Much of today's renewable energy debate in Europe is focusing on the challenge of exploiting its largest indigenous resource, offshore wind power. But in truth, for the next decade at least, the offshore sector will still be relatively small fry. It will be onshore wind that takes the starring role in the coming decade, remaining the undisputed top dog in terms of renewable energy deployment up to at least 2020.

As the cheapest renewable electricity technology, onshore wind will be the largest contributor to meeting the 34% share of renewable electricity needed by 2020 in the EU, as envisaged by the 2009 EU Renewable Energy Directive.

The Directive sets a target for 20% of all EU energy to come from renewable sources by 2020. And in June member states finally have to submit National Action Plans (NAPs) outlining exactly how they expect to meet their individual binding targets under the Directive.

“Governments will have to say what technologies they believe will contribute to targets and give an indication of how much of each is needed,” says Christian Kjaer, chief executive officer of the European Wind Energy Association (EWEA).

“Onshore wind will be the most affordable option for most countries,” he adds: “This [NAP] process has sparked an incredible amount of policy making especially in the new member states, which were not subject to previous directives.”

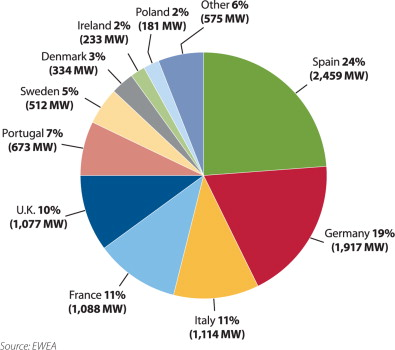

Thanks to the directive then, and as the lead renewable energy technology, the economic opportunity relating to onshore wind is vast. Investment in new European wind farms already reached €13 billion last year, with onshore wind accounting for 88.5% and offshore wind just 11.5%, or €1.5bn, says EWEA.

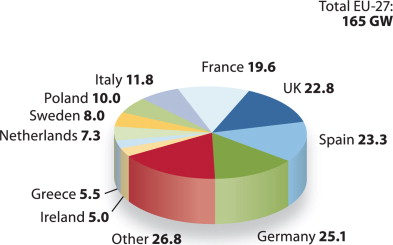

In total, over 10.1 GW of new wind capacity was installed, up 23% on 2008, bringing the EU's cumulative installed wind capacity to just shy of 75 GW.

New onshore wind additions totalled 9,581 MW, up 21% on the previous year, while 582 MW of offshore wind plant capacity was installed (a 56% increase).

Significantly, for the second year running, more wind power capacity was installed than any other electricity-generating technology, including coal, gas and nuclear. It accounted for 39% of all electricity generating capacity installed in 2009, up from 35% in 2008. Moreover, it represented 9.1% of the EU's total 820.6 GW of installed power capacity.

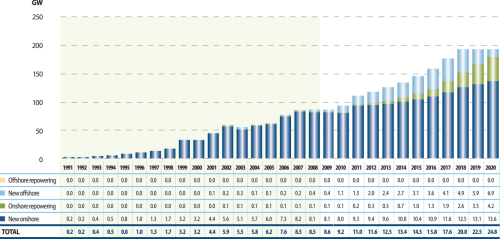

Driven by the RE Directive, EWEA expects that installed onshore wind capacity in Europe will more than double within the next decade. By 2020, the annual market will be worth €23.5bn, rising in the 10 years thereafter to €25bn by 2030.

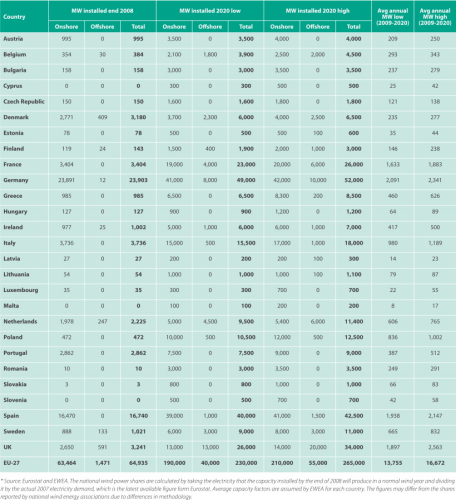

The association also suggests that 230 GW of wind could be operational in the EU by 2020, with 190 GW of this on land. Wind would be producing 580 TWh of electricity, meeting 14.2% of total EU electricity demand, up from around 4.8% last year. And this is under its more conservative low growth scenario (see Figure 1 on the right).

| "Only [after the NAP submissions] will the industry have a clear idea of exactly how, and where the European wind market will progress in the coming decade." |

Under its high growth scenario, which takes into account wind power targets already announced by national governments, wind capacity could reach 265 GW by 2020, producing 681 TWh of electricity and meeting 16.7% of EU demand.

The low growth scenario requires an average annual increase of 13.8 GW in capacity to 2020, while the high scenario requires 16.7 GW a year.

A further 170 GW could then be installed in the following decade, largely offshore, to bring cumulative EU wind capacity to 400 GW by 2030, the association adds in its updated Pure Power report, published last year.

Lead markets

The top five wind markets over the next 10 years will remain those already leading the pack at present. Europe's undisputed leaders for total installed capacity, Germany and Spain, in that order, are set to remain ahead in terms of new gigawatts installed.

While Spain was Europe's biggest market in 2009 for new wind power installations, adding 2,459 MW to take its cumulative tally to 19.15 GW, Germany will install more capacity than Spain in the next 10 years, suggests EWEA.

Having added 1,917 MW of wind last year to bring its cumulative installed wind total to 25.78 GW, Germany will add over 23 GW in the next decade under the low scenario. This will bring its total wind capacity to 49 GW by 2020, requiring an annual average increase of 2,091 MW. Under the high 2020 scenario it will add 26 GW, averaging at 2,341 MW in new capacity installed a year.

Spain's installed total wind is expected to reach 40-42.25 GW by 2020 under the two scenarios, requiring an average annual increase of 1,938-2,147 MW.

While offshore wind will account for much of Germany's new additions, with 8-10 GW expected to be installed out to sea based on current plans, significant onshore activity will continue as existing smaller machines are decommissioned and replaced with larger modern turbines, says Kjaer.

Indeed, across Europe the market for replacement wind turbines is expected to increase from 1 GW in 2015 to 4.2 GW in 2020, as greater amounts of existing capacity gets decommissioned in the second half of this decade.

Other EU countries outside the top 10

| Increase in wind energy capacity 2009-2020 | % of EU-27 increase in wind energy capacity 2009-2020 | |

| Portugal | 4.6 | 2.8% |

| Belgium | 3.5 | 2.1% |

| Romania | 3.0 | 1.8% |

| Denmark | 2.8 | 1.7% |

| Bulgaria | 2.8 | 1.7% |

| Austria | 2.5 | 1.5% |

| Finland | 1.8 | 1.1% |

| Czech Republic | 1.5 | 0.9% |

| Lithuania | 0.9 | 0.6% |

| Hungary | 0.8 | 0.5% |

| Slovakia | 0.8 | 0.5% |

| Slovenia | 0.5 | 0.3% |

| Estonia | 0.4 | 0.3% |

| Luxembourg | 0.3 | 0.2% |

| Cyprus | 0.3 | 0.2% |

| Latvia | 0.2 | 0.1% |

| Malta | 0.1 | 0.1% |

Source: EWEA

In Spain, meanwhile, onshore wind will account for virtually all the market activity in the coming decade, with offshore accounting for just 2.43-3.53% of its forecast cumulative capacity in 2020.

The UK, France and Italy round out EWEA's forecasted top five markets up to 2020. The UK's installed wind capacity is set to rise from just over 4 GW at end 2009 to 26-34 GW by then, France from 4.5 GW to 23-26 GW, and Italy from 4.85 GW to 15.5-18 GW. To achieve that, average annual installations will need to be up to 2.56 GW, 1.88 GW, and 1.19 GW respectively.

Expected offshore wind development, boosted by the Crown Estate's Round 3 offshore wind programme which issued rights for 32 GW of projects, is largely responsible for the massive growth prediction for the UK, says Kjaer.

But there will still be significant scope for onshore activity. EWEA expects 13-20 GW of offshore wind capacity to be operating in UK waters by 2020, accounting for 50%-59% of the 26-34 GW total installed capacity forecast under its two scenarios. In contrast, offshore wind will account for 17%-23% (4-6 GW) of cumulative capacity in France by 2020, while in Italy it will account for just 3.2-5.5% (0.5-1 GW).

“The UK, France and Italy all then still have enormous potential for onshore wind”, stresses Kjaer. “France has particular potential, with around 20 GW of new capacity possible onshore, but [like in many countries] it is being held up by difficult planning procedures. And Italy has been a reasonable market for a while, but it has not really taken off to its potential, again due to planning and grid issues.” Under EWEA's forecast, Italian onshore capacity could rise to 15-17 GW by 2020.

UK sending out the right signals

In the UK, onshore wind capacity could rise to 13-20 GW over the next decade. But as in France and Italy, planning objections to onshore projects have been a major factor in the UK's market not living up to its potential as yet.

And the same problem is also showing potential signs of affecting its offshore plans – protests against planning applications for onshore substations (which will feed electricity generated offshore to the mainland electricity grid) are already gathering force.

| "...in truth, for the next decade at least, the offshore sector will be relatively small fry." |

But Britain's outgoing Labour Government has taken action to smooth the planning process for renewable energy projects. And the new Conservative/Liberal Democrat coalition has pledged to do the same.

The key for full UK market take-off, says Kjaer, is attracting local manufacturing. “It is difficult for the UK government,” he acknowledges. “They have very ambitious plans but are still finding it hard to attract manufacturers. It is manufacturing that will be vital in driving the UK market.”

When leading wind turbine manufacturer Vestas finally closed its UK blade manufacturing plant on the Isle of Wight last year, it seemed like the probable death knell for any hope the UK had of attracting manufacturers to its shores.

But, ironically, a flurry of announcements, have revived hopes for what RenewableUK (formerly the British Wind Energy Association) describes as “the rebirth of manufacturing in the UK”.

In January Mabey Bridge announced a US$40 million investment in a new factory to build towers for wind turbines in Chepstow. In February Clipper Windpower started construction of a factory in Newcastle upon Tyne, where it will build blades for its 10 MW Britannia offshore turbine, currently under development.

This was quickly followed with news that Mitsubishi is investing £100 million in a UK-based R&D facility. Mitsubishi expects to produce a prototype 6 MW offshore turbine within three years, with full scale production starting a year later, if all goes to plan. The UK government is supporting the company with grants up to £30 million. And as we go to press, GE has said it will invest €110 million to develop offshore wind turbine manufacturing facilities in the UK. The company will also locate design, application and service engineering resources for offshore wind in the UK – creating up to 1900 new jobs in total by 2020.

| "By end 2009, Poland's cumulative wind capacity stood at just 725 MW. The Pure Power report forecasts this to rise to 10.5-12.5 GW by 2020, in line with the 13 GW forecast by the Polish Wind Energy Association (PWEA)." |

“Twenty years ago the UK was a leading centre for onshore wind technology, but we failed to capitalise on that by not providing the right climate for growth,” said UK business secretary Lord Peter Mandelson at the time. “We are determined not to let that happen again. We are creating the largest market in the world for offshore wind and we intend to build and support the industry.”

Polish potential

Manufacturing will be as equally vital for Poland, the country EWEA expects to be the sixth biggest market in the coming decade and where the association's members are gathering this month for its annual conference. “Poland is interesting,” says Kjaer. “The key to market take-off in Poland is if we get job creation there.”

While the UK may struggle to attract manufacturers to its shores, Kjaer believes it will happen for Poland. “It has a skilled workforce and a competitive labour market…it has the ability to attract that manufacturing.”

By the end of 2009, Poland's cumulative wind capacity stood at just 725 MW. The Pure Power report forecasts this to rise to 10.5-12.5 GW by 2020, in line with the 13 GW forecast by the Polish Wind Energy Association (PWEA) in its Wind power development in Poland by 2020 report, published in January. Onshore wind farms will account for 11 GW of this, says PWEA, with 1.5 GW coming from offshore and a further 600 MW comprising small domestic turbines.

If achieved, this would see wind power account for 24% of Poland's electricity supply, up from just 0.58% in 2009. By 2030, this could increase to a 45% share, PWEA adds. The association believes some 66,000 jobs could be created in Poland from this boom in its wind market, with around 23,500 of them related directly to turbine manufacturing and a further 14,000 indirectly so.

Meanwhile, PWEA says that while there are constraints on where development can take place, often due to strict rules on nature and architectural preservation, “the availability of land for wind turbine location is not a significant restriction of the wind energy development in Poland”.

Still, around 1.6 million hectares of land, some of it earmarked by wind developers for future projects, could be reclassified as no development zones. The land is being considered for inclusion under the EU's Natura 2000 nature reserve programme. The industry has called for a decision to be made soon so developers can move forward with investment decisions.

A lengthy grid connection consents process is also stalling some developments, while lack of availability and proximity of the country's energy infrastructure to locations where development is allowed is another issue facing the industry. PWEA says the country's grid and transmission network needs significant expansion, at an estimated cost of PLN 1.6-2 billion.

This could see overall wind project costs rise by 4-5%, but for most large projects, especially those planned for Poland's windier northern regions, this is unlikely to be seen as an obstacle to proceeding with an investment, PWEA suggests. “The necessity and conditions of the expansion of the transmission system and distribution system do not create a serious restriction of wind energy development,” it says.

In fact as we go to press, REpower Systems AG has concluded a contract with a project company of the WSB Group to deliver 15 wind turbines to Poland. The REpower MM92 turbines each have a rated power of 2.05 megawatts (MW) and a hub height of 80 metres. They are due to be constructed and commissioned at the Lipniki wind farm near Opole in southwest Poland later this year. With a total output of 30.75 MW, the Lipniki wind farm is so far the biggest project undertaken by the Hamburg-based wind turbine manufacturer in Poland.

REpower entered the Polish market in 2009 with the two wind farms Leki Dukielskie and Bukowsko near Rzeszow. Poland's potential as a fast-growing market for wind energy makes the contract extremely important to REpower,” according to the company's CEO Per Hornung Pedersen: “We can see a lot of potential in the Polish market for wind power. The country is home to many prime wind locations”.

The dark horses

Meantime, Kjaer says Sweden and Norway are worth watching. “I am confident about the Swedish market,” he says. “It is not based on anything specific or concrete, but more a feeling I have.” While in most countries onshore wind is the cheapest option for meeting their respective EU 2020 RE Directive targets, in Sweden biomass is cheaper.

“But biomass has already been fully utilised and now wind is moving in,” he says. Up to mid 2008 there were a lot of planned projects for Sweden, he points out, but developers struggled to secure turbines for them, mainly because most of the plans involved small one or two turbine projects. “Last year due to the financial crisis Swedish projects could suddenly get turbines.”

And, he adds, “there could be some other surprises, for example in Romania and Bulgaria, where we have some interesting developments”. Along with Bulgaria, countries like Greece and Turkey could find that their markets boom. “Manufacturers are looking at these countries for potential regional bases,” says Kjaer. “If you get regional manufacturing then local markets will take off. I think that in that region [Greece, Turkey, Bulgaria] they have the ability to attract manufacturing.”

Critical requirements

For all countries the key to successful market development is generating long-term investor confidence. “In terms of policy framework investors need predictability and stability,” says Kjaer. “It takes time for them to be confident in a market framework. Take Austria or the US for that matter. Their legislation changes every one or two years so it is difficult for investors to have confidence [when it comes to investing in bigger, long term projects]. They need to have stability and predictability in the policy framework for at least the lifetime of the project investment period.”

If they only have policy certainty for two to three years they will also demand a higher risk premium on loans made to project owners and developers, he adds. “But if, as in Germany, you have certainty for twenty to thirty years, they will not demand such a high price.” And in a financially constrained market, from a wind project developer's point of view the latter is certainly the preferred option, so governments have a simple choice to make, says Kjaer.

What they “do not want to do is pull away the carpet from investors”. Certainty, he adds, will also translate into benefit for the end-use consumer through lower electricity bills, with the investors taking on the costs associated with risk rather than them.

While market stability and predictability are “absolutely critical” investor confidence also requires that projects have access to the electricity grid at a reasonable and transparent cost and that a smooth planning process be in place, Kjaer adds. “It is a chair with three legs. If one element of this does not work then investors will not have confidence.” The RE Directive is structured around these three elements for exactly this reason, he points out.

And to that end, all eyes are now firmly focused on the upcoming NAP submissions in June. Only then will the industry have a clear idea of exactly how and where the European wind market will progress in the coming decade and where the best investment opportunities will be.