Today's performance requirements for the global rail industry demand that trains travel faster and carry more passengers and freight. Improved fire, smoke and toxicity (FST) properties are also desired for enhanced safety as rail systems carry more people on a daily basis. In the United States in 2007, 10.3 billion people rode the rails in 34 billion trips per week, reflecting a 50 year high.

Market estimates for FRP in exterior and interior rail components vary, but overall, demand is seen as steady and positive for growth over the next few years. Stronger emphasis on environmental stewardship is also driving this industry to materials with greener chemistry as an alternative to traditional materials, such as composite cross ties, called ‘sleepers’, as a replacement for creosote-treated wood rail ties.

Getting onboard big time

When it comes to increased speed and locomotive pulling power, major rolling stock manufacturers are announcing significant international contracts for new trains operating from all points on the globe. This year, Alstom's Transport Division of Levallois-Perret, France, has been contracted to provide 242 R160 subway cars for New York's Metropolitan Transit Authority in a project worth €360 million (US$491 million). With an 8% capture of the locomotive market, Alstom will also be providing 180 electric Primas to China. Canada's Bombardier will supply 45 double-decker passenger cars for operation on the Danish State Railway system in a contract worth €75 million ($101 million). Valued at €298 million ($380 million), Bombardier's contract with the Land Transport Authority of Singapore involves an order for 219 metro cars.

Making history by building train sets for Russia's first high speed train, the Mobility Division of Germany's Siemens AG is slated to deliver eight trains by 2010. The 250 km/h (135 mph)Velaro RUS has an installed traction power of 8000 kW (11 000 horsepower), and the Siemens contract, including a 30 year maintenance period, is worth €600 million ($748 million). The Russian government may invest up to € 400 billion ($499 billion) in new trains and railway network expansions by 2030, representing some 20 000 km (12 400 miles) of new rail lines. In a € 35 million ($43.6 million) contract, Siemens will provide 10 Class ER20CF freight locomotives to the Lithuanian Railway.

In October, GE Transportation of Erie, Pennsylvania, USA, and Bharat Heavy Electricals Ltd of New Delhi, India, joined forces to compete for a 1000 diesel locomotive tender issued by Indian Railways. GE's bid is based on its Evolution Series locomotive platform, with a peak output of 6000 GHP delivering 40% more power at 30% less weight and 5% greater fuel efficiency than other same-class locomotives. In September, Kawasaki Heavy Industries Ltd of Tokyo, Japan, announced its in-house development of the 350 km/h (189 mph) efSET train, with an eye toward global rail construction projects of an estimated 10 000 km (6213 miles) of new track emerging in the USA, Brazil, Russia, India and Vietnam.

SMC boosts FST properties

Greater application of fibre reinforced plastics (FRP) within even a portion of these train set designs could be an important indicator of the eventual scale of growth possible in this market. A representative of Siemens tells Reinforced Plastics that the rail market is growing “as a result of infrastructure demands by the increasing world population, with composites offering significant weight advantages compared to other materials.” FRP components on the Velaro RUS will be used in the interior and front end coverings. Siemens also uses glass reinforced sheet moulding compound (SMC) in its Desiro trains running in Europe, specifically SMC 2400 from Menzolit-Fibron GmbH.

Introduced in 2005, this polyester-based compound meets the strongest fire safety standard in Europe – British standard BS 6853 for railways – and is also used in interior components on the Tucheng rail line in China and street cars in Berlin. According to Peter Stachel, Director of Technology, Menzolit's rail market represents €3 million annually within the company's total business volume of €130 million. He says Menzolit sees the rail market optimistically: “The days of cheap fuel are gone, even in the US, and this will give a boost to public transport, including in Russia and Asia.”

In wall claddings, window frames, door and seat structures, SMC 2400 is easily moulded in large panels. A key FST ingredient is aluminium-trihydrate (ATH), a mineral filler that acts as a quenching element in the SMC by releasing water at elevated temperature up to 200° C (392° F), “like a built in fire extinguisher,” Stachel explains. Menzolit is using up to 350 parts ATH and 30% fibre loading in SMC 2400.

“Under fire conditions, SMC components do not generate poisonous gases, collapse, or spread molten material or droplets,” adds Stachel, “keeping escape ways open for passengers to get out.”

He notes that every country and often each rolling stock operator has different specifications for FST performance, which adds to the complexity of supplying materials and cost to the end product.

Phenolic prepregs

The range of interior rail components forms an impressive list, including seating, ceilings, floorings, bulkheads, vestibules, fire barriers, wall panels, window surrounds, doors, corridor adapter frames, staircases, luggage bins/racks, fairings, and toilet modules. E-glass reinforced phenolic prepregs from Gurit's Aerospace and Rail divisions in Switzerland and Germany, feature good surface finish achieved in short cure cycles (10 minutes at 160° C) with 63–68% glass loading. The prepregs have been used in interior components aboard the Siemens high speed AVE S103 in Spain and in the exterior front end for the Combino Plus in Portugal.

Gurit's PH840-300-42 prepreg is available in 8H satin woven fabric with 42% phenolic resin, whereas PH840-600-40 comes in satin HD special with 40% phenolic resin. PH840-M850-37 is a non-crimp fabric with 37% phenolic resin. All three prepregs are designed for laminate with bright colour. Cure can be performed by press, vacuum and autoclave moulding. Service temperature in cured state is reported at −55° C to +80° C.

The fabrics meet these European flame retardant rail specifications: BS 476-6 and 7 Class 1, BS 6853 R. 025 (UK), NF-F 16-101/102 (M1, F1), UNE 23-721 (M1), DIN 5510 S4, SR2, ST2 and DIN EN 455-45 now under testing.

Matthias Hucke of Gurit reports that the rail business represents a fairly small annual output, though a single rail project in China recently required a much greater material output, and “the potential for future projects is very high.” Gurit introduced the prepregs in 2000, primarily to provide FST protection for subways or trains used mostly in tunnels.

“Gurit's knowledge stemmed from its experience in interior applications for the aerospace market since the construction for rail car interiors has similarities,” says Matthias.

Transport cores

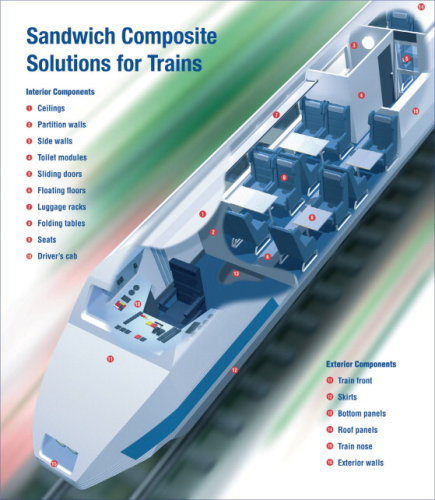

A well known name in the composites industry for its Divinycell core materials used in sandwich constructed composites is DIAB, headquartered in Laholm, Sweden, with production facilities for its transport cores, Divinycell F and Divinycell P, in DeSoto, Texas, USA. Sandwich cores are suited to rail applications in both interior and exterior components, the latter including skirts and fairings, train front and nose components, and bottom/roof panels. Petr Bartusek of DIAB's marketing group in the Americas, reports that the strength-to-weight ratio of composites over steel and aluminium is garnering inquiries for the P and F cores in metro, light rail and tram projects.

“We are working closely with many of the leading producers of rolling stock and their sub-suppliers in Europe and Asia, and we expect the use of fibre reinforced composites to increase substantially in the next few years,” he says. “We have received positive feedback from the industry, and these materials are already being specified for projects by these OEMs.”

DIAB's transport cores are thermoplastic, recyclable, compatible with polyester, vinyl ester, epoxy and phenolic resins, and have been designed for FST performance at elevated temperature. Divinycell F shows excellent heat aging at 180° C (356° F) and is compatible with most common composite manufacturing processes up to 220° C (428° F) cure cycles, including prepregs and infusion. When used with most prepregs, the cores do not require a film adhesive. In either plain sheets or kit form, the F cores are available in three densities: 50, 90 and 130 kg/m3 (3.1, 5.6 and 8.1 lb/ft3). Divinycell P is available in densities of 60, 100 and 150 kg/m3 (132, 220, and 331 lb/ft3) with a processing window to 150° C (302° F). Grid scored, double cut and infusion grooved or perforated finishes are available, and this core has demonstrated positive acoustic and thermal insulation properties and low water absorption.

Trains capitalising on the benefits of DIAB's core materials in composite rail components are the Austrian Bayerische Oberlandbahn (flooring), Siemens Combino tram (front panel incorporating bumper), Bombardier's Talent and Regina trains (front, sides and roof) and the Adtranz Regio Shuttle (front panel).

“There is little doubt that the railway industry is looking to further reduce operating costs,” Bartusek concludes. “FRP composites not only offer light weight/high strength solutions, but also can reduce maintenance costs.”

FRP composites not only offer light weight/high strength solutions, but also can reduce maintenance costs.

Introduced in 2005, the T90 foamable polyethylene terephthalate (PET) core from Alcan Airex of Sins, Switzerland, is used in interior components such as floors, sidewalls and engine covers on a wide variety of trains in Austria, the Czech Republic, Finland, Zurich, Germany, China and Switzerland. These include double-decker intercity trains, high speed trains, and tram systems. T90 has demonstrated high compressive strength in panel edge close outs and the ability to bond well with metals and glass reinforced fabric skins. Onboard Siemens' Combino tram cars, the T90 core is used in 20 mm thickness with glass/phenolic skins in a partition wall between cockpit and passenger compartment. Besides being easy to cut and trim, the T90 core shows thermal stability and compatibility with multiple adhesives. This results in lower manufacturing costs and increased part quality.

Philipp Angst, Product Manager for Core Materials in Europe at Alcan Airex, cites the economic benefits of continuously extruded PET core as compared to Alcan Airex's R82 batch extruded polyetherimide (PEI) core, which has even higher FST properties. He believes that Europe's environmental ‘greening’ trend is one of the drivers for more use of FRP in rail; the other being cost as lighter weight is always a translation to boosting freight and passenger revenues. Angst expects “these trends to open new market opportunities for us.”

Tie that binds

In its 2007 State of the Recycled Plastic Lumber Industry, the Plastic Lumber Trade Association of Worthington, Minnesota, USA, reports that demand for plastic rail ties, which have been in use for about 12 years, grew considerably in 2007. Composite ties resist decay, insect attack, water absorption, and temperature extremes under load.

“As the railroad industry continues to green itself,” states the report, “the perception of creosote-treated wood and the use of hard woods as being less environmentally friendly is helping boost the image of recycled plastic lumber ties.”

Cross ties are short, rectangular beams laid about 2 ft apart and on top of the rail bed or crushed stone ballast. As the name implies, cross ties are placed in between and transverse to the metal rails. Used to anchor the rails and clamped to the rails with spikes or bolts, cross ties must endure exposure to the elements, and for wood ties, this limits them to a five to seven year lifetime. Concrete and steel sleepers are also utilised, but each has its tradeoffs in weight and corrosion issues.

Rex Crick, CEO of Recycle Technologies International (RTI) in LaBelle, Florida, USA, estimates total current capacity for composite rail ties (qualified for this article as containing glass fibre, carbon fibre, or mineral fillers as reinforcement of commodity resin such as polyethylene (PE) and polyurethane (PU) from recycled products) at 600 000 annually. These ties weigh around 250 lbs each, and Crick believes the cost ranges from $85 to $105 per tie. RTI extrudes its PermaTie from PE and talc, a mineral filler, at 25-35% filler loading. The company makes its Permatie in lengths from 3 m to 6 m (8.5 ft to 16 ft). A recent project in Oklahoma involves several thousand ties for its largest customer, Burlington Northern Santa Fe Railroad.

“We've also sold many ties to the US Army for installation on their bases. There's no need to drill holes in RTI ties, since they can be staked the same way that wood ties are staked, which saves on labour and equipment,” Crick states.

Costs to install or replace wood or composite ties can range from $70 to $200 per tie, and some 17 to 18 million ties, or about 5% of the total of those in place now in the US and Canada, must be replaced every year. Because of this expense, Crick believes that “there will always be a need for wood ties, with composites used to replace every third or fourth wood sleeper.” In his estimation, this translates to 800-900 composite ties per rail mile.

“With the 40 to 50 year life of a composite tie, the added expense can be recovered within the time frame in which wood ties are usually replaced, and composite ties hold the rail gauge well. This is truly an engineered material.”

RTI expects to select two new expansion locations for producing PermaTies in 2009, and Crick sees growing interest from rail companies in Mexico and Brazil.

“The demand is there, it could reach up to a million ties a year just for Class l railroads in the US and Canada,” says Crick.

The leading US supplier of composite rail ties is TieTek LLC of Dallas, Texas, USA, a subsidiary of North American Technologies Group, with over a million of its TieTek PE sleepers in service and carrying more than two billion gross tons of load. To gain tensile strength and stiffness, some 10-15% fibre glass reinforcement is part of the tie formulation that also includes recycled polyethylene, rubber from waste tires, and structural mineral fillers. In 2007, the company sold 350 000 ties, predominantly in North America.

Rod Wallace, CEO of TieTek, tells Reinforced Plastics that the market for composite ties is growing due to benefits such as higher abrasion resistance and reduced noise and vibration, and “because heavier rail use shortens the life of existing ties on track. While rail regulations have not changed related to composite ties, there is clearly increased concern about the environment, which favours our product.”

Wallace verifies that about 3300 composite ties make up a typical track mile. Production of 300 000 ties requires about 60 million lbs of high density PE from the recyclate waste stream and eliminates harvesting from some 75 000 hard wood trees for a commensurate number of wood ties.

Two of the company's key customers are Union Pacific Railroad and the Chicago Transit Authority (CTA), representing a combined installation of about 200 000 TieTek composite ties to date. CTA definitely has a green perspective, claiming to be the US' largest purchaser of recycled-content plastic (composite) railroad ties. Use of these products began within the CTA system in 1998. Last December, the CTA began a $90 million upgrade of its 20-mile Blue Line track from Addison to O'Hare Airport, including the addition of the TieTek composite ties. Spaced 20 inches apart and secured with four bolts each, the ties were selected by the CTA for long lifetime, reduced maintenance, and a more comfortable ride with, as one passenger put it, “less wiggle wobble.” Train speeds have increased fourfold on this upgraded line.

Other US companies which market composite ties (again by the definition of this article) include Performance Rail Tie of Paris, Texas, USA, with its CavityTie design and split mould manufacturing process, and Axion International of Basking Ridge, New Jersey, USA, utilising materials and processing technology based on research and testing started in the mid-1990s by Rutgers University. The Indian Department of Science and Technology has composite tie R&D underway, as does Australian sleeper OEM, Austrak.

New history in the making

In rail projects across the globe, FRP has the potential to break out of its relatively small, and slow but steady ‘sleeper’ market position and into more widespread usage. Reflecting on “one of the greatest signs that Europe and its rail systems has changed,” Menzolit's Stachel points out that high speed trains as well as intercity trains now travel regularly from Paris to Heidelberg, Stuttgart and Munich.

“The last time trains were travelling directly between these French and German cities was some 60 years ago when they carried soldiers to combat,” he says. “To me, this demonstrates the renewed importance of long distance public transport.”

This change in historic rail routes could also bring a chance for the benefits of composite materials, including safety, positive strength/weight ratio and economic producibility.