The history of European manufacture of continuous glass filament is rather short since the founding of this industrial activity dates back only to the 1930s. For almost half a century glass fibre was affiliated to, and considered as belonging to, the then-emerging category of so-called manmade fibres, mainly used in textile applications.

Indeed, glass fibre manufacturing companies were for many years affiliated to trade associations responsible for artificial and synthetic textile fibre interests. The constitution by the manufacturers of continuous filament glass fibre of a fully autonomous and independent European trade association (Association des Producteurs de Fibres de Verre Européens, or APFE) in 1987 can therefore be regarded as an important milestone in the short existence of our industry.

This 20th anniversary of APFE corresponds to the duration of my administrative management of the association. I have had the privilege of being associated with 20 years of an exhilarating, constructive and open-minded cooperation between European manufacturers in a series of common actions aimed at safeguarding the collective interests of our industry. Such a landmark deserves an objective and neutral review of the major factors which have characterised the remarkable and positive evolution of the industry and of the challenges I believe it will be facing, hopefully with success, in the future. In this article I have tried to summarise what I have witnessed as the main achievements of the industry to date and the principles and aspects on which its future could be based.

The European industry

It is well known that glass fibre as a raw material is not only the basis for the conception and birth of composites but has also figured prominently in their growth and the development of multiple uses. There is no doubt that properties offered by glass fibre have, and are still, contributing to the progressive substitution – in a growing series of applications – of some traditional raw materials by composite materials. These properties include the high strength of glass fibre, its low weight, its corrosion resistance, and its very low thermal and electrical conductivity. These unique benefits open up many markets to composites based on glass fibre.

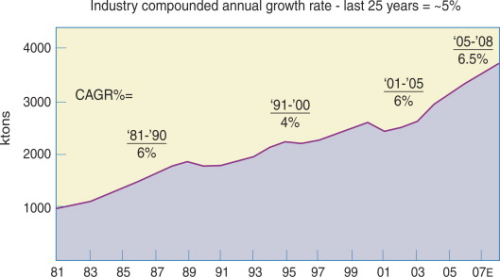

The almost umbilical cord which links continuous glass filament manufacturers in Europe so closely to their European processing customers explains why APFE member companies were, and are still, intensively involved in all efforts aimed at securing the future and prosperity of both their own European industry and those connected to it within the European composites chain. Like many new industries, our sector has not been able to escape the effects of the ‘boom and bust’ cycle. However, as can be seen from Figure 1, which shows the evolution of the world market for glass fibre, our business has always recovered and continued to grow after periods of less favourable economic circumstances.

Glass fibre is by far the leading reinforcement being used in composites globally. In tonnage terms, glass fibre represents over 80% of the reinforcement fibres used in composites worldwide. The European industry's share in this global volume is approximately one third and consists of Europe-made high performance and quality products delivered by APFE member companies to European converters. This is undoubtedly the result of a 70-year heritage of leadership in a dynamic market, which has shown its potential to transform almost every application in a large number of industries. Evolving fibre technologies allowed composite materials to target and to enter into new market niches requiring specific developments, which became increasingly high-tech.

One can conclude that the growth of APFE member companies followed that of their composites customers but that their major contribution to this common success lies in the merit of having delivered reinforcement solutions.

Composites

Over the years, APFE member companies have developed a considerable number of product types. They can roughly be categorised as both assembled and direct rovings, both dry and wet, chopped strands, chopped strand mats, continuous filament mats, yarns, without forgetting those increasingly sophisticated products with more added value like speciality reinforcements, multiaxial reinforcements, multilayer reinforcements and combination products. Each of these play a crucial role in processes designed for specific applications, allowing the penetration of composites into markets nobody could have imagined even a decade ago – markets where such traditional materials as metal, aluminium and wood appeared to rule the roost.

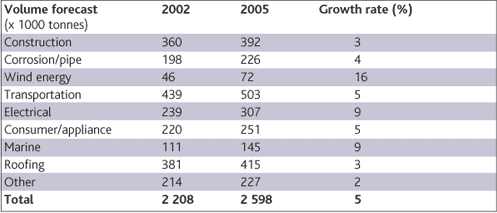

Thanks to the inherent characteristics and advantages of glass fibre, composites stand for performance, durability and sustainable development. Composites are now increasingly involved in an extensive range of applications as shown in Table 1.

Contribution of APFE members

As indicated above, and in line with their commitment to growth, APFE and its member companies are more than ever involved in the monitoring and participating in the shaping of policies aimed at preserving the safe and sustainable growth of their business and consequently that of their customers. Never before have our industries been faced with such a variety of regulations and constraints.

As one example, APFE, together with the appropriate internationally recognised scientific and medical evidence published by reputable international authorities such as the International Agency for Research on Cancer (IARC) and other governmental organisations, could demonstrate that continuous glass filament (even fragmented) does not represent any health hazard during its manufacturing or in its subsequent processing. Thanks to this, sectors involved in the composites chain can be assured of the safety of our raw material and that their workers are not exposed to health hazards during its processing. This evidence, as well as official statements issued by international authorities, has been freely circulated by APFE.

From the technical side, it is worth mentioning that member companies generally are certified to ISO 9000 for quality, ISO 14000 for environmental performance and ISO 18000 for safety systems. APFE actively participated in, and even sponsored, the research and work of normalisation bodies as ISO and CEN for the drafting and adoption of international standards relating to glass filament and other associated products, all of which offer confidence and guarantees to our processing customers as to the specifications of the raw material that they purchase.

APFE's internal work and actions have always been based on its member companies’ proactive and positive approach in the areas of health, safety and the environment. They strive to continuously improve their environmental performance with a view to the establishment of appropriate solutions via a responsible risk assessment and in compliance with customers’ concerns.

Recycling of composite waste products is another key issue but no longer an inhibiting factor. Innovative solutions are emerging which could prove to be economically sustainable.

APFE member companies have always been at the forefront of every initiative which is likely to contribute to a sustainable environmental policy and make sure that glass fibre reinforced plastics are environmentally friendly. This is even more so the case now that energy policy in the European Community is not all bad news for the composites industry: the double-digit growth in the production of wind energy and the air-transportation sector, boosted by the need for green solutions or the reduction of energy consumption, are prime examples of this.

|

APFE (Association des Producteurs de Fibres de Verre Européens) was set up as a non-profit organisation in Brussels at the beginning of 1987. It succeeded a ‘group’ that was part of CIRFS (Comité International de la Rayonne et des Fibres Synthétiques, based in Paris), which in fact was created earlier as the interest group of producers and processors of man-made fibres, in opposition to processors of natural fibres. As CIRFS progressively focused on textiles and textile industry sectors, West European continuous glass filament producers decided to set up an independent branch organisation with a close link with CPIV (Comité Permanent des Industries du Verre Européennes). It only included producers of reinforcement fibres, as producers of glass wool were affiliated to EURIMA (the European Association of Insulation Manufacturers). Following some mergers during the 1980s, the current member companies of APFE number eight. Due to the likely enlargement of the European Community, namely by Eastern European countries in which some of these companies acquired new subsidiaries, APFE membership is no longer restricted to companies operating in Western Europe, but also includes companies in the other parts of the continent. Member companies Ahlstrom Glassfibre Oy, Finland Cam Elyaf Sanayii AS, Turkey Johns Manville Europe, Slovakia Lanxess Deutschland GmbH, Germany Owens Corning Composites, Belgium P + D Glasseiden GmbH Oschatz, Germany PPG Industries Fiber Glas BV, Netherlands Saint-Gobain Vetrotex, France |

Partnership: simply a must!

The remarkable growth of composites in Europe is based on a close partnership between APFE member companies and their customers. At the beginning of this success story, APFE companies’ state-of-the-art manufacturing facilities and their broad perspective on legislation and compliance issues were of considerable help to customers, and still are today. Working together and solving problems as a team not only resulted in a steady penetration of composite products into new markets but also in new products for these markets. There is no doubt that without this close cooperation and the glass fibre industry's assistance in developing new materials and applications, together with new processes and technologies, the significant growth of the European composites industry would not have happened.

Furthermore, from numerous articles in the press, it is apparent that the large and still increasing number of composites applications (most probably a few hundred every year) is to a large extent the result of the constant adaptation and technological progress, involving considerable investment, to meet the needs of potential new market niches for composites.

From my personal contacts, I know that APFE member companies are optimistic about the further growth of their European customers and will continue to offer their support. They are fully aware that in a perpetually changing business environment, their ability to innovate is definitely an indispensable factor which forces them to constantly adapt their commercial and industrial strategy. They believe that composites are more than just a material but a theme in product evolution. This approach implies and requires a close collaboration with customers.

Competition with other materials

Although composite markets are strong and growing faster than the global economy (according to some economists as much as twice the GDP [gross domestic product]), many experts believe in the tremendous potential of composites to further replace traditional materials, saying that the true conversion from traditional materials to composites is only just beginning. The composite value chain should convey this message to the marketplace in a stronger way, in order to convince people who use steel/aluminium/wood of the benefits of composites and how strongly they shape and influence our living environment.

As was earlier the case for thermosets, the production of thermoplastics has considerably increased over the last five years, with the growth occurring in previously unexpected markets and in unanticipated applications.

|

A detailed report of the environmental challenges facing the composites industry would require several pages. Listed below are some of the current and upcoming regulations which will affect our industry the most. REACH Within all sectors of the glass industry a lot of brainstorming was devoted to the ‘status’ of glass under REACH. Should glass be considered as a ‘preparation’ (the definition currently favoured by the EU Commission), a ‘special preparation’ (similar to alloys for instance), or as a ‘substance’ (the definition preferred by the glass industry after lengthy discussions)? Here again, according to the ‘status’ (which will ultimately be selected by the Commission), the varying registration obligations foreseen by the Directive will determine which onerous procedure our products are exposed to. Recycling and waste management While recycling of glass fibre production waste does not represent a major problem, that of composites, in which glass fibre is only a constituent, has for some years been a matter of serious concern for all parties involved. Earlier, projects such as ERCOM and some others were offering technical solutions, but these were not economically sustainable. There now exists ECRC (European Composite Recycling Company), whose membership includes the major APFE member companies, which is working in particular on the issue of waste management in the framework of the End-of-Life Vehicles Directive. It is actively engaged in devising solutions for recycling thermosets in the first instance, and hopefully also for thermoplastics in a further stage. Unfortunately, despite strong lobbying by the composites industry, one promising solution involving the incineration of composites in cement kilns (offering in fact both energy recovery and material recycling), was recently rejected by the European Parliament as an ‘energy recovering’ operation and thus not a recognised priority way of disposing waste according to the Directive. But the struggle for environmentally acceptable solutions must go on. Plastics for food contact This concerns the draft EU Commission Directive 2007/19/EC amending Directive 2002/72/EC relating to plastics and articles intended to come into contact with food. According to this current proposal, the ‘plastics directive’ applies exclusively to plastics. However, officials in the Commission in charge of this issue are of the opinion that glass fibre reinforced plastics are covered by the scope of the plastics directive. (This is contrary to what we believe on the basis of detailed analysis by legal consultants well known for their specific expertise in food contact regulations.) If this is the case, sizings applied to glass fibre intended to make these appropriate for these types of applications would need to be included in the lists of authorised additives appended to the directive. This procedure represents such a burdensome and high cost factor that it raised serious doubts concerning its practical feasibility. This is why our industry should be concerned about this sector and should monitor discussions in this area. |

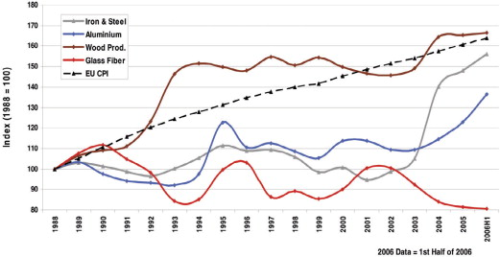

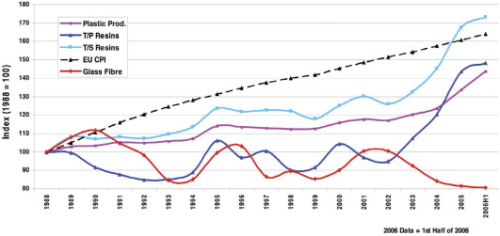

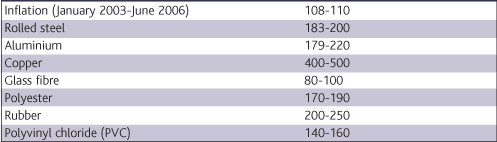

The enhanced performance and reduced cost and weight of composites is leading to a voracious demand for composite materials and technology. Besides the recognised intrinsic technical assets offered by glass filament in a growing number of applications, the penetration of our products can also be explained by their favourable price evolution compared to competing traditional materials. Figure 2 shows that over the last decades, price levels for glass fibre declined in absolute terms, whereas those for the competitive materials increased substantially in recent years.

Innovation: the magic element

It is clear that innovation and quality are the keys to further growth. It is also generally accepted that multi-performance solutions will be required to meet the needs of the composites industry as composites are considered less and less as a homogeneous material. Research for novelties, for products with higher technology content and added value, as well as the development of structural design, seem to be the current leading trends. Therefore, innovation has more than ever become a prerequisite when differentiating oneself in an increasingly competitive market. The more demanding and competitive the market is, the more technology becomes a ‘weapon’ required to stand above the rest.

In the past, APFE member companies have demonstrated their dedication to innovation by focusing on the substitution of traditional materials with composite solutions. This commitment must be continuous to meet the concerns of their customers. They continue to believe that they are well-placed, as raw material producers, to advise their customers about technical transfers, as it is well known that products made of glass fibre have extended life and higher reliability. Within companies, themes of research are now concentrated mainly on innovation of applications based on the flexibility and deformability of continuous filament products, and their easy adaptation to the geometry of even the most complex moulds.

Besides their laboratories equipped with the finest technology, APFE companies enjoy the reputation of employing numerous experts in their application centres to support R&D activities. It is important to stress that they are also at the disposal of customers wanting to transform their ideas into commercial success stories, while simultaneously providing assistance and services to develop new processes and technologies. In their search for quality, these experts continue to observe a high regard for environmental issues linked to any innovation.

Challenges

There is no need to point out that external factors pose problems to the complete composites chain because they may, or do, impact directly on the raw material – glass filament.

APFE, as part of the global glass industry, is heavily involved in numerous lobbying actions with a view to preserving glass fibre from excessive environmental regulations initiated by both the European Union and member states' authorities, in particular when they imply either huge financial constraints or even endanger the future use of the material in some composites applications. The very restrictive policy on materials coming into contact with food, the REACH directive, and the authorisation to continue to use some basic substances in the manufacture of glass, are clear examples of how administrative measures could prejudice and even endanger the future of the entire composites chain. We need to constantly remind the authorities that the composites business is one of the cornerstones of the new society, providing lightweight solutions and thus major savings in a multitude of industrial activities.

APFE has rightly favoured alliances between industry sectors exposed to common specific challenges. A well-known example of common concern relates to the disposal of waste or recycling of end-of-life composites. APFE member companies have long since participated and contributed, via expertise and financial support, to any scheme likely to foster the research and implementation of technologies which could and would offer satisfactory solutions to the treatment of end-of-life composites. They are committed to share their customers’ concerns in this respect.

By external factors, I also mean the negative impact on the competitiveness of composite materials against either competing materials or third-country producers of composites and their component raw materials, resulting from increasing production costs (energy, transport, equipment, etc.) and the inherent difficulty of recovering these in the sale price.

|

Tommi Björnman, the current president of APFE, says a few words about Gilbert Maeyaert, who has been the association's general secretary for the past 20 years. No matter what you ask, the answer is ‘no problem’, or an offer of ‘can I help you?’ These are the words Gilbert Maeyaert, the General Secretary of APFE, is famous for. He is the strong man behind the scenes holding the APFE organisation together, as he has done throughout the past 20 years. Earlier, during the 1970s and 1980s, the European glass fibre industry was part of CIRFS (International Rayon and Synthetic Fibres Committee) and, at best, there were 15 individual European glass fibre producing companies as members. In 1987, when APFE was reorganised within CPIV (the European glass industry association), there were only five glass fibre companies represented, a result of industry consolidation during the years. Today, there are eight members of APFE, and, as such, they practically represent the whole of Europe's production of continuous glass fibre. This is a good indicator of Gilbert Maeyaert's time of command. Another good indicator is the average growth rate of 4-6% per year of the industry during the same period. The growth in 2006 was as high as 11% per annum versus 2005. Gilbert Maeyaert has always been able to keep the glass fibre industry together as ‘one family’, where the focus has been to secure and develop the European manufacturing platform, in order to be able to serve its European customers and end-users in the longer term. He has done a great job by ensuring a good operational environment for the European glass fibre industry, despite different external pressures, like CO2 trading, Integrated Pollution Prevention and Control (IPPC), REACH, and other initiatives. I wish all possible success and a bright future to the 20-year-old organisation. On behalf of APFE and its Board of Directors, I also want to thank Mr Maeyaert for his remarkable and devoted work for the industry and I sincerely hope that we will continue on the same path for many years to come. Once again, our most humble ‘thank you.’ By saying this, I truly believe that our industry will continue to grow together with its customers. There is a constant need for new solutions and applications, and for renewed products in the market place. The penetration of different glass fibre reinforced composite products is reasonably high in, for example, the automotive, transportation, infrastructure and marine industries, which, at the same time, are growing nicely. There's also a lot of potential in the building materials sector and in different applications where lightweight yet strong constructions are needed. Just looking around, we see high energy costs, especially high oil prices, as well as high metal prices, and, in some areas, lack of concrete or even timber. This all opens up our industry to new potential, considering also the fact that the trend seems to be towards ready-made and ready-to-be-installed solutions. All this should indicate a bright future for the European composites industry and its loyal suppliers and supporters, and I see that this 20+ years of growth will continue in the future, thanks to our good customers. |

While being aware that the increasing logistical costs are an inevitable fact, we have to face and live with member companies' needs to maintain their competitive advantage over traditional materials. Glass filament producers, despite the recent favourable inflation rates as shown in Table 2, cannot be expected to constantly absorb higher costs while continuing to invest in better performing and environmentally friendly products. It is clear that if APFE member companies are to cope with volatile price increases and meet the future long-term supply requirements of their customers, they must ensure that their business is sustainable.

Similarly, the composites industry, from compounder to moulder to the end-users, needs to remain sustainable throughout the value chain in its competition with other materials and solutions.

In this respect, our partners in the composites chain need to be aware that the cost of the ‘component glass’ in their composite material has been falling over the last 20 years compared to the rising prices of other components.

Needless to say, if the composites industry is not completely successful in rolling its cost increases down to the value chain, it will result in a structural setback of profitability and this cannot be afforded. The message must be perceived and understood that without a minimum level of profitability at each stage of the production chain, the long term investment efforts needed for further growth (and even survival of the complete chain) can no longer be requested from operators. A disruption of the required commitments within the chain, even in only one link of the chain, leads inevitably to the shivering of the whole chain, with its catastrophic consequences on the so-needed cohesion between allied sectors.

What about the future?

As is and will continue to be the case in many industrial activities, the Asian continent – because of unbeatable comparative advantages resulting from much cheaper manufacturing costs – is currently the most economical place to produce glass fibre and in the not too distant future composites. Our APFE member companies are indeed suffering from the abnormal and damaging competition resulting from the fast growth of imports, in particular originating in China, at a rate much higher than that of local demand.

I gladly noticed however from our internal APFE assessment of this alarming situation that member companies are confident that innovation and quality will remain determining assets for the European composites chain to face the challenging times ahead of us, provided solidarity between its various converters is considered by all as a vital and not an idle concept.

This is not simply an entrepreneur's conviction. A recent study by Frost & Sullivan confirms that particularly in Europe, the composites markets continue to exhibit tremendous scope for expansion with new niches emerging. The allocation of greater resources towards research, development and more sophisticated equipment will however be required if we all want to seize an opportunity to neutralise this unquestionable threat to the survival in Europe of the complete composites chain.

When I referred to a milestone at the beginning of this article, I could not better define the absolute need for both our APFE member companies and their European customers in the composites chain to keep alive their ancient team spirit and to close up links as never before. This implies that APFE members should confirm their dedicated mission to continue to assist their customers, particularly in solving practical manufacturing/processing problems, and also cooperating in the development of new applications for composite products.

In exchange for this commitment from their European suppliers, European composites manufacturers should intensify wherever possible their business relations with these 'local' suppliers, whose doors will always remain open to them.

It is my personal conviction that the interests of each of these partners (independent of their size) are similar as they depend on the long-term preservation of a healthy and sustainable composites industry in Europe, which can only be secured through a well-conceived and long lasting cooperation at all levels. Taking advantage of temporary benefits resulting from external factors by any of the partner sectors to the detriment of another partner sector would mean losing sight of the required long-term strategy. Such behaviour would inevitably lead to the failure of endeavours the whole European chain needs to make for its security, if it wants to strengthen its competitive position in the global world economy.