Rail is arguably ‘behind the curve’ on composites adoption compared with aerospace. Today’s mainline rail vehicles tend to be extensively composite inside, but outside and especially structurally, still mainly metal. In contrast, the latest airliners are 50% composite – including their load-bearing primary aerostructures.

Why the disparity? After all, rail and air vehicles have much in common. They are both fast moving, passenger-carrying tubes that are prone to static and dynamic stresses plus material fatigue over long and intensive service lives. Fire is a potent hazard in both cases so structures have to be engineered to minimise this and also with crashworthiness in mind. Comfort and aesthetics are important for passenger appeal. Escalating fuel costs mean the need for lightweighting is the leading driver for composites adoption in both cases.

According to Dr Richard Horn, Rail Market Manager at Umeco Structural Materials (formerly the Advanced Composites Group) in Derby, UK, a typical glass composite for rail application has a specific gravity of 1.4, about half that of aluminium (2.7) and less than a fifth of that of mild steel. Weight differences of this order explain why part-plastic trains can reach higher speeds with reduced power, accelerate faster and brake more quickly than their all-metal predecessors.

Rail applications also benefit from the high stiffness and strength with outstanding resistance to fatigue, impact and corrosion that composites provide. Moreover, reinforced plastics can be moulded into aesthetically pleasing shapes and lend themselves to medium-volume series production. Moulding complex shapes can reduce part count significantly compared with metal, thereby cutting cost.

The case against composites

Yet composites have not yet penetrated into the deepest sinews of rail vehicles, their primary load-bearing structures, in contrast to the situation in aerospace. Admittedly, the drive for weight reduction is bound to be strongest for machines that must leave the ground and fly, but there are additional reasons for this lag.

There is, of course, the innate conservatism of an older industry that is rooted in heavy engineering and for safety reasons cannot be too experimental. Apart from this cultural consideration, railway engineers asked to move outside their metals-based comfort zone have found it hard to grasp the reality of composites because they are not sure what that reality is. While it might seem advantageous to have almost as many material formulations as there are applications, this does come with a degree of identity crisis. This is reflected in the dearth of software models that are generic enough to be widely applicable development tools, whereas for metals, with their greater uniformity, a number of standard simulation tools exist. Developers report that it can take several days to model an intended application for composites, compared with just a few hours for a metal equivalent.

Then again, the variability of composites that allows designers to optimise a material for each intended use is a nuisance when it intrudes at the fabrication stage due to material or manpower inconsistency. Material consistency is helped by selecting composite forms such as sheet moulding compounds (SMC) and prepregs, that are manufactured within tightly controlled process parameters. Unfortunately, the variability of human input is harder to limit in anything short of automated production solutions. Yet much composite lamination still relies on manual wet lay-up, although reducing this with closed mould processes is yielding improvements in quality control.

Another issue concerns the joining of materials and the difficulty of verifying the ultimate strength of a composite bond. Coupon testing is helpful but can never give full confidence because of the chance that coupons might not be fully representative. Joining dissimilar materials, particularly, can be challenging, yet combinations of metal and composite are a natural evolutionary step en route to structures that are wholly composite. Hybrid material forms are bound to stretch the capability of bonding/joining technology in the rail sector, just as they do in aerospace.

Fire risk is another constraint. Making fire, smoke and toxicity (FST) properties acceptable to regulators has required the addition of fire retardant compounds to conventional polyesters, epoxies etc, or the use of alternative resins such as phenolics or acrylics which are, however, generally regarded as harder to process. Regulations dictate that additives used in resins are non-halogenated.

Then there is the standards and regulations minefield. Railways are primarily national enterprises and up to now, individual nations have produced their own standards for FST requirements, crashworthiness and other properties. Rolling stock builders have to take account of a multiplicity of these in catering for home and export markets. More recently, harmonisation efforts have led to the emergence of international specifications, such as EN 45545 due to come into force next year. Nevertheless, more harmonisation is needed.

Interior trends

Despite these constraints, the advantages of composites have ensured a growing role for them in rail vehicle structures. This is especially so for interiors where they are used for items as various as side panels and trim, seats, tables, window surrounds, baggage racks and bins, bulkheads, standbacks, floors and ceilings, vestibules, toilet compartments and staircases. Cumulatively, they can save considerable weight, yielding worthwhile performance and economy benefits.

| A 10% saving in the mass of a metropolitan rail vehicle can reduce energy consumption by 7%, saving up to $100 000 annually per vehicle. |

Dr Joe Carruthers, until recently head of the rail vehicles group of Newcastle University’s NewRail research centre, has estimated that a 10% saving in the mass of a metropolitan rail vehicle can reduce energy consumption by 7%, saving up to $100 000 annually per vehicle.

In presenting a recent case study, Carruthers indicated that substituting composites for metal in items as commonplace as grab rails can make a difference. Steel grab rails typically add more than half a tonne to the mass of a metro vehicle. A carbon fibre grab rail prototyped by Exel Composites, UK, to NewRail specifications proved 57% lighter than the standard stainless steel version while also being cheaper thanks to use of the pullwinding technique to produce it. (Pultruded items should be similarly affordable when produced in volume.)

Carruthers holds that composites could find greater acceptance if designers were to be less prescriptive in specifying interiors. It would, he suggests, be better to specify performance metrics rather than saying something like ‘the grab rail shall be made from satin-polished stainless steel or aluminium’. He adds that introduction of new material technologies should be carefully managed, perhaps through limited pilot programmes, and that realistic lifecycle assessments would often support the case for such materials.

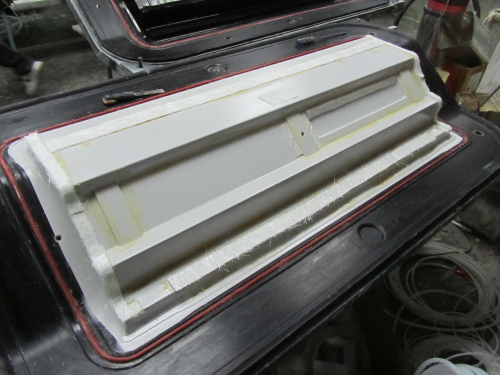

Umeco’s Richard Horn points out that much interior work is still based on basic wet lay-up and sheet moulding compound (SMC), but that moves to more advanced process/material combinations such as press-moulded prepregs can prove cost-effective. At this year’s JEC Europe exhibition he cited the example of standback components where substituting previous polyester SMC technology with a solution based on a Umeco 2 mm thick glass/phenolic prepreg resulted in a 40% weight saving. Costs were competitive once initial difficulties in achieving the required superior surface finish had been overcome.

Significantly, Ipeco Composites UK, which produced the items, has an aerospace background and employed a relatively high-specification technique using prepreg vacuum-infused over a male mould and autoclave cured. High mechanical and FST performance resulted as well as appreciable weight saving and, over the production run of 960 standbacks, costs proved acceptable. The items were produced for 30 Bombardier Electrostar vehicles for UK train operator National Express.

Horn argues that it is train operators which most powerfully propel composites uptake rather than train builders.

“What tends to happen,” he explains, “is that OEMs provide standard body shells into which operators put their own interiors. Operators often favour composites because they clearly see the impact of weight reduction on their operating costs and profits.”

| Weight saving is a higher priority in certain rail categories – high-speed trains, metro trains, double-deckers, monorails etc– explaining greater composites penetration in these areas. |

Horn adds that weight saving is a higher priority in certain rail categories – high-speed trains, metro trains, double-deckers, monorails etc– explaining greater composites penetration in these areas. Making monorail vehicles lighter, for instance, not only reduces fuel consumption but also enables the track infrastructure to be lighter and less subject to wear.

Umeco continues to work on material and process developments aimed at enhancing properties and processability whilst also reducing cost. Of course, it is not alone in this. Gurit, for example, has developed a range of rail prepregs based on epoxy, cyanate ester, phenolic and benzoxazine resin systems reinforced with glass, aramid or carbon. The company is supplying its modified phenolic-based prepregs to several recent high-speed and metro railway projects in Europe and China.

According to Kees Reijner, General Manager Transportation at Gurit, phenolics are widely favoured for interiors because of their ability to meet stringent FST requirements. He notes that, for further weight reduction, traditional monolithic laminates are increasingly giving way to light sandwich structures made up of prepregs with honeycomb or foam core. Materials it has developed provide flexible autoclave-free processing with fast curing cycles and high-quality surface finishes.

Phenolics are not, though, the only FST-compliant show in town. Scott Bader is achieving some success in the rail industry with its urethane acrylate alternative. A number of Spanish and Chinese rolling stock producers have switched from phenolics, the company reports, to its Crestopol® resins which utilise alumina trihydride (ATH) mineral filler loadings to meet fire performance requirements. These resins, optimised for closed moulding and pultrusion processes, are claimed to have had shop floor productivity and health and safety benefits whilst also meeting the necessary mechanical and fire performance specifications. Good surface finish is also attributed.

Scott Bader has also introduced a range of halogen-free hand and spray applied gel and topcoat finishes that help laminates meet FST standards.

Underground trains are a special case with extremely onerous fire and other safety requirements. Materials developed to meet these are a speciality of Permali Gloucester Ltd in the UK. Permaglass MFM is a decorative laminate used for lining the interiors of many trains including London’s Underground ‘Tube’ stock. Permaglass MER materials provide halogen-free fire retardant electrical insulation and can substitute for asbestos-based materials in enclosures for a range of electrical units. The company also provides sandwich flooring panels and thermal barriers.

Composite sandwich offers a valuable combination of weight reduction, stiffness and beam strength. Materials developed specifically for rail application include the structural core Divinycell P developed by Sweden-headquartered DIAB International. This recyclable thermoplastic core meets European FST regulations, is compatible with commonly used resin systems including phenolic, and can be processed using traditional hand lamination and vacuum bagging methods but also more advanced techniques including infusion and resin transfer moulding (RTM). It can be used with various medium-temperature prepregs and may also be thermoformed or pultrusion moulded.

Claimed attributes include good mechanical properties and fatigue resistance, low water absorption, good acoustic and thermal insulation, chemical resistance and the environmental benefit of being recyclable. Available in panels or ready-to-use construction kits, Divinycell P can be acquired in various thicknesses and densities of 60-150 g/m3. Interior applications include carriage floors.

Another sandwich exponent, Swiss firm Airex Composite Systems (ACS), market its COMFLOOR floor systems comprising sandwich panel with insulating foam core and integral surface heating elements to distribute warmth to the passengers above. ♦

This article is an excerpt from the feature Can trains be half plastic?, which was published in the July/August 2012 issue of Reinforced Plastics magazine. Part 2 of this feature is available here.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.