CSeries

Canada’s Bombardier Aerospace unveiled the first of its CSeries narrowbody airliners on 7th March. This first flight test example of an aircraft that is intended to bring a step improvement in operating economics to the regional jet arena is, after significant delays to date, scheduled to fly in late June. (See Bombardier throws down the gauntlet with CSeries airliner.)

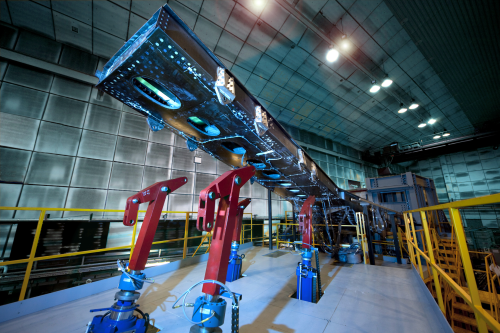

The CSeries has substantial composites content. The wings, engine nacelles, rear fuselage and empennage are all of carbon fibre composite construction, saving an estimated 2000 lb in weight compared with an all-metal airframe. Bombardier’s Belfast, UK, facility produces composite wings for the two models – CS100 (100-125 seat) and CS300 (120-160 seat) – using a patented resin infusion method for the primary components (see Bombardier completes first phase of Belfast wing facility). GKN Aerospace is providing composite winglets (see GKN delivers first composite winglets for CSeries aircraft). Final assembly of the aircraft is taking place at Bombardier’s Mirabel, Quebec, establishment.

| The CSeries relies for its economic promise partly on its composite content, but also on a radical turbofan engine architecture ... |

The CSeries relies for its economic promise partly on its composite content, but also on a radical turbofan engine architecture in which the large front-end fan is driven by the engine’s later stages at a speed that is optimum for efficiency, rather than a non-optimum speed determined by turbine speed. This is accomplished by a gearing system which the engine maker, Pratt & Whitney, has spent several years developing, in the face of initial doubts about its likely effectiveness and reliability. Scepticism has been changing to positive anticipation as development has progressed and especially given the recent clearance by Transport Canada of the PurePower 1500G engine for flight testing, one of the final steps needed in preparation for a maiden flight. If the concept proves to be successful in early service, Bombardier is likely to find growing acceptance of its CSeries formula.

Lufthansa subsidiary Swiss European Airlines is launch customer for the smaller CS100 and expects to receive its first example in 2015. It is reported to be considering the CS300 also. Prospects for the latter may have been boosted by Bombardier‘s decision, late in the model’s development, to extend the fuselage by 2 ft so that, along with some interior reconfiguration, passenger capacity can be expanded from 149 to 160.

Exceeding the 150-seat level takes Bombardier into the territory currently dominated by the Airbus/Boeing duopoly and could be seen as a direct challenge at the lower end of their market. This represents something of a U-turn since the Canadian company had previously sought to avoid direct competition with the world’s commercial airframe giants. Bombardier will have a fight on its hands as those giants will undoubtedly flex their financial and commercial muscles to squeeze out the incomer. This is already evident, given Ryanair’s reported commitment to order some 200 Boeing 737NGs at discounts rumoured to be greater than 50% over list prices. Nevertheless, Bombardier has a launch customer for its CSeries 300, that reportedly being Air Baltic with an order for 10 plus 10 options. First flight for the CS300 is scheduled for early 2014, with certification intended by the end of that year.

Three of the five CS100 flight test aircraft are now in final assembly at Mirabel, near Montreal, and the fourth and fifth are beginning to take shape. The first flight test aircraft was expected to be handed over to the test team by late March and the full fleet of five test aircraft is expected to be in place by October. A structural test airframe has hosted a test in which the carbonfibre wing was taken to 115% of design load with the tip deflecting by 5 ft. It survived this extreme gust simulating test without damage.

Bombardier has bet everything on its game-changing technology and may have to wait until that has proved itself in early service before orders start to materialise in the volumes that must be achieved for the programme to be viable.

COMAC C919

However, the CSeries is not the only shot in Bombardier’s locker as it edges into Airbus/Boeing territory. It is also collaborating with the Commercial Aircraft Corporation of China (COMAC) in developing the latter’s C919 narrowbody, another aircraft project where composites play a substantial role. The collaboration is aimed at securing a degree of commonality between the two aircraft, as well as a joint campaign to market the 100-160 CSeries aircraft and the 168-plus seat COMAC C919.

COMAC also has a cooperation agreement with Ryanair, which is attracted by the prospect of a contemporary narrowbody in the 168-190 seat category (depending on the family model) able to offer attractive acquisition and operating costs. For its part, COMAC would dearly like to break the Airbus/Boeing dominance of the market.

While most of the airframe is aluminium alloy, carbon composite has been selected for the critical centre wing box plus engine nacelles and thrust reversers. Although production nominally began in December 2011, certification delays the Chinese have experienced with another airliner project, the ARJ21 regional jet, have delayed progress on the C919, pushing back first flight and delivery milestones for an unspecified time. This will not please the would-be customers, mostly Chinese, who have placed orders for nearly 400 aircraft so far. It will be no inconvenience to Airbus and Boeing however, since neither underestimates the potency of Chinese competition.

MRJ Regional Jet

Competition in the regional jet arena also comes from Asia in the shape of the 70-90 seat Mitsubishi MRJ regional jet, which is powered by Pratt and Whitney’s radical geared turbofan engine. Carbon composites account for some 10-15% of the airframe, mainly around the tail. Originally, the wing also was to have been carbon but the Japanese airframer opted for aluminium instead. All Nippon Airways has ordered 15 of the jets in its largest MRJ90 variant. A maiden flight is scheduled for late this year, with first delivery expected in 2015. As of late March, Mitsubishi had 165 firm orders and 160 options for the MRJ.

A380

| The A380 was the first commercial airliner to have a carbon composite centre wing box. |

At the other end of the size and weight spectrum, Airbus’ impressive A380 superjumbo, with its more than 20% composite content, has been winning praise in service, its birth pangs now becoming a memory. Carbon, glass and quartz reinforced plastics are used in the wings, tail surfaces, parts of the fuselage and doors. The A380 was the first commercial airliner to have a carbon composite centre wing box. GLARE, a GLAss-REinforced fibre metal laminate, is used in the upper fuselage and the stabiliser leading edges. An advantage of this material is that it can be repaired using conventional airframe repair techniques. The wing-mounted slats have thermoplastic leading edges.

The A380 programme took a hit when, early last year, cracks were discovered in carbon fibre-reinforced aluminium brackets used as part of the internal wing structure. Brackets on the first 120 A380s are having to be changed for replacements in regular aluminium, albeit with a weight penalty of 90 kg per aircraft. A second setback occurred in 2010 when a Qantas aircraft suffered an uncontained engine failure, forcing a temporary grounding of its Rolls-Royce Trent powered fleet while an investigation took place. After the problem was traced to an oil leak, Rolls-Royce replaced about half the engines in the Qantas fleet together with a number belonging to other operators.

By February this year, there had been 262 firm orders for the world‘s largest passenger airliner, with Emirates Airlines alone accounting for 90 of them. In March, the 100th A380 was delivered, to Malaysia Airlines. The type has now been in operation for nearly six years, Singapore Airlines having introduced its first example into service in October 2007. Passenger reaction to the enormous double-decker has been generally positive. Despatch reliability has risen steadily as various technical wrinkles have been ironed out, and has now exceeded 99.3%.

Materials transition

In conclusion, we can expect the progress being made in civil aircraft operating economics to be maintained as the newest aircraft, such as the B787, the A350XWB and the Bombardier CSeries, impact air transport operations. Much of this improvement is thanks to composites and, while the greatest benefit of this revolution in aerospace materials is weight saving, other merits include improved aerodynamics, reduced maintenance, reduced material fatigue and corrosion, and greater structural integration with lower part count.

These benefits will increase as manufacturers transition progressively from traditional metal technologies through hybrid solutions to majority reinforced plastic airframes. At the same time there will be a move to ever greater levels of manufacturing automation for cost, quality consistency and production rate reasons. ♦

- Read Part 1 of this article here.

This article was published in the May/June 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.