fibres at speciality compounder RTP Company. Coupling of the fibre and polymer matrix, another key factor, is affected by the fibre sizing, which is a protective surface coating, and sometimes additional coupling agents. Coupling and dispersion are critical for achieving mechanical and aesthetic properties in the final part.

Glass fibres

Glass fibres are used in a wide range of resins, with the largest volumes going into PP, polyamides (PA), and polyesters (PET/PBT). Automotive applications, such as under-the-hood (bonnet) and cooling system parts, make up at least half of the market for glass fibres in thermoplastics, estimates Mike Petley, director of global marketing for thermoplastics at glass fibre supplier PPG. Other major application areas include electrical and electronics applications like connectors; consumer goods, including sporting equipment; appliance applications, such as washing machine tubs and hand held power tools; and business equipment such as housings.

A new application area is in building and construction, where glass filled thermoplastics are of interest for damage resistant, temporary or modular housing, spurred in North America by hurricane damage in 2005, notes Charles Pratt, leader of thermoplastic technology at glass fibre supplier Owens Corning. In the wind energy market, which is a big growth area for glass reinforced thermosets, there is some investigation into using thermoplastics.

“We are seeing opportunities for highly reinforced, flame retardant compounds in electrical and electronic parts and in structural applications in business machines,” notes Cliff Watkins, vice-president of US compounder TP Composites Inc.

Since these compounds have more filler than plastic, they present a challenge to wetting-out fibres and obtaining uniform dispersion. External dispersion aids help in processing, explains Watkins. Technical advancements in both short glass fibres and long glass fibres, as well as in composite manufacturing processes, are taking composite design to new levels, says Pratt.

“We are developing more tools that allow us to design fibres for better cost-performance in meeting specific application needs. The key is to design the chemistry of the glass sizing so that it handles well, disperses well, and results in good mechanical properties. This must be done in combination with how the composite will be processed, since moulding parameters can affect fibre breakage and final properties,” he adds.

The global market for short glass fibres (SGF) is growing at about 4-6% average annual growth rate (AAGR), with phenomenal growth occurring in Asia, says Petley, noting that PPG opened a glass fibre manufacturing facility in China in 2006 through a joint venture, in addition to its existing joint venture facility in Taiwan. Compounders using chopped short glass fibres continue to look for higher throughputs. New, densified short glass fibre products have improved dry handling and feeding characteristics without negatively affecting wet-out and dispersion characteristics, notes Petley.

Johns Manville's ThermoFlow® technology, first introduced in 2004, has reduced fines content that allows compounders to feed more efficiently.

Glass fibre customers are also looking for increased hydrolysis resistance of glass fibres in polyamides and polyesters, particularly for under-the-hood (bonnet) applications in which high temperatures and more aggressive chemicals in coolant mixes necessitate improved hydrolysis resistance. New products such as PPG's HP3610 and Owens Corning's PerforMax® HR address increased hydrolysis requirements for glass filled PAs. Johns Manville introduced a new ThermoFlow® chopped strand with improved hydrolysis resistance for high-temperature resins such as polyphenylenesulphide (PPS), polysulphone (PSO) and polyetheretherketone (PEEK).

Johns Manville's next generation 600 series of glass fibres, targeted for commercialisation in 2007, is focused on performance improvements in colour, mechanical performance and hydrolysis resistance for PP, PA and PBT. The continued trend towards miniaturisation in electrical and electronic components has created a need for fibres that can perform well in thin-wall parts.

Owens Corning recently introduced MicroMax™, a fine diameter chopped strand, that can allow part wall thicknesses to be reduced by 40% compared to standard glass fibre, says the company. The fibre's small filament diameter and proprietary binder give it good flow, higher mechanical strength, and smoother part surfaces. MicroMax and the new PerforMax® LG chopped strand are designed to reduce outgassing during moulding, which can cause defects in the moulded part. This is particularly important for reflective surfaces and for small electrical and electronic components, explains Pratt.

Segments of the LGF market, such as large structural parts for automotive applications, are growing at 8-12% AAGR, estimates Petley. Long glass fibres can be compounded and pelletised prior to moulding. Alternatively, the moulder can compound fibres, polymer and additives directly in-line with the moulding process (D-LFT). While most LGF market is pre-compounded, D-LFT is growing, driven by cost savings, say industry experts. Drawbacks to D-LFT include high initial capital cost for equipment and the added responsibility for the moulder of formulating and material certification.

While D-LFT had some past problems with dispersion, improvements in equipment, resin, and fibres have made D-LFT competitive with pre-compounding, says Steve Bassetti, global product associate for reinforcements at Johns Manville. The company's StarStran® LCF long chopped fibre product, now being commercialised, is designed to be easily dispersed and wet-out under low-shear. PPG plans to introduce several new LGF products in 2007 that are designed for D-LFT of either PP, PA or polyesters. While fibres that are compatible with multiple materials are preferred for the logistics of pre-compounding pellets, D-LFT can use resin-specific glass fibres to maximize physical property performance in a particular resin, explains Petley.

Owens Corning recently introduced new long glass fibre products designed for either pellet or D-LFT processes, including SE4531 for higher heat resistance and higher stiffness in PA-LFT products. In pre-compounded pellets, there is a trend towards LF concentrates, containing 60-80% glass fibre, which can be let-down in the moulder's process to save costs as an alternative to D-LFT.

Natural fibres

Natural fibres, including flax, hemp, jute, sisal, abaca and kenaf, have been used commercially since the 1990s in thermoplastic mats for compression moulded, interior automotive applications. A second generation of wood fillers is used in profile extruded wood-plastic composites for decking and other applications. The next generation of natural fibre composites, compounded for use in injection moulding, is just beginning to be commercialised. Although most of the industry is still early on the learning curve, a few compounders such as Netherlands-based GreenGran and French company AFT Plasturgie claim to have overcome problems such as feeding and poor properties. Some who have tried compounding natural fibres point to processing problems such as excessive friability, which causes feeding difficulties, and high moisture contents that need venting and have the potential to slow extrusion rates. Potential end-use problems include low thermal stability, which limits use to resins that process at lower temperatures, and water absorption, which causes properties to vary depending on humidity.

These problems can be overcome with proper compounding techniques, counters Martin Snijder of GreenGran. Pre-treating the fibres and increasing their bulk density allows natural fibres to be fed into the extruder at industrial throughputs, he says.

“The right combination of compounding parameters and compatibilisers prevents voids and blends the fibre with the plastic as well as breaks down the fibre to dimensions equivalent to glass fibres. The compounding quality determines mechanical properties and moisture sensitivity,” explains Snijder.

Limits of natural fibre composites are lower impact resistance than glass filled composites and possible long-term moisture sensitivity in outdoor applications, admits Snijder. However, natural fibres have advantages of lighter weight, lower cost and a ‘green’ image. The composites also show high heat deflection temperature (HDT) performance and improved acoustic and thermal isolation properties.

“The primary driver for use of agrofibre composites (AFC) is its good price-performance balance, with both strength and stiffness properties comparable to glass filled. The green image is a secondary driver and marketing tool,” says Snijder.

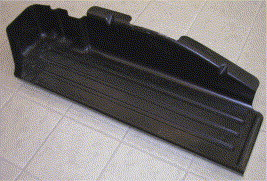

The environmental profile of fibres is a concern for the automotive industry in Europe; the End-of-Life Vehicle (ELV) directive currently mandates a reuse or recycling rate of 85% by average weight per vehicle, increasing to 95% by 2015. Natural fibres have an advantage over glass fibres because natural fibres are easier to recycle and can potentially be composted or incinerated. Globally, AFCs are being evaluated for replacing SGF in automotive applications such as instrument panels and under-the-hood (bonnet) applications such as battery trays and fuse boxes, says Snijder. The packaging industry is also showing a serious interest in AFCs, he adds. GreenGran is currently producing at pilot scale and expects to begin industrial-scale production in the first quarter of 2007.

Aramid fibres

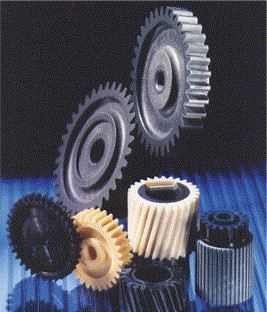

Aramid fibres are used primarily in high temperature engineering thermoplastics such as polyamides (PA), polybutylene terephthalate (PBT), polycarbonate (PC) and styrene-ethylene-butylene-styrene (SEBS). Application areas include automotive and electrical and electronics. Aramid fibres reduce wear in a reinforced part, and have an advantage over other fibre types of causing minimal wear to counter materials. This is critical for parts such as bushings, bearings, and gear wheels. Aramid fibres also have the advantage of making a lighter weight composite.

“Aramid fibres are seeing growth in the automotive and electrical and electronic areas, where the trend is towards lighter, more compact components that require higher load bearing capacity, higher operating speeds and temperatures, and higher wear resistance,” comments Thomas Bijker, business manager for composites and intermediates at Teijin Twaron BV, a supplier of aramid materials. Twaron recently introduced fibres with PET-based and PU-based sizings that have much improved dosability, says the company.

Carbon fibres

While carbon fibres are primarily used in thermosets, with large amounts going into aerospace applications, there are also some interesting applications in thermoplastics. In thermoplastics, carbon fibres are used for conductivity, such as in electronics materials handling; for strength, such as in structural parts; and in some applications for both strength and conductivity.

Supply of carbon fibres is currently very tight. Carbon fibre producers such as Hexcel, Toray and Cytec have announced capacity expansion plans, which are mainly driven by aerospace needs for continuous fibre but are hoped to also help ease the supply for thermoplastics. The carbon fibre shortage drives designers to consider alternative technologies, such as nanomaterials or glass, aramid, or stainless steel fibres, notes Chris Landis, business director for PolyOne's Engineered Materials Group . PolyOne's Edgetek™ compounds, containing carbon or glass fibres, are used in industrial fluid-handling applications such as pump housings and impellers.

Nanomaterials

While not fibrous in form, nanomaterials are beginning to compete commercially with fibres in thermoplastic reinforcement. PolyOne's Nanoblend™ compounds and concentrates, using nanoclays, are used to obtain improved toughness and stiffness compared to traditional mineral fillers and lighter weight than glass fibres, explains Landis. Nanoblend compounds are recommended for applications such as automotive interior and exterior trim and air handling system components; appliance assemblies; and industrial applications including telecommunications. In many of these applications they compete with glass fibre reinforced compounds, says Landis.

GE Plastics’ HMD (high modulus ductile) technology incorporates a proprietary, non-clay nanomaterial to increase modulus and reduce coefficient of thermal expansion (CTE) with a low specific gravity compared to fibres. HMD is being used commercially in injection moulded automotive applications.

“We continue to look at HMD technology across resins and processing lines as an enabling technology. Other applications such as consumer electronics might be able to take advantage of its properties,” adds Apte.

An emerging class of materials that holds great promise for reinforcing plastics is carbon nanotubes (CNTs), notes Ned Bryant, product development engineer at RTP Company. CNTs are hollow cylinders of conductive graphite sheets that are thousands of times smaller in diameter than carbon fibres. CNTs have extremely high aspect ratios, which should translate into high strength reinforcement at very low loadings. RTP's CNT based composites create a more uniform conductive surface, reducing the occurrence of electrical hot spots commonly found in carbon fibre filled compounds. These composites also enable thin-wall moulds to fill at lower temperatures, resulting in significant weight savings and greatly reduced particulate generation, says the company.