Thermoplastic composites (TPCs) are a beguiling technology that look set to take a growing share of the reinforced plastics market. Many see this material class as the future wave in composites, envisaging everything from rapidly thermoformed structural parts for electric cars to impact-resistant leading edges on fast-moving aerodynamic surfaces. Some see it as being the ‘missing link’ between exotic top-end applications and the mass market. Ironically, thermoplastics are up against similar constraints to those faced by thermosets in competing with metals. By now there is a considerable body of experience over a wide application base and growing designer confidence in the use of thermosets, enabling these composites to displace or partner metals. But this was not always so and TPCs face those same barriers that thermoset composites have largely overcome - lack of familiarity, established design codes, properties database, proven production technologies etc. Investment has tended to follow tried and tested conventional composites, causing reinforced thermosets to thrive while TPCs, seen as higher risk, have only gradually emerged from the shadows. Today, however, it is better understood that thermoplastics have much to offer. For air vehicles they can provide superior toughness - several times the impact resistance of their thermoset competitors; low FST characteristics, resistance to most aviation fluids and, prior to manufacture, an indefinite shelf-life in material stores. Being melt-processable, they can be thermoformed and later re-formed for new uses. They are fusion weldable to produce high integrity joints, avoiding the weight and expense of fasteners. At the ends of service lives they are recyclable. Production processes are typically much more rapid and generally autoclave-free. Emission of VOCs during production is not an issue. Fibre placement processes and other automation can be used. This type of composite lends itself to highly integrated structures and this, combined with low weight, makes these materials just as valuable in minimising structural mass as thermosets. The automotive sector will appreciate cycle times that are more consistent with production of hundreds of vehicles per day than with the 10 to 12 aircraft a month that leading commercial airframers aim for. Indeed, TPC parts can be produced in cycle times of only a few minutes, a fraction of the curing times needed for thermoset components. As with the aerospace sector, the materials’ weight reduction possibilities are crucial, particularly in electric and hybrid vehicles. Another big plus for automotive manufacturers is that thermoplastics can help them meet the stringent post-life recycling targets now being imposed by national and international regulators. On the downside, because most thermoplastic resins are naturally highly viscous, rather than liquid as with thermosets, impregnating reinforcing fibres is more difficult and generally requires heat, to melt the resin, and pressure. Special tooling and equipment are needed for this, adding to manufacturing cost. There may still be issues around the strength of the bond between the thermoplastic resin and the reinforcing fibres, although improvements in fibre sizing and surface treatments have progressively reduced this problem. Also on the downside is the fact that some thermoplastics are more inclined than thermosets to creep over time when under load. Certain thermoplastics will degrade in direct strong sun and ultraviolet light. Others may start to melt in high temperatures, although there are thermoplastics that can withstand temperatures in excess of 300°C. Here are some examples of how thermoplastics are ‘making waves’ in particular application sectors.

Aerospace

Aircraft constructors have blazed a trail for thermoplastic composite structures, favouring high-specification resins such as polyetheretherketone (PEEK), polyetherketone (PEK), polyetherimide (PEI, polyethersulphone (PES) and polyphenylene sulphide (PPS). For example, Westland Helicopters experimented with PEEK composite tailplanes for helicopters over a decade ago. Today Agusta-Westland, the original firm’s Anglo-Italian corporate successor, is using carbon-reinforced PPS for the tailplane of its commercial AW169 helicopter. The 3m long main body of the horizontal tailplane comprises four preformed panels that are joined by thermo-fusing them together under pressure. The high impact resistance of the thermoplastic is particularly valuable at the tailplane leading edge. Overall, the design is some 15% lighter than Agusta-Westland’s previous equivalent metal design. The tailplane is manufactured from TPC fabrics produced by Dutch specialist TenCate Advanced Composites BV using Fortron carbon PPS supplied by Ticona GmbH of Germany. Fokker Aerostructures was also involved in the award winning project as designer of the structure. TenCate in particular has been a leading proponent and developer of continuous fibre reinforced thermoplastic composites and now markets a range of materials including unidirectional fabric-based prepregs combining carbon, glass or aramid fibre reinforcement with PEEK, PEI and PPS resins, under the TenCate Cetex® brand. Leading edges on the wings of Airbus’ flagship superjumbo, the A380, and the smaller four-engined A340 are of PPS-based composite, again securing high impact resistance. Cetex semi-preg material protects areas of the fuselage sides on the Airbus A400M Atlas military aircraft from chunks of ice thrown from the propeller tips of the four turboprop-engined military airlifter in certain weather conditions. The Gulfstream Aerospace G650 business jet has TPC rudder and elevator, these being made up of parts that are induction-welded together. The structures are made from TenCate Cetex carbon reinforced PPS prepregs. An inductive welding robot is used to weld spars and ribs to the skins, the carbon serving to conduct the heat during the process. To achieve the highest levels of quality, these parts are given an additional cycle in an autoclave. Frank Meurs, Group Director of TenCate Advanced Composites, calls this a classic application for TPCs saying:

“It brings together advanced design, materials and processing in a winning combination that has resulted in a high-performance primary aerostructure. Impact behaviour, low weight and part integration are strong points.”

In addition, the control surfaces, believed to be the first thermoplastic primary structure to fly on a commercial airplane, are said to weigh a tenth less than the previous (thermoset based) composite design and cost a fifth less. TenCate materials are used in a range of commercial and military aerospace applications including radomes, unmanned air vehicles (UAVs), helicopters, light aircraft, missiles, satellites and space platforms. Frank Meurs points to the two and a half decades of experience the company has in TPC application, particularly in aerospace. This includes extensive flight experience with its TPC prepregs, which are valued for their optimised resin chemistries and their ability to improve part throughput and productivity using cost-effective out-of-autoclave processing. The company also supplies TPC materials and expertise to makers of industrial, recreational, communications and ballistic protection systems. The Netherlands as a whole has built leading expertise in fibre reinforced thermoplastics. TenCate has long collaborated with the University of Delft on material development, while since 2008 the University of Twente, through its Research in Production Technology group (TPRC), has been working with TenCate, Fokker Aerostructures and Boeing on thermoplastic composites, with a particular focus on joining and bonding methods. Recently, French Tier 1 supplier Daher-Socota has joined the group to help develop and foster reinforced thermoplastic technologies for aerospace applications. The French company already has a substantial track record in reinforced thermoplastics having delivered parts for five aircraft programmes in 2013 alone, says Stephane Mayer, its President and CEO. According to a Daher statement:

“Application of these high-tech materials is growing as they offer clear advantages over thermoset composites in that they can be formed and welded at elevated temperatures, making them suitable for rapid production techniques such as ultrasonic and induction welding.”

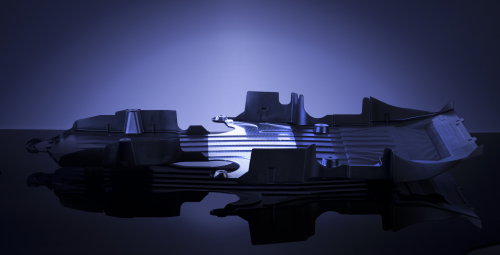

Daher-Socota utilises a range of fibre/resin combinations including carbon and glass fibre matched with PEEK, PEK, PPS and PEI matrices. Its manufacturing centre in Nantes, France, produces for Airbus the cockpit floor for the A400M Atlas military airlifter; spars, ribs and pylon components for the popular A320 commercial jet; and the myriad clips that connect the composite fuselage panels for the new Airbus A350 XWB to the underlying rib and stringer framework. The fasteners are made from Cetex PPS-based blanks supplied by TenCate with bespoke ply counts and orientations. These are delivered in 3.7 by 1.2 metre sheets between two and five millimetres thick. Items are cut out then infra-red pre-heated before being pressed to shape in a heated mould. Costs, particularly for PEEK, are still a factor that constrain adoption of aerospace thermoplastics. Attempts to use cheaper and faster processing PEKK more widely are held back by the latter’s lower mechanical performance, but researchers hope to develop a new matrix that is midway between PEEK and PEKK in terms of properties and cost. Such a material might be affordable for use in wings, where its resistance to corrosive jet fuel and other fluids would be advantageous.

Automotive

Another field holding high promise for TPCs is the automotive sector, and in particular the electric vehicles that are expected to end the dominance of ubiquitous internal combustion engined vehicles. Indeed, electric cars are appearing on the roads now. An interesting example is the BMWi3 from the well-known German automotive maker. This five-door urban electric car, BMW’s first zero-emissions mass-produced vehicle, is also the first car to have a thermoplastic exterior skin. Although in this case the thermoplastic is not fibre reinforced, the application will help accelerate adoption of technical thermoplastics, both reinforced and unreinforced, in road vehicles, so is worthy of mention here. To deliver on its promise of an 80 to 100 mile range between charges (a hybrid option is available for longer ranges) the BMWi3 has been engineered to be as light as possible. Hence, while most of the internal structure and body are of carbon fibre reinforced thermoset plastic, the outer skin consists of EDPM-modified polypropylene (PP) thermoplastic, except for the roof which is of recycled CFRP. BMW says that as well as being exceptionally light, the outer skin is corrosion-free, highly resistant to damage and requires less energy to manufacture. The thermoplastic structure is produced at BMW’s Leipzig plant using 25% recycled or renewable material. Like the front and rear aprons on conventional BMW models, the BMWi3 parts are injection moulded and later fused together under heat. The final result is a tough car body that is about half the weight of an equivalent made from welded steel panels. A number of internal components are of carbon fibre reinforced polyurethane (PU) and are claimed to be the first vehicular use of this TPC. For example, a composite comprising fibre from recycled CFRP reinforcing a polyurethane matrix is used for the rear seat shells. This technology is predicted to have wide application potential for the future. Other applications involve specific components. Swiss company Kringlan Composites AG, for example, is collaborating with TenCate Advanced Composites to develop a carbon reinforced thermoplastic wheel for high performance cars. Kringlan is responsible for design and manufacturing aspects while TenCate is injecting its TPC expertise. A weight reduction of 30 to 40 percent is expected compared with equivalent metal wheels. Kringlan says it has developed a patented technology that can be used for the series production of composite wheels that comply with the highest performance standards, including high load bearing and impact resistance capabilities. TenCate predicts that TPC, digital printing and advanced 3D design technologies will come together in a range of future vehicle components that will help automotive makers meet increasingly stringent legislative requirements, not only for emissions reduction and road safety but also for recycling at the end of service life.

Among several further applications currently in various stages of development are a tipping dump truck the skip (tipping section) of which is TPC based, and ‘Superbus’, a call bus system in which much of the structure is TPC-based. TenCate’s Frank Meurs predicts a rosy future for automotive TPCs. As he tells Reinforced Plastics:

“There is enormous scope for reducing the process times associated with thermoset fabrication. This is hugely important in products like cars that are manufactured in high volumes. Another plus is the relative ease of part integration, leading to substantial part count reduction and a further increment in overall speed of production. I see increased future use of reinforced thermoplastics in primary structural parts of a vehicle such as pillars and frames.”

TenCate is also in a working alliance with BASF to develop mouldable materials in which long fibre reinforcements will be included in densities and orientations determined by the structural requirements of automotive clients.

Renewables

There is also scope for reinforced thermoplastics in renewable energy structures. Manufacturers of wind turbine blades, for example, are tempted by the short mould cycle times and the relative ease of repair and recyclability that TPCs potentially offer, although currently they are daunted by the practicalities of moulding on such a large scale and by uncertainties around static and fatigue properties, moisture uptake and especially cost. A liquid or near-liquid resin is required because melt processing under pressure of a highly viscous matrix material is not feasible at the large scale of a utility turbine blade. Hence EireComposites Teo in Ireland has produced a 12.6m (85ft) long blade using cyclic butylene teraphthalate (CBT), a liquid moulding thermoplastic, reinforced with glass fibre. This R&D project was part of the company’s Greenblade programme aimed at developing large TPC blades that are lighter and more affordable than the thermoset-based blades which predominate at present, as well as being quicker to produce and recyclable at the end of service life. Partnering EireComposites in the programme were Mitsubishi Heavy Industries, Ahlstrom Glassfibre and Cyclics Corporation. Meanwhile, Dutch blade maker Global Blade Technology (trading name for the now bankrupt General Blade Technology BV), targeted blade affordability in working with a team from Delft University of Technology which had developed an anionic polyamide (APA-6), a reactive thermoplastic that is highly liquid and processes somewhat like a thermoset. A Delft source described the viscosity of APA-6 as ‘water like’, so that it readily wets out reinforcing fibres during initial production of the composite. This thermoplastic is said to exhibit outstanding static properties and good resistance to fatigue, one of the main requirements of wind turbine blade composites. Relative affordability, short infusion and curing times, and economic recyclability are other claimed advantages. Experiments have suggested, however, that APA-6 may be more prone to moisture uptake than CBT, creating a need for drying during the production cycle. Debate continues as to which low-viscosity matrix material might be the best suited to wind turbine blade manufacture, or indeed whether other thermoplastics might be preferable. Whatever material is chosen, it will have to be amenable to the vacuum infusion processes that most blade manufacturers have adopted and must be affordable in bulk. Currently a four-year project part-funded by the European Commission under the Seventh Framework Programme is under way to improve blade design by substituting high-performance TPCs for thermosets in certain parts of offshore wind blades. The Wind Blade Using Cost-Effective Advanced Composite Light-Weight Design (WALiD) project, which commenced last year, is aimed at introducing TPCs into the blade root, tip, shell core and sheer web so as to save weight and cost. Replacing the shell core with thermoplastic foam materials will, it is suggested, enable the density of the core material to be optimised to the loads present in various zones of the blade while also being compatible with fast automatic processing. A thermoplastic coating will improve blades’ environmental and abrasion resistance, plus anti-icing properties and durability. Eleven European organisations make up the WALiD consortium, which is committing just over €5m to the project while the European Commission provides almost €4m. Certain organisations including, for instance, leading blade producer LM Wind Power of Denmark, fear that TPC technology is too expensive to adopt in place of conventional thermosets in wind turbine blades and that no TPC system is yet ready to challenge thermoset primacy. Even EireComposites apparently has reservations about such factors as drying cycle times, viscosity variation, tool cooling and CBT availability, causing it to seek novel thermoset solutions such as use of powdered epoxy technology instead. However, the inherent attraction of TPCs remains high and researchers continue to seek just that combination of materials, tooling and processing methods that will provide the tipping point for this form of composite in blade manufacture. No doubt all the above and many other issues will be debated in detail at the forthcoming 2nd International Conference and Exhibition on Thermoplastic Composites (ITHEC 2014) due to be held in Bremen, Germany, in October. Delegates might come away with a better idea of whether TPCs really are the wave of the future in composites and, if they are, how disruptive/creative that wave may prove to be. ♦

This article was published in the July/August 2014 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing this short registration form.