China is a land with a long history, undergoing rapid change. The marine composites industry parallels this, being typecast with the legacy of ‘old technology,’ but in reality transforming itself to be world class in many areas.

The domestic market has been almost entirely focussed on commercial and paramilitary craft, with no tradition of a leisure boat sector. The latter is predicted to grow (some say explode) with the rising wealth of the entrepreneurs driving the economic growth, but there are differing views as to the timing of this. The report produced by YP Loke for BoatTech China estimated some 250 builders of glass reinforced plastic (GRP) craft in the 10-20 m range in 2006.

Commercial craft are governed by the China Classification Society (CCS) rules, and until recently these were out of step with the international developments in composites technology. The most recent version, with the exception of a few clauses, is a well-written, modern set of requirements, reflecting current knowledge about loadings, construction techniques and materials. However, the current designs are more in line with what was permitted in the past, and the boat builders have yet to adapt to the new regulatory environment. As a result, many of the small craft being built for local use are very conventional in their construction philosophy, with single skin shells, a grillage of close spaced frames, and based solely on chopped strand mat (CSM)/woven roving (WR) in polyester resin. In order for these boat builders to move with the times and adopt sandwich construction, as well as making use of the more efficient and now readily available multiaxial reinforcements, they need to present well engineered arguments to the CCS, explaining what they want to do and demonstrating that their approach meets the current rules. It is not necessarily a change in attitude of the governing body, which is in fact quite forward thinking, that is required to help move forward the use of new technology.

The specifications for production leisure boats built for the offshore market are not constrained by local rules. However, in many situations the laminates are still very traditional in their approach, due to the fact the boats being built are older models, often heavier displacement, and hence not weight critical. These projects have come from Taiwan as the boat builders there move ‘up market,’ producing larger, semi-custom motor yachts. As labour costs in Taiwan increased, their 12-18 m models became uneconomic given the established price point in the international market, and they have transferred production to mainland China – and with it the construction technology of a decade or so past. This was understandable as the build processes were tried and true, and easy to replicate with a new workforce. As the boat yards become established, and more capable, and as other materials become available locally, there is a shift away from the conventional CSM/WR approach, but this has to be justified against a number of criteria, not the least being cost of construction.

The cost of construction in China is likely to be less than in other environments, due to the lower labour cost. However, the lower material costs also play an important role. The composites market as a whole is huge in China, and the marine sector piggy backs on this, with the opportunity to source commodity products at much lower rates than in other low labour cost locations. An increasing number of suppliers of the next level of technology are becoming established in China, such as multiaxial weavers, epoxy resin formulators and core manufacturers. As High Modulus illustrated in its paper at BoatTech China 2006, the differences in labour and material costs may result in a lower cost laminate specification which is unlike that found in the US or other markets. Whilst multiaxials are now available, and at a lower cost than in the West, the relatively very low cost of woven rovings is such that often the optimum laminate is still very traditional. In other markets the difference between the two forms of reinforcement is minimal, and a good commercial case can be made for use of multiaxials, due to the increased material costs being offset by lower labour costs.

The picture painted so far is one of an industry stuck in the '70s and not yet in line with many of the advances in marine composites developed over the last 20 years. But don't blink – it's changing very fast. The passion for new technology, and the willingness of the boat builders to learn and try new techniques, is probably unmatched in the world. The gulf between what they are doing now and where they have to be to become internationally competitive is recognised, and a number of yards are moving quickly to catch up.

As an example, consider the use of infusion. There are no emission regulations to drive the industry in this direction. Given the cost of labour relative to imported vacuum bag films and transfer mediums, it is not, at present, the path to reduced product-ion costs. But a number of boat yards have recognised it is a technique which can produce high quality parts with a relatively unskilled shop floor workforce, provided the right management of the process is in place. And that the international market is increasingly demanding this level of technology.

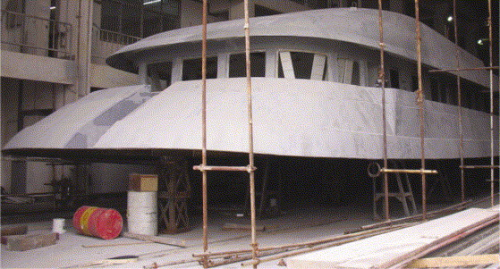

Cheoy Lee, in Doumen, with which High Modulus works closely, has been infusing its 80-100 ft semi-custom motoryachts for a number of years. Investment in training from Andre Coquet of GRP Guru has been followed up with a commitment from the yard to develop in-house expertise and capability, so that they now routinely infuse their hulls, decks, and most of the internal structures. This has meant their specifications are moving towards use of multiaxials and grooved PVC foam for better flow. Due to the size of the vessels and the inevitable paint finish, they are not concerned with fibre or core print and infuse the whole laminate in one operation.

Down the road at Sunbird the approach is a little different. Its 62 ft motor yacht hull is first skinned with two plies of 300 g/m2 CSM, and then a structural outer layer of hand laid triaxial. Then the grooved Airex C70 core and biaxial inner skin are infused. In the bulk-heads and decks, the whole laminate is infused in a single shot.

Vic Duppenthaler, of Padden Creek Boatworks, Seattle, is on a two year secondment to get this long-established yard up to speed with the technology necessary to compete in the US market. He has engaged High Modulus to develop the specifications, which are supplied in a complete kitset format, with all reinforcements and core pre-cut and ready to be loaded into the tool.

There are other examples of advanced technology in boat building. In Shanghai, Double Happiness Yachts was familiar with vacuum bagged core construction, and quite happily took on the build of the fleet of Dubois-designed 68 ft sailing yachts for the Clipper Round the World Yacht Race. In the same town, Five Star Marine is using the same technology for the build of commuter powerboats for the Scandinavian market. Flying Eagle Boats, in Hangzhou, Zhejiang Province, is one of the world's largest builders of prepreg carbon rowing skiffs, with a workforce in excess of 350, and over 26 000 m2 of factory. And the well known Australian boatbuilder McConaghy's has formed a joint venture with Jin Li Composites, and has started the construction of China's first America's Cup Class yacht.

These examples illustrate that although the Chinese boat building industry as a whole has a reputation of being well behind today's international standards, in many parts it is committed to a rapid advance in technology, and, with new designs and appropriate assistance, will be a world class competitor.